1.

October 11, 1913

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

Twenty-four Counts. The indictment contains twenty-four counts, on each of which the statutory penalty is not less than five, nor more than ten years' imprisonment. There is no option of a fine. Twenty-three of the counts are for either purchsing or discounting, without the knowledge or consent of the bank directors, notes which, it is alleged, proved to be worthless. The twenty-fourth count alleges that on October 19, 1910, Metcalf issued a check for $140,200 on the Eliot National Bank, of Boston, to the order of the Traders' National Bank, of Lowell, in connection with the efforts of the Columbus Securities Company to secure control of the Lowell bank, and that Metcalf then discounted or purchased six promissory notes to cover this amount in the Atlantic National Bank. These six notes, which make the first six counts in the indictment, are alleged to be valueless. Metcalf resigned as president and sailed for Europe on April 20 last. Twelve days later the bank suspended payment, by order of Joseph Balch, national bank examiner. At that time the deposits amounted to $2,076,268 and the capital stock paid in was $300,000, with a surplus fund of $120,000. The loans and discounts amounted to $2,574,043.

2.

October 20, 1913

The Bridgeport Evening Farmer

Bridgeport, CT

Click image to open full size in new tab

Article Text

BANK ORDERED CLOSED BY THE COMPTROLLER Lowell, Mass., Oct. 20.-The Traders' National Bank of this city was closed today by order of the comptroller of the currency. The bank is connected to some extent with the suspended Atlantic National Bank of Providence, of which President Metcalf is under indictment. The Traders' National was purchased by Mr. Metcalf a year or two ago but was not controlled by him when the suspension was ordered. President Nelson issued this statement today: "The closing of the Traders' National Bank of this city is due to a combination of circumstances. "The marked decline in the market value of bonds held by the bank was an important factor. The suspension of the Atlantic National Bank of Providence, R. I., and later the closing of the First-Second National Bank of Pittsburgh, had a serious effect on the financial condition of a number of firms and corporations, previously well rated, whose notes were held by the bank. These conditions resulted in the impairment of the capital stock of the bank and the directors have deemed it wise in protection of depositors to suspend the further transaction of business. Depositors may be assured that their interests will be fully protected." The Traders' National Bank was orgauized in 1892. According to the last report, the capital stock is $200,000, surplus $79,000, and deposits $3,031,000, of which $22,000 was in savings. The officers of the bank are Clarence H. Nelson, president; William F. Pillis, vicepresident; Amos T. Hill, cashier, and Edward T. Wilder, teller. WASHINGTON REPORTS BANK IS INSOLVENT Washington, Oct. 20.-The Traders' National Bank, of Lowell, Mass., was closed on a report from National Bank Examiner Norwin S. Bean that the institution is insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Traders' and the Atlantic National Bank of Providence, R. I., which was closed April 14. Three months ago the capital was shown to be in bad shape. Under the law the bank had three months in which to make an assessment on the stockholders or go into voluntary bankruptcy. The bank examiner reported that the capital had not been restored and that the bank was insolvent.

3.

October 20, 1913

The Evening World

New York, NY

Click image to open full size in new tab

Article Text

1 National / Bank of this city was closed A to-day by order of the Comptroller of the Currency. The bank had a paid up capital of $200,000 and its deposits are estimated at more than $2,500,000. It was established in 1892. An order issued by the Comptroller last July that the bank increase its resources.Conditions not having materially improved. the Comptroller took charge of the institution to-day. The bank is connected to some extent with the suspended Atlantic National Bank of Providence, R. I., whose president, Edward P. Metcalf, is now under indictment. The Traders' National was purchased by Mr. Metcalf a year or two ago, but was not controlled by him when the suspension was ordered. President Nelson issued this statement to-day: "The closing of the Traders' National Bank of this city is due to a combination of circumstances. The marked decline in the market value of bonds held by the bank was an important factor. The suspension of the Atlantic National Bank of Providence, R. I., and later the closing of the First-Second National Bank of Pittsburgh had a serious effect on the financial condition of a number of firms and corporations, previously well rated, whose notes were held by the bank. "These conditions resulted m the impairment of the capital stock of the bank and the directors have deemed it wise in protection of depositors to euspend the further transaction of business. Depositors may be assured that their interets will be fully protected." PROVIDENCE, R. I., Oct. 20.-Ward P. Metcalf, indicted for misapplication of more than $200,000 and conspiracy in connection with the failure of the Atlantic National Bank, of which he was president, did not change this original plea of not guilty to the first indictment when he appeared before Judge Brown in the United States Court to-day. He had been given until to-day to make a change. He was not asked to plead to the three additional indictments returned last Thursday charging conspiracy. At the request of United States Attorney Stlness the court not prossed the seventeenth count in the first indictment, which was covered more accurately in one of the later indictments. The Traders' National Bank of Lowell, which was closed to-day, figured in one of the principal transaction alleged d to have been illegal in the indictments returned against Metcalf and four New York brokers and promoters. d Through the Columbus Securities Com: pany of New York, now in bankruptcy, It is alleged that Metcalf purchased control of the Lowell bank by issuing a check for $140,200 to the Traders' Nan tional on the Ellot National of Boston a w to cover this deficiency in the or Atlantic National purchased or discounted a deries of notes aggregatina b this are maigned by persons who have not yet been located. The notes are alleged to be worthless. Ofion R. Farror, a

4.

October 20, 1913

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

LOWELL BANK CLOSED BY CONTROLLER'S ORDER Traders' National, Organized in 1892, Had $3,031,000 Deposits. LOWELL, Mass., October 20.-The Traders' National Bank of this city was closed today by order of the controller of the currency. The Traders' National Bank was organized in 1892. According to the last report, the capital stock is $200,000; surplus, $79,000, and deposits $3,031,000. The officers of the bank are Clarence H. Nelson, president; William F. Hillis. vice president; Amos T. Hill, cashier, and Edward T. Wilder, teller. President Nelson issued this statement today: "The closing of the Traders' National Bank of this city is due to a combination of circumstances. The marked decline in the market value of bonds held by the bank was an important factor. The suspension of the Atlantic National Bank of Providence, R. I., and later the closing of the First-Second National Bank of Pittsburgh had a serious effect on the financial condition of a number of firms and corporations, previously well rated, whose notes were held by the bank. These conditions resulted in the impairment of the capital stock of the bank and the directors have deemed it wise in protection of depositors to suspend the further transaction of business." The Traders' National Bank of Lowell was closed on a report from National Bank Examiner Norwin S. Bean that the institution is insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Trader and the Atlantic National Bank of Provi dence, R. I., which was closed April 10 Three months ago the capital of the Traders was shown to be badly impaired and a formal notice was served on its directors. This directed them to make good the impairment by an assessment or the stockholders or to place the bank in voluntary liquidation. Under the law the bank had three months in which to do either of these things. The three months expired October 17, and the bank examiner reported that the capital had not been restored and that the bank was insolvent.

5.

October 21, 1913

Norwich Bulletin

Norwich, CT

Click image to open full size in new tab

Article Text

THE TRADERS' NATIONAL BANK AT LOWELL CLOSED. National Bank Examiner Reported Institution Insolvent. Washington, Oct. 20.-The Traders' National bank of Lowell was closed today on a report from National Bank Examiner Norwin S. Bean that the institution is insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Traders' and the Atlantic National bank of Providence, R. I., which was closed April 14. Three months ago the capital of the Traders' was shown to be badly impaired and a formal notice of impairment was served on its directors. This directed them to make good the impairment by an assessment on the stockholders. or to place the bank in voluntary liquidation. Under the law the bank had three months in which to do either of these things. The three months expired Oct. 17 and the bank examiner reported that the capital had not been restored and that the bank was insolvent.

6.

October 21, 1913

The Lancaster News

Lancaster, SC

Click image to open full size in new tab

Article Text

LOWELL BANK CLOSED. The Traders' National is Said to be Insolvent. Lowell, Mass., Oct. 20. The Traders National Bank of this city was closed today by order of the comptroller of the currency. The bank was closed on a report from National Bank Examiner Norwin S. Bein that the institution is insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Traders' and the Atlantic National Bank of Providence, R. I., which was closed April 14. Three months ago the capital of the Traders' was shown to be badly impaired and a formal notice of impairment was served on its directors. The notice directed them to make good the impairment by an assessment on the stockholders or to place the bank in voluntary liquidation. Under the law the bank had three months in which to do either of these things. ,

7.

October 21, 1913

Ottumwa Tri-Weekly Courier

Ottumwa, IA

Click image to open full size in new tab

Article Text

TRADERS' NATIONAL BANK IS CLOSED Washington, D. C., Oct. 20.-The Traders National Bank of Lowell was closed on a report from National Bank Examiner Norwin 8. Bean that the in. stitution was insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Traders and the Atlantic National Bank of Providence, R. I., which was closed April 14. Three months ago the capital of the Traders was shown to be badly impaired and a formal notice of impairment was served on its direc tors.

8.

October 21, 1913

The Daily Banner

Cambridge, MD

Click image to open full size in new tab

Article Text

National Bank Closed. Lowell, Mass., Oct. 21.-The Traders' National Bank of this city was closed by order of the Comptroller of the Currency. The closing of the bank followed a report from Norwin S. Bean, national bank examiner, that the institution is inso'vent. Harold G. Murray has been appointed receiver.

9.

October 21, 1913

The Bemidji Daily Pioneer

Bemidji, MN

Click image to open full size in new tab

Article Text

NATIONAL BANK IS CLOSED Lowell (Mass.) Institution With $3,000,000 Deposits Shuts Down. Lowell, Mass., Oct. 21.-Thè Traders' National bank of this city was closed by order of the comptroller of the currency. The Traders' National bank was organized in 1892. According to the last report the capital stock was $200, 000, surplus $70,000 and deposits $3,031,000. President Nelson issued a statement that the closing of the bank is due to a combination of circumstances. The suspension of the Atlantic National bank of Providence, R. I., and later the closing of the First-Second National bank of Pittsburg had a serious effect on the financial condition of a number of firms and corporations previously well rated, whose notes were held by the bank.

10.

October 21, 1913

The Madison Daily Leader

Madison, SD

Click image to open full size in new tab

Article Text

NATIONAL BANK IS CLOSED Lowell (Mass.) Institution With $3,000,000 Deposits Shuts Down. Lowell, Mass., Oct. 21.-The Traders' National bank of this city was closed by order of the comptroller of :he currency. The Traders' National bank was organized in 1892. According to the ast report the capital stock was $200, DOO, surplus $70,000 and deposits $3,031,000. President Nelson issued a statement that the closing of the bank is due to a combination of circumstances. The suspension of the Atlantic National bank of Providence, R. 1., and later the closing of the First-Secand National bank of Pittsburg had a serious effect on the financial condition of a number of firms and corporations previously well rated, whose notes were beld by the bank. Lives Year With Broken Neck. New York, Oct. 21.-Joseph Weeks, who had lived a year with a broken neck, died in a hospital at Babylon, L. I. His mind was clear until the end, but since the accident he had never been able to use Ms limbs. Weeks' neck was broken when be dived into shallow water while bathing.

11.

October 21, 1913

The Salt Lake Tribune

Salt Lake City, UT

Click image to open full size in new tab

Article Text

NATIONAL BANK IS FOUND INSOLVENT Traders', at Lowell, Mass., Is Closed by Order of the Comptroller. LOWELL, Mass., Oct. 20.-The Traders National bank of this city was closed today by order of the comptroller of the currency. The Traders National bank was organized in 1892. According to the last report, the capital stock was $200,000. surplus $79,000. and deposits $3,031,000. President Clarence H. Nelson issued this statement today: "The closing of the Traders National bank of this city is due to a combination of circumstances which resulted in the impairment of the capital stock of the bank. and the directors have deemed it advisable to suspend the further transaction of business."

12.

October 21, 1913

The Salt Lake Tribune

Salt Lake City, UT

Click image to open full size in new tab

Article Text

WASHINGTON. Oct. 20.-The Traders National bank of Lowell was closed on a report from National Bank Examiner Norwin S. Bean that the institution is insolvent. Harold S. Murray has been appointed receiver.

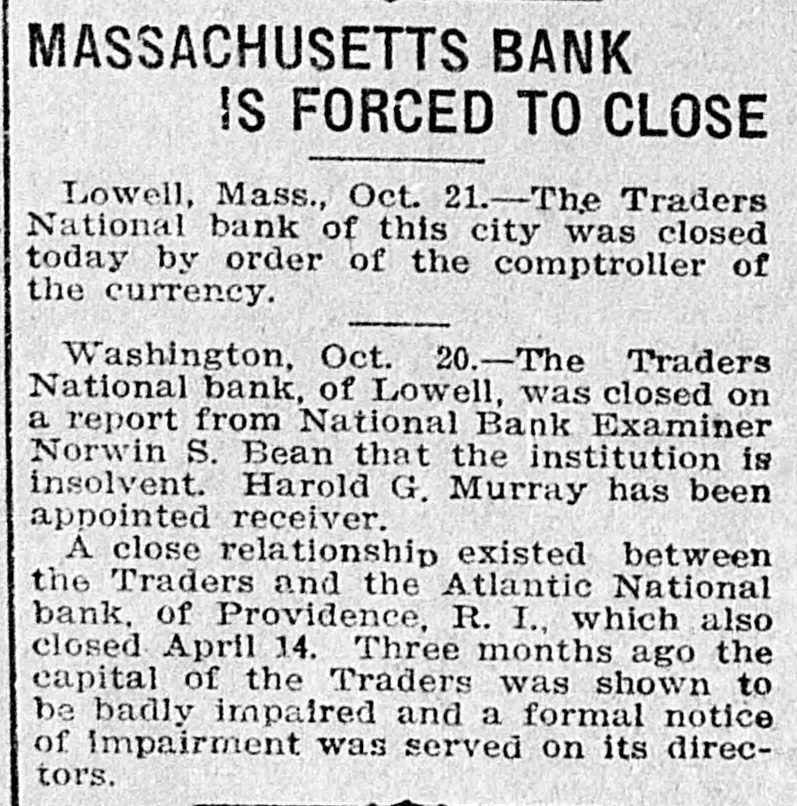

13.

October 23, 1913

The Citizen-Republican

Scotland, Parkston, SD

Click image to open full size in new tab

Article Text

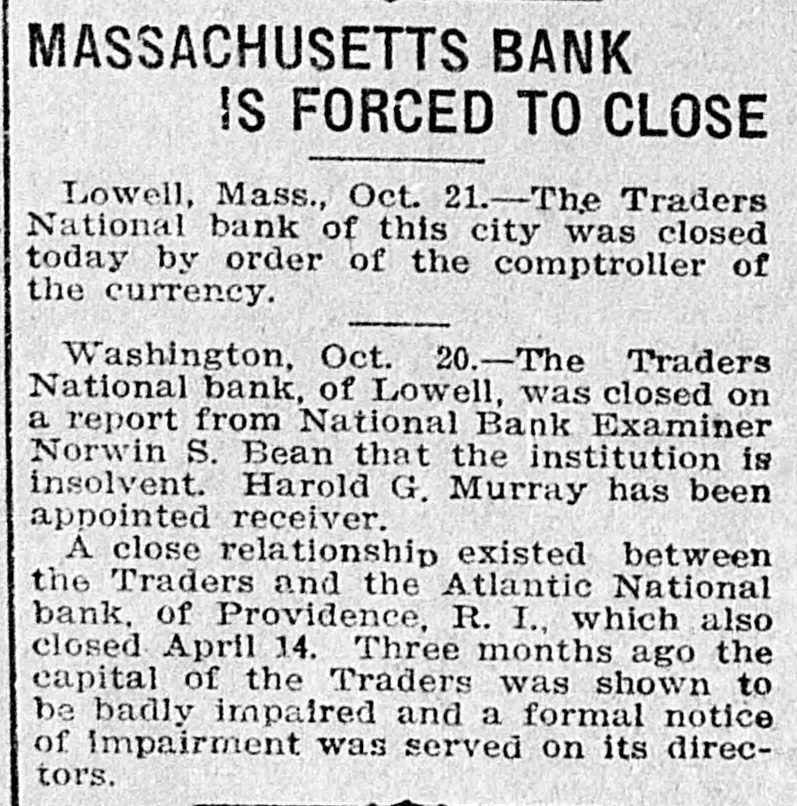

MASSACHUSETTS BANK IS FORCED TO CLOSE Lowell, Mass., Oct. 21.-The Traders National bank of this city was closed today by order of the comptroller of the currency. Washington, Oct. 20.-The Traders National bank, of Lowell, was closed on a report from National Bank Examiner Norwin S. Bean that the institution is insolvent. Harold G. Murray has been appointed receiver. A close relationship existed between the Traders and the Atlantic National bank, of Providence, R. I., which also closed April 14. Three months ago the capital of the Traders was shown to be badly impaired and a formal notice of impairment was served on its directors.

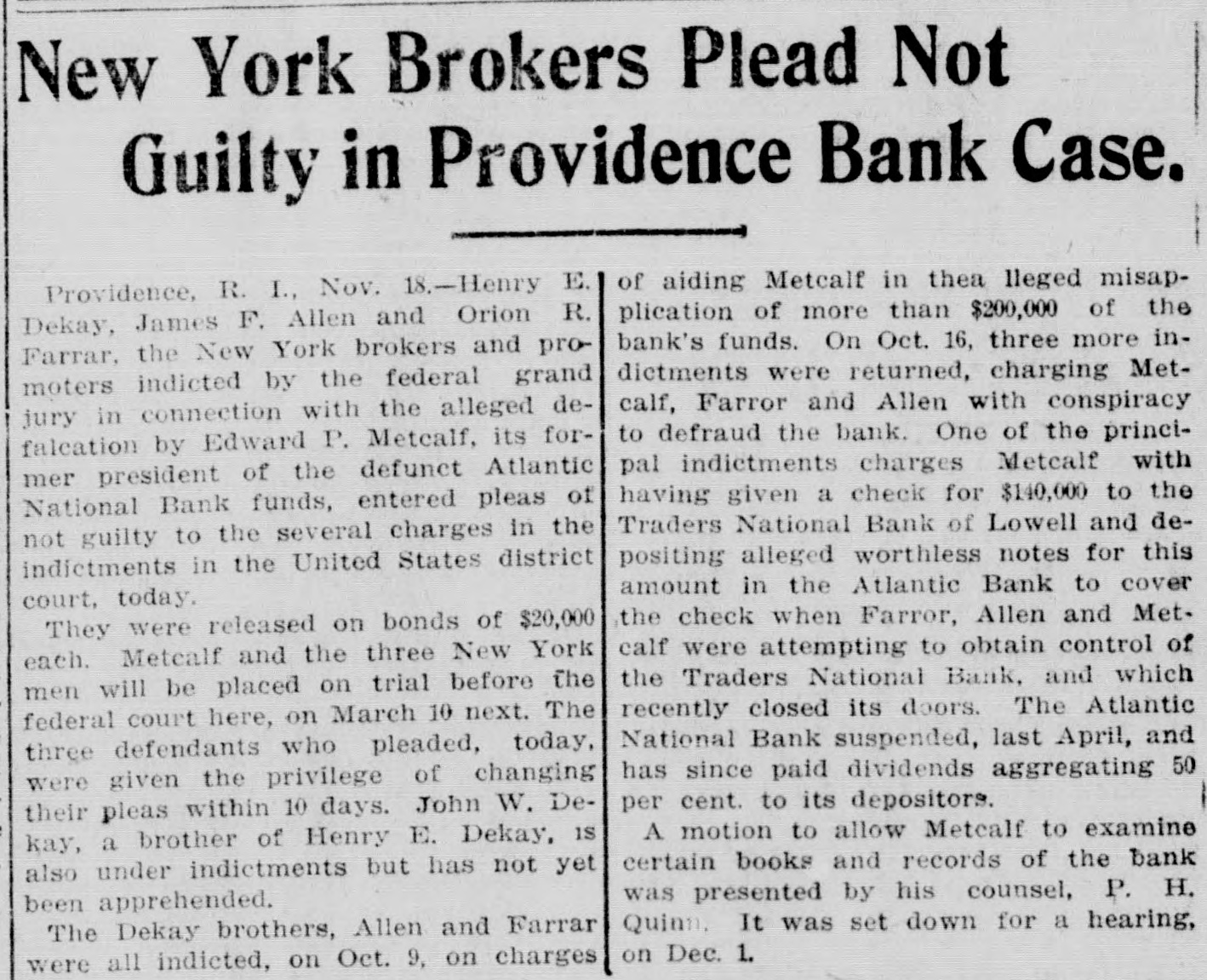

14.

November 19, 1913

Daily Kennebec Journal

Augusta, ME

Click image to open full size in new tab

Article Text

# New York Brokers Plead Not

# Guilty in Providence Bank Case.

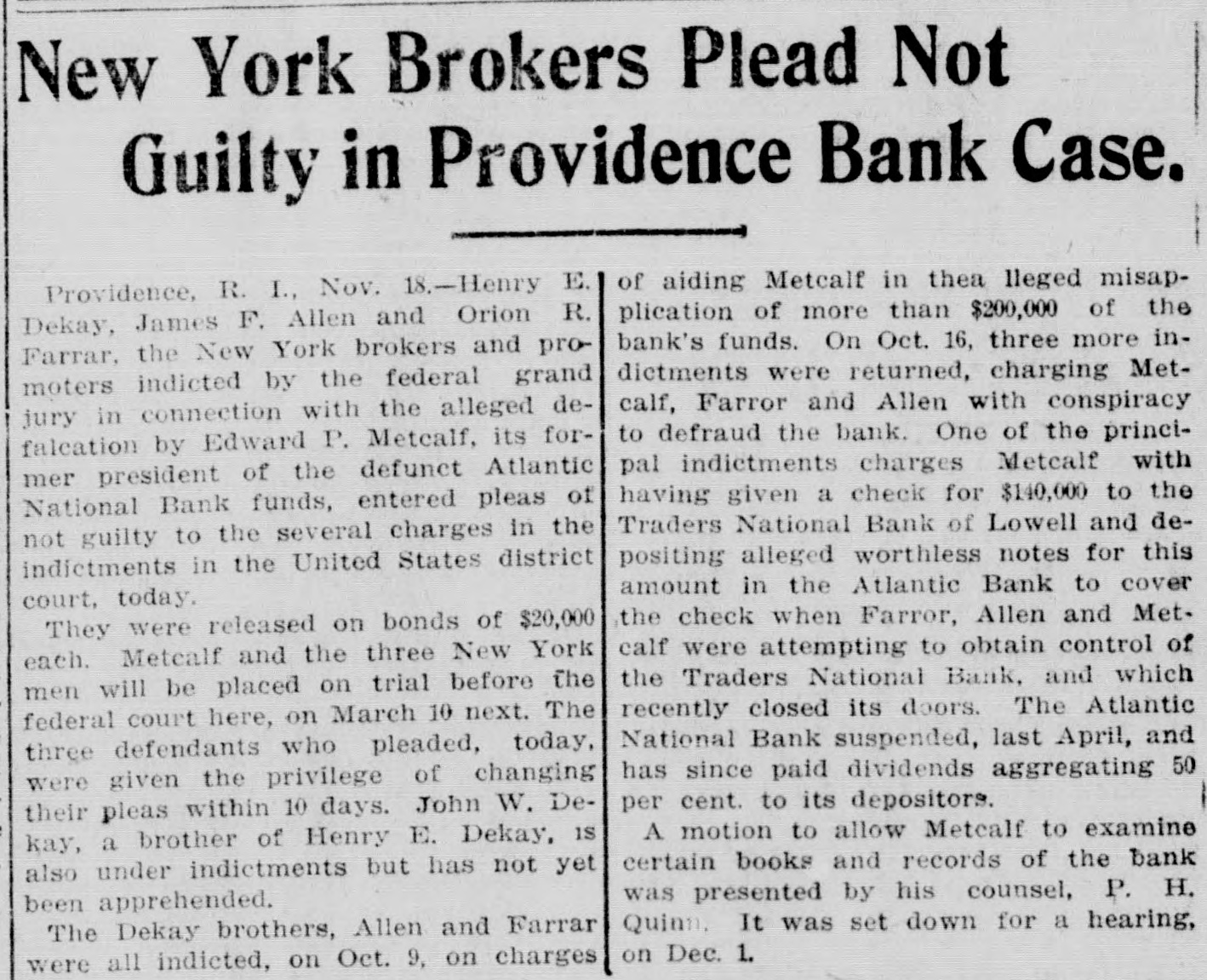

Providence, R. I., Nov. 18.-Henry E. Dekay, James F. Allen and Orion R. Farrar, the New York brokers and promoters indicted by the federal grand jury in connection with the alleged defalcation by Edward P. Metcalf, its former president of the defunct Atlantic National Bank funds, entered pleas of not guilty to the several charges in the indictments in the United States district court, today.

They were released on bonds of $20,000 each. Metcalf and the three New York men will be placed on trial before the federal court here, on March 10 next. The three defendants who pleaded, today, were given the privilege of changing their pleas within 10 days. John W. Dekay, a brother of Henry E. Dekay, is also under indictments but has not yet been apprehended.

The Dekay brothers, Allen and Farrar were all indicted, on Oct. 9, on charges of aiding Metcalf in the alleged misapplication of more than $200,000 of the bank's funds. On Oct. 16, three more indictments were returned, charging Metcalf, Farror and Allen with conspiracy to defraud the bank. One of the principal indictments charges Metcalf with having given a check for $140,000 to the Traders National Bank of Lowell and depositing alleged worthless notes for this amount in the Atlantic Bank to cover the check when Farror, Allen and Metcalf were attempting to obtain control of the Traders National Bank, and which recently closed its doors. The Atlantic National Bank suspended, last April, and has since paid dividends aggregating 50 per cent. to its depositors.

A motion to allow Metcalf to examine certain books and records of the bank was presented by his counsel, P. H. Quinn. It was set down for a hearing, on Dec. 1.

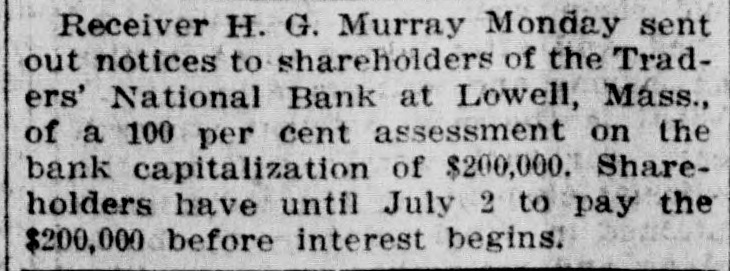

15.

March 11, 1914

Daily Kennebec Journal

Augusta, ME

Click image to open full size in new tab

Article Text

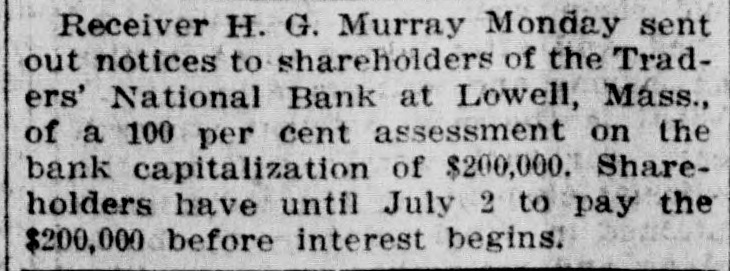

Receiver H. G. Murray Monday sent out notices to shareholders of the Traders' National Bank at Lowell, Mass., of a 100 per cent assessment on the bank capitalization of $200,000. Shareholders have until July 2 to pay the $200,000 before interest begins.

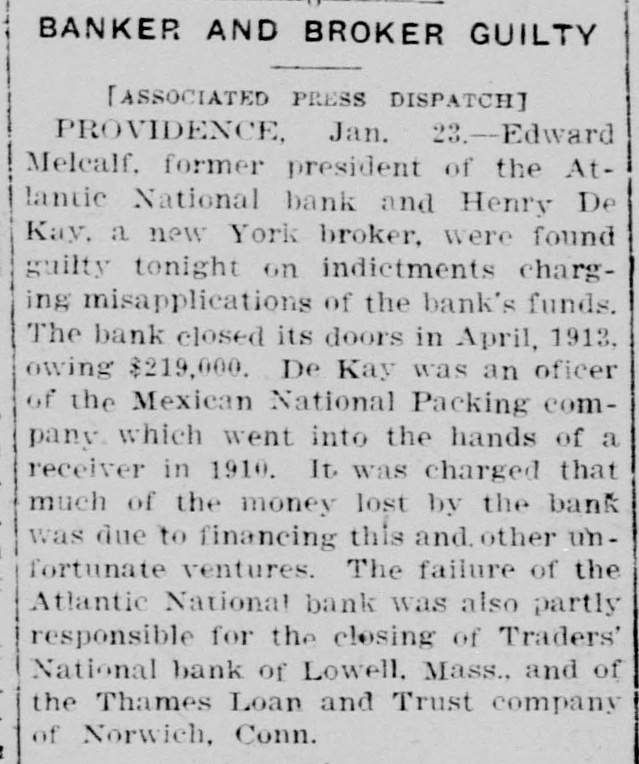

16.

January 24, 1915

Arizona Republican

Phoenix, AZ

Click image to open full size in new tab

Article Text

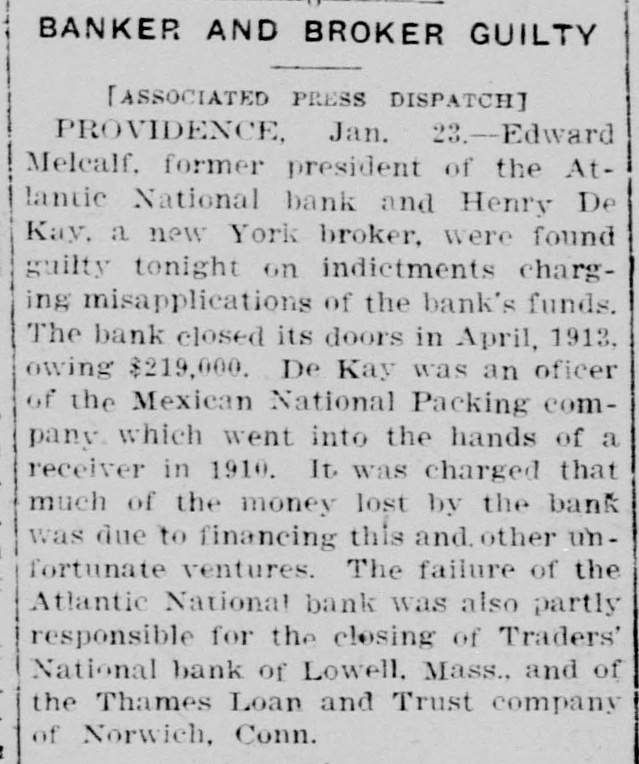

BANKER AND BROKER GUILTY [ASSOCIATED PRESS DISPATCH] PROVIDENCE, Jan. 23.--Edward Melcalf. former president of the Atlantic National bank and Henry De Kay. a new York broker. were found guilty tonight on indictments charging misapplications of the bank's funds. The bank closed its doors in April, 1913, owing $219,000. De Kay was an oficer of the Mexican National Packing company. which went into the hands of a receiver in 1910. It. was charged that much of the money lost by the bank was due to financing this and. other unfortunate ventures. The failure of the Atlantic National bank was also partly responsible for the closing of Traders' National bank of Lowell, Mass., and of the Thames Loan and Trust company of Norwich, Conn.