Article Text

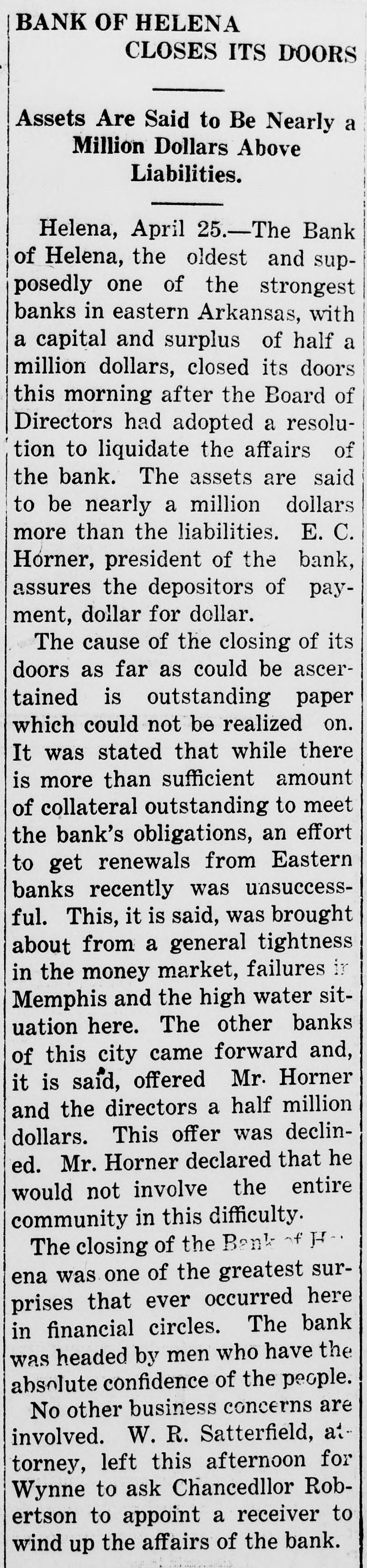

BANK OF HELENA CLOSES ITS DOORS Assets Are Said to Be Nearly a Million Dollars Above Liabilities. Helena, April 25.-The Bank of Helena, the oldest and supposedly one of the strongest banks in eastern Arkansas, with a capital and surplus of half a million dollars, closed its doors this morning after the Board of Directors had adopted a resolution to liquidate the affairs of the bank. The assets are said to be nearly a million dollars more than the liabilities. E. C. Horner, president of the bank, assures the depositors of payment, dollar for dollar. The cause of the closing of its doors as far as could be ascertained is outstanding paper which could not be realized on. It was stated that while there is more than sufficient amount of collateral outstanding to meet the bank's obligations, an effort to get renewals from Eastern banks recently was unsuccessful. This, it is said, was brought about from a general tightness in the money market, failures ir Memphis and the high water situation here. The other banks of this city came forward and, it is said, offered Mr. Horner and the directors a half million dollars. This offer was declined. Mr. Horner declared that he would not involve the entire community in this difficulty. The closing of the Bank H-. ena was one of the greatest surprises that ever occurred here in financial circles. The bank was headed by men who have the absolute confidence of the people. No other business concerns are involved. W. R. Satterfield, attorney, left this afternoon for Wynne to ask Chancedllor Robertson to appoint a receiver to wind up the affairs of the bank.