Article Text

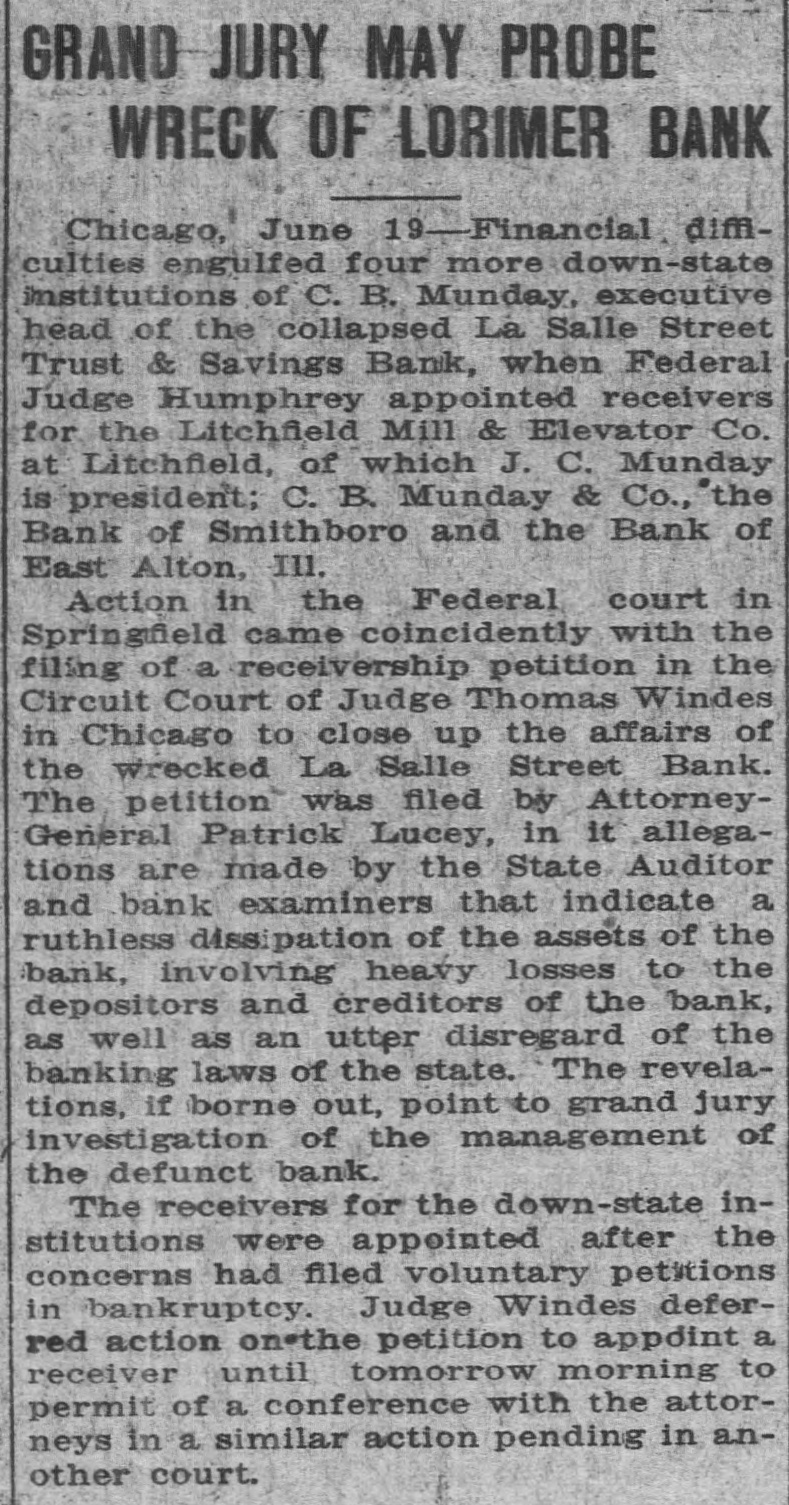

GRAND JURY MAY PROBE WRECK OF LORIMER BANK Chicago, June 19-Financial diffculties engulfed four more down-state institutions of C. B. Munday, executive head of the collapsed La Salle Street Trust & Savings Bank, when Federal Judge Humphrey appointed receivers for the Litchfield Mill & Elevator Co. at Litchfield, of which J. C. Munday is president; C. B. Munday & Co., the Bank of Smithboro and the Bank of East Alton, III. Action in the Federal court in Springfield came coincidently with the filing of a receivership petition in the Circuit Court of Judge Thomas Windes in Chicago to close up the affairs of the wrecked La Salle Street Bank. The petition was filed biy AttorneyGeneral Patrick Lucey, in it allegations are made by the State Auditor and bank examiners that indicate a ruthless dissipation of the assets of the bank, involving heavy losses to the depositors and creditors of the bank, as well as an utter disregard of the banking laws of the state. The revelations, if borne out, point to grand jury investigation of the management of the defunct bank. The receivers for the down-state institutions were appointed after the concerns had filed voluntary petitions in bankruptcy. Judge Windes deferred action on the petition to appoint a receiver until tomorrow morning to permit of a conference with the attorneys in a similar action pending in another court.