Article Text

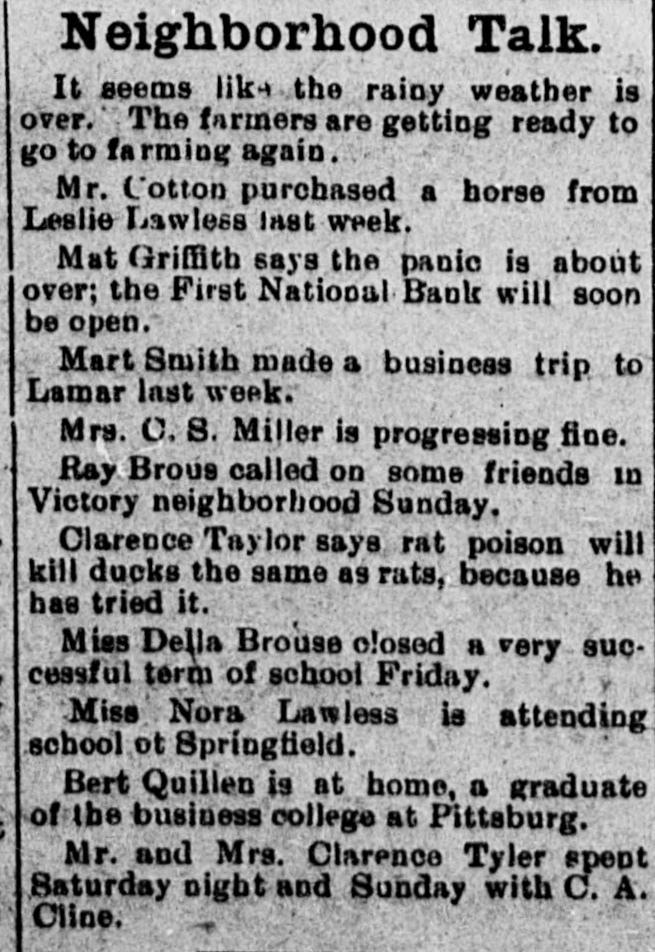

Neighborhood Talk. It seems like the rainy weather is over. The farmers are getting ready to go to farming again. Mr. Cotton purchased a horse from Leslie Lawless last week. Mat Griffith says the panic is about over; the First National Bank will soon be open. Mart Smith made a business trip to Lamar last week. Mrs. C. S. Miller is progressing fine. Ray Brous called on some friends in Victory neighborhood Sunday. Clarence Taylor says rat poison will kill ducks the same as rats, because he has tried it. Mies Della Brouse closed a very successful term of school Friday. Miss Nora Lawless is attending school ot Springfield. Bert Quillen is at home, a graduate of the business college at Pittsburg. Mr. and Mrs. Clarence Tyler spent Saturday night and Sunday with C. A. Cline.