Article Text

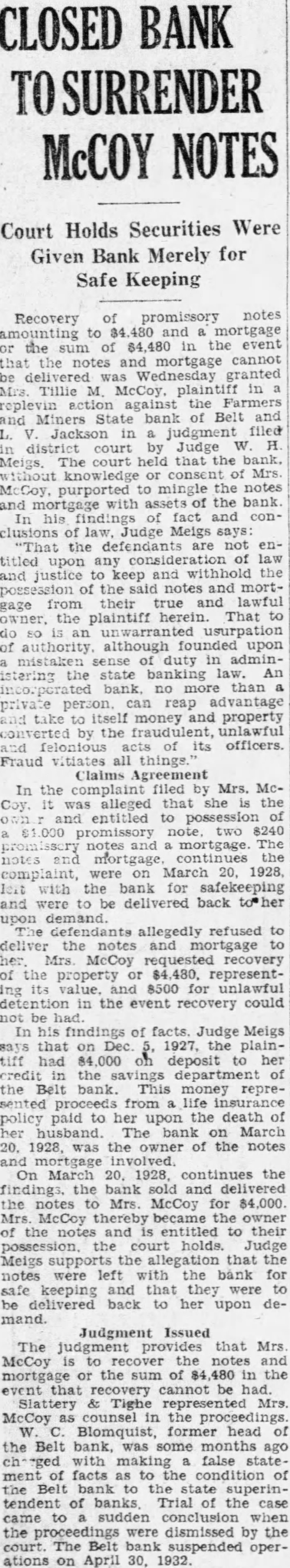

CLOSED BANK TO SURRENDER McCOY NOTES Court Holds Securities Were Given Bank Merely for Safe Keeping promissory notes Recovery of amounting to 480 and mortgage or the sum of in the event that the notes and mortgage cannot be delivered Wednesday granted Mrs. Tillie M. McCoy. plaintiff in replevin action against the Farmers and Miners State bank of Belt L. Jackson in judgment filed district court by Judge W. H Meigs. The court held that the bank, without knowledge of Mrs McCoy, purported to mingle the notes and with the bank. his findings of fact and conclusions of law, Judge Meigs says: "That the defendants are not entitled upon any consideration of and justice to keep and the possession of the and morttheir true and lawful gage from owner, the plaintiff herein. That to do an usurpation of authority although upon mistaken sense of duty in administering the state banking law. An bank. no more than private person. reap advantage take to itself money and property converted by the fraudulent, unlawful felonious acts of its officers. Fraud vitiates all things. Claims Agreement In the complaint filed by Mrs. McCoy. it alleged that she is the and entitled to possession promissory note. two $240 and mortgage. The notes mortgage. continues the complaint, were on March 20, 1928, left with the bank for safekeeping and were to delivered back to her upon demand. The defendants allegedly refused to deliver the notes and mortgage to /her Mrs McCoy requested recovery of the property or representing its value. and 8500 for unlawful detention in the event recovery could not be In his findings of facts. Judge Meigs says that on Dec. 1927, the plaintiff had 84,000 deposit to her credit the the Belt bank. This money represented from life policy paid to her upon the death of her husband. The bank on March 20. 1928, was the owner of the notes and mortgage involved. March 20. 1928, continues the findings. the bank sold and delivered the notes to Mrs. McCoy for $4,000. McCoy became the owner of the notes and entitled to their the court holds. Judge Meigs supports the allegation that the notes were left the bank for safe keeping and that they were to be delivered back to her upon demand. Judgment Issued The judgment provides that Mrs McCoy is to recover the notes mortgage or the of 480 in the event that cannot be had. Tighe represented Mrs. McCoy as counsel the proceedings Blomquist, former head of the Belt bank, was some months ago with making false statement of facts to the condition of the Belt bank to the state superintendent of banks Trial of the case came to sudden conclusion when the were dismissed by the court The Belt bank suspended operations on April 30, 1932.