Click image to open full size in new tab

Article Text

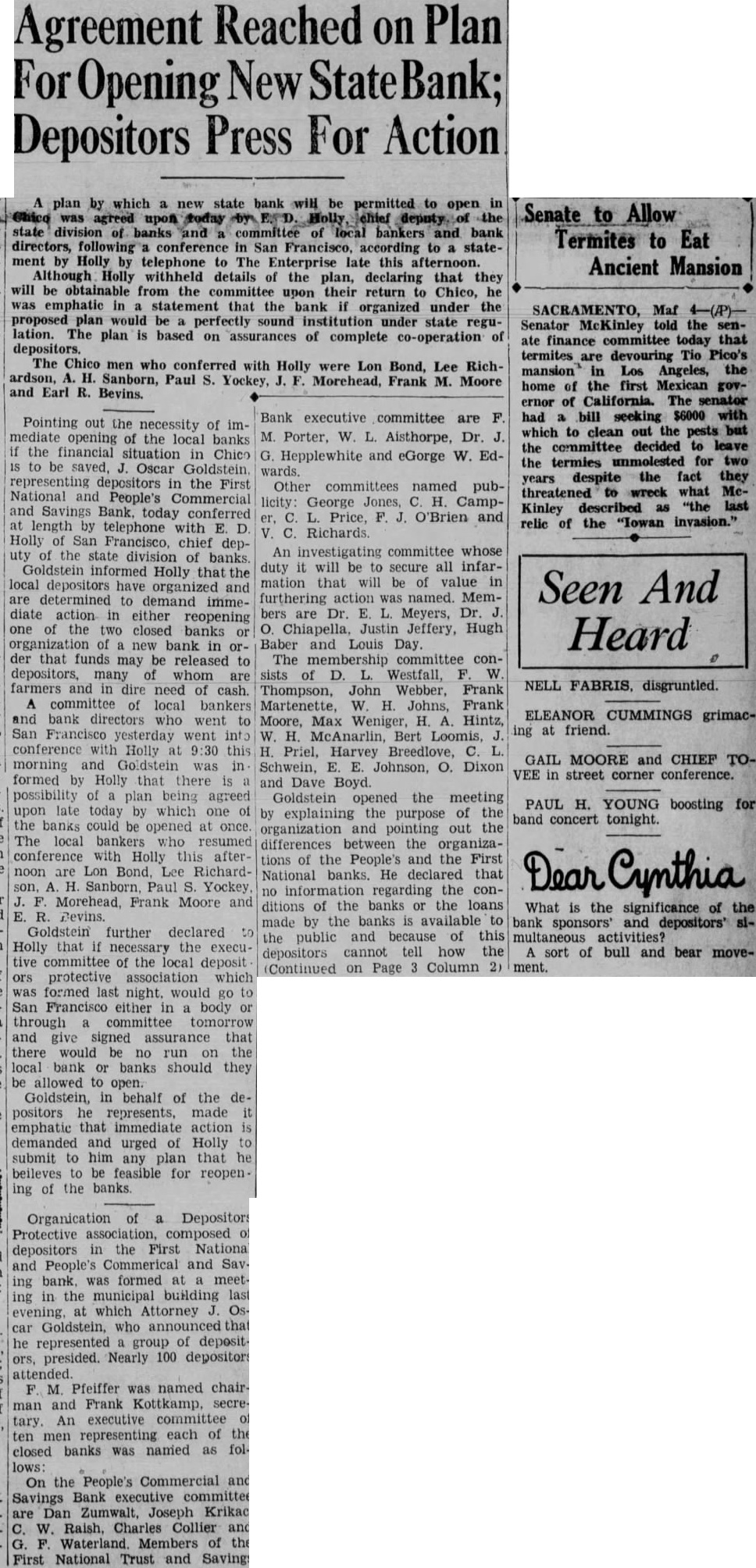

Agreement Reached on Plan For Opening New Depositors Press For Action plan by which new state bank will be permitted to open was agreed upon today chief deputy. the state division of banks and committee of bankers and bank directors, following conference in San Francisco, according to statement by Holly by telephone to The Enterprise late this Although Holly withheld details of the plan, declaring that they be obtainable from the committee upon their return to Chico, he was emphatic in that the bank organized under the proposed plan would be sound institution under state regulation. The plan is based on assurances of complete co-operation of depositors. The Chico men who conferred with Holly were Lon Bond, Lee Richardson, Sanborn, Paul Yockey, Frank Morehead, M. Moore and Earl R. Bevins.

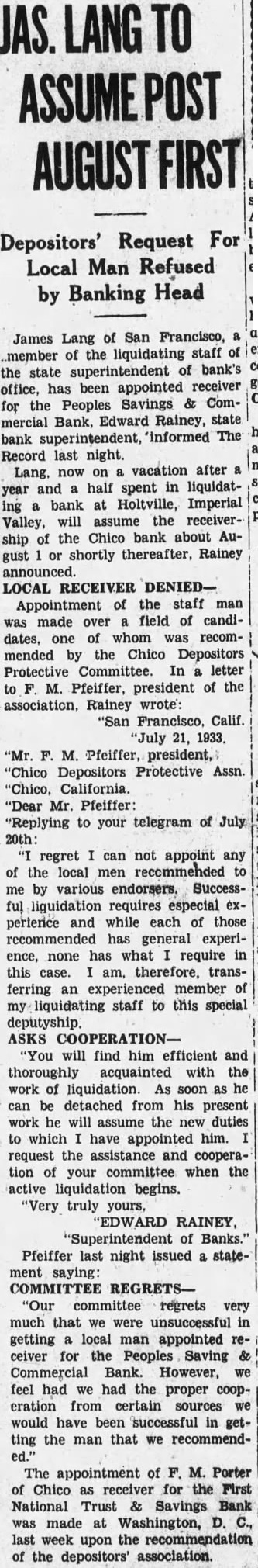

Pointing out the necessity of immediate opening of the local banks the financial situation Chico in to be saved, Oscar Goldstein representing depositors in the First National and People's Commercial and Savings Bank. today conferred length by telephone with E. Holly of San Francisco, chief deputy of the state division of banks. Goldstein informed Holly that the local depositors have organized and determined to demand immediate action either reopening one of the two closed banks organization of new bank in order that funds may be released to depositors, many of whom are farmers and in dire need of cash. committee of local bankers bank directors who went to San Francisco yesterday went conference with Holly at this morning and Goldstein was in formed by Holly that there possibility of plan being agreed upon late today by which one of the banks could be opened once The local bankers who resumed conference Holly this afternoon are Lon Bond, Lee RichardMorehead, Frank Moore and R. Goldstein further declared Holly that necessary the execu tive committee of the local deposit ors protective association which formed last night, would go San Francisco either in body or through committee tomorrow and give signed assurance that there would be on the local bank or banks should they be allowed to open. Goldstein, in behalf of the depositors represents, made emphatic that immediate action demanded and urged of Holly submit to him any plan that he beileves to be feasible for reopen ing of the banks.

Organication of Depositors Protective association, composed of depositors in the First National and People's and Saving bank, was formed at meeting in the municipal building last evening, at which Attorney Oscar Goldstein, who announced that he represented group of depositors, presided. Nearly 100 depositors Pfeiffer was named chairman and Frank Kottkamp. secretary. An executive committee ten men representing each of the closed banks was named as follows: On the People's Commercial and Savings Bank executive committee are Dan Zumwalt. Joseph Krikac, W. Charles Collier and Waterland. Members of the First National Trust and Savings

Bank executive committee are had bill seeking $6000 which to clean out the pests M. W. L. Aisthorpe, Dr. the committee decided to Hepplewhite and eGorge W. Edthe termies unmolested for wards. despite the fact they years Other committees named pubthreatened wreck what licity: George Jones, H. CampKinley described Price, O'Brien and of the "Iowan invasion.' An investigating committee whose duty it will be to secure all infarmation that will be of value in Seen And furthering action was named. Members are Dr. Meyers, Chiapella, Justin Jeffery, Hugh Heard Baber and Louis Day. The membership committee consists of Westfall, NELL FABRIS, disgruntled. Thompson, John Frank Martenette, H. Johns, Frank ELEANOR CUMMINGS grimacMoore, Max Weniger, H. Hintz, ing at friend. W. H. McAnarlin, Bert Loomis, Priel, Harvey Breedlove, GAIL MOORE and CHIEF TOSchwein, Johnson, O. Dixon VEE in street corner conference. and Dave Boyd. Goldstein opened the meeting PAUL H. YOUNG boosting for explaining the purpose of the band concert tonight. organization and pointing out the differences between the organizations of the People's and the First National banks. He declared that no information regarding the conditions of the banks or the loans What is the significance of the made by the banks is available to bank sponsors' and depositors' the public and because of this multaneous activities? cannot tell how the sort of bull and bear movedepositors Continued on Page Column ment.