1.

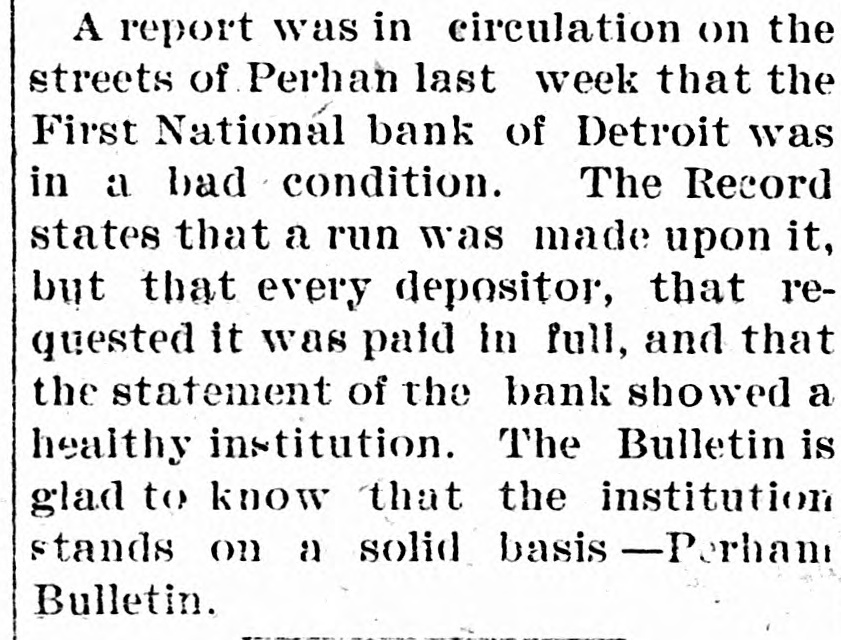

February 17, 1893

Little Falls Transcript

Little Falls, MN

Click image to open full size in new tab

Article Text

A report was in circulation on the streets of Perhan last week that the First National bank of Detroit was in a bad condition. The Record states that a run was made upon it, but that every depositor, that requested it was paid in full, and that the statement of the bank showed a healthy institution. The Bulletin is glad to know that the institution stands on a solid basis -Perhan Bulletin.

2.

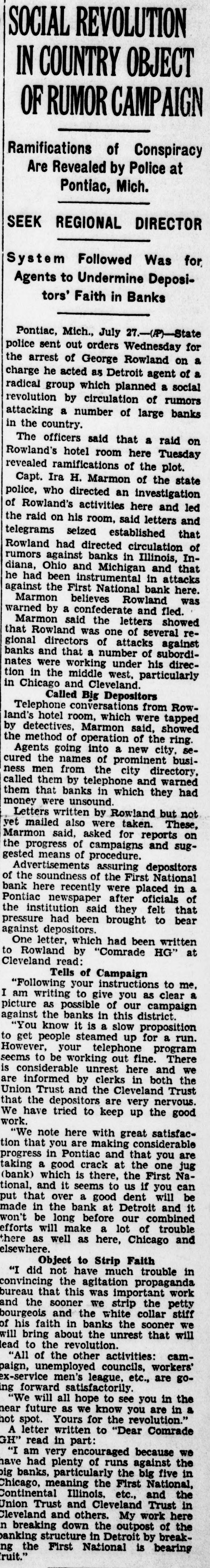

July 27, 1932

The Bismarck Tribune

Bismarck, Mandan, ND

Click image to open full size in new tab

Article Text

SOCIAL REVOLUTION IN COUNTRY OBJECT OF RUMOR CAMPAIGN Ramifications of Conspiracy Are Revealed by Police at Pontiac, Mich. SEEK REGIONAL DIRECTOR System Followed Was for Agents to Undermine Depositors' Faith in Banks Pontiac, Mich., July 27.-(P)-State police sent out orders Wednesday for the arrest of George Rowland on a charge he acted as Detroit agent of a radical group which planned a social revolution by circulation of rumors attacking a number of large banks in the country. The officers said that a raid on Rowland's hotel room here Tuesday revealed ramifications of the plot. Capt. Ira H. Marmon of the state police, who directed an investigation of Rowland's activities here and led the raid on his room, said letters and telegrams seized established that Rowland had directed circulation of rumors against banks in Illinois, Indiana, Ohio and Michigan and that he had been instrumental in attacks against the First National bank here. Marmon believes Rowland was warned by a confederate and fled. Marmon said the letters showed that Rowland was one of several regional directors of attacks against banks and that a number of subordinates were working under his direction in the middle west. particularly in Chicago and Cleveland. Called Big Depositors Telephone conversations from Rowland's hotel room, which were tapped by detectives, Marmon said, showed the method of operation of the ring. Agents going into a new city, secured the names of prominent business men from the city directory, called them by telephone and warned them that banks in which they had money were unsound. Letters written by Rowland but not yet mailed also were taken. These, Marmon said, asked for reports on the progress of campaigns and suggested means of procedure. Advertisements assuring depositors of the soundness of the First National bank here recently were placed in a Pontiac newspaper after oficials of the institution said they felt that pressure had been brought to bear against depositors. One letter, which had been written to Rowland by "Comrade HG" at Cleveland read: Tells of Campaign "Following your instructions to me, I am writing to give you as clear a picture as possible of our campaign against the banks in this district. "You know it is a slow proposition to get people steamed up for a run. However, your telephone program seems to be working out fine. There is considerable unrest here and we are informed by clerks in both the Union Trust and the Cleveland Trust that the depositors are very nervous. We have tried to keep up the good work. "We note here with great satisfaction that you are making considerable progress in Pontiac and that you are taking a good crack at the one jug (bank) which is there, the First National, and it seems to us if you can that over a good dent will be put made in the bank at Detroit and it won't be long before our combined efforts will make a lot of trouble there as well as here, Chicago and elsewhere. Object to Strip Faith "I did not have much trouble in convincing the agitation propaganda bureau that this was important work and the sooner we strip the petty bourgeois and the white collar stiff we of his faith in banks the sooner will bring about the unrest that will lead to the revolution. "All of the other activities: campaign, unemployed councils, workers' ex-service men's league, etc., are going forward satisfactorily. "We will all hope to see you in the hear future as we know you are in a not spot. Yours for the revolution." A letter written to "Dear Comrade GH" read in part: "I am very encouraged because we have had plenty of runs against the banks, particularly the big five in Chicago, big meaning the First National, Continental Illinois, etc., and the Union Trust and Cleveland Trust in Cleveland and others. My work here n breaking down the outpost of the banking structure in Detroit by breakfruit." ng the First National is bearing

3.

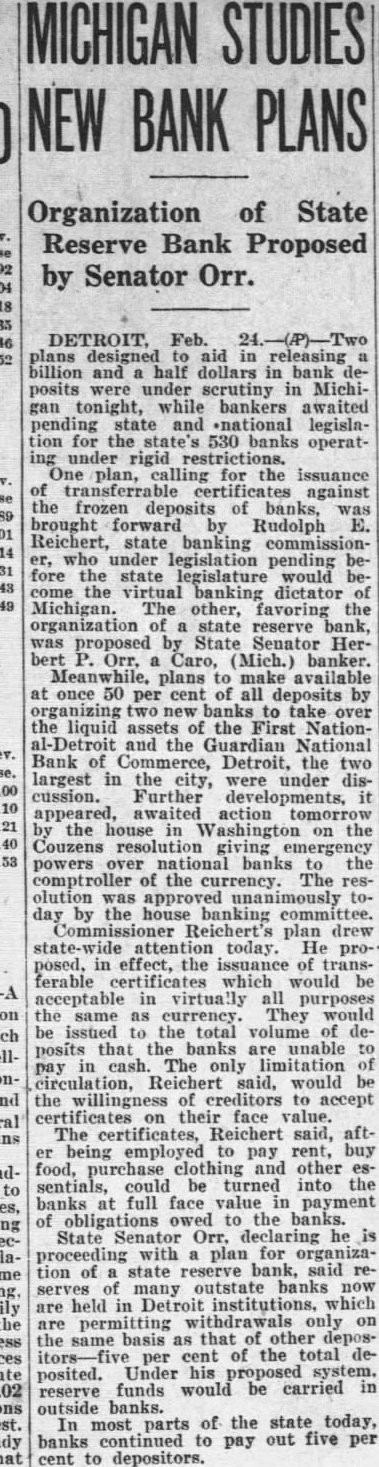

February 25, 1933

The Atlanta Constitution

Atlanta, GA

Click image to open full size in new tab

Article Text

MICHIGAN STUDIES NEW BANK PLANS

Organization of State Reserve Bank Proposed by Senator Orr.

DETROIT, Feb. plans designed aid in releasing billion and half dollars in bank deposits were under scrutiny in Michigan tonight, while bankers awaited and national legislation for the 530 banks operating restrictions. One plan, calling for the issuance of transferra certificates against the frozen deposits of banks, brought forward by Rudolph E. Reichert, state banking commissioner, who under legislation pending before the state legislature would come the virtual banking dictator Michigan. The other, favoring the organization of state reserve was proposed by State Senator HerOrr, Caro, (Mich.) banker. plans make available at once 50 per cent of all deposits by organizing two take over the liquid assets of the First NationDetroit and the Guardian National Bank of Detroit, the two largest in city, were under cussion. Further it appeared, action tomorrow by the house in Washington on the Couzens giving powers over national banks to the comptroller of the currency. The olution was approve imously day by the house committee. Reichert's plan drew state-wide today. He proposed, in effect, the issuance of ferable which would be acceptable in virtually all purposes the same as currency. They would be issued the total volume of deposits that the banks are unable to pay cash. The only limitation circulation, Reichert said, would be the willingness of creditors to accept certificates on their face value. The certificates, Reichert said, aftbeing employed to pay rent, buy food, and other essentials, could be turned into the banks at full face value in payment of obligations owed to the banks. State Senator Orr, declaring he is proceeding with plan for organization of a state reserve bank, said reof many outstate banks now are held in Detroit institutions. which are withdrawals on the same basis as that of other itors- per cent of the total deposited. Under his reserve funds would be carried in outside In most parts of the state today, banks continued to pay out five per cent to depositors.

4.

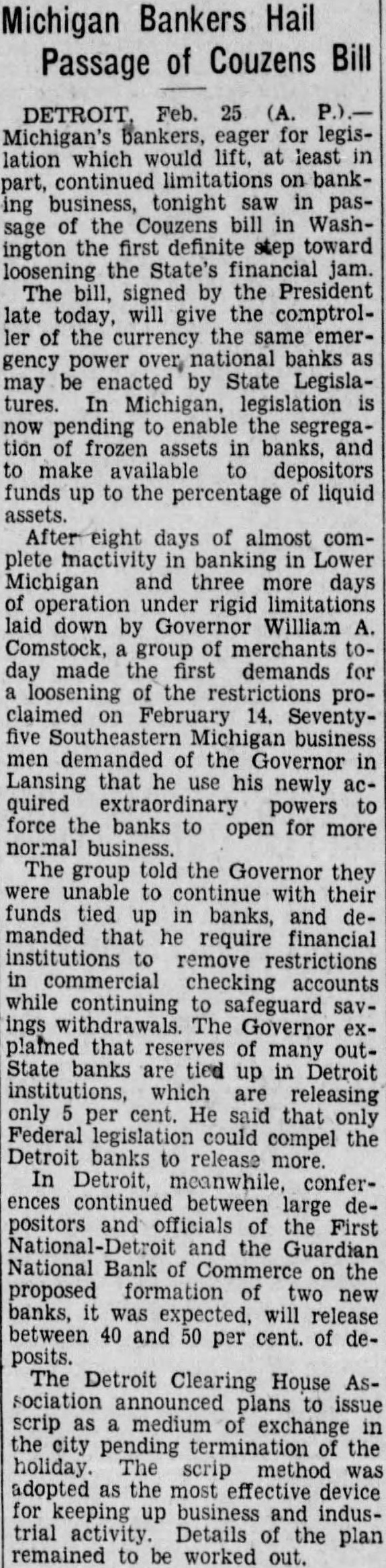

February 26, 1933

The Philadelphia Inquirer

Philadelphia, PA

Click image to open full size in new tab

Article Text

Michigan Bankers Hail Passage of Couzens Bill

DETROIT Feb 25 (A. Michigan's bankers, eager for legislation which would lift. at least in part, continued limitations on banking business, tonight saw in passage of the Couzens bill Washington the first definite step toward the State's jam The bill signed by the President late today will give the comptroller of the the same emergency power over national banks as may be enacted by State Legislatures. In Michigan, legislation is now pending enable the segregation frozen assets in banks, and to make to depositors funds up to the percentage of liquid After eight days of almost commactivity banking in Lower Michigan and three more days of operation under rigid limitations laid down by Governor William A. Comstock group of merchants today made the first demands for of the restrictions proclaimed on 14. Seventyfive business demanded of the Governor in Lansing that he use his newly acquired extraordinary powers to force the banks to open for more business. The group told the Governor they were unable to with their funds tied up in banks, and demanded that he require financial institutions remove restrictions in commercial checking accounts while continuing to safeguard savings withdrawals. The Governor ex. plained that reserves of many outState banks are tied up in Detroit are releasing only per cent. He said that only Federal legislation could compel the Detroit banks to release more. In Detroit, meanwhile conferences continued between large depositors officials of the First National- the Guardian National of Commerce on the proposed formation two new banks, was expected. will release between 40 and 50 per cent. of deThe Detroit Clearing House Association plans scrip as medium of exchange in the city pending termination of the holiday The method was adopted as the most effective device for keeping up business and industrial activity Details of plan remained to be worked out.

5.

February 27, 1933

The Grand Rapids Press

Grand Rapids, MI

Click image to open full size in new tab

Article Text

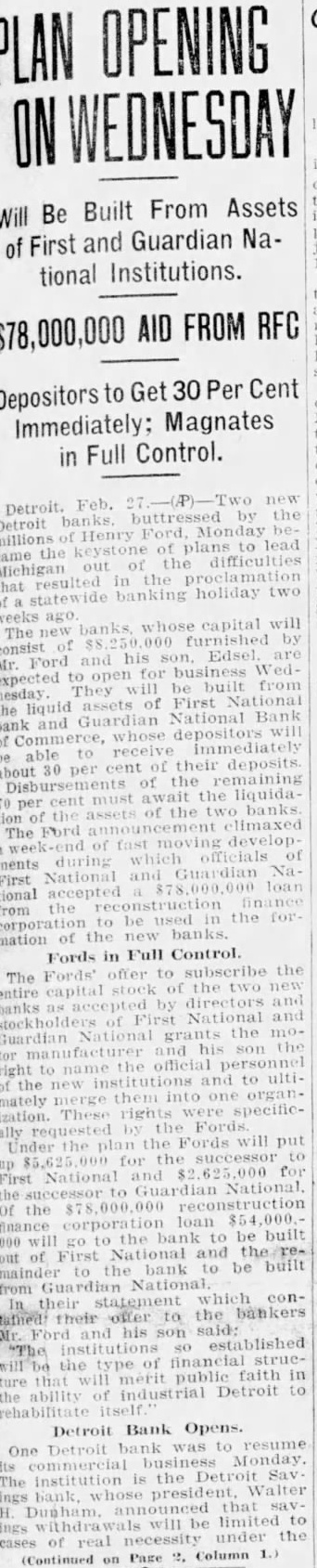

PLAN OPENING WEDNESDAY ON

Will Be Built From Assets of First and Guardian National Institutions.

$78,000,000 AID FROM RFC

Depositors to Get 30 Per Cent Immediately; Magnates in Full Control. buttressed by Detroit Henry Monday lead plans the difficulties Michigan banking holiday capital will furnished by Ford and his business Wedopen expected be built from They First National liquid assets National Bank and receive immediately of their deposits about the remaining await the of the banks assets tion The develop which of ments during National Guardian First loan corporation to in of Fords in Full Control The First grants the Guardian his specificFords will put up First National and built bank their the Detroit ability

Detroit Bank resume One The that limited under the of real necessity Page Column on

6.

February 27, 1933

Stevens Point Journal

Stevens Point, WI

Click image to open full size in new tab

Article Text

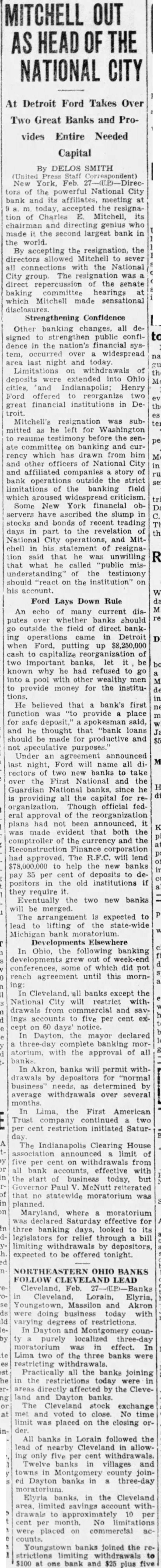

MITCHELL OUT HEAD THE NATIONAL CITY

At Detroit Ford Takes Over Two Great Banks and Provides Entire Needed

Capital

DELOS SMITH New of the National City bank affiliates, today, accepted the resignation of Charles Mitchell, its and genius who made second largest bank in the world. By accepting the resignation, the Mitchell sever all the National City The was direct the senate baking committee hearings which Mitchell made sensational Strengthening Confidence

Other banking changes, all designed strengthen public confidence the nation's financial tem, occurred widespread night today. Limitations withdrawals of deposits extended Ohio cities, Indianapolis; Henry Ford offered reorganize great financial institutions in Detroit. Mitchell's resignation was submitted as left for Washington resume before the sencommittee banking and rency which has from him and other officers of National City affiliated companies story of bank operations outside the strict limitations of banking field aroused widespread Some New York financial observers the slump in stocks and bonds of recent trading days part the revelation National City operations, Mitchell statement resignation that unwilling what he called "public understanding" testimony should "react on the institution" his account.

Ford Lays Down Rule

An echo current disputes banks should outside the field of direct banking came in Detroit when Ford, up $8,250,000 cash let be why he had refused to go into other wealthy provide money for the instituHe believed that bank's first provide place for safe deposit, said, and thought that "bank loans should be made for and not purposes.' Under announced last night, Ford name all dibanks to take the First and the Guardian banks, since he providing all the capital for organization. Though official federal approval of the reorganization plans had been announced, was made that both the comptroller currency and the Reconstruction corporation approved. The R.F.C. will lend $78,000,000 help new banks pay 35 per deposits depositors the old institutions if require Eventually the two new banks be merged. The arrangement is expected lead lifting state-wide bank moratorium. Developments Elsewhere In Ohio, following banking developments grew out week-end conferences, which did not reach agreement until this mornCleveland, all banks except the National City restrict withdrawals from commercial and accounts five per cent exdays' notice. mayor declared three-day banking atorium, with the approval of all banks. In Akron, banks will permit withdrawals by depositors for "normal business" needs, determined by average withdrawals over several In Lima, the First American Trust company continued two per cent restriction initiated SaturThe Indianapolis Clearing House limit five per from all bank accounts, effective with the start business today, but Governor Paul McNutt reiterated that statewide moratorium was Maryland, where moratorium declared Saturday effective for three banking days, looked to legislators relief through bill limiting withdrawals by depositors, expected to be offered tonight.

OHIO BANKS LEAD

Lorain, Elyria, Youngstown, Massilon and Akron business today with degrees In Dayton and Montgomery counpurely localized three-day moratorium effect. Lima two the three banks Practically the banks joining the restrictions today were affected the CleveDayton banks. Cleveland stock exchange and voted No limit placed on the closing order.

All banks Lorain followed the lead of nearby Cleveland allowonly five withdrawals. Twelve banks villages and in Montgomery county joined Dayton banks in three-day Elyria banks, in the Cleveland limited savings account withdrawals approximately cent per month. No placed on commercial counts. Youngstown banks joined the limiting withdrawals one bank and $25 plus five

7.

February 27, 1933

The Macon News

Macon, GA

Click image to open full size in new tab

Article Text

U. S. Moves to Strengthen Banks

NEW TREASURY HEAD TALKS TO MILLS

Woodin Called Into Conference as Federal Aid Is Extended Institutions

MONEY TO BE ADVANCED MICHIGAN ORGANIZATION

Feb. 27. The federal government Monday prepared to exert all available to strengthen weakened links in the country' banking system. William H. Woodin, secretary of the was here conference the outgoing are to act, not the said. With those words he turned aside all queries regarding the banking situations caused Michigan and Maryland to close their banks temporarily and led banks in number of Ohio cities limit withMills Sunday conferChairman Eugene Meyer of the federal reserve board assistance the treasury the banks could Directors the Reconstruction Finance corporation continued their study the They met in two protracted secret sessions Sun- m unusually authoritative sources was reported the R. F. has agreed to the two big Detroit banks reorganized new capital supplied by Henry Ford. said in the same quarter that an additional $40.would advanced by other financial institutions

FORD FINANCES two BANKS Detroit buttressed the lions Henry Monday came the of plans lead Michigan out of the difficulties which in the of statewide banking holiday two The banks whose capital will consist 250,000 furnished by Mr. and his are expected to open for business They be built from the of the First National Bank and the Guardian National Bank of whose depositors be able receive immediately about cent of their Disbursement remaining 70 per cent must await the Continued on Page

8.

March 21, 1933

Hickory Daily Record

Hickory, NC

Click image to open full size in new tab

Article Text

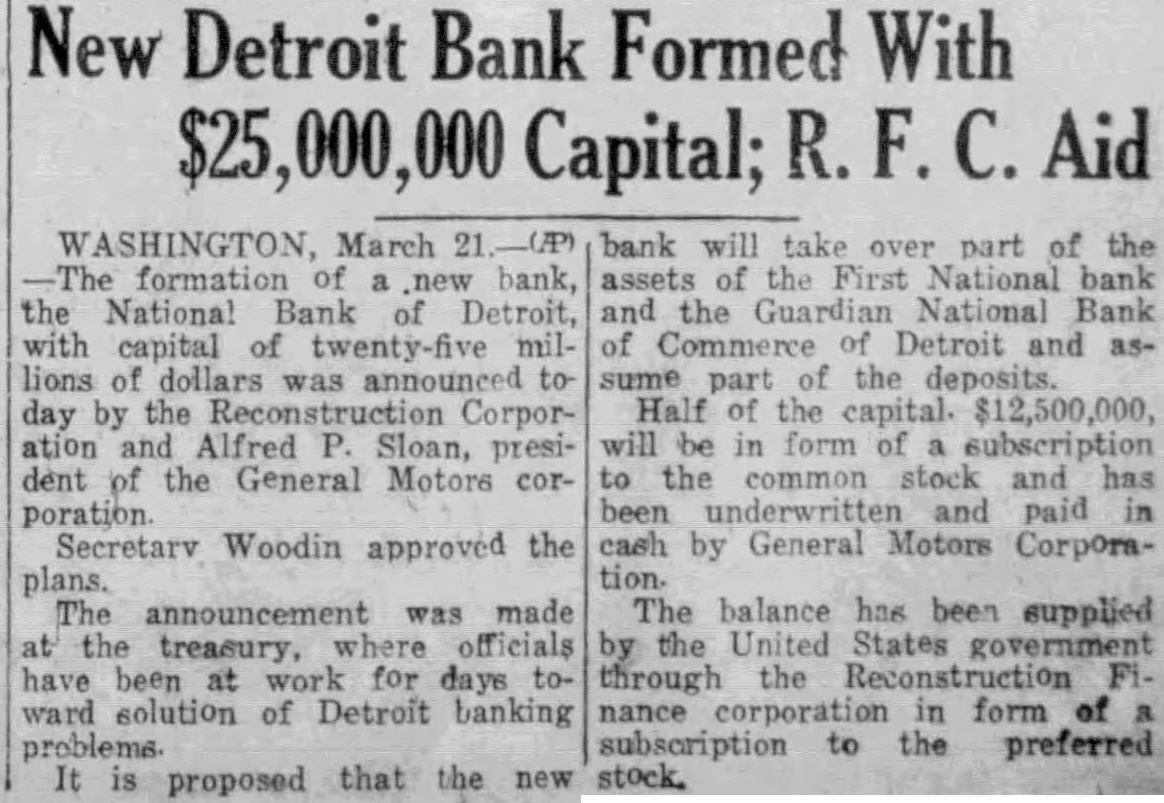

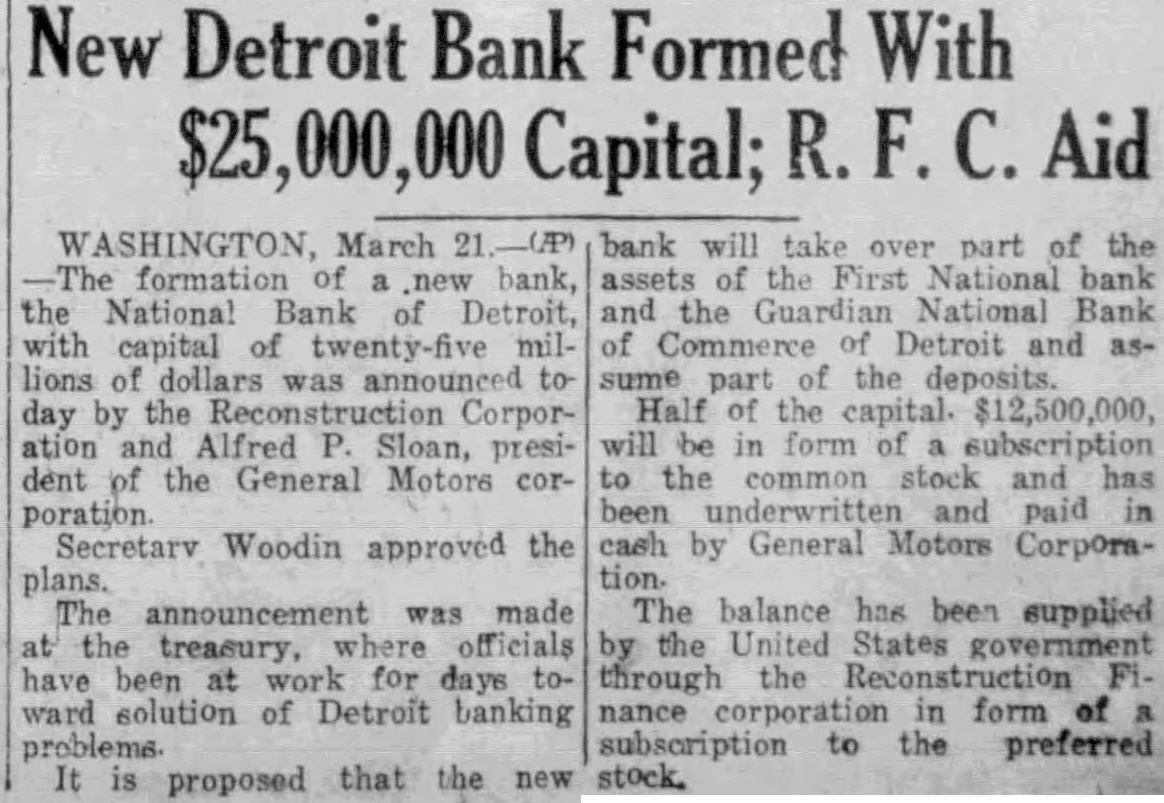

New Detroit Bank Formed With Capital; Aid

WASHINGTON, March formation bank, the National Bank Detroit, capital of twenty-five lions dollars was day by the Corporand Alfred Sloan, dent of the General Motors corSecretarv Woodin approved the The announcement was made treasury, where been for days solution Detroit banking problems. bank will take over part of the assets the First National bank and the Guardian National Bank Commerce Detroit and sume part the deposits. Half of the capital. will be form of subscription the common stock and has paid by General Motors Corporation. The balance has been supplied the United States government through the Reconstruction nance form subscription to the preferred

9.

March 21, 1933

The Saginaw News

Saginaw, MI

Click image to open full size in new tab

Article Text

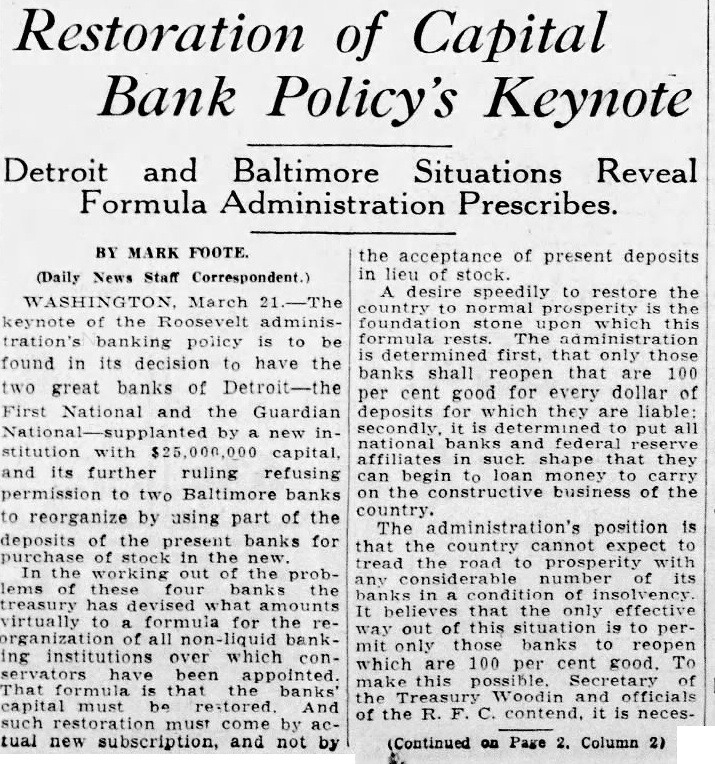

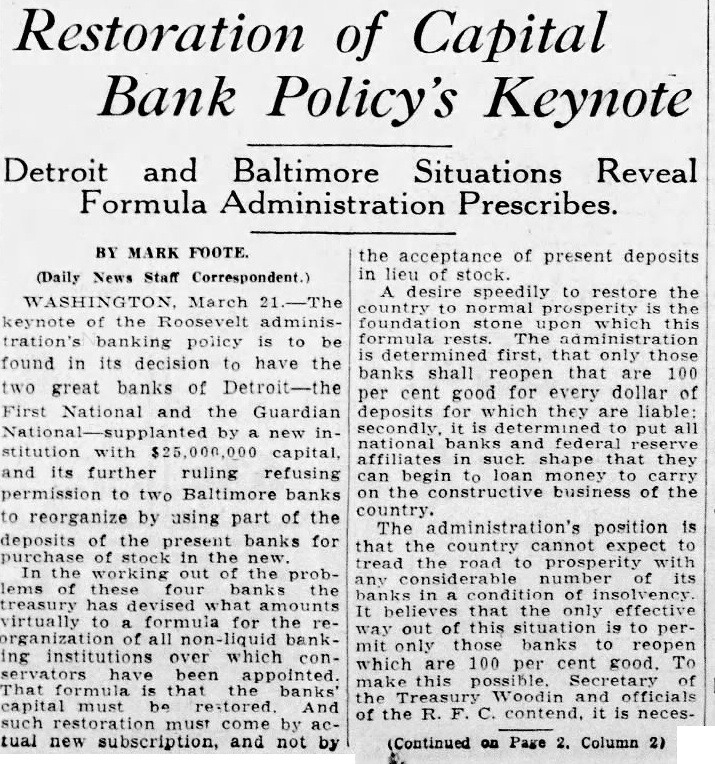

Restoration of Capital Bank Policy's Keynote

Detroit and Baltimore Situations Reveal Formula Administration Prescribes.

BY MARK FOOTE.

(Daily News Staff Correspondent.) keynote of the administration's banking policy is to be found in its decision to have the two great banks of Detroit-the First National the Guardian by new institution with capital, and its further ruling refusing permission to two Baltimore banks to reorganize by using part of the deposits of the banks for purchase the new. In the working out the problems these banks the treasury has devised amounts virtually formula for the reorganization banking institutions over which have been That that the capital be restored. And come by tual new subscription, and not by the acceptance of present deposits in lieu desire speedily to restore the normal prosperity foundation stone upon this formula determined first, only those banks shall reopen that are 100 per cent good for every dollar of deposits for which they are liable: secondly, is determined put all national affiliates in shape that they can begin loan money carry on the constructive business of the country. The administration's position is that the country cannot expect to tread road prosperity with any considerable number of its condition of It believes that the only effective way out this situation is to permit only those banks to reopen which are 100 per cent good. To the Woodin and officials of the R. contend, it is neces-

(Continued on Page 2. Column 2)

10.

March 21, 1933

Detroit Free Press

Detroit, MI

Click image to open full size in new tab

Article Text

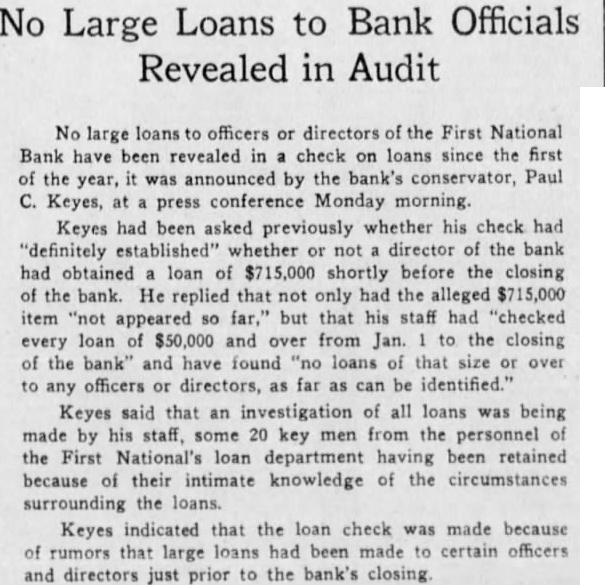

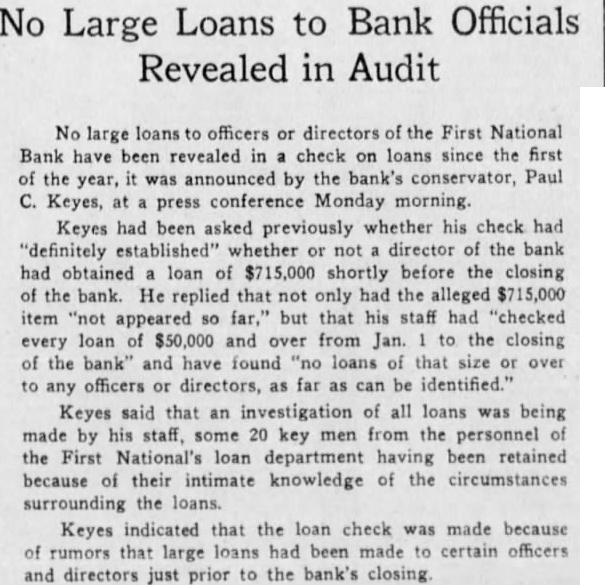

No Large Loans to Bank Officials Revealed in Audit

No large loans officers or directors of the First National Bank have been revealed in check on loans since the first of the year, announced by the bank's conservator, Paul C. Keyes, press conference Monday morning. Keyes had been asked previously whether his check had "definitely established" whether not director of the bank had obtained loan of $715,000 shortly before the closing of the bank. He replied that not only had the alleged $715,000 item "not appeared so far," but that his staff had "checked every loan of $50,000 and over from Jan. to the closing of the bank" and have found "no loans of that size or over to any officers or directors, as far as can be identified." Keyes said that an investigation of all loans was being made by his staff, some 20 key men from the personnel of the First National's loan department having been retained because of their intimate knowledge of the circumstances surrounding the loans. Keyes indicated that the loan check was made because of rumors that large loans had been made to certain officers and directors just prior to the bank's closing.

11.

March 27, 1933

Detroit Free Press

Detroit, MI

Click image to open full size in new tab

Article Text

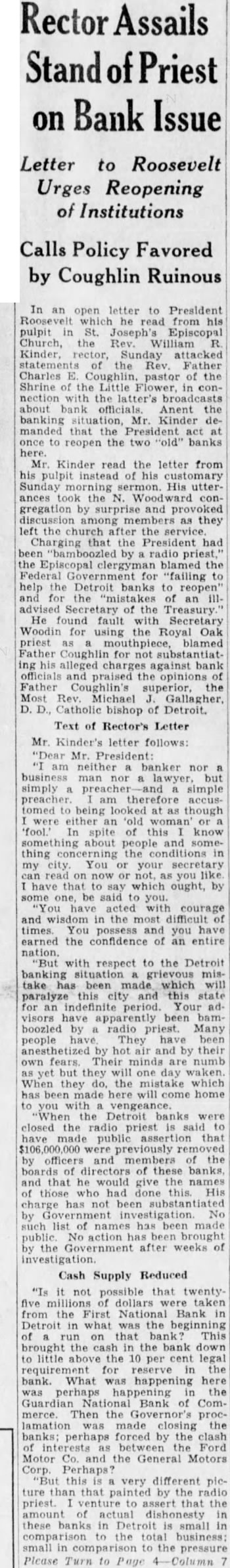

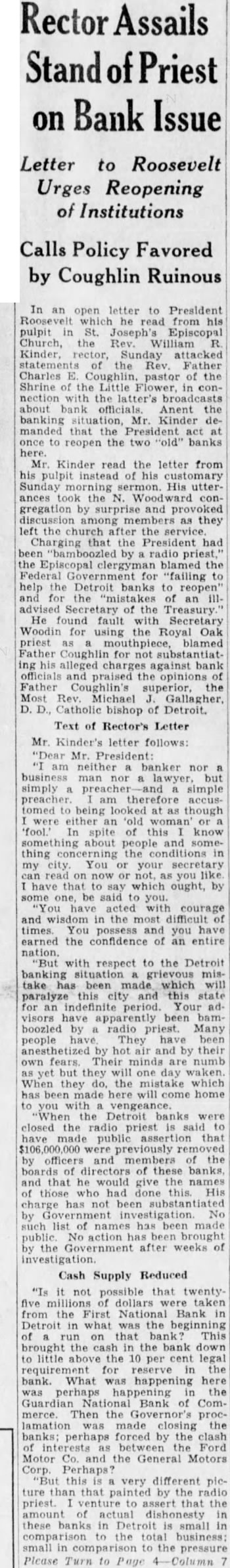

on Bank Issue

Letter to Roosevelt Urges Reopening of

Calls Policy Favored by Coughlin Ruinous

In an open letter to President which he read from pulpit in St. Joseph's Episcopal Church, the William Kinder, rector, Sunday attacked statements the Father Charles Coughlin. pastor of the Shrine the Little nection the latter's about bank officials. Anent the banking situation, Mr. Kinder demanded that the President once to reopen the two banks Mr. Kinder read the letter from his pulpit instead of his customary Sunday morning sermon. His ances the Woodward gregation by they left that the President by radio the Episcopal blamed the Federal Government for "failing the Detroit banks for the "mistakes advised Secretary of the Treasury. found fault with Secretary Woodin for using Royal Oak priest mouthpiece, blamed Father Coughlin for alleged against officials praised the Father Coughlin's superior, the Most Rev. Michael Gallagher, Catholic bishop of Detroit. Text of Rector's Letter Mr. Kinder's letter follows: "Dear Mr. President: neither banker business man nor simply simple tomed though either 'old fool. spite of know about people and thing conditions my city. You your now that which ought, by some be said with courage and the most difficult times You and you have earned the confidence an entire nation. with respect to the Detroit banking situation grievous mistake been made which paralyze this state period. visors have been bamboozled by radio priest. Many people They been anesthetized hot by their own fears. Their minds numb but they will one day waken. When they the mistake which been here will come home vengeance. banks closed radio have made public that previously officers and members the directors of these banks, and that would give names those had done His charge has not been substantiated by Government No list has made action the after weeks of

Cash Supply Reduced

"Is not possible that twentyfive millions dollars taken from the First National Bank Detroit in what the beginning that bank? brought the cash the bank down above cent legal requirement for reserve bank. What happening perhaps happening the Guardian National Bank of Commerce Then the Governor's lamation made closing perhaps forced by the clash interests between the Ford Motor Co. the General Motors Corp. Perhaps? this very different ture that by the radio priest. that amount actual dishonesty these banks in Detroit small comparison the total business: small the pressure Please Turn to Page

12.

March 30, 1933

The Plain Dealer

Cleveland, OH

Click image to open full size in new tab

Article Text

U. S. Union Trust Gets $25,000,000 Aid;

CHARGES FRAUD IN 2 DETROIT BANKS

Receiver of Mt. Clemens Bank in Suit Accuses Holding Companies.

March Detroit's largest banking ing companies for inoperative First and the Guardian National Bank of Commerce. tonight faced new difficulties as charges of deceit and trickery" were made against them the receiver for outstate bank The Detroit Bankers Co. the Group. facing ship with the Detroit banks and banking officials were charged Macy Watkins receiver the Citizens Savings Bank of Clemens, attempting to their ship majority of stock in the The charge was made in state ment filed Circuit Court petitioning for authorty levy 100 assessment on all stockholders of the Mount Clemens Bank, because bank's have preciated The asked for authority collect from the bring suit against of the two operative national banks Hearing the petition set for April Action for the appointment of holding was group of stockholders each group today petition for the Detroit Bankers Co filed by Thomas G. Long. attor for Hearing on petition mornThe included denial of all charges the suit filed by receivership for the company Aaron Kurland chairman of the Michigan Depositors Co-Operative League, oppose voluntary would permit the company to which name its The filed denies the First Bank of unable pay depositors that saying could banking by comptroller of

It denies there an but admits against that the Detroit Bankers panies the receiver for the by Mount and dition the following banks and Fred executive mercial Bank Harry former vice Bank president the First National First National the Guardian National the Common Bank State and the Detroit Bank banking and personal He charged the Detroit obtained in the and for payment the Bank Clemens the that of the earning Federal Reserve this procedure He the Detroit tually shares of Mount through ownership part through teller in the National The receiver the holding

13.

June 27, 1933

Richmond Times-Dispatch

Richmond, VA

Click image to open full size in new tab

Article Text

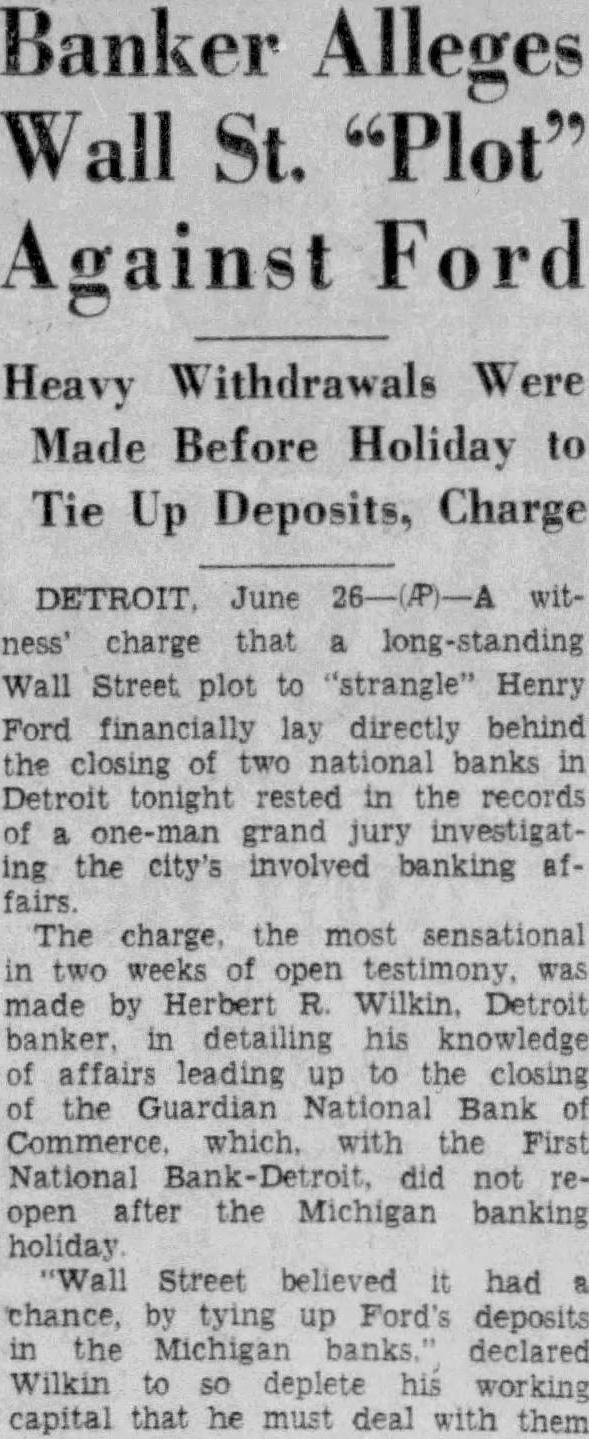

Banker Alleges Wall St. "Plot" Against Ford

Heavy Withdrawals Were Made Before Holiday to Tie Up Deposits, Charge

DETROIT June 26-(P)-A witness' charge that long-standing Wall Street plot to "strangle" Henry Ford financially lay directly behind the closing of two national banks in Detroit tonight rested in the records of one-man grand jury investigating the city's involved banking afThe charge, the most sensational in two weeks of open testimony, was made by Herbert R. Wilkin. Detroit banker, in detailing his knowledge of affairs leading up to the closing of the Guardian National Bank of Commerce which, with the First National Bank-Detroit, did not reopen after the Michigan banking holiday "Wall Street believed it had chance, by tying up Ford's deposits in the Michigan banks declared Wilkin to so deplete his working capital that he must deal with them

14.

July 7, 1933

The Forum

Fargo, ND

Click image to open full size in new tab

Article Text

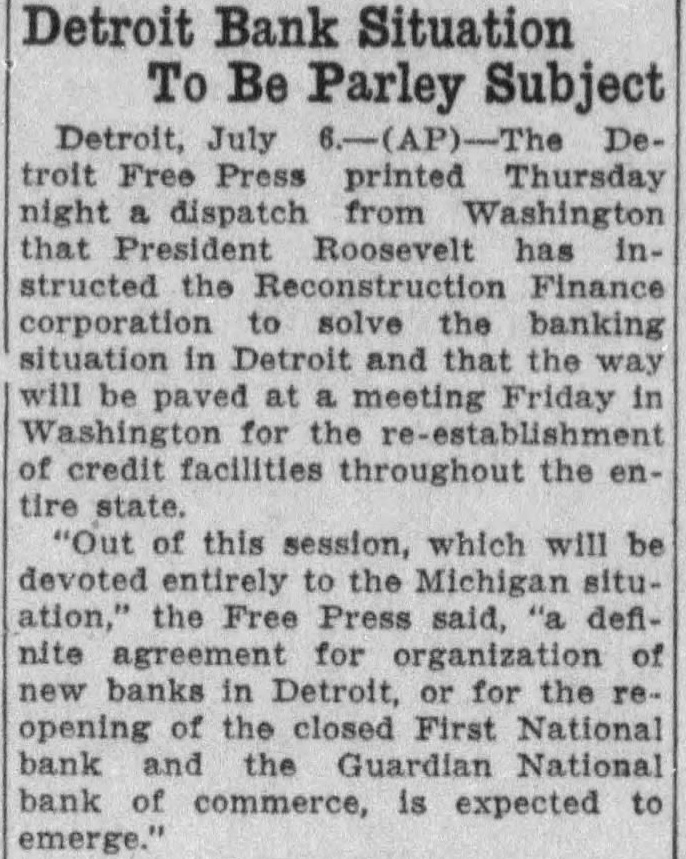

Detroit Bank Situation To Be Parley Subject

Detroit, July DeFree Press printed Thursday dispatch from Washington that President Roosevelt has in. structed the Reconstruction Finance corporation solve the banking Detroit and that the way will be paved at meeting Friday in for the of credit facilities throughout the entire "Out of this session, which will be devoted entirely to the Michigan ation," the Free Press said, definite for organization new banks in Detroit, or for the opening the closed First National bank and Guardian National bank of commerce, is expected to emerge."

15.

July 23, 1933

The Saginaw News

Saginaw, MI

Click image to open full size in new tab

Article Text

BANK CASE DELAYED

Court Hesitates to Impede Efforts to Reopen Institutions.

Associated Press. DETROIT July Judge Ernest A. 0 Brien in federal court until August hearing on the certain the companies of the closed national banks for an ing the ing against Technically the made the ground that Robert attorney for the receiver the First National not entered a formal the Judge he not want efforts the banks. Plans Under Way

Plans and the National Commerce for In grand last leading up holiday February 14 by William Numerous before the jury some two Finance week the banks are

16.

September 1, 1933

The Ludington Daily News

Ludington, MI

Click image to open full size in new tab

Article Text

BY COUZENS

Tells How Changes Were Made When Loan Officers of Bank Were Called Weak

'Utterly False' that He Dictated Bookkeeping Method, He Declares

DETROIT, Sept. Detroit's two National banks failed because government aid withheld when was needed, Emory Clark, director of the First National and chairman of the board of the Detroit Bankers Co., clared today before the grand jury Michigan bank closings. "Senator Couzens was critical the RFC corporation loan asked the Union Guardian Trust Clark asserted. "That upset the applecart."

DETROIT Sept. Mills. former chairman of the closed First National BankDetroit. told the one-man grand jury bank today that federal bank iners in May, 1932, had criticized officers of his institution being His testimony came in sponse to question testimony given recently by ator James Couzens. who read from federal examiners report the statement that many officers of the bank were weather zAlfred Leyburn, former (Please Page Column

17.

October 3, 1933

The Grand Rapids Press

Grand Rapids, MI

Click image to open full size in new tab

Article Text

DETROIT BANK RECEIVERS TO CONSIDER HOME BONDS

Detroit, Oct. received here Monday by closed First National bank Detroit, and Schram, receiver of the National Bank Commerce, the the currency exchange mortgages for home loan corporation bonds. Previously the receivers had deThe for saction be submitted comptroller his approval. When receiver has completed to Washington detailed on the persons involved and receiver estimates he might realize on home bonds open market. the agrees to it must receive court approval.

18.

February 2, 1934

Detroit Free Press

Detroit, MI

Click image to open full size in new tab

Article Text

Borrowing Judges' Names Kept Secret dinand Pecora, counsel for the Senate Banking considering tonight whether he would make the names of Michigan owed the First National Bank when closed. Pecora besieged by newspapermen veal names, but their publication serve useful He consider the matter night While the indicated that the judges from Detroit, Pecora said that some from outstate. was ported office judges the State Court also the beinjustice done the judges, jurist not desires write him he would make part the committee record. voted for dividend that he did not was On question that the bank always insisted collateral the borrower's condition Bank Demanded Mortgage

He drew attention case director in which bank demanded mortgage on the home. Directors loans were discussed than directors' unwieldly the numbered members, Mr Stair testified. board size through institutions and the consequent of board finally was duced half asserted that he garded "splendid the remark about the efficient methods loaning officers, to be lenient the directors know," Mr. Stair meticulous condition of their Stair's National loans which owed himself to any units the Detroit Bankers Company but had indorsed some ligations of business associates and relatives

Demand Note Paid Up

He listed $75,000 demand note Realty Feb. dorsement $125,999 borrowing Keim, which $78,000 balance against Mr. Inc., for which reduced balance $8,000. Against this offset the firm's of In addition, the DeTransfer totaling $50,000, which Pecora developed that the witness director the Buhl Stamping which had $130,000 why that had not included the didn't Mr overlooked any dorsed by Lawrence D.

Railway Note Explained

Pecora that the Wabash Railway Mr. Stair to the extent $125,000. plained that the York Bank through other banks. He said that not known banks that had taken part the Pecora that the witness and Mr. Stair did not those "Did you "that direct liabilities the First National directors totaled their indirect obligations $2,634,283?' didn't know that," Mr. Stair replied remember, however, 90 rectors the loans were cent Pecora sought to take Mr. Stair over other statements the Detroit Bankers witness said he nothing the detail that they had approved by the commit-

Signed 1932 Statement Mr. Stair one the He the tained Joseph Dodge, then ecutive having faith Mr. Dodge, signed. has faith in Mr Dodge, the told the Committee that he considered his position president of the Company less honorary He did any time office his received the honorary officer, all the others seem to been on the payroll," Chairman don't know," replied Mr Stair. "Possibly only nontestified that had no knowledge of the indebtthe First Co., affiliate the Detroit Bankers this debt had been incurred before became director. He said he the of filed Michigan Securities Com-

Letter Quoted

Pecora copy letNewberry Dodge, good plan include the report First National the annual statement. Stair he did not know what Mr. Newberry had in or mind. Judge Murfin obviously belbrief examination before adjournPecora challenged Murfin on the progress the double liability provisions the Federal much interested in that I'm am going it," Judge Murfin going "And when will deprive depositors efits might accrue to them," shot "When for stockholders will be for per cent the depositors," Judge Murfin replied. Enlarging upon this answer after Murfin said the and their per all deposits the bank. Both Sorry

Judge Murfin had requested that his today could return to Detroit, but taken the debate Pecora, the Committee counsel turned witness have to ask you to return tomorrow. sorry," Murfin said. sorry, Pecora said "because told me you wanted hope that both of won't after Murfin only you have to return Pecora retorted.

19.

February 13, 1934

Ironwood Daily Globe

Ironwood, MI

Click image to open full size in new tab

Article Text

Unique Plan of Detroit Bank to Affect 136,000 Persons.

Detroit, Feb. one day of the gan's bank ficial notice was issued today that with less in the Guardian National Bank Commerce when will paid full through plan believed unique in banking inte:ory was just tomorthat Governor William stock signed the request of the state's banking associations, ordering bank tions suspended for eight days. that period had elapsed, the bank holiday had spread other to be climaxed on March presidential proclamation closing all banks in the counToday's announcement told completion of arrangements whereGuardNational their c'aims share an eight per cent financed Reconstruction Finance Corporation loan make possible for smaller depositors all their money. All depositors already have shared in payments totaling 60 the announcement will begin about February This payment will amount about $8,000,000. The holiday tied up Detroit banks :rust panies alone, and two the Guardian National and First National did open Since Guardian have while First National depositors have celved 50 accounts,

20.

February 3, 1935

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

Debt Cited in Affidavit. In the affidavit, Bard had declared "Elizabeth Dee O'Brien is indebted to the First National Bank, Detroit, on various and numerous mortgages and notes exceeding the sum of $27,000, all of which are past due and unpaid; that the receiver on numerous occasions has attempted to enforce collection of these obligations from the said Elizabeth Dee O'Brien and has been informed by Ernest A. O'Brien, acting on behalf of his wife, that she is unable to liquidate these obligations." The affidavit further said that when a receiver for the banks was appointed "a joint collateral note in the amount of $3,045.50 in the name of Ernest A. O'Brien and Elizabeth Dee O'Brien was among the assets of the First National Bank, Detroit; that this note was secured by $11,000 worth of various securities." Opinion Allegedly Expressed. In concluding his affidavit Bard said that he had "been informed and verily believed that District Judge O'Brien manifested an unusual interest in the banking investigation in Michigan conducted by the United States Government," and that the judge had "expressed an opinion regarding the above-entitled case on several occasions." Summing up, Bard said he believed O'Brien "is undoubtedly personally biased and prejudiced against the Government and biased and prejudiced in favor of the defendants and is, therefore, not a suitable judge to try this case fairly and impartially and that he should be disqualified and another judge designated to try the said case." In a copy of his opinion, made public yesterday by the department, Judge O'Brien said that the affidavit had not complied with the judicial code and explained: Reasons for Decision. "I am satisfied and so find that the affidavit, neither in substance nor form, complies with the requirements of section 21 of the judicial code; that it is not an affidavit of a party to the proceedings as required by that section, is not accompanied by a certificate of counsel of record as required, it appearing from the records of this court that the certifying counsel has not been admitted to practice in this court, that it is legally insufficient to establish the claimed bias and prejudice, that it fails to identify the names of informants of affiant as to the opinions claimed to * or the have been expressed * time and place of such expression, that no proper application for deter-

21.

April 13, 1936

The Waterbury Democrat

Waterbury, CT

Click image to open full size in new tab

Article Text

Operates in Lower Rank of Jurists Federal Courts Blamed for Detroit Muddle Hughes Takes a Hand. Washington, April 13-The impeachment trial of a federal district judge by the senate calls attention way it to sometimes the judicial operates process in and the the lower reaches of the federal courts. Appointments to the district bench political ones and the apSenators grounds. pointees are usually have of political the party back- in have important voice in those power the appointments. most While District Judge Halsted L. Ritter of Florida was trying to exto the rea to ceived plain money senate from why lawyer he whom he had assigned a receiverChief of the supreme ship, Hughes Justice U. S. Charles Evans court into a in stepped Detroit, where cockeyed several situation other district judges play important roles. The tale: More than three years ago, two billion-dollar banking chains in Michigan collapsed, precipitating the state bank holiday, which precipitated the national bank holiday. The key banks of the two chains were the First National and the Guardian National Bank of Commerce. Thirty-four bankers, officers of the two were groups indicted in June, 1934, for alleged false reports and other banking law violations. Judges Won't Step Aside has The trying Department get of the Justice been to cases tried ever since and its lawyers attribute failure to proceed to the refusal of Michigan's three federal district judges-republicans appointed by Taft, Coolidge and an without Hoover-to outside judge step aside Detroit and allow banking connection to be assigned to the bank cases. has now appointed Patrick T. Judge Hughes Stone of Wis- the a democrat, to try a bankers. consin, Recently fourth judicdistrict created in Michiand the job was to Arthur gan ial F. Lederle, was who is given expected to sit elsewhere while Stone comes in for that purpose. to trial the case The with government first will proceed May 1. Judge Arthur J. Tuttle and Judge Edward A. Moinet had been bank presidents in Michigan and they Ernest A. Judge disqualified themselves. O'Brien, That who left inhe the insisted cases, that though would government try the bankers' sisted he was unfit to do so. O'Brien went on with a trial which resulted in acquittal of three defendants-who, however, are still under other indictments. Charge Judge Erred The government went to the circuit court of appeals, charging more than 30 prejudicial errors in O'Brien's charge to the jury. It also that was personally alleged involved, O'Brien because his wife to one and suit was facing in debt by its of receiver the banks beon cause certain she had loans recovered without collateral paying off certain other loans in the bank. The appeals court ordered O'Brien to step down and let an outside come Brien on. by fought judge Represented in. But O'John W. Davis, he appealed to the supreme court itself. The sucourt which made preme case, refused to the review appeals the court ruling effective. But Department of Justice officials declare the appeals court still was unable to persuade one of the three judges to accept a transfer so asthat a substitute The might stymie be signed to the trial. was broken by creation of the fourth judgeship.

22.

January 3, 1941

Detroit Evening Times

Detroit, MI

Click image to open full size in new tab

Article Text

# Reading Sentence

# Date to Be Fixed

A date for the sentencing of former Mayor Richard W. Reading for making a false statement to a bank/receiver, in connection with a loan from the defunct First National Bank-Detroit, will probably be set next week, Richard F. Doyle, Federal Court probation officer, said today. At that time, he expects to turn over his probation report to the court.

23.

May 1, 1941

Detroit Evening Times

Detroit, MI

Click image to open full size in new tab

Article Text

# Reading Hunting

# $10,500 Cash to Pay U.S. Fine

Former Mayor Richard W. Reading was hard at work today attempting to raise the $10,500 in fines assessed against him by Federal Judge Frank A. Picard yesterday. A suspended sentence of 18 months accompanied the fines.

Reading pleaded guilty four months ago to three counts of a four-count federal indictment which accused him of making false statements to B. C. Schram, receier for the defunct First National Bank-Detroit. The fourth count was dismissed.

Judge Picard said that Reading must pay the fine by May 12 or serve the 18-month term.

# MAY SEE SOME BARGAINS

"I'm going to see if I'm a super salesman or not," Reading said. "I've just got to raise that money. About everything I have is tied up in real estate. Most of it is vacant property and I guess you can say that there will be some big bargains in unimproved property until I get the $10,500."

The government accused Reading of making a financial statement which listed his cash on hand at $100 when he really had $30,000 in cash in a safety deposit box. On the basis of his statement, a $17,303 debt he owed the bank was compromised for $5,350.

# SPENT OR INVESTED

"That cash is either spent or invested now," Reading said. "Some of it is in oil properties which return small earnings or in unimproved property."

Reading still faces trial on another federal indictment returned on Aug. 7, 1940, which charges him with evading payment of $12,039 in income taxes for the years 1938 and 1939. He stood mute when arraigned on this indictment and was freed on $2,000 bond.

24.

June 15, 1941

Detroit Evening Times

Detroit, MI

Click image to open full size in new tab

Article Text

# Bowen Estates Told

# To Pay $131,299

The estates of Julian P., Paul M. and Edgar W. Bowen, prominent Detroit industrialists and financiers, were ordered to pay $131,299 to B. C. Schram, federal receiver for the defunct First National Bank-Detroit, in a decision handed down Saturday by Federal Judge Arthur F. Lederle.

The sum represents the interest and balance on notes signed by the three brothers in connection with their investment concern known as the Bowen Brothers. Julian died in 1933 and Paul and Edgar died in 1935.

25.

April 19, 1942

Detroit Evening Times

Detroit, MI

Click image to open full size in new tab

Article Text

# The Business Front

Parcel of Old First National Notes

Goes to Nonprofit Organization

By WARD SCHULTZ

Detroit Times Financial Editor

OME weeks ago, this column reported the sale of a parcel of outlawed notes of bankrupts by the receiver of the First National Bank-Detroit.

I thought you might be interested in what has transpired since on this matter.