Click image to open full size in new tab

Article Text

SOCIETY NEWS

ST. MARGARET'S CHAPTER CARD PARTY, OCTOBER 10

The card party, sponsored by St. Margaret's chapter of Holy Trinity Church Service league, which was announced for Thursday, October 13. has been changed to Monday, October 10, at 8 o'clock at the Holy

Trinity parish house, because of the Business and Professional Women's Stunt night program at the city park High score awards will be presented at each table, awards will be given for the first four aces, the first blank hand and a door award will be given. Refreshments will be served. The public is invited to attend. The committee in charge of arrangements consists of Mrs. M. G. Lambdin, chairman, assisted by Mrs. P. W. Weybrecht and Mrs. Chris Erneston.

CHORUS CLUB FORMED HERE

A group of local singers met at the home of Mr. and Mrs. B. H. Gault on Kanuga drive last night for the purpose of organizing chorus club. Twenty-five charter members were enrolled and more are expected to be added later. Plans wert made to use both secular and sacred music in order to have selections suitable for any occasion. The club is non-profit, and was formed to be of service to local organizations in providing musical programs and entertainment.

A weekly rehearsal will be held on Thursday evenings. At the first rehearsal last night, the cantata "Ruth" by Gaul, was used. At its initial meeting the club elected the following officers R. W. Pinder, president: W. H. Boozer, vice-president Miss Harriette Latterner, secretary Mrs. D. D. Newberry, treasurer; Mrs. B. H. Gault, director and Miss Marjorie Brown. accompanist. In addition to the officers the following charter members were enrolled: Mr. and Mrs. A. B. Hartsfield, Mr. and Mrs. W. L. Halsey, Mr. and Mrs. L. W. Johnson, Mr. and Mrs. W. D. Wagner, Mr. and Mrs. W. R. DeWitt, Dr. and Mrs. R. H. Baldwin, Mrs. Belle Iles, Mrs. Randolph Pinder, Mrs. W. H. Boozer, Henry Lee Davis, Gus Davis, B. H. Gault and Dr. D. D. Newberry.

B. Cook. Peggy Graham, Elva White, Dixie Graham. Nina Ellis, Pearl Walker, Mae Farnum, Freda Drake, Wilma Arnold, Doris Houfer, Agnes Reddick, Marie Long and Virginia Blackwell and Mrs. Mary Harrison.

WOMEN'S REPUBLICAN CLUB MEETS THIS AFTERNOON

A special program has been ar ranged for the weekly meeting of the Women's Republican club of Palm Beach county, to be held this afternoon o'clock at El Verano hotel, with Mrs. Ralph Payne, president, in charge. Sydnor Tucker of Palm Beach will be the speaker of the afternoon, using the republican platform as his topic.

OFFICERS ELECTED BY UNUSUAL CLUB Almer Tedder was elected president of the Unusual club last night at the regular meeting at the home of Ray Allen, 621 Ardmore road. Other officers elected to serve the next quarter were Ray Allen, vicepresident: Miss Myrtie Chastain. secretary; Miss Mary Lee Cottle treasurer. and Miss Helen Huff. publicity chairman Bob Sasser and Miss Lucille Blair were appointed to be in charge of Halloween party to be given the last of the month. The next meeting will be held at the home of Miss Myrtie Chastain, 533 Gardenia street. Following the meeting refreshments were served. Attending were the Misses Helen Riggs, Lois Drawdy. Myrtie Chastain, Mary Lee Cottle. Lucille Blair Edna Winters and Helen Huff and Ralph Kohl, Jimmy Lord. Ray Allen, Boyd Ellis. Almer Tedder. Richard Sparks, John Crabtree. Ed Pieper and Riley Sims.

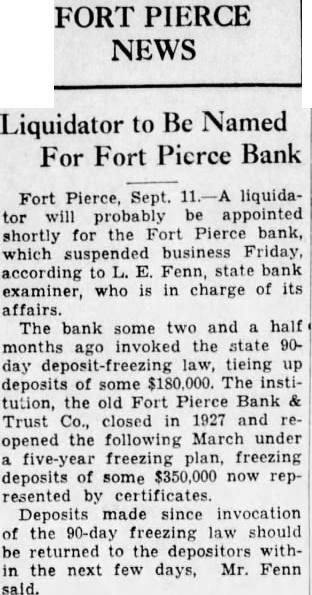

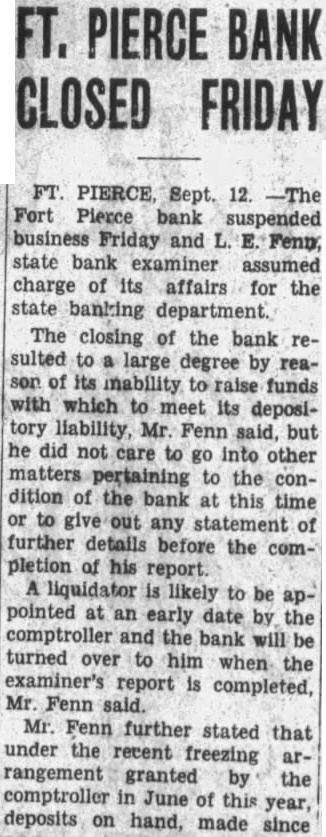

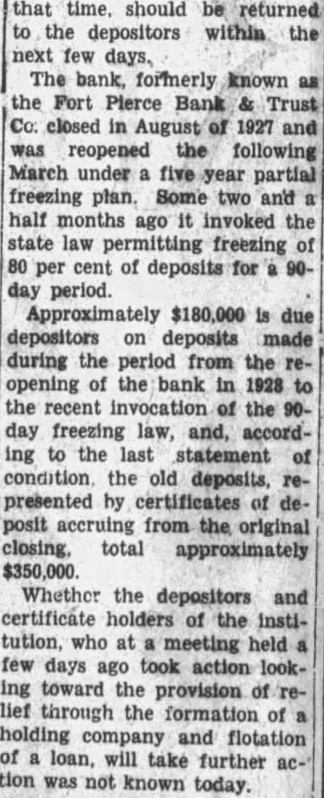

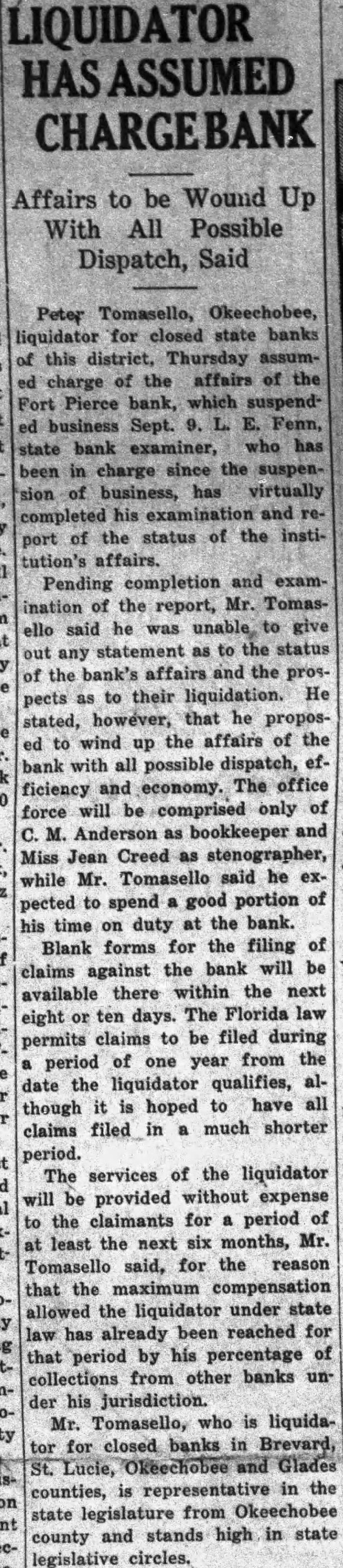

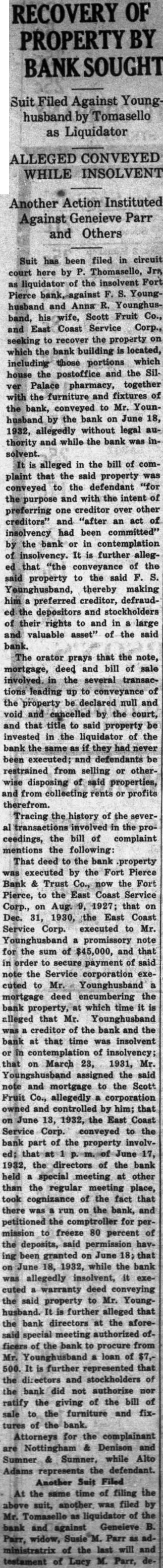

TOMASELLO IS LIQUIDATOR

Fort Pierce, Oct. Peter Tomasello. Okeechobee, liquidator for closed state banks in this district, has assumed charge of the affairs of the Fort Pierce bank, which suspended business Sept. 9. Pending completion and examination of the examiner's report, Mr. Tomasello said he was unable to give out any statement relative to the status of the bank's affairs.