Click image to open full size in new tab

Article Text

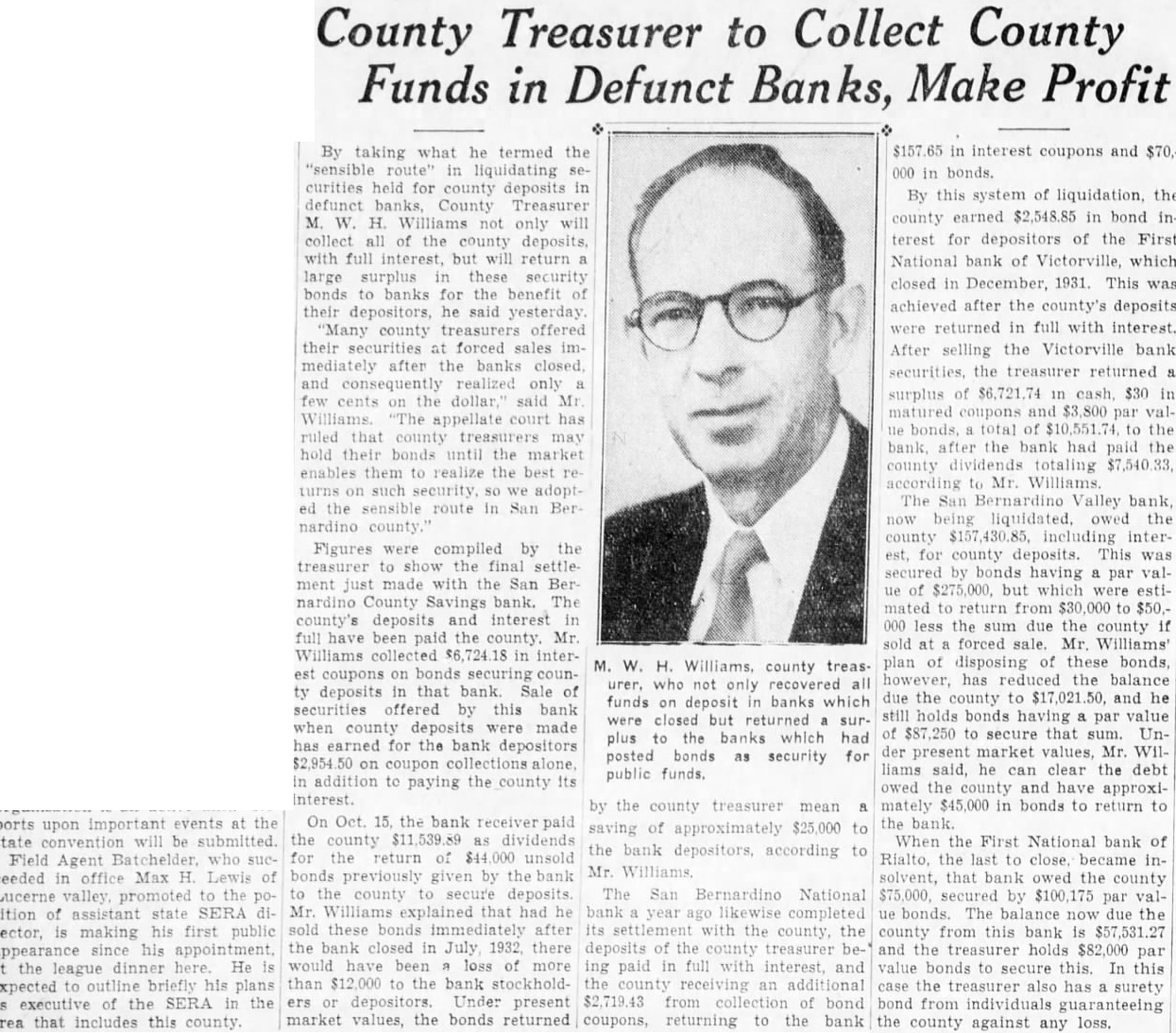

County Treasurer to Collect County Funds in Defunct Banks, Make Profit

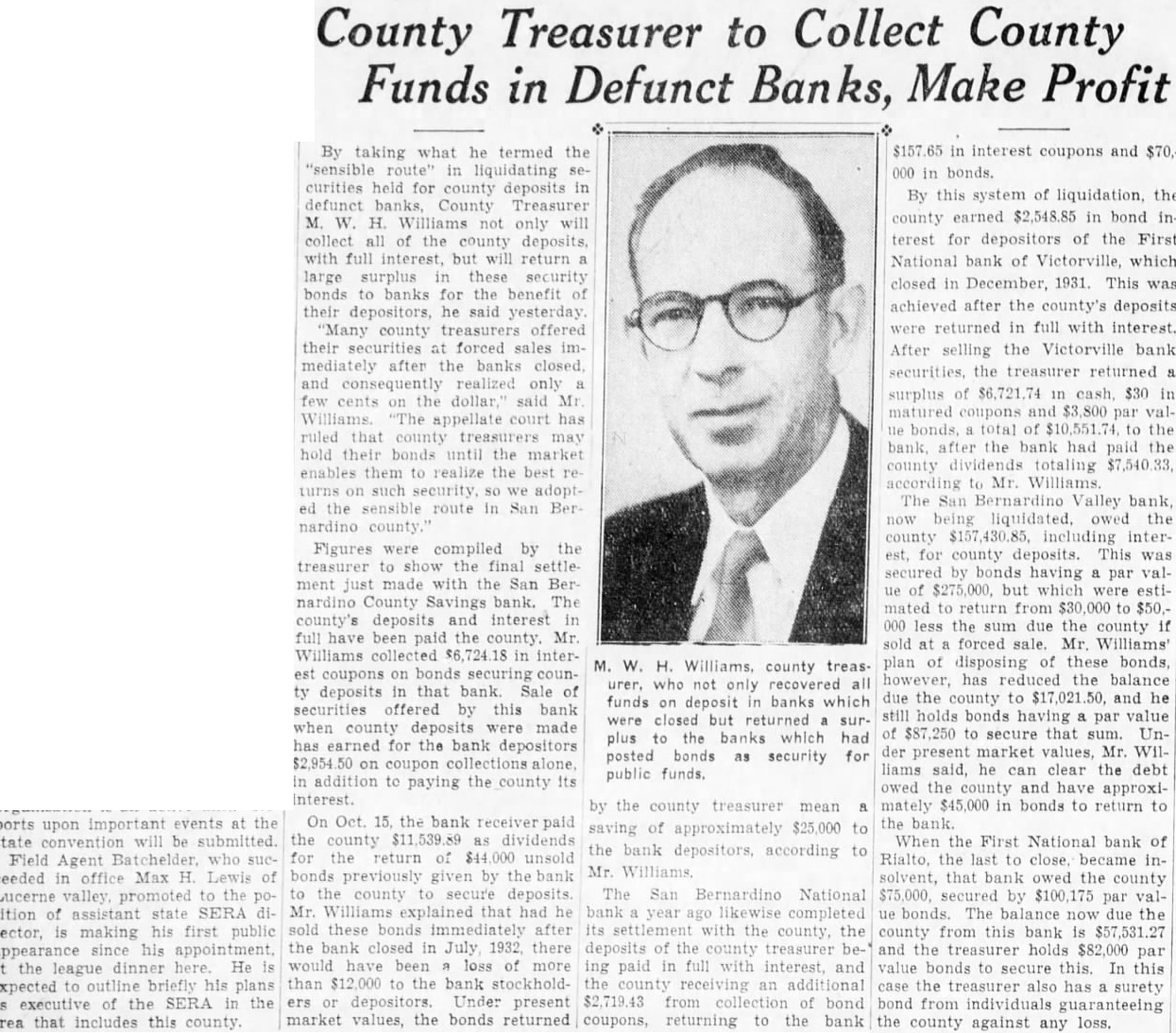

By taking what he termed the "sensible route" in liquidating securities held for county deposits in defunct banks, County Treasurer M. W. H. Williams not only will collect all of the county deposits, with full interest, but will return large surplus in these security bonds to banks for the benefit of their depositors, he said yesterday Many county treasurers offered their securities at forced sales im mediately after the banks closed and consequently realized only few cents on the dollar, said Mr Williams. "The appellate court has ruled that county treasurers may hold their bonds until the market enables them to realize the best re turns on such security, so we adopted the sensible route in San Ber nardino Figures were compiled by the treasurer to show the final settlement just made with the San Bernardino County Savings bank. The county's deposits and interest in full have been paid the county. Mr. Williams collected $6,724.18 in interest coupons on bonds securing county deposits in that bank Sale of securities offered by this bank when county deposits were made has earned for the bank depositors $2,954 on coupon collections alone, in addition to paying the county its interest.

On Oct. 15. the bank receiver paid the county $11,539.89 as dividends for the return of $44,000 unsold bonds previously given by the bank to the county to secure deposits Mr. Williams explained that had he sold these bonds immediately after the bank closed in July 1932 there would have been loss of more than $12,000 to the bank stockholders or depositors. Under present market values, the bonds returned by the county treasurer mean a saving of approximately $25,000 to the bank depositors, according to Mr. Williams. The San Bernardino National bank year ago likewise completed its settlement with the county, the deposits of the county treasurer being paid in full with interest, and the county receiving an additional $2,719.43 from collection of bond coupons, returning to the bank

$157.65 in interest coupons and $70,000 in bonds. By this system of liquidation, the county earned $2,548.85 in bond interest for depositors of the First National bank of Victorville, which closed in December, 1931. This was achieved after the county's deposits were returned in full with interest After selling the Victorville bank securities, the treasurer returned a surplus of $6,721.74 in $30 in matured coupons and $3,800 par valtie bonds, total of $10,551.74 to the bank, after the bank had paid the county dividends totaling $7,540.33, according to Mr. Williams The San Bernardino Valley bank, now being liquidated. owed the county $157,430.85 including interest, for county deposits. This was secured by bonds having a par value of $275,000, but which were estimated to return from $30,000 to $50.000 less the sum due the county if sold at forced sale. Mr Williams' plan of disposing of these bonds, however, has reduced the balance due the county to $17,021.50 and he still holds bonds having par value of $87,250 to secure that sum. Under present market values, Mr. Williams said, he can clear the debt owed the county and have approximately $45,000 in bonds to return to the bank. When the First National bank of Rialto, the last to close, became insolvent, that bank owed the county $75,000. secured by $100,175 par value bonds. The balance now due the county from this bank is $57,531.27 and the treasurer holds $82,000 par value bonds to secure this. In this case the treasurer also has surety bond from individuals guaranteeing the county against any loss,