Article Text

alone, we dare to raise the velce of condemnation against the second spoliation meditated by these corrupt and unprincipled corporations.

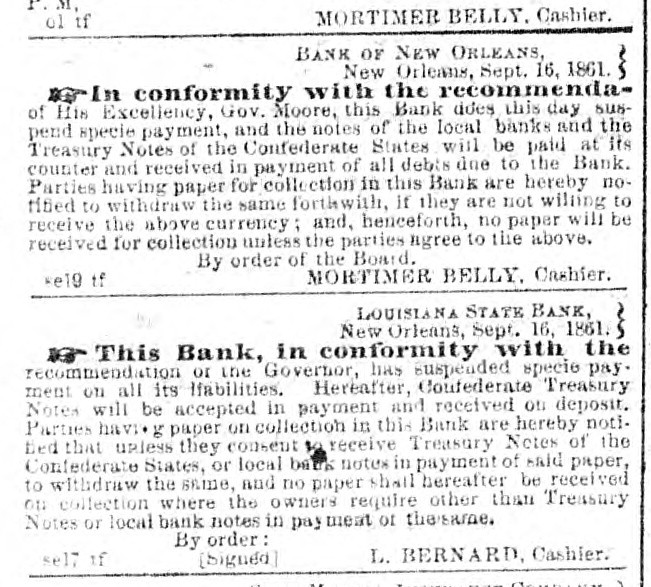

On the memorable day of Bank dishonesty, the 16th of September, 1861, when the banking concerns of this place with the exception alluded to, declared their doors oclosed against the just claims of bill-holders, and with an effrontory without precedent, undertook to paste in the pass books of their cepositors a notice to the effect that the deposite them due would be paid to each and all on the resumption of specie payments, provided that the same had not been previously drawn for, we implored them to pense in the flagitious work, and not ruin this community by their insane infidelity to every honorable duty.

We pointed out the heinousness of the pase-book notice, which claimed the use of depositors' money at the pleasure of the banks without interest, and we protested acainst an act which only the ples of national necessity and national relief could possibly or reasonably justify. Had the money of which this people was thus defranded been taken for the support of the revolution, the conduct of the banks would not, as we maintained at the time, have been justifisule, although the people would doubtless have approved it; but they pre-cipitated bankruptcy for no object conceivable to educated or opright minde, and now they avail themselves of the order of Gen. Butler to consummate their wickedness.

The banks were even in advance of the popular disposition in the revolutionary cause; but we have yet to hear of sny unusual sacrifices their directors have made out of their own pockets for the support of the cause. It is a remark bie fact, too, that on the morning of their suspension they all seemed to possess an unlimited supply of that Confederate paper they then forced the public to receive, and of which they now set the first example of repudiation. We neither approved their first operation nor this of repudiation, their last; nor their la-termediate endeavors to put their property by every species of contrivance, beyond the resca of its legitimate owners.

There are principles of right and justice so incontrovertibly obvious and supreme that no law or code, civil or military, can ignore or deny them; and such principles are now in-volved in the monetary affairs of this people. If one military power can absolve banking institutions from the redemption of their obligations solemnly guarantied, and another eaables them to complete the iniquitous work in the way most con-ducive to their own interests, any country under Heaven would be a paradise of justice compared to such a place.

But we have no apprehension of any such resuit. and we would advise the banks not to presame too far upon the pe-tienae, good nature and forbearance af this public. If the po-sition they assume be sustained, revolution will be the chronia condition of every American commonwealth. If banks aud bankites are to be the only parties in social conflicts who are surete make a profitable business of such work the key te their boisterous patriotism is furnished. And that this view of their prospects is the one entertained by the public the following published statement of a sale of some ne of their stocks on Saturday last, will indisputably confirm. The sale is publiated as that of Palfrey & Co.

Bank of New-Orleans.... $107 Crescent City Bank $00

Mechanics Bank. 121 Union Bank 110

Louisiana Bank.. 221 Citaens' Bank 209

Merchants' Bank.. 102 Baok of Americs... 198

This result will surprise no one who has watched the course of these institutions. They first procure the suspectsion of specie payment, under a patriotic pretext wholly beyond any human being's perceptions of its necessity. Then, avaiting themselves of the public necessities, they cause the price of foreign exchange, of which they have a monopoly, to advance two or three hundred per cent; seil bonds bought under ex-trenfe depression, or below par in every instance, for two or three times their nominal value; place their specie in hiding places unknown and insccessible except to themselves and their agents, and now undertake to close in a grand finale of cheatery by paying off in a currency they themselves com-pelied the people to accept, both the old cash deposits of the latter and all their accretions since the memorable epoch of suspension!

They first force Confederate paper into circulation, and proit enormously by the operation, and then depreciate it by repudiation after it has been made to serve their sordid and dishonest purposes. In these proceedings the people will see the clue to the motive of these bank men in pusning this State into the issuance of war bouds in such toordinate amounte They wanted to make of the State credit a sponge for the ab-sorption of the surplus Confederate paper in their hands, and so nicely have they made their calculations, that at this mo-ment every device is in requisition to obtain even the Confed-erate bills necessary to meet the demand of resens depositors!

We have no concealments to make in presence of Federal or Confederate authority; our record has no stains upon it; is enallenges examination We never hesitated, during the pe-riod to which we are referring, in proclaiming our opicion that, if the Richmond Government deemed the specie in the banks of this city absolutely indispensable to the revolution-ary cause, to which the country had committed itself, it was competent to it to take it. This we admitted, qualifying t however, er, with the opinion that to take unduly from one por-tion of the people, or to burden one class of citizens dispropor-tionately in this or any similar or dissimilar mauner, was an act of oppression for which extreme necessity only, which overrules all law, could be a justification.

THURSDAY May 29, 1862.

Markets-CAREFULLY REPORTED FOR THEN. Y. TRISCES

ASHES are in improved demand, and the market is firm; antes of 50 bbis. Pots at $5 75, and 60 do. Posris at $6.

COTTON-The advices from New Orleans to-day have been rather unfavorable to the prospects of speculators, and as thه manufacturers who were in the market have, in a great meas-ure, supplied themselves, the business has been less scrive, and at the close prices are heavy-31c. for Middling Uplands is quoted, though one or two lots sold a trifle below this figure. Sales of 900 bales.

COFFEE-We hear of no sales in any description, and prices are nominally unchanged.

FLOUR AND MEAL-The demand for Western and State Flour is less active, owing partly to the absence of a good as-sortment of Extra State, which is preferred to Western by shippers. The medium grades are insctive and quite irregu-lar: Trade" brauds aro quiet yet steady; the sa es are 12, 100 bbis, at $4 250 $4 40 for Superline State and Western; 455 @$480 for the low grades of Westera Extra; $45506465 for Extra State; $470@$480 for fancy do.; $500/520 for shipping brands of round-hoop Extra Ohio, and 35 36 66 25 for trade brands do. Canadian Flour is less abundant dand is quiet; the arrivals are moderate and consist mainly of the better grades; sales of 850 bbls. at $4 552 $4 75 for ship-ping brands of Spring Wheat Extras, and $4 802 $6 25 top Extras Southera Floar is in fair demand, especially good and choice Extras, but the low grades are dull yet steady ta price; sales of 1,630 bbls. at $5 100 +5 70 for wixed to go Superfine Baltimore, &c, and $5 75256 75 for trade brands ado. Rye Flour is steady and in fair request; sales of 260 bbia. at $2 152 64 05 for Superfine and Extra. Corn Meal is in moderate request and steady; sales of 400 bols. at $290 for Jersey, and 63 15 for Brandywine.

GRAIN-The Wheat market is less active, and though the receipts are less liberal, prices of most kinds are 122e bush. lower, except prime, which is scarce and wanted; the inquiry is mainly for export, and notwithstanding the decline in the rates of freight, prices favor the buyer at the close; the trans-actions include 191.000 bush.. consisting of 46,000 do. Chicage Spring at 850.@$1; 60,700 do. Milwaukee Cub 90.@+1; 36.300 do. Amber lows at $102@$1 04: 12.400 do. North-Western Club at 870.@$1; 17.6% do. Red Western at $108@$1124, the inside rate for foul, and 17,700 do. Amber Michigan at $1 15@$118. Barley and Barley Mait are less active, but prices are unchanged. Onts are scarce and a shade firmer: salemof Canadian and Western as 3422440, and State at 44@44jc. Rye is in fair demand, and is of firmer; sales of 6,700 bush. at 6320ije, for Wes eru and 70e. for State. Corn is less active, and a shade easier, the demand alis mainly for the East; sales of 73,000 bush. at @4io. for new Mixed Western, and 4712 48te. for old do.

HOPS are steady and in moderate request; sales of 100 bales e New at 14 @18c., as to quality.

HAY-The supply is larger, and the market is heavy; sales e of 900 bales at 602650 100 1b.

MOLASSES-There has been a moderate inquiry for home nee, and prices are maintained; sales of 45 hids Porto Rico eat 372 127 do. Cuba Mu covado at 272., and 60 do, at 3 je.

NAVAL STORES generally are quiet, but prices are well maintained, sales of 100 bols. Common Rosin at $7 15, and e 100 do. No, 2 at 8252$350 280 10.

OILS The market is inactive for most kinds, and prices are without essential change.

PROVISIONS There has been only a moderate inquiry for Pork, and with continued large receipts the market is heavy sles of 700 bbls., at $12 25 for less, $12 for Unta-espected Mess, and $9 621@$975 for Prime Beef is inse motive, and priors are beavy; sales of 175 bbla, at $1225@$19 50 for Fisin Mesr, and $14@$14 87 for Extra do. Bacon is doll, and we have only to notice sales of 36 boxes Short-ribbed Western, at 44c. Cut Meats are in good request, at about me former rates: sales of 900 boxes, tes, aod hhds, at 31 @ijo. for ar Shoulders, and 44@5jc. for Hams. Lard seils only to a mod-erate extent, without material change, in prices; sales of 500 bois, and tes, at 7428jc, the inside rate for quite dark.

RICE-Carolina is quiet, but holders stil demand full for at mer rates; East sells moderately at steady rates; 300 bags Rangoon were taken at 50ője.

SUGARS-The sales of itaw to-day are very fair, being chiefly to refiners and city grocers, and prices are still main-dtained. The transactions embrace some 200 ahds. Porto Rico at 70810.700 Cuba at 747jc.; 37 bxs. Havana at The, and 13.500 bags Mantila at 70.

SEEDS-Rough Flax Seed is in fair demand, and the mar-ket is firm at $2 1002 30 bush. Clover Seed is quiet at y 6. @ite. Timothy Seed is in fair request at $1750$ bush.

TALLOW is in good demand, and holders are firm; sales of 520,000 15 Prime City at Dc., cash. Rough Fat is in fair request at 6c., essh

WHISKY-A. very fair demand prevails, and prices are a