Click image to open full size in new tab

Article Text

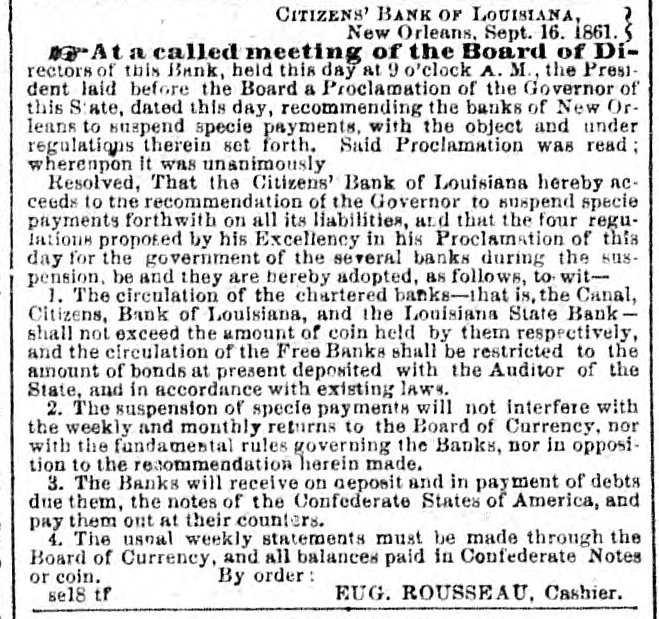

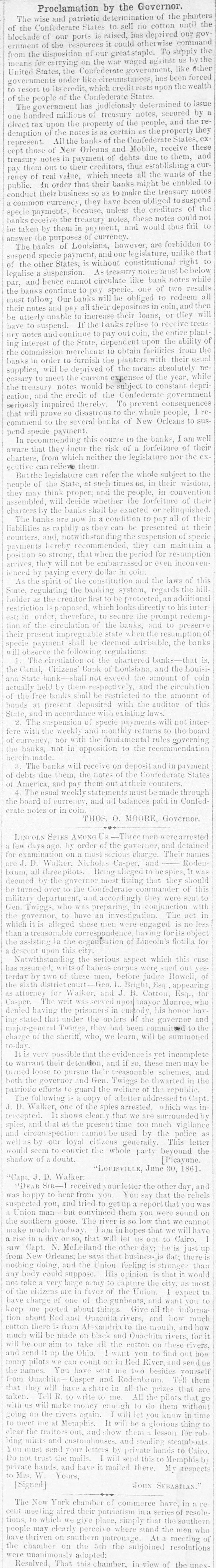

# Proclamation by the Governor.

The wise and patriotic determination of the planters

of the Confederate States to sell no cotton until the

blockade of our ports is raised, has deprived our gov-

ernment of the resources it could otherwise command

from the disposition of our great staple. To supply the

means for carrying on the war waged against us by the

United States, the Confederate government, like other

governments under like circumstances, has been forced

to resort to its credit, which credit rests upon the wealth

of the people of the Confederate States.

The government has judiciously determined to issue

one hundred millions of treasury notes, secured by a

direct tax upon the property of the people, and the re-

demption of the notes is as certain as the property they

represent. All the banks of the Confederate States, ex-

cept those of New Orleans and Mobile, receive these

treasury notes in payment of debts due to them, and

pay them out to their creditors, thus establishing a cur-

rency of real value, which meets all the wants of the

public. In order that their banks might be enabled to

conduct their business so as to make the treasury notes

a common currency, they have been obliged to suspend

specie payments, because, unless the creditors of the

banks receive the treasury notes, these notes could not

be taken by them in payment, and would thus fail to

answer the purposes of currency.

The banks of Louisiana, however, are forbidden to

suspend specie payment, and our legislature, unlike that

of the other States, is without constitutional right to

legalise a suspension. As treasury notes must be below

par, and hence cannot circulate like bank notes while

the banks continue to pay specie, one of two results

must follow; Our banks will be obliged to redeem all

their notes and pay all their depositors in coin, and then

be utterly unable to increase their loans, or they will

have to suspend. If the banks refuse to receive treas-

ury notes and continue to pay out coin, the entire plant-

ing interest of the State, dependent upon the ability of

the commission merchants to obtain facilities from the

banks in order to furnish the planters with their usual

supplies, will be deprived of the means absolutely ne-

cessary to meet the current expenses of the year, while

the treasury notes would be subject to constant depri-

cation, and the credit of the Confederate government

seriously impaired thereby. To prevent consequences

that will prove so disastrous to the whole people, I re-

commend to the several banks of New Orleans to sus-

pend specie payment.

In recommending this course to the banks, I am well

aware that they incur the risk of a forfeiture of their

charters, from which neither the legislature nor the ex-

ecutive can relieve them.

But the legislature can refer the whole subject to the

people of the State, at such times as, in their wisdom,

they may think proper; and the people, in convention

assembled, will decide whether the forfeiture of their

charters by the banks shall be exacted or relinquished.

The banks are now in a condition to pay all of their

liabilities as rapidly as they can be presented at their

counters, and, notwithstanding the suspension of specie

payments hereby recommended, they can maintain a

position so strong, that when the period for resumption

arrives, they will not be embarrassed or even inconven-

ienced by paying every dollar in coin.

As the spirit of the constitution and the laws of this

State, regulating the banking system, regards the bill-

holder as the creditor first to be protected, an additional

restriction is proposed, which looks directly to his inter-

est; in order, therefore, to secure the prompt redemp-

tion of the circulation of the banks, and to preserve

their present impregnable state when the resumption of

specie payment shall be deemed advisable, the banks

will observe the following regulations:

1. The circulation of the chartered banks that is,

the Canal, Citizens' Bank of Louisiana, and the Louisi-

ana State bank-shall not exceed the amount of coin

actually held by them respectively, and the circulation

of the free banks shall be restricted to the amount of

bonds at present deposited with the auditor of this

State, and in accordance with existing laws.

2. The suspension of specie payments will not inter-

fere with the weekly and monthly returns to the board

of currency, nor with the fundamental rules governing

the banks, not in opposition to the recommendation

herein made.

3. The banks will receive on deposit and in payment

of debts due them, the notes of the Confederate States

of America, and pay them out at their counters.

4. The usual weekly statements must be made through

the board of currency, and all balances paid in Confed-

erate notes or in coin.

THOS, O. MOORE, Governor.

# LINCOLN SPIES AMONG US.

Three men were arrested

a few days ago, by order of the governor, and detained

for examination on a most serious charge. Their names

are J. D. Walker, Nicholas Casper, and Roden-

baum, all three pilots. Being alleged to be spies, it was

deemed by the governor most fitting that they should

be turned over to the Confederate commander of this

military department, and accordingly they were sent to

Gen. Twiggs, who was preparing, in conjunction with

the governor, to have an investigation. The act in

which it is alleged these men were engaged is no less

than a treasonable correspondence, having for its object

the assisting in the organisation of Lincoln's flotilla for

a descent upon this city.

Notwithstanding the serious aspect which this case

has assumed, writs of habeas corpus were sued out yes-

terday by two of these men, before judge Howell, of

the sixth district court-Geo. L. Bright, Esq., appearing

as attorney for Walker, and J. B. Cotton, Esq., for

Casper. The writ was served upon mayor Monroe, who

denied having the prisoners in custody, his honor hav-

ing stated that under the orders of the governor and

major-general Twiggs, they had been committed to the

charge of the sheriff, who, we learn, will be summoned

to-day.

It is very possible that the evidence is yet incomplete

to warrant their detention, and if so, these men may be

turned loose to pursue their treasonable schemes, and

both the governor and Gen. Twiggs be thwarted in the

patriotic efforts to guard the welfare of the republic.

The following is a copy of a letter addressed to Capt.

J. D. Walker, one of the spies arrested, which was in-

tercepted. It shows clearly that we are surrounded by

spies, and that at the present time too much vigilance

and circumspection cannot be used by the police as

well as by our loyal citizens generally. This letter

would seem to convict the whole party beyond the

shadow of a doubt.

[Picayune.

"LOUISVILLE, June 30, 1861.

"Capt. J. D. Walker:

"DEAR SIR-I received your letter the other day, and

was happy to hear from you. You say that the rebels

suspected you, and tried to get up a report that you was

a Union man-but convinced them you were sound on

the southern goose. The river is so low that we cannot

make much headway. I am in hopes that we will have

a rise in a day or so, that will let us out to Cairo. I

saw Capt. N. McLelland the other day; he is just up

from New Orleans; he says that business is flat; there is

nothing doing, and the Union feeling is stronger than

any body could suppose. His opinion is that it would

not take a very large army to capture the city, as most

of the citizens are in favor of the Union. I expect to

have charge of one of the gunboats, and want you to

keep me posted about things Give all the informa-

tion about Red and Ouachita rivers, and how much

cotton there is from Alexandria to the mouth, and how

much will be made on black and Ouachita rivers, for it

will be our aim to take all the cotton on these rivers,

and send it up the Ohio. I want you to find out how

many pilots we can count on in Red River, and send us

the names. You have sent me two besides yourself

from Ouachita-Casper and Rodenbaum. Tell them

that they will have a share in all the prizes that are

taken. Tell R. to write to me. All the pilots that go

with us will make money enough to do them without

going on the rivers again. I will let you know in time

to meet me at Memphis. It will be a glorious thing to

clear the traitors out, and show them a lesson for rob-

bing mints and customhouses, and stealing steamboats.

You must send your letters by private hands to Cairo.

Do not trust the mails. I will send this to Memphis by

private hands, and have it mailed there. My respects

to Mrs. W. Yours,

[Signed]

JOHN SEBASTIAN."

The New York chamber of commerce have, in a re-

cent meeting aired their patriotism in a series of resolu-

tions, to which we give place, simply that the southern

people may clearly perceive where stand the men who

have thriven on southern patronage. At a meeting of

the chamber on the 5th the subjoined resolutions

were unanimously adopted:

Resolved, That this chamber, in view of the unex-