Article Text

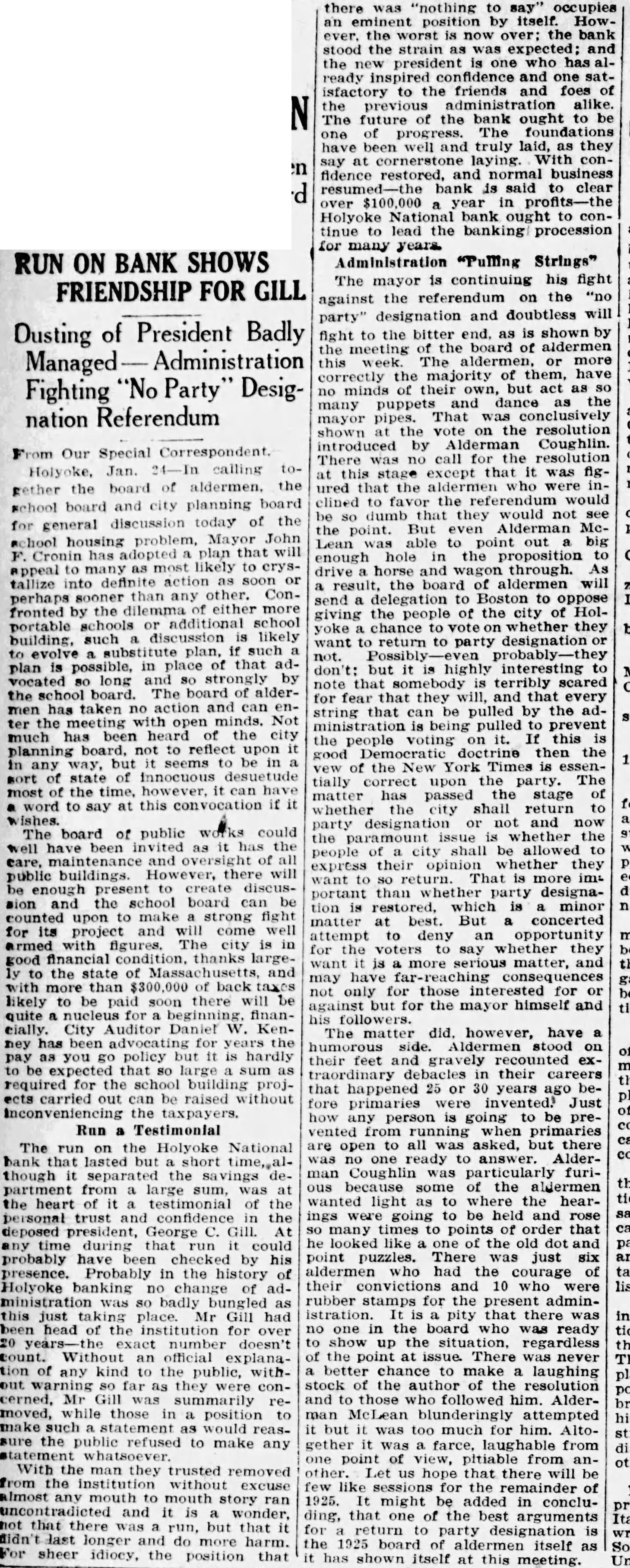

RUN ON BANK SHOWS FRIENDSHIP FOR GILL Dusting of President Badly Managed Administration Fighting "No Party" Designation Referendum From Our Special Correspondent. Holyoke, Jan. In calling together the board of aldermen. the school board and city planning board for general discussion today of the school housing problem, Mayor John F. Cronin has adopted plan that will appeal to many as most likely to crystallize into definite action as soon or perhaps sooner than any other. Confronted by the dilemma either more portable schools or additional school building, such discussion is likely to evolve substitute plan, if such a plan is possible, in place of that advocated so long and SO strongly by the school board. The board of aldermen has taken no action and can enter the meeting with open minds. Not much has been heard of the city planning board, not to reflect upon it in any way, but seems to be in a sort of state of innocuous desuetude most of the time, however, it can have word to say at this convocation if it wishes. The board of public works could well have been invited as it has the care, maintenance and oversight of all public buildings. However, there will be enough to create discussion and the school board can be counted upon to make strong fight for its project and will come well armed with figures. The city is in good financial thanks largely to the state of Massachusetts, and with more than $300,000 of back taxes likely to be paid soon there will be quite a nucleus for beginning, financially. City Auditor Daniel W. Kenney has been advocating for years the pay as you go policy but it is hardly to be expected that so large a sum as required for the building projects carried out can be raised without the taxpayers. Run a Testimonial The run on the Holyoke National bank that lasted but short time,,although separated the savings department from a was at the heart of it testimonial of the personal trust and confidence in the deposed president, George C. Gill. At any time during that run could probably have been checked by his presence. Probably in the history of Holyoke banking no change of administration 80 badly bungled as this just place. Mr Gill had been head of the institution for over the number doesn't count. Without an official explana tion of any kind to the public, without warning so far as they were concerned, Mr Gill was summarily removed, while those in a position to make such a statement as would reassure the public refused to make any statement With the man they trusted removed from the institution without excuse almost any mouth to mouth story ran uncont and it is wonder, not that there run, but that it didn't last longer and do more harm. For sheer idiocy, the position that there was "nothing to say" occupies an eminent position by itself. However. the worst is now over; the bank stood the strain as was expected; and the new president is one who has already inspired confidence and one satisfactory to the friends and foes of the previous administration alike. The future of the bank ought to be one of progress. The foundations have well and truly laid, as they say at cornerstone laying. With confidence restored, and normal business resumed-the bank is said to clear over $100,000 year in profits-the Holyoke National bank ought to continue to lead the banking procession for many years. Administration "Pulling Strings" The mayor is continuing his fight against the referendum on the "no party" designation and doubtless will fight to the bitter end, as is shown by the meeting of the board of aldermen this week. The aldermen, or more correctly the majority of them, have no minds of their own, but act as so many puppets and dance as the mayor pipes. That was conclusively shown the vote on the resolution introduced by Alderman Coughlin. There no call for the resolution at this stage except that it was figured that the who were inclined to the referendum would be dumb that they would not see the point. But even Alderman McLean was able to point big enough hole in the proposition to drive horse and wagon through. As a result, the board of aldermen will send a delegation to Boston to oppose giving the people of the city of Holyoke a chance to vote on whether they want to return to party designation or not. Possibly probably-they don't: but it is highly interesting to note that somebody is terribly scared for fear that they will, and that every string that can be pulled by the administration is being pulled to prevent the people voting on it. If this is good Democratic doctrine then the vew of the New York Times is essentially correct upon the party. The matter has passed the stage of whether the city shall return to party designation or not and now the paramount issue is whether the people of city shall be allowed to express their opinion whether they want to so return. That is more im: portant than whether party designation is restored, which is a minor matter at best. But a concerted attempt to deny an opportunity for the voters to say whether they want it is a more serious matter, and may have consequences not only for those interested for or against but for the mayor himself and his followers. The matter did. however, have a humorous side. Aldermen stood on their feet and gravely recounted extraordinary debacles in their careers that happened 25 or 30 years ago before primaries were invented. Just how any person is going to be prevented from running when primaries are open to all asked, but there was no one ready to answer Alderman Coughlin was particularly furious because some of the aldermen wanted light as to where the hearings were going to be held and rose so many times to points of order that he looked like one of the old dot and point puzzles. There was just six aldermen had the courage of their convictions and 10 who were rubber stamps for the present administration. pity that was no one in the board was ready to show up the situation. regardless of the point at issue. There was never a better chance to make a laughing stock of the author of the resolution and to those who followed him. Alderman McLean blunderingly attempted it but it was too much for him. Altogether it was a farce, laughable from one point of view, pitiable from anLet us hope that there will be few like sessions for the remainder of 1925. might be added in concluding, that one of the best arguments for to party designation is the 1925 board of itself as it has shown itself at this meeting.