Click image to open full size in new tab

Article Text

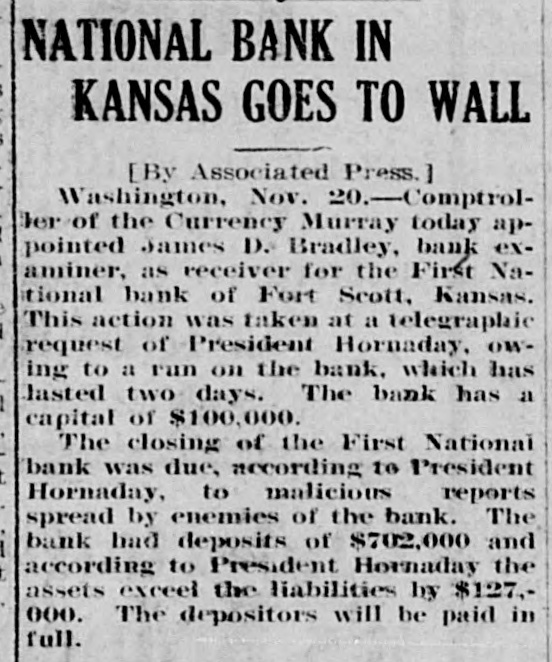

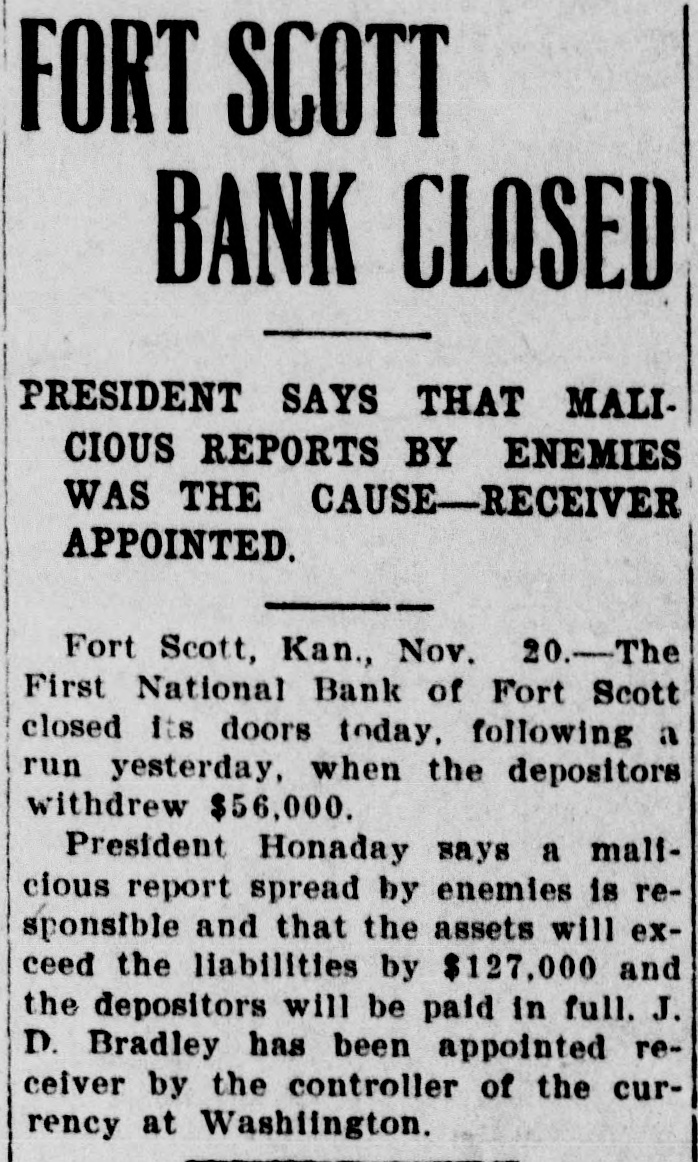

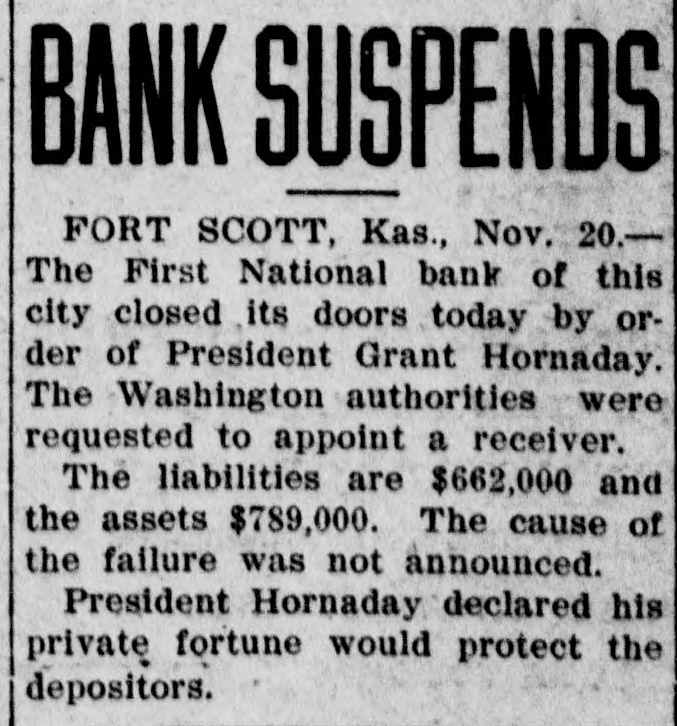

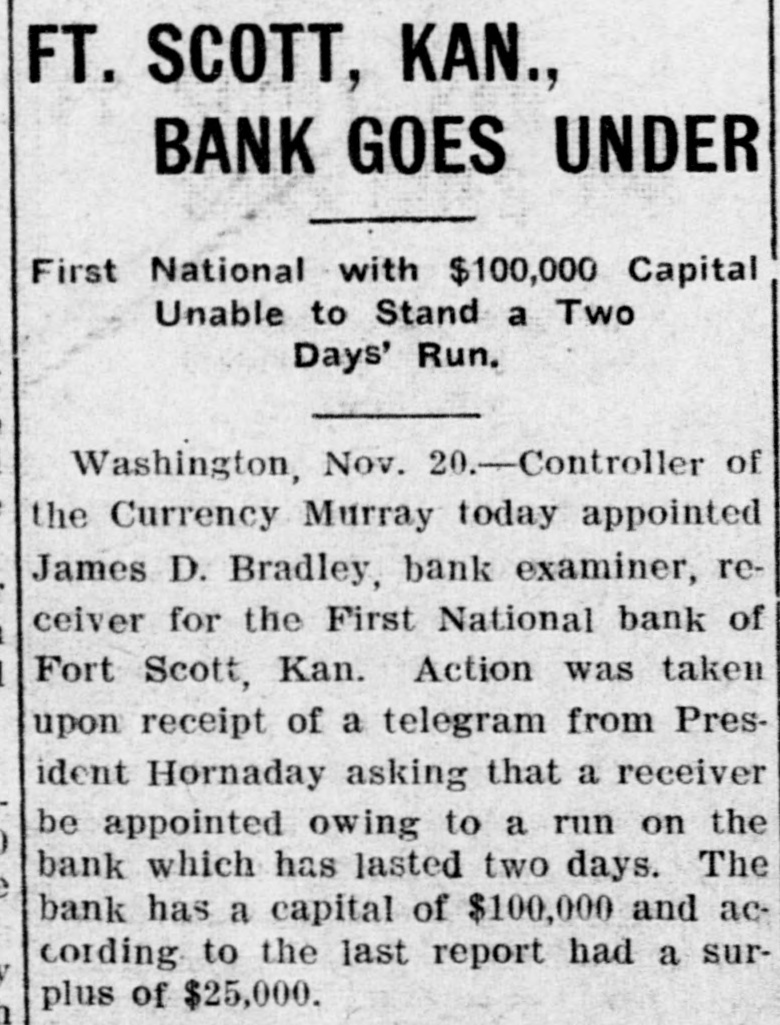

disease in western New York has caused the federal and state officials MeN pus quarantine 01 York. The East Buffalo stock were closed. Several children at Danville, Pa., were reported to have contracted the foot and mouth disease, an outbreak the which among cattle caused of states of New York and Pennsylvania eq 01 Fire in a mine at Red Lodge, Mont., caused the death of nine miners. with Scores of others were rescued great The state having rested its case in trial of Ray Lamphere at Laporte, the the defense opened with a stateInd., ment to the jury by Attorney Worden the hearing of several the witnesses and whose evidence tended to disprove supposition that the body of an adult found in the ruins of the farmhouse was that of Mrs. Gunness. Juniors in the Grand Rapids, Mich., Veterinary college struck because two colored students were admitted in accordance with a court ruling. Robbers in Attica, O., held several of citizens at bay, blew open the safe a store and escaped with $6,000. receive 8 'uns SAEP OM1 B er was appointed for the First Nationat bank of Fort Scott, Kan. Lewis Fletcher was hanged at Charlotte, N. C., for the murder of George Boyd. Both were negroes. One man was killed and five were fatally injured by a dynamite explosion in the Simpson coal mine near Brownsville, Pa. The Cairo (III.) city council granted 50-year interurban franchise and the a a 20-year street railway franchise to McKinley syndicate. An interurban line will be built to connect Cairo with Mounds, Mound City and Villa Ridge. Hugh Thompson, a wealthy be- young farmer living near Danville, Ky., came suddenly insane and shot and killed his nephew, Frederick Garrison, aged 18 years. The boy after being shot seriously wounded his uncle. Eileen Orme, a musical comedy actress, was married in London to Hon. Morris Hood, heir of Viscount Bridport. The greatest transaction in leaf tobacco ever made in America was closed at Louisville, Ky., when the Burley Tobacco society sold to the American Tobacco Company the crop of 1906 and part of that of 1907. The American company pays an average of 201/2 cents a pound for the former and 17 cents for the latter, the total being about $14,000,000. Malcolm Stewart, who was wanted in Duluth on a charge of being short $1,700 in his accounts with the Universal Milling Company, leaped head foremost through a lavatory window on the Omaha's Twilight limited and Mrs. escaped. Mary Harbour, accused of the murder of Miss Rose Adams, her foster daughter, was found guilty of murder in the second degree at Sioux City. Ia. John Krauss, said to have been connected with the Pacific State and Sunset Telegraph Company of San Francisco, committed suicide on the steam er Adriatic as it was entering Queens harbbr... UMO1 The balloon Yankee, which sailed from St. Louis in an effort to win the Lahm cup, failed to do so, landing near Tiger, Ga., after traveling 375 J. miles. B. Walton, representing the Corn Products Company, known as the "starch trust," had a most uncomfortable time trying to answer the questions of the house ways and means committee at the tariff revision hearcompany siq Aqm explain 01 pur Sup sold its products much cheaper in England than here. Herbert Grigg, alleged accomplice Cline Wheeler and Walter Zeller 18 Read jo mander the JO up Vineland, N. J., was arrested in PhilaThe delphia. supreme court of South Dakota granted a new trial to Mrs. Emma Kauffman, wife of the Sioux Falls brewer, who was found guilty in the circuit court of manslaughter on a charge of causing the death of a servant through beating. Mrs. Alphia M. Shevalier, convicted of perjury in connection with the Horn will case, was sentenced to five years in prison by Judge Lincoln Frost at Lincoln, Neb. In view of the fact that an interesting event is expected next spring, Queen Wilhelmina of Holland has been forbidden by her physicians to hold her.customary private audiences. The body of Brent Woodall, secretary of the University of Cincinnati, and former newspaper man of that city, was found in the Ohio river at Louisville, Ky. Fifty state convicts employed in the mines at Pratt City, Ala., formed a conspiracy to set No. 3 mine afire and escape during the confusion, and as a result eight of them were burned to death, one is missing and the other 41 were safely locked in the stockade. At an interview between Emperor William and Chancellor von Buelow the emperor made formal promise to his people that in the future he would not act except through the chancellor and his associate ministers. Two warehouses of the Tom Moore