Article Text

# MONEY TO BE CALLED FOR

DUE TO DEPOSITORS IN DEFUNCT SAVINGS BANKS.

A LIST OF THOSE FOR WHOM SUMS EXCEEDING

FIVE DOLLARS EACH ARE HELD BY THE

STATE SUPERINTENDENT OF BANKING.

Albany, July 22. Among the functions imposed

upon him by law, the Superintendent of the State

Banking Department is obliged to become a sort of

second receiver of the assets of defunct savings

banks.

Between 1871 and 1879 some thirty savings banks

doing business in this State failed or went into liquida-

tion. The greater number of these were adjacent

to or in New-York City. The usual legal course was

pursued in the case of these insolvent corporations;

receivers were appointed and the affairs of each bank

closed up by due process of law, with the exception of

a few where a final settlement could not be made

because of undetermined litigation. The total amount

of deposits involved was something like $15,000,000, of

which about two-thirds has been paid to depositors in

receivers' dividends. Of course in this as in every

other business transaction of the kind, some of the

receivers were particularly good appointments, and

fortunately for depositors they managed the estate

of the defunct bank with prudence and realized all that

it was possible to realize out of the assets committed

to their care. Others, whether from lack of moral

force or financial skill, did not meet with the same

successful career. Hence the dividends paid by these

receivers ranged all the way from 15 to 87 per centum.

William F. Russell, receiver of the Sixpenny Savings

Bank, and Willis S. Paine, receiver of the Bond Street

Savings Bank, declared the largest dividends.

Under the provisions of the banking law, before a

receiver of a savings bank can be discharged he must

make a transcript or statement from the books of the

bank of the names of all depositors and creditors who

have not claimed the balances due them, and of the

sums due to each respectively, and file such statement

or transcript in the State Banking Department, at the

same time transferring all such unclaimed moneys to

the Bank Superintendent. The Superintendent is given

power to receive and receipt for these moneys and to

deposit them in some solvent savings bank in this

State to the credit of the Superintendent, in trust, and

he may pay over any balances to the owner thereof

upon being furnished with satisfactory evidence of his

right to the amount. The interest received from the

deposits is applied toward defraying the expenses of

caring for such moneys and the necessary clerical work

incident thereto.

Under this provision of the banking law there has

been deposited with the State Superintendent of Bank-

ing, in trust, $108,612 93, and he has paid on claims

presented $32,658 92, leaving still in his hands upward

of $75,000 in unclaimed balances which is due to the

depositors in the following banks:

Mechanics and Traders' Savings Institution,

Sixpenny Savings Bank.

Bond Street Savings Bank.

German Savings of the Town of Morrisania.

People's Savings Bank.

Mutual Benefit Savings Bank

Abingdon Square Savings Bank

German Uptown Savings Bank.

Central Park Savings Bank.

Clinton Savings Bank.

Security Savings Bank.

New-Amsterdam Savings Bank.

Morrisania Savings Bank.

Oriental Savings Bank.

Union Savings Bank of Saratoga Spa.

Trades Savings Bank.

Park Savings Bank of Brooklyn.

Clairmont Savings Bank.

To the rightful owners or their heirs of these

balances still in the superintendent's hands Mr.

Preston stands ready to pay at any time upon applica-

tion. Claimants have but to forward their pass-books

to the superintendent at his office here with an order

inclosed to pay the balance still due, or in the event

of the loss of the pass-book to furnish an affidavit of

that fact, containing sufficient facts to establish

identity and rightful ownership. Herewith are given

the names of persons entitled to balances amounting

to $5 and upward. Besides the amount due the

depositors whose names are here given, there are

between 2,000 and 3,000 depositors whose balances

are under $5, and which in the aggregate make many

thousands of dollars, the amount of them in the

Sixpenny Bank making $20,000.

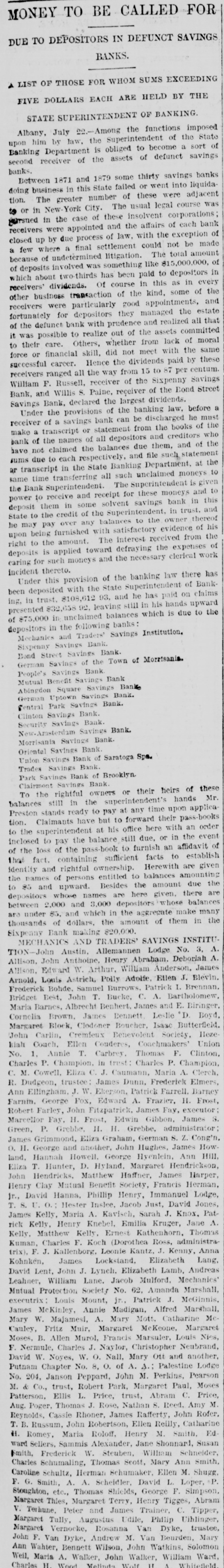

# MECHANICS AND TRADERS' SAVINGS INSTITUTION

John Austin, Allemannen Lodge No. 3, A.

Allison, John Anthoine, Henry Abraham, Deboriah A.

Allison, Edward W. Arthur, William Anderson, James

Arnold, Louis Astrich, Polly Adolfe, Ellen J. Blevin.

Frederick Bohde, Samuel Burrows, Patrick I. Brennan.

Bridget Best, John T. Bucke, C. A. Bartholomew,

Maria Barnes, Albrecht Benhert, James and E. Biringer.

Cornelia Brown, James Bennett, Leslie D. Boyd,

Margaret Block, Clodoner Boucher, Isaac Butterfield.

John Carlin, Cremieux Benevolent Society, leze-

kiah Couch, Ellen Couderes, Coachmakers' Union

No. 1. Annie T. Carbrey, Thomas F. Clinton,

Charles P. Champion, in trust: Charles P. Champion,

C. M. Cowell, Eliza C. J. Caumann, Maria A. Clerch,

R. Dudgeon, trustee James Dunn, Frederick Elmers,

Ann Ellingham, J. W. Ekerson, Patrick Farrell. Barney

Farnin, George Fox, Edward A. Frazier, H. Frost,

Robert Farley, John Fitzpatrick, James Fay, executor;

Marcellor Fay, H. Frost, Edwin Gibbon, James S.

Green, P. Grebbe, H. H. Grebbe, administrator;

James Grimmond, Eliza Graham, German S. Z. Cong'n,

O. H. George and another, John Hughes, James How-

land, Hannah Howell, George Hyenlein, Ann Hill,

Eliza T. Hunter, D. Hyland, Margaret Hendrickson,

John Hendricks, Matthew Haffner, James Harper,

Henry Clay Matual Benefit Society, Francis Herman,

Jr., David Hanna, Phillip Henry, Immanuel Lodge,

T. S. U. O.; Hester Inslee, Jacob Just, David Jones,

James Kelly, Maria A. Kavisch, Sarah J. Knox, Pat-

rick Kelly, Henry Knebel, Emilia Kruger, Jane A.

Kelly, Matthew Kelly, Ernest Kathenhorn, Thomas

Kuman, Charles F. Koch (Dorothea Ross, administra-

trix), F. J. Kallenborg, Leonie Kantz, J. Kenny, Anna

Kohnken, James Lockstand, Elizabeth Lang.

David Lent, John J. Lynch. Elizabeth Lamb, Andreas

Leahner, William Lane. Jacob Mulford, Mechanics'

Mutual Protection Society No. 62, Amanda Marshall,

executrix: Louis Mount, jr., Patrick J. McGinnis,

James McKinley, Annie Madigan, Alfred Marshall,

Mary W. Majamesi, A. Mary Mott, Catharine Mc-

Cauley, Fritz Muir, Margaret McKeone, Margaret

Moses, B. Allen Murol, Francis Marsuler, Louis Nies,

F. Nermule, Charles J. Naylor, Christopher Neubrand,

David W. Noyes, W. O. Nall, Mary Ott and another,

Putnam Chapter No. 8, O. of A. A.; Palestine Lodge

No. 204, Janson Peppard, John M. Perkins, Pearson

M. & Co., trust, Robert Park, Margaret Paul, Moses

Patterson, Ellis L. Price, trust, Abram C. Price,

Aug. Poger, Thomas J. Rose, Nathan S. Reed, Amy M.

Reynolds, Cassie Rhoner, James Rafferty, John Rofer.

T. B. Russum, John Robertson, Ellen Reilly, Catharine

H. Romey, Maria Roloff, Henry M. Smith, Ed-

ward Sellers, Sammis Alexander, Jane Shonnard, Susan

Smith, Frederick W. Steuben, William Schneider,

Charles Schumaling, Thomas Scott, Mary Ann Smith,

Caroline Schultz, Herman Schumaker, Ellen M. Shugg.

F. G. Smith, A. A. Scheidler, David L. Loper, P.

Stoughton, etc., Thomas Shields, George F. Simpson,

Margaret Thies, Margaret Terry, Henry Tigges, Abram

V. Terhune, Peter and James Trainer, C. Tipper,

Margaret Tully, Augustus Udile, Philip Uihlinger,

Margaret Vernocke, Rosanna Van Dyke, trustee,

John F. Van Dyke, Andrew M. Van Beurden, Mary

Ann Wahter, Bennett Wilson, John Watkins, Solomon

Weil, Maria A. Walker, John Walker, William Ward,

Charles H. Wood Melinda Wolf H. A Whitefield