Article Text

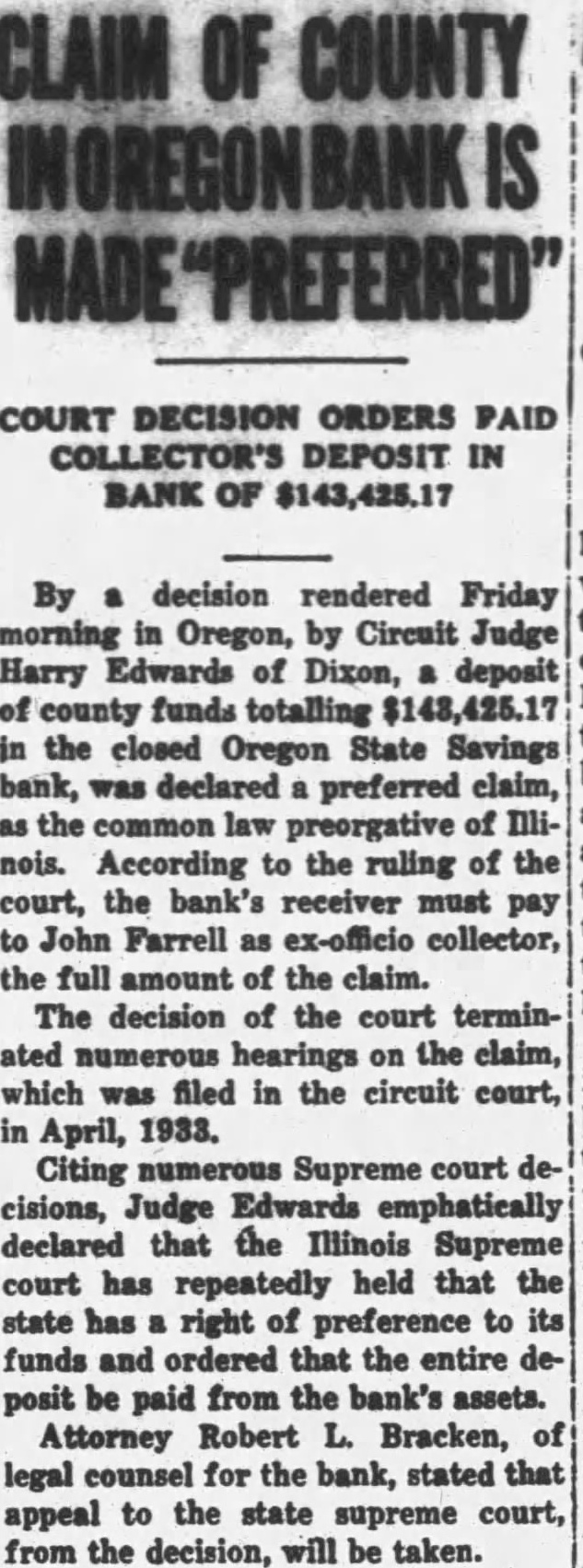

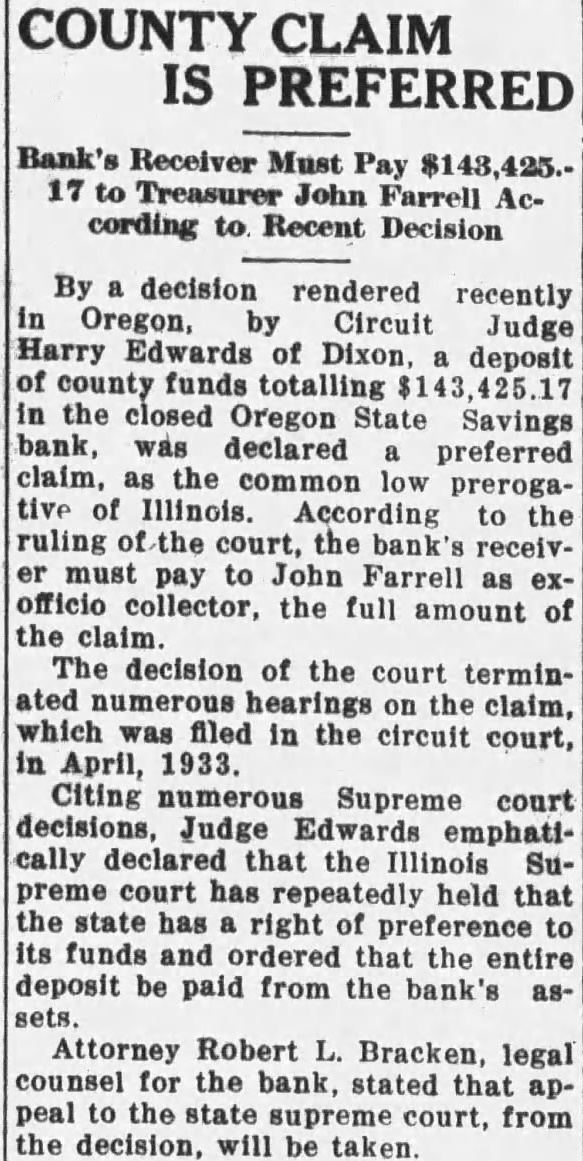

STOCKBRIDGE GREED in human nature. Nellie Gray died weeks chronic invalid, tricked out of her small inheritance young woman. she had been the town pauper of West Mass. years. Then died and left her The first thing Nellie did with the money was pay back the the had her support Only one Nellie's relations ever did for her when she was poor He cousin most hard up as she was. But soon got her relations flocked to her house from all rections When she died seventeen different families claimed share in her They her starve. but now they wanted her wealth The probate examined all the claims. There was claim on behalf of the only relation who had ever done anything to befriend Nellie Gray He said he didn't need could get along. He wouldn't like of anyone think he'd been kind his cousin the hope gain. But the court dealt out justice and this cousin got half of the estate, disgust of the seventeen greedy ones. In this imperfect world it is not often that run across human uation which well bears the belief that right and justice will triumph the end. SUPERSTITION pains inside. In my boyhood used hear back country people say that was dangerous drink from open stream spring. They told weird persons who had swallowed frogs eggs which hatched in their insides. Sometimes was lizard eggs. member reading many years ago gruesome of man who had thus accidentally swallowed alligator egg and devoured from within the reptile which hatched in his imagine that belief is as old humanity. Folk ignorant of physiology attributed internal pains some sort actual reptile in their vitals. But had supposed that erybody knew enough in these lightened to realize the impossibility such happenings until newspaper article from shore resort the other day According to this story young woman walking on the beach picked what she thought pearl She put in her mouth and accidentally swallowed And some time later acording the account. she died in devoured by octopus which had hatched from the egg that had mistaken for pearl! Apparently there still people gullible enough swallow such storAge-old beliefs do not vanish speedily in the face of imagined HUMOR cheese. The funniest sayings often not intended. The bit of unconscious humor which have heard lately told to me very able woman physician specializes in mental cases New England city. One her patients attempted suiside by taking three boxes of rat poison That was overdose. and nature got rid of quickly that he recovered But he had his own theory why failed to work course. now what was the matter,' the poor the doctor directions on told the box to spread the cheese, and forgot the on pieces and At church lawn-party long ago heard the minister's daughter complain. seriously. that young shy off from girls who live in parsonage. "What chance has minister's she sighed. with one eye on the young man who the village tends the himself who was couple of chattering girls. Her father. overhearing her, make me think of Methodist parsonage England, where there were two daughters. They may felt much you do, those have the world two of two girls gave most famous men. One of them became the mother Rudyard Kipliving poet, and the her sister's Stanley Baldwin. came Prime Minister of England. saw the minister's daughter little later. with young college professor on of the village girls have couldn't branded thought she was letting sure but him hold her hand. JOBS men. man is The mark of that he secondrate chance in to prove his One young man know lost his of the depresjob the hardest part else he could tried anything sion. but all he could get get to do, sell advertising on comchance He went the biggest job the world, and six months his within running to much as the high- Now he had ever earned. est salary man of his newspaper the star organization. want first-rate Second-rate men First-rate jobs handed make their own first-rate jobs. Bank for Polo 1933!" Postpone Indefinitely the Hearing on County Moneys By agreement of counsel, the hearpetition of on the intervening Donald Crowell State's Attorney deposit more declare county in the defunct Oregon than preferred claim Savings bank State been indefinitethe bank has against postponed. The hearing was Edwards origJudge Harry set inally of Dixon for last Monday morning courthouse. Attorthe Ogle county ney Robert Bracken, representing Attorneys receiver, and bank and Gerald Martin Peterman the bank derepresenting filed to the positors, have