Article Text

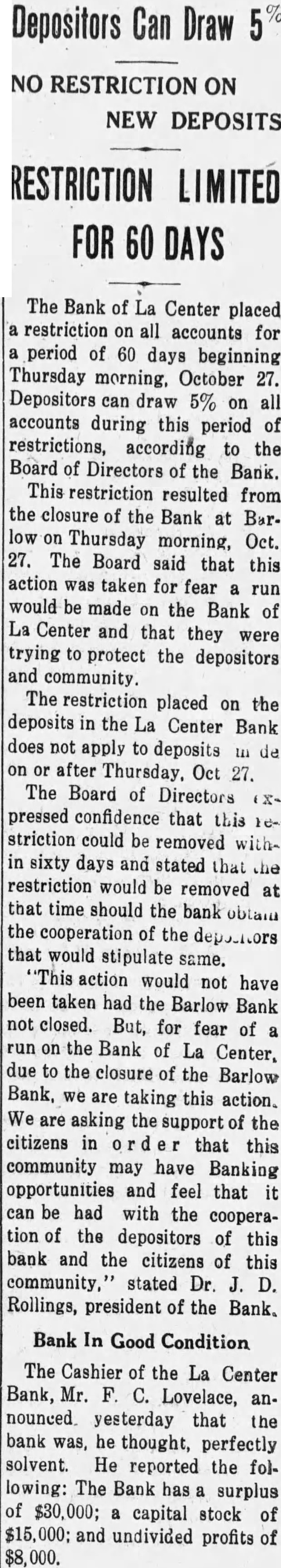

Depositors Can Draw NO RESTRICTION ON NEW DEPOSITS RESTRICTION LIMITED FOR 60 DAYS The Bank of La Center placed a restriction on all accounts for a period of 60 days beginning Thursday morning, October 27. Depositors can draw 5% on all accounts during this period of restrictions, according to the Board of Directors of the Bank. This restriction resulted from the closure of the Bank at Barlow on Thursday morning, Oct. 27. The Board said that this action was taken for fear a run would be made on the Bank of La Center and that they were trying to protect the depositors and community. The restriction placed on the deposits in the La Center Bank does not apply to deposits In de on or after Thursday. Oct 27. The Board of Directors (Xpressed confidence that this restriction could be removed within sixty days and stated that the restriction would be removed at that time should the bank obtain the cooperation of the depositors that would stipulate same. "This action would not have been taken had the Barlow Bank not closed. But, for fear of a run on the Bank of La Center, due to the closure of the Barlow Bank, we are taking this action. We are asking the support of the citizens in d that this community may have Banking opportunities and feel that it can be had with the cooperation of the depositors of this bank and the citizens of this community,' stated Dr. J. D. Rollings, president of the Bank. Bank In Good Condition The Cashier of the La Center Bank, Mr. F. C. Lovelace, announced. yesterday that the bank was, he thought, perfectly solvent. He reported the following: The Bank has a surplus of $30,000; a capital stock of $15,000; and undivided profits of $8,000.