Article Text

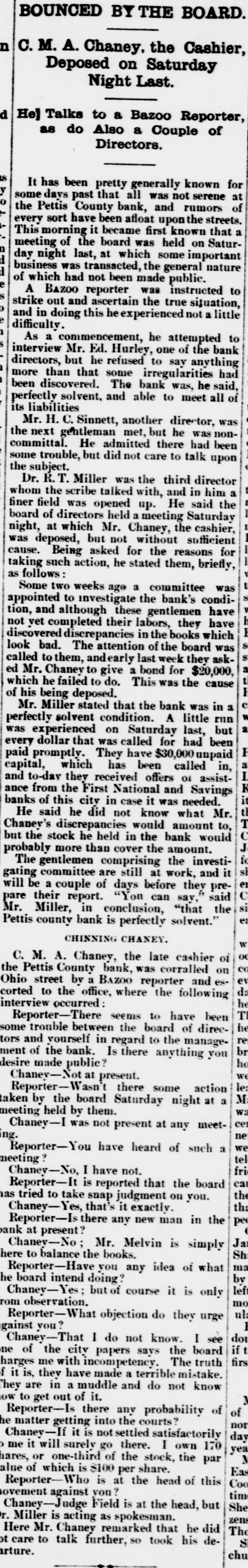

BOUNCED BY THE BOARD n C.M. A. Chaney, the Cashier, Deposed on Saturday Night Last. d He) Talks to a Bazoo Reporter, as do Also a Couple of Directors. It has been pretty generally known for some days past that all was not serene at the rumors sort upon streets. This a was on every Pettis morning have County it been became bank, afloat first and known the Satur- that of day at some business nature meeting night of was last, the transacted, board which the held general important of which had not been made public. A BAZOO reporter was instructed to strike out and ascertain the true situation, and in doing this he experienced not a little difficulty. As a commencement, he attempted to interview Mr. Ed. Hurley, one of the bank directors, but he refused to say anything more than that some irregularities had been discovered. The bank was, he said, perfectly solvent, and able to meet all of its liabilities Mr. H. C. Sinnett, another director, was the next gentleman met, but he was noncommittal. He admitted there had been some trouble, but did not care to talk upon the subject. Dr. R.T. Miller was the third director whom the scribe talked with, and in him a finer field was opened up. He said the board of directors held a meeting Saturday night, at which Mr. Chaney, the cashier, was deposed, but not without sufficient cause. Being asked for the reasons for taking such action, he stated them, briefly, as follows Some two weeks age a committee was appointed to investigate the bank's condition, and although these gentlemen have not yet completed their labors, they have discovered discrepancies in the books which look bad. The attention of the board was called to them, undearly last week they ask ed Mr. Chaney to give a bond for $20,000 cause which he failed to do. This was the of his being deposed. Mr. Miller stated that the bank was in a perfectly solvent condition. A little run was experienced on Saturday last, but every dollar that was called for had been I paid promptly. They have $30,000 unpaid a capital, which has been called in, and to-day they received offers of assistance from the First National and Savings banks of this city in case it was needed. He said he did not know what Mr. T Chaney's discrepancies would amount to, but the stock he held in the bank would probably more than cover the amount. fo The gentlemen comprising the investigating committee are still at work, and it en will be a couple of days before they prepare their report. "You can say, said Mr. Miller, in conclusion, "that the Pettis county bank is perfectly solvent. CHINNING CHANEY. oe C. M. A. Chaney, the late cashier of ce the Pettis County bank, was corralled on ev Ohio street by a BAZOO reporter and esda corted to the office, where the following interview occurred he T Reporter-There seems to have been he some trouble between the board of direcre tors and yourself in regard to the managebr ment of the bank. Is there anything you he desire made public? we Chaney-Not at present. le Reporter-Wasn't there some action M a taken by the board Saturday night at wa meeting held by them. cer Chaney-I was not present at any meeting. ne we a Reporter-You have heard of such tel meeting fri Chaney-No, I have not. ca Reporter-It is reported that the board the as tried to take snap judgment on you. tha Chaney-Yes, that's it exactly pe Reporter-Is there any new man in the bank at present? Ja Chanev-No Mr. Melvin is simply here to balance the books. Sh ma Reporter-Have you any idea of what by he board intend doing lef Chaney-Yes but of course it is only rom observation. mo Reporter-Wh objection do they urge against you? do Chaney-That I do not know. I see if ne of the city papers says the board firs harges me with incompetency The truth f it is, they have made a terrible mistake. They are in a muddle and do not know low to get out of it. of Reporter-Is there any probability of he matter getting into the courts not Chaney-If it is not settled satisfactorily day me it will surely go there. I own 170 yea M hares, or one-third of the stock, the par alue of which is $100 per share. Eas Coc Reporter-Who is at the head of this movement against you tim Chaney-Judge Field is at the head, but She r. Miller is acting as spokesman. zens The Here Mr. Chaney remarked that he did care to talk further, so took his deS arture. chu