Article Text

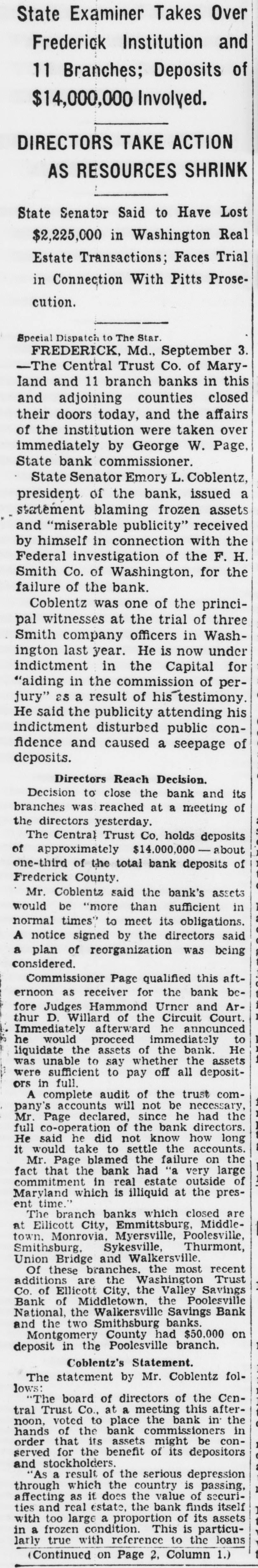

State Examiner Takes Over Frederick Institution and 11 Branches; Deposits of $14,000,000 Involved. DIRECTORS TAKE ACTION AS RESOURCES SHRINK State Senator Said to Have Lost $2,225,000 in Washington Real Estate Transactions; Faces Trial in Connection With Pitts Prosecution. Special Dispatch to The Star. FREDERICK, Md., September 3. -The Central Trust Co. of Maryland and 11 branch banks in this and adjoining counties closed their doors today, and the affairs of the institution were taken over immediately by George W. Page, State bank commissioner. State Senator Emory L. Coblentz, president of the bank, issued a statement blaming frozen assets and "miserable publicity" received by himself in connection with the Federal investigation of the F. H. Smith Co. of Washington, for the failure of the bank. Coblentz was one of the principal witnesses at the trial of three Smith company officers in Washington last year. He is now under indictment in the Capital for "aiding in the commission of perjury" as a result of his testimony. He said the publicity attending his indictment disturbed public confidence and caused a seepage of deposits. Directors Reach Decision. Decision to close the bank and its branches was reached at a meeting of the directors yesterday. The Central Trust Co. holds deposits of approximately $14,000,000 about one-third of the total bank deposits of Fredcrick County. Mr. Coblentz said the bank's assets would be "more than sufficient in normal times" to meet its obligations. A notice signed by the directors said a plan of reorganization was being considered. Commissioner Page qualified this afternoon as receiver for the bank before Judges Hammond Urner and Arthur D. Willard of the Circuit Court. Immediately afterward he announced he would proceed immediately to liquidate the assets of the bank. He was unable to say whether the assets were sufficient to pay off all depositors in full. A complete audit of the trust company's accounts will not be necessary, Mr. Page declared, since he had the full co-operation of the bank directors. He said he did not know how long it would take to settle the accounts. Mr. Page blamed the failure on the fact that the bank had "a very large commitment in real estate outside of Maryland which is illiquid at the present time." The branch banks which closed are at Ellicott City, Emmittsburg, Middletown. Monrovia, Myersville, Poolesville, Smithsburg, Sykesville, Thurmont, Union Bridge and Walkersville. Of these branches. the most recent additions are the Washington Trust Co. of Ellicott City, the Valley Savings Bank of Middletown, the Poolesville National, the Walkersville Savings Bank and the two Smithsburg banks. Montgomery County had $50,000 on deposit in the Poolesville branch. Coblentz's Statement. The statement by Mr. Coblentz follows: "The board of directors of the Central Trust Co., at a meeting this afternoon, voted to place the bank in the hands of the bank commissioners in order that its assets might be conserved for the benefit of its depositors and stockholders. "As a result of the serious depression through which the country is passing, affecting as it does the value of securities and real estate, the bank finds itself with too large a proportion of its assets in a frozen condition. This is particularly true with reference to the loans (Continued on Page 2. Column 1.)