Article Text

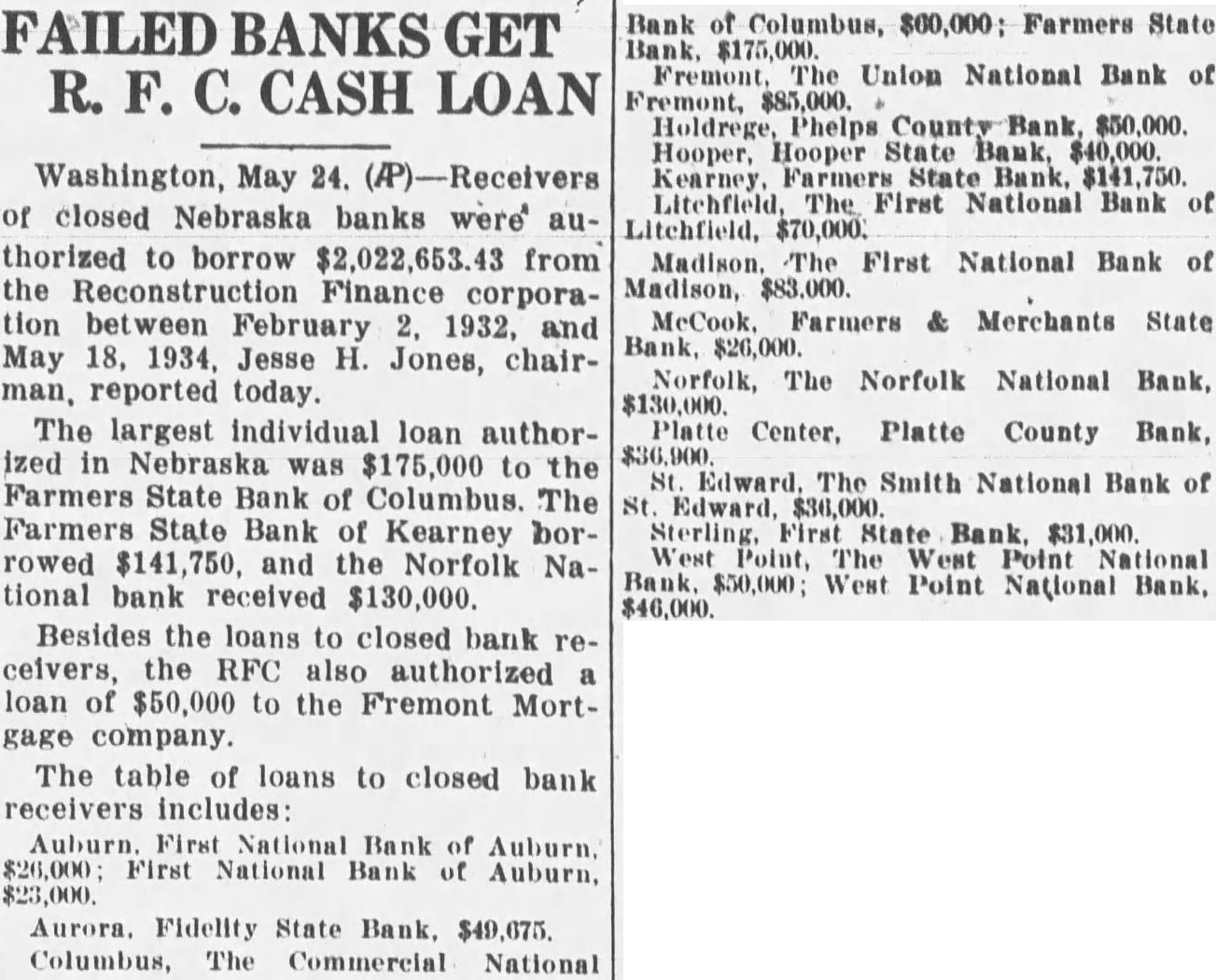

EARLY GAINS CANCELLED BY PROFIT TAKING New York, Sept. 9, (AP)Stocks ran into profit taking this afternoon and earlier gains of 1 to 3 points in most active shares were either sharply mod- ified or lost. Some leaders finished lower. U. S. Steel and American Tele. phone gave up 2 point advances. American Can backed up substantially after 3 point rise. National biscuit, Westinghouse and several coppers were heavy, losing 1 to 2 points. Rails; which had moved forward briskly, yielded much of their gains. Transactions approximated 3,900,000 shares. DEPOSITORS WANT TO NAME OWN BANK RECEIVER Aurora, Neb., Sept. 9, (AP)A group of depositors in the fiailed Fidelity State bank here yes. terday filed an action in district court asking appointment of a local receiver instead of E. H. Luikart, secretary of the state trade and commerce department. faculty members. "Here are the results on the movement to date. (And they have been accompanied by no financial gains, for football alone pays its own way.) "The number of competing athletes in intercollegiate sports has been multiplied by four. The department of physical education reports gains in the same proportion. Formerly it was hard to get students interested in gym, but now not only has the interest increased four-fold among the freshmen, but upperclassmen are trying to get into plebe classes. "The superlative athletes, thru the broadened intercollegiate program, are competing against the best of other schools, while the others are competing against students of like skill in whatever sport they choose. Children /are picking up weight under menu sponsored by Toledo welfare dietitians.