Click image to open full size in new tab

Article Text

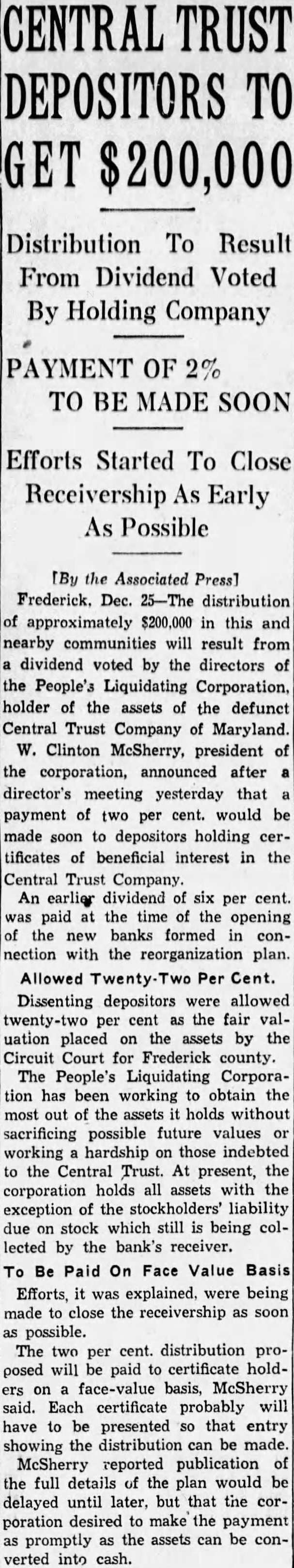

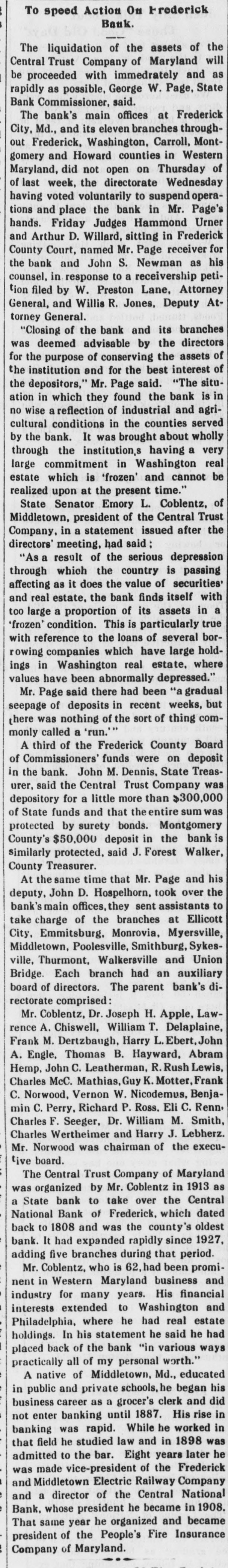

To speed Action On Frederick Bank. The liquidation of the assets of the Central Trust Company of Maryland will be proceeded with immedrately and as rapidly as possible, George W. Page, State Bank Commissioner, said. The bank's main offices at Frederick City, Md., and its eleven branches throughout Frederick, Washington, Carroll, Montgomery and Howard counties in Western Maryland, did not open on Thursday of of last week, the directorate Wednesday having voted voluntarily to suspend operations and place the bank in Mr. Page's hands. Friday Judges Hammond Urner and Arthur D. Willard, sitting in Frederick County Court, named Mr. Page receiver for the bank and John S. Newman as his counsel, in response to a receivership petition filed by W. Preston Lane, Attorney General, and Willis R. Jones, Deputy Attorney General. "Closing of the bank and its branches was deemed advisable by the directors for the purpose of conserving the assets of the institution and for the best interest of the depositors," Mr. Page said. "The situation in which they found the bank is in no wise a reflection of industrial and agricultural conditions in the counties served by the bank. It was brought about wholly through the institution,s having a very large commitment in Washington real estate which is 'frozen' and cannot be realized upon at the present time." State Senator Emory L. Coblentz, of Middletown, president of the Central Trust Company, in a statement issued after the directors' meeting, had said "As a result of the serious depression through which the country is passing affecting as it does the value of securities' and real estate, the bank finds itself with too large a proportion of its assets in a 'frozen' condition. This is particularly true with reference to the loans of several borrowing companies which have large holdings in Washington real estate, where values have been abnormally depressed." Mr. Page said there had been "a gradual seepage of deposits in recent weeks, but there was nothing of the sort of thing commonly called a 'run.'' A third of the Frederick County Board of Commissioners' funds were on deposit in the bank. John M. Dennis, State Treasurer, said the Central Trust Company was depository for a little more than $300,000 of State funds and that the entire sum was protected by surety bonds. Montgomery County's $50,000 deposit in the bank is similarly protected, said J. Forest Walker, County Treasurer. At the same time that Mr. Page and his deputy, John D. Hospelhorn, took over the bank's main offices, they sent assistants to take charge of the branches at Ellicott City, Emmitsburg, Monrovia, Myersville, Middletown, Poolesville, Smithburg, Sykesville, Thurmont, Walkersville and Union Bridge. Each branch had an auxiliary board of directors. The parent bank's directorate comprised: Mr. Coblentz, Dr. Joseph H. Apple, Lawrence A. Chiswell, William T. Delaplaine, Frank M. Dertzbaugh, Harry L. Ebert, John A. Engle, Thomas B. Hayward, Abram Hemp, John C. Leatherman, R. Rush Lewis, Charles McC. Mathias, Guy K. Motter, Frank C. Norwood, Vernon W. Nicodemus, Benjamin C. Perry, Richard P. Ross. Eli C. Renn. Charles F. Seeger, Dr. William M. Smith, Charles Wertheimer and Harry J. Lebherz. Mr. Norwood was chairman of the executive board. The Central Trust Company of Maryland was organized by Mr. Coblentz in 1913 as a State bank to take over the Central National Bank of Frederick, which dated back to 1808 and was the county's oldest bank. It had expanded rapidly since 1927, adding five branches during that period. Mr. Coblentz, who is 62, had been prominent in Western Maryland business and industry for many years. His financial interests extended to Washington and Philadelphia, where he had real estate holdings. In his statement he said he had placed back of the bank "in various ways practically all of my personal worth." A native of Middletown, Md., educated in public and private schools, he began his business career as a grocer's clerk and did not enter banking until 1887. His rise in banking was rapid. While he worked in that field he studied law and in 1898 was admitted to the bar. Eight years later he was made vice-president of the Frederick and Middletown Electric Railway Company and a director of the Central National Bank, whose president he became in 1908. That same year he organized and became