Article Text

Feb. 27, out March (First OF SALE OF LANDS NOTICE UNDER 5615 Notice hereby given, that execution pursuance issued the clerk's District Court, and for Me Curtain County State of the 28th day of January, 1926, action Ruby Nichols now, formerly Ruby Hall, was plaintiff and James Hall was cause No. 5615, me to levy belonging to said upon James sufficient satisfy judgment rendered action favor of Plaintiff against said James Hall, for the sum of $305.00 with $17.75 costs, with interest from the date the 22nd day of January 1926: have upon certain lands and belonging to said James E. Hall not exempt from sale under for want of goods chattels of the said James Hall, to wit: An undivided one-half interest and to parts of Lots Block the City Idabel, Oklahoma, scribed more particularly as follows: Begin at Northwest corner of the Masonic Bldg., same being 25 feet Northwest from Southwest corner of said Lot 3, thence in Northeasterly direction perpendicular to Central Avenue 100 feet, thence Northwesterly parallel Central Avenue 25 feet; thence in Southwesterly direction Central Avenue 100 feet to East Boundary line of Central Avenue; thence in Southeasterly direction parallel to Central Avenue 25 feet to beginning; Situated in said McCurtain Counand have duly caused the interest said defendant in and to said lands and tenements to be appraised according to law, at $1000.00, now, therefore, notice hereby given that pursuance of the of said writ, will offer for sale and sell for cash to the highest bidder, to prior to the subject Georgia State Loan Co. for said lands and tenements, or so much thereof as will satisfy the said judgment and costs, on the 1st day April, 1926, at 10 o'clock said day, at the front door the court house, in the city of Idabel, in said county and State. Witness my hand this 24th day of February, 1926.

JONES, Sheriff McCurtain County

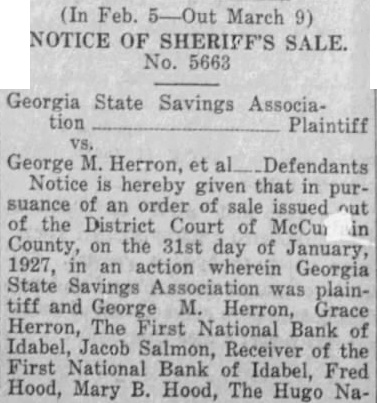

(First published March 3, out April 1926) IN THE DISTRICT COURT WITHIN AND FOR THE COUNTY OF McCURTAIN STATE OF OKLAHOMA. No. 5981 Jacob A. Salmon, Receiver of the First National Bank of Idabel, Oklahoma, Plaintiff, vs. Love, Clevia Love, Love and Virginia Love, NOTICE BY PUBLICATION THE STATE OF To: Love, Clevia Love, Love and Virginia Love, YOU AND EACH of you, the defendants, J. Love, Clevia Love, C. H. Love and Virginia Love, will take notice that on the 10th day of February, 1926, the above named plaintiff, Jacob Salmon, Receiver the First National Bank of Idabel, Oklahoma, filed in the District Court of McCurtain County, Oklahoma, his petition, against the defendants, Love, Clevia Love, H. Love and Virginia Love, others, and that you the said G. LOVE, CLEVIA LOVE, C. H. LOVE and VIRGINIA LOVE, must answer the petition of the plaintiff filed said cause against on before the 16th day of April, 1926, or said petition will be taken as true judgment in said against said defendants, Love, Clevia Love, C. H. Love and Virginia Love, and estab lishing that there due and owing to the plaintiff the sum of $6500.00 on gold bond notes executed by the said Love, Clevia Love, C. Love and Virginia Love to the Oklahoma Farm MortCompany, bearer, dated gage December 10th, 1920, due and payable December 1925, and the further sum of $455.00 on interest coupons notes, and the of $650.00 attorneys fees, and taxes paid by plaintiff, and further decreeing and establishing that the Deed Trust, executed, and by the defendants, Love, Clevia Love, H. Love and Virginia Love, dated 10th, 1920, and given secure the payment of the above mentioned sums money, is valid subsisting first lien upon the property described therein and described follows, to-wit: and Section 16, and Section 20, and Lots and of Section 21, all in Township South, Range 24 East, in McCurtain County, and that the plaintiff is the owner and holder thereof, and judgment rendered further said Deed of Trust, and ordering the above described real estate sold, without according law, satisfy the above indebtedness, and barring you and each you, the Love Clevia Love, H. Love and Virginia Love, and all persons claiming by through or under you or any of you, from serting or claiming any right, title interest in and to above described estate since the of this action. this 2nd day of March,

BASCOM COKER, Court Clerk McCurtain County, Oklahoma.

(SEAL) .EDBETTER & HUDSON, Attorneys for Plaintiff.

(First published March 10, out April BY PUBLICATION STATE OF In The District Court In And For Said County And State. Plaintiff, vs. Annie Fred Tapley, Tapley, Defendant. No. 6031 STATE OF TO ANNIE TAPLEY, DEFENDANT: Defendant, Annie Tapley, will take notice that she has been sued in the above named court for divorce, and that Annie Tapley, must the petition the plainFred Tapley, filed herein, on or before the 24th day of April, 1926, said Petition will be taken as true judgment for said Plaintiff for be accordingly. Witness my hand and the seal said Court, this 9th day of March,

(SEAL)

BASCOM COKER, Court Clerk COCHRAN & WILKINSON,

(First published March 20, out April 17, 1926)

NOTICE OF SHERIFF'S SALE No. 5671

NOTICE IS HEREBY GIVEN, that in pursuance an Order of Sale, issued out of the District Court McCurtain County, State of Oklahoma, on the 19th day of March, 1926 in an action wherein Waddell Company, plaintiff and Jennings, was Jennings, Robinson Mary and F. Brewer were defendants, directed the undersigned McCurtain County, State sheriff of Oklahoma, commanding me to of levy upon, advertise and accordto law, without appraisement, first mortgage of $1200.subject the following described real estate, situated in McCurtain County, Oklahoma, W½ of NE% of and and of of Seeof of tion and and acre described one at the northwest as beginning of Northwest Quarter corner Southeast Quarter Section Township South, Range East, thence east 22 yards stake on the north line the Quarter of the South east Quarter of Section 27, thence direction to the the East Half of Northeast Half of East Quarter Southwest Quarter Section thence north the said East Half line Northeast Quarter of Quarter to the point of beginone acre; being located Section South, Range East, 61 acres, more or less, satisfy judgment and decree of real estate mortgage foreclosure real said above on said plaintiff and favor and said defendants, against the 18, day said court 1925, for the sum September, with interest thereon at the of ten per cent per annum from until January, 1925, the 1st of further of and sum attorney's paid, fee, and all costs accruing of said and action, the 20th day of April, on hour of 10 o'clock 1926, at the the front door the said day, at the city of Idabel, house in County, Oklahoma, offer auction and sale public subject to said mortgage highest bidder for said above described in hand the much thereof as real estate, or intersatisfy said fee and costs. attorney's HAND, this 19th WITNESS MY March, WILL for Plaintiff Attorney JONES, Sheriff of McCurtain County, Oklahoma it in Idabel. Be published March 20, out April 10, 1926)

THE DISTRICT WITHIN IN AND FOR COUNTY OF STATE OF OKLAHOMA.

No.

Shafter, Plaintiff, John Westal.

NOTICE BY PUBLICATION Oklahoma Upham Shoe ComTrust Company, Sanders one of the pany and partners of the partnership firm of Dalton, will take notice Sanders Shafter, did 10th day of January, 1925, the his petition in the District Court McCurtain County, State of Oklahoma said above named against defendants and other defendants in this action, and said defendants, American Trust Company, Upham Shoe Company and Sanders, must answer said petition on or before the 1st day of May, 1926, said petition will be taken as true and judgment rendered in said action of said plaintiff and against favor said above and other in this action, adjudging and to be due uptwo certain notes executed John and delivered to Shafter one note for the sum of $1700.00, interest thereon at the rate of ten per cent annum from October 1921, and note for $2000.00 with interest at the rate of ten cent per num from January 1922 until paid, and the further sum of $370.00 attorney's fees, and all costs of this action in favor of said plaintiff and against said defendants above named and other defendants in this action, for the foreclosure of certain real estate mortgage securing the pay ment of said notes, interest, attorney's fees and costs of suit, upon the fol. lowing described real property and situated in McCurtain County, State of Oklahoma, to-wit: Lot 10, Block 12 in the original town of Haworth, Oklahoma, and platted as Harrington, Ind. Ter. together with all interest accrued and therein; and further adaccruing judging default has been made and mortgage, and that said first and prior lien plaintiff has upon and against said premises, amount for which judgment be taken as establishing and finding that all said sums mentioned above are first, and prior lien upon said superior premises, in favor of said plaintiff, said sold with and ordering premises and the proceeds plied to the payment the several together with sums fees of $370.00 and the this action; and forever barcosts ring, and said American Trust Company, Upham Shoe Company and Sanders and each of them, and each and all other of and from right, title, interest, claim, any property equity or redemption said and ever part premises thereof. Witness my hand and seal of said court this 19th day of March, 1926. (SEAL)

BASCOM COKER. Court Clerk

PAUL STEWART, Attorney for Plaintiff.

(First published March 13, out April 1926) NOTICE OF APPLICATION FOR DEED STATE OF OKLAHOMA, M'CURTAIN TO: Lang. lois, and if dead, their unknown heirs, devisees, executors, administrators, trustees, assigns, and grantees, and to owners, and persons owning or claiming any right, title or interest of any nature kind and to the real estate herein described, AS OWNERS, and to any persons possession of the hereafter described estate.

You and each of you are hereby notified that the undersigned Zuzi Kovach is the owner and holder of Tax Sale Certificate numbered 105, issued by the Treasurer of McCurtain County, State of Oklahoma, on and covering the described real lands and situate, lying and being in said County, and State of NE% of Section 13 Twp. South and Range 26 East. and each you are hereby notified that the above land the 6th day of November, legal notice been given provided by law, by the Treasurer Curtain County for the taxes levied there on for the year which said taxes were not and the said tract of land was by the County Treasurer for McCurtain Oklahoma, and thereafter County, signed said County's Interest in and said Tax Sale Certificate to Zuzi Kovach. Now therefore, unless demption is made from said sale authorized agent or your torney or before sixty days from hereof, wit: on before service the 14th day May, 1926, the undersigned Zuzi Kovach as the legal holdof said certificate of purchase, demand of the County Treasurer of McCurtain County, Oklahoma, that deed issue to him for the above described real estate as provided by Dated this 11th day of March, 1926. ZUZI KOVACH, Certificate Owner.

(First published March 20, out April 10, 1926)

IN THE DISTRICT COURT WITHIN AND FOR COUNTY, OKLAHOMA.

No. 6022

Eberle, Plaintiff, vs. Richert Defendant. NOTICE BY PUBLICATION The State of Oklahoma to J. Richert, Defendant. NOTICE hereby given to the defendant, Richert that he has been sued in the above entitled action in said court and that the filed he must answer petition against on or before the 3rd day said petition will be May, 1926, or taken as true and rendered against him quieting the title of the plaintiff in and to the following real estate in McCurtain scribed County, Oklahoma, The SE% of Section 18, Township South, Range 23 East. in the event that plaintiff's tax to real estate void, voidable defective that he have judgment fixing the amount he has pended in said tax deed, and the amount of the taxes he has said real estate and the penalties interest and costs of said taxes and the costs of this action including fee herein in the sum attorney's $100.00, and declaring said amounts lien upon the above described lands, further order and judgment tax lien herein plaintiff's upon said real estate and ordering same sold as the law provides without appraisement to satisfy said tax lien, interest, attorney's fees and costs, after sale same, that said defendant has no right, title or interest in said real estate. Dated this the 20th day of March, 1926.

BASCOM COKER, Court Clerk By A. Deputy.

C. RAY, Atty. for Plaintiff.

(First published March 24, out April 1926) NOTICE OF HEÁRING PETITION TO DETERMINE HEIRSHIP STATE OF OKLAHOMA, SS. County IN COUNTY COURT In the matter of the determination of the heirs of Charles Williams, deceased, Choctaw Indian, enrolled opposite Roll No. 3717. No. 3286 Sarah Tate, nee Fowler, et al, Petitioners, Plaintiffs.

James Williams, et al, Defendants. THE STATE OF OKLAHOMA TO The unknown heirs, executors, admin- successors, grantees, assigns and trustees, remote of Charles Williams, deceased, and any person claiming under the heirs, the known heirs, their executors, devisees, trustees, assigns, grantors, grantees mediate remote of Charles Wilthat Tate Fowler Wilson, Rosetta Lillian Aubery have filed their petition in County Court of McCurtain Counalleging that Charles Choctaw Indian, duly enrolled as such upon rolls of the Choetaw Tribe of Indians, opposite Roll No. 3717; That said Charles Williams died McCurtain County, State Oklahoma, at near the Town or about the day August, 1911; that the death he was the owner of the following described real estate, toW½ of NW% of NW%; and of of and NW% of of NW% 26, Township South, Range 21 East: of of and SE% of SW% of NW% of Section Township South, Range 21 East, and situate the County of State of That the said Charles Williams him as his sole and only heirs at law George Wilson, Sarah Tate, Fowler, Rosetta Fowler, and Lillian Fowler, nieces; Aubery R. Irons, And you and each of you are herenotified that said petition for the determination of fact as to who are heirs at law of the said Charles illiams, deceased, has been set for hearing the hour of ten o'clock on the 10th day of May, 1926, the court room of the County Court the Town of Idabel, McCurtain Oklahoma; And you and each of you are heredirected to appear the court the time and place specified and submit to the Court to establish the question of fact as to who are the heirs at law of Charles Williams, and you must answer the petition filed herein on or before the hour of ten o'clock the 10th May, 1926, or said petition will be taken as true and judgment rendered matter fact that the said Charles left surviving him George Sarah Fowler, Rosetta Fowler and Lillian Fowler, nieces, and Aubery R. Irons, as the only heirs to the estate of the said Charles Williams, deceased, as of the date of death.

(SEAL)

(SEAL)

CARR, County Judge of McCurtain County, Oklahoma.

BASCOM COKER, Court Clerk of McCurtain County, Oklahoma.

By A. BARTLETT, Deputy

J. N. FORTNER, Atty. for Plaintiffs.

National garden week, April 18 25.

It's short road that has no filling station.

Every good road built is an investment and paying one.

The prone is 50 year old, and we'll say that it has improved with age.

CHEVROLET CO. BREAKS ALL PREVIOUS MONTHLY SALES RECORDS FOR FEBRUARY

Chevrolet dealers in February delivered 32,504 cars, the largest numever sold in that month in the history of the company The quota set for the thirty sales zones of the company was 22,002 estimate based on conservative examination of the prospective February demands. When the total sales for the month were tabulated it was found that the increase in sales was 147.7 cent of the quota. Despite decided increases made in the quota set for February it was found the zones had practically exceeded their allotments. In January every sales zone exceeded its quota, ranging from 112.9 per cent in the Jacksonville zone to 275.4 per cent in the Omaha zone. The Omaha zone, established only three months ago, again led the zones exceeding their February allotments, with percentage of 398.3. Minneapolis zone was second with 304.9 per cent of its quota, reflecting the unprecedented growth of the Northwests diversified industries. Oklahoma City was third with 255.4 per cent quota, Atlanta fourth, with 249 per cent and Des Moines fifth, with 243.8 per cent. Of the six sales regions, Great Lake region led in February, with Middle West, Southeastern, Flint, Atlantic Coast and Pacific Coast regions in the order named. While the original factory production for March was set at 54,553 cars, has already been found necessary to make three additional increases in this schedule, bringing the total number to be built this month to 59,244 cars, not including the 4367 cars to be built in the Chevrolet Canadian plant at Oshawa.

Some of the Wall Street operators know how the farmer felt about the price of

We're sorry about Pershing's teeth, but he should have let Peru and Chile do all the gnashing.

Miami's boom has not collapsed, just relaxed, so say the despatches. That's a difference worth noting.

The 1926 bathing suit styles now running in the papers look very promising. Conservatism seems to be the motto. everybody's business makes living in Idabel to help constantly in the making of it a greater town.

The North Pole might as well give up. Wilkins and a few other expeditions will be off this year to search for it.