Article Text

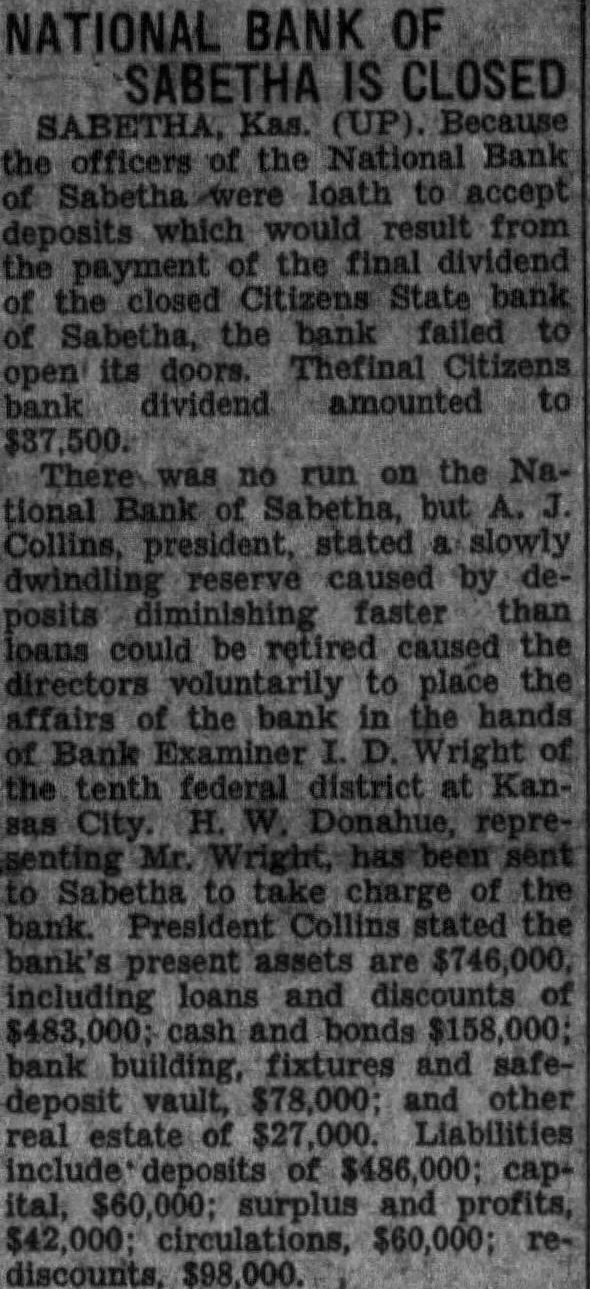

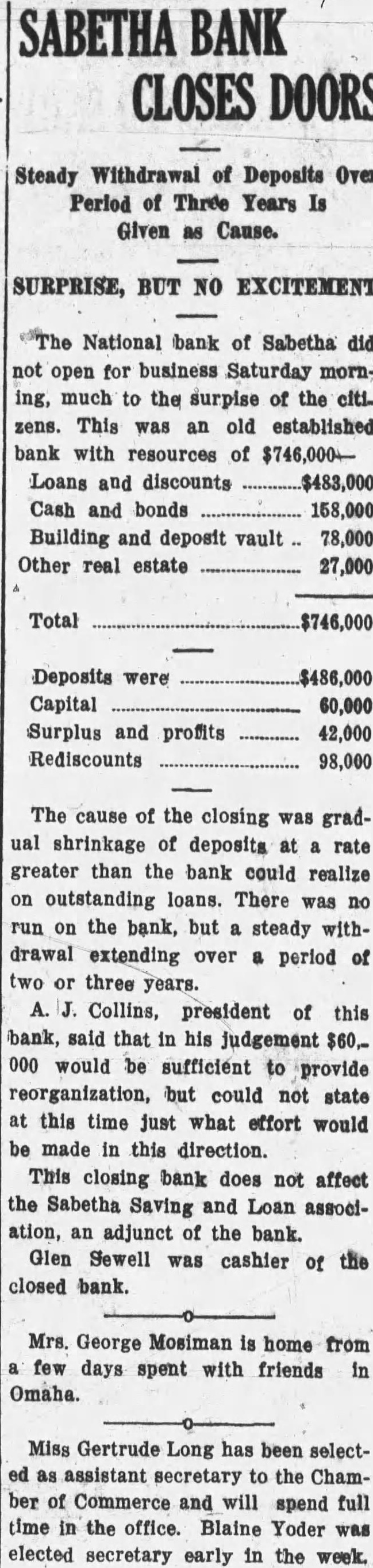

NATIONAL BANK OF SABETHA IS CLOSED Kas. (UP). Because the officers of the National Bank loath to accept deposits which would result from the of the final dividend the closed Citizens State bank of Sabetha, the bank failed to open its doors. Thefinal bank dividend amounted to 500. There was no run on the National Bank of Sabetha, but A. Collins, president, stated slowly dwindling reserve caused by deposits faster loans could be caused the directors to place the affairs of the bank in the hands of Bank Wright the tenth federal district at KanCity. W. Donahue, to Sabetha to take charge of the bank. President stated the bank's are $746,000, including loans discounts of $483 bonds $158,000; bank building, fixtures and safedeposit vault, $78,000; and other real estate $27,000. Liabilities of $486,000; capital, $60,000; surplus and $42,000: circulations, $60,000; rediscounts, $98,000.