Article Text

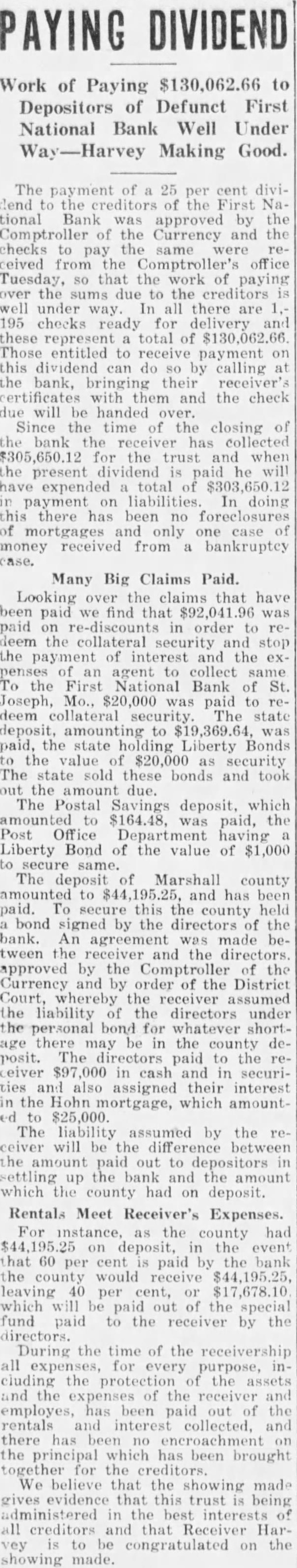

PAYING DIVIDEND Work of Paying to of Defunct First Depositors National Bank Well Under Making Good. The payment of 25 per cent dividend to the creditors of the First National Bank was approved by the Comptroller of the Currency and the checks to pay the same were ceived the Comptroller's office Tuesday, that the work of paying the sums due to the creditors well under In all there are 195 checks ready for delivery and these represent total of Those entitled to receive payment this dividend can do by calling at the bank, bringing their receiver's certificates with them and the check be handed Since the time of the closing the bank the receiver has collected for the trust and when the present dividend he will have expended total payment on liabilities. In doing this there has been no foreclosures of mortgages and only case of money received from bankruptcy case. Many Big Claims Paid. Looking over the claims that have been paid find that was paid re-discounts order to deem the collateral security and stop the payment of interest and the penses agent collect the First National Bank of St. Joseph, Mo., $20,000 was paid to deem collateral security. The state deposit, amounting to paid, the state holding Liberty Bonds the value of $20,000 as security The state sold these bonds and took the amount due. The Postal Savings deposit, which amounted $164.48, was paid, the Post Office Department having Liberty Bond of the value of to same. The deposit of Marshall county amounted to and has been paid. secure this county held bond signed by the directors the bank. An agreement was made tween the receiver and the directors. approved by the Comptroller of the Currency and by order of the District Court, whereby the receiver assumed the liability of the directors under the personal bond for whatever shortage there may be in the county deposit. The directors paid to the ceiver in cash and in securities and also assigned their interest in the Hohn which amount$25,000. The liability assumed by the ceiver will be the difference between the amount paid out depositors in settling up the bank and the amount which the county had deposit. Rentals Meet Receiver's Expenses. For instance, the county had deposit, in the that per cent paid by the bank the county would receive leaving 40 per cent, or $17,678.10 which will paid out of the special fund paid to the receiver by the directors. During the time of the receivership all expenses, for every purpose, cluding the protection assets and the expenses of the receiver and employes, has been paid out the rentals and interest collected, and there has been the which has been brought for the creditors. believe that the showing made gives evidence that this trust being administered in the best interests all creditors and that Receiver Harto be congratulated the showing made.