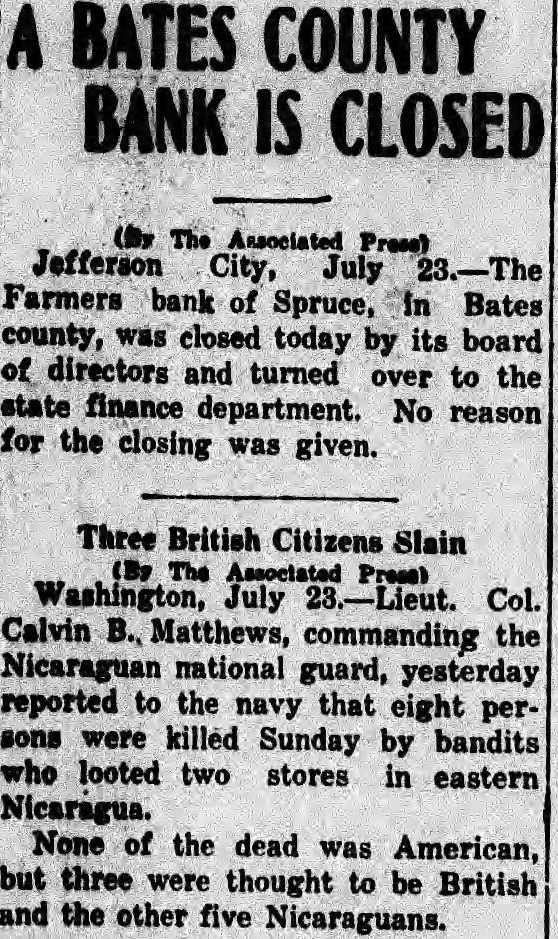

Article Text

A BATES COUNTY BANK IS CLOSED (By The Associated Press) Jefferson City, July Farmers bank of Spruce, in Bates county, was closed today by its board of directors and turned over to the state finance department. No reason for the closing was given. Three British Citizens Slain Associated Press) Washington, July Col. Calvin B., Matthews, commanding the Nicaraguan national guard, yesterday reported to the navy that eight persons were killed Sunday by bandits who looted two stores in eastern Nicaragua. None of the dead was American, but three were thought to be British and the other five Nicaraguans.