Article Text

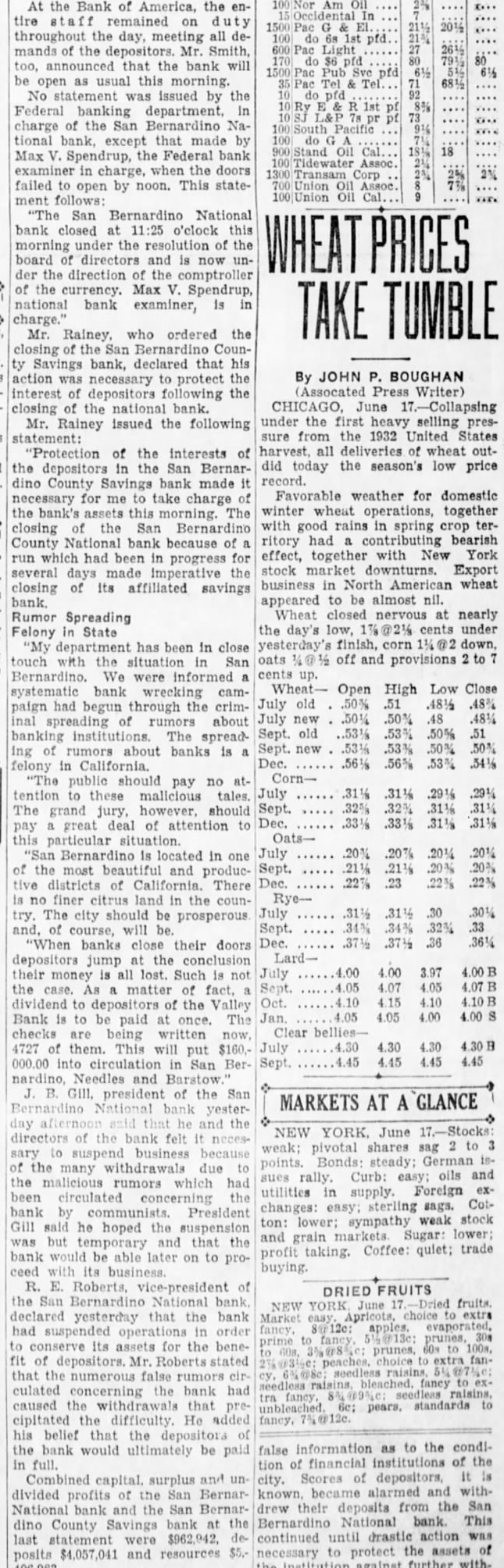

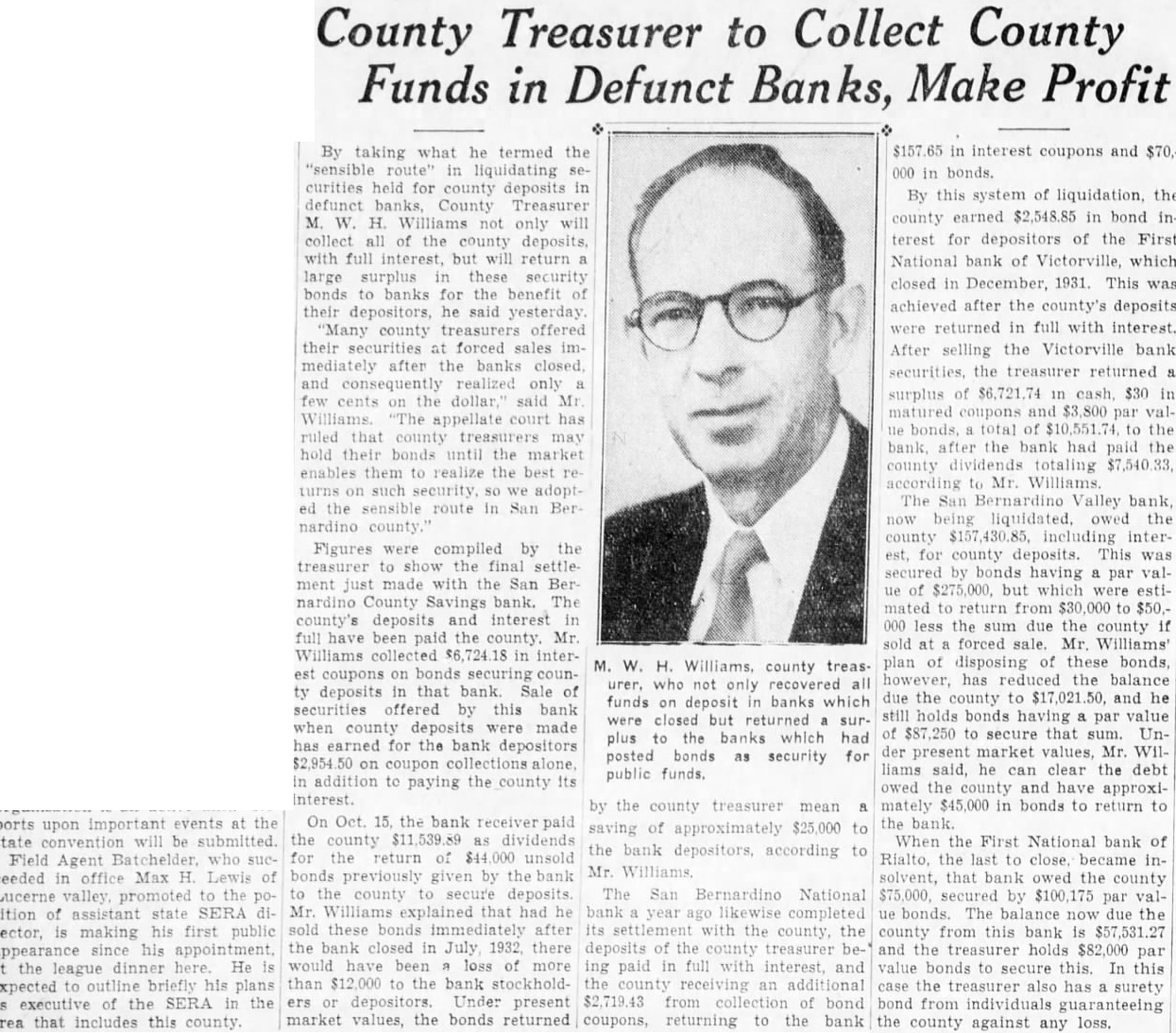

TAKE At the Bank of America, the entire on throughout the day, all demands the Mr. Smith, too, that the bank will be open as usual this morning No issued by the Federal banking department, charge of the San Bernardino National except that made by Max the Federal bank in doors failed open by noon. This statement San Bernardino National bank closed at o'clock this the of the board directors and is now under the direction of the currency. Max V. Spendrup, national bank examiner, is charge.' Mr. Rainey, ordered the Bernardino ty Savings bank, declared that his action was necessary protect the By JOHN P. BOUGHAN interest of depositors following the Writer) closing of the national bank. CHICAGO, June 17.-Collapsing under the first selling presMr. Rainey issued the following sure from the 1932 United States "Protection of the interests of harvest, all wheat outthe depositors in the San Bernar- did today the season's low price dino County Savings bank made Favorable weather for domestic necessary for me to take charge the bank's this morning. The winter together closing of the San Bernardino with rains spring terCounty bank because of ritory had bearish effect, together with New York run which had been in progress for stock Export several made business in American wheat closing its affiliated savings bank appeared to be almost nil. Rumor Spreading Wheat nervous at nearly Felony in State the day's cents under "My has been in close finish, down, touch the San oats off and provisions Bernardino. We were cents systematic bank cam- Open High Low Close July old .48% paign had begun through the criminal rumors about Sept. old The spreading about banks is felony in .53% "The public should pay no tention these malicious tales. July The grand however, should Sept. jury, Dec. pay great deal of attention to Oatsparticular located in one July 20% of the most and produc- Sept. tive districts of California. There Dec. .22% .23 finer in the country. The city should be prosperous July course, "When banks close their doors Dec. depositors jump the conclusion Lardmoney all lost. Such is not July 3.97 the case. As matter of fact, Oct. 4.10 4.10 B dividend depositors the Valley 4.05 4.00 Bank to be paid once. The checks are written Clear July 4.30 4.30 4727 of them. This will put 000.00 into San Ber- Sept. 4.45 4.45 4.45 Needles and Barstow. Gill, president of the San MARKETS AT A GLANCE yesterday he and the NEW June directors of the bank felt necesweak; pivotal shares to business because points. Bonds steady: German the many withdrawals due sues rally. Curb: oils and the rumors which had utilities supply. Foreign been concerning the changes: sterling sags. Cotbank President sympathy stock Gill he hoped the was but and that the profit taking. Coffee: quiet; trade bank would be able on to probuying. ceed its business. R. E. Roberts, vice-president DRIED FRUITS the San Bernardino bank fruits NEW YORK June declared the bank Market apples had operations in order its assets for the benefit of depositors Mr. Roberts that the numerous rumors fancy culated concerning the bank had seedless caused the withdrawals standards cipitated the difficulty. He added his belief that the the would ultimately be paid false information as to the condiin full. of financial of the city. Scores of depositors, Bernar alarmed and divided profits of the San bank and the San Bernar drew deposits from the San Bernardino National bank. This dino County Savings bank at the continued drastic action $4,057,041 and resources necessary to protect the posits the against further with