Article Text

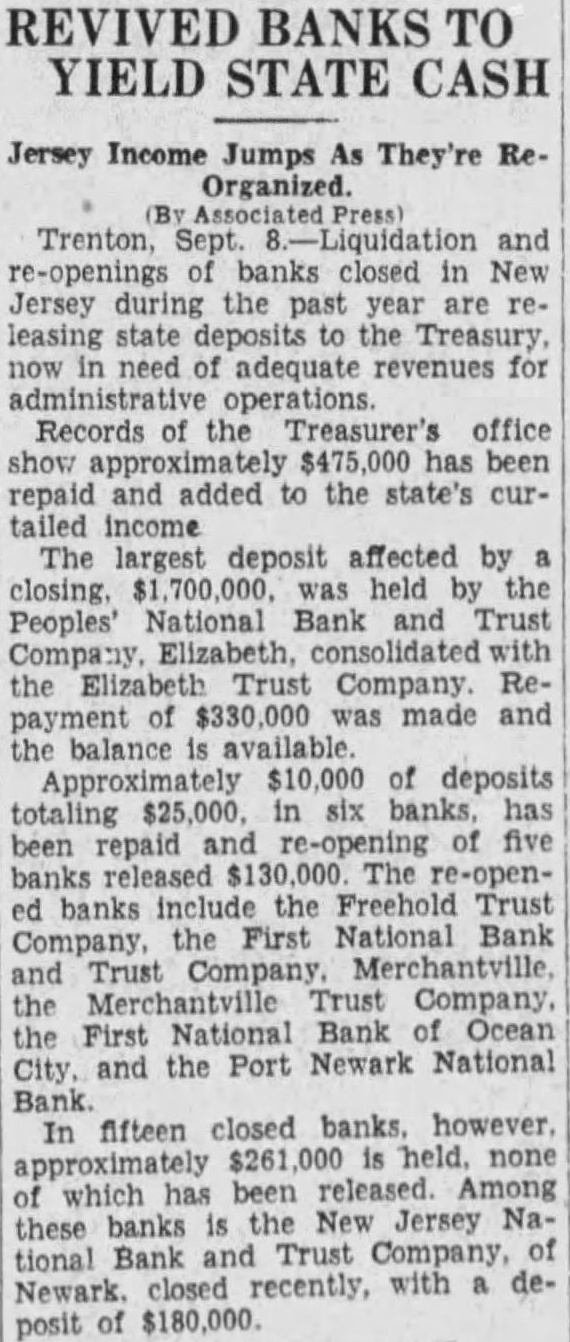

REVIVED BANKS TO YIELD STATE CASH Jersey Income Jumps As They're ReOrganized. re-openings banks closed in New Jersey during the past year are leasing state the Treasury need adequate revenues for Records of the Treasurer's office has repaid and added to the state's curtailed income The largest deposit affected by closing. held by the Peoples' National Bank and Trust the Elizabeth Trust Company. Reof $330,000 made and payment the balance Approximately $10,000 of deposits totaling in repaid of five banks released The re-openbanks the Freehold Trust First National Bank Merchantville Trust First National Bank Ocean City, the Port Newark National In fifteen closed banks however none which been Among Jersey Nabanks Bank and Trust Company, tional Newark. closed recently, with deposit of $180,000.