Article Text

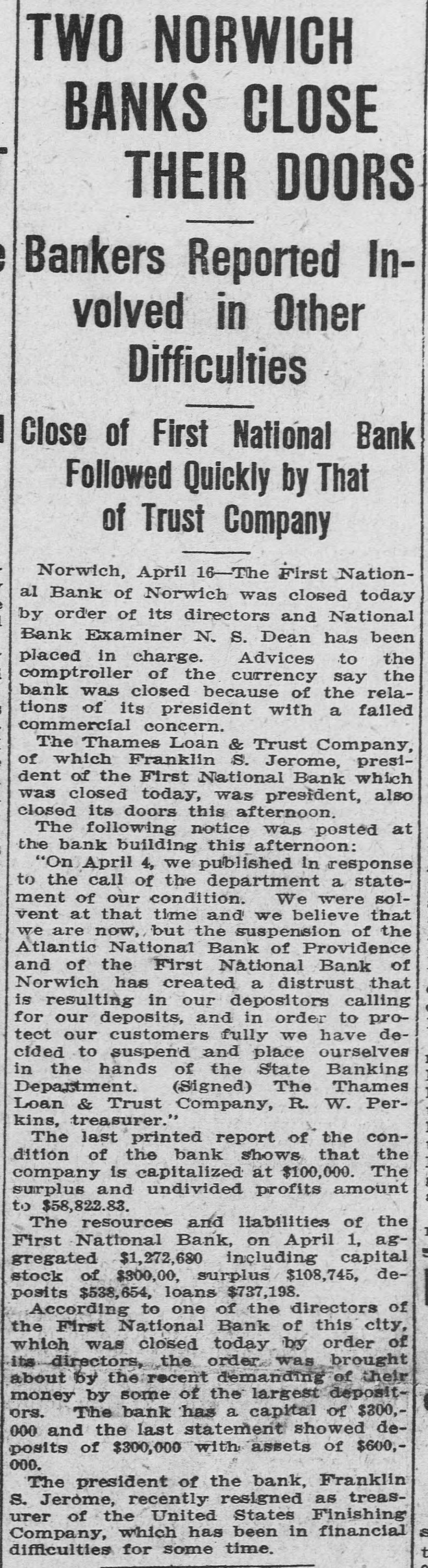

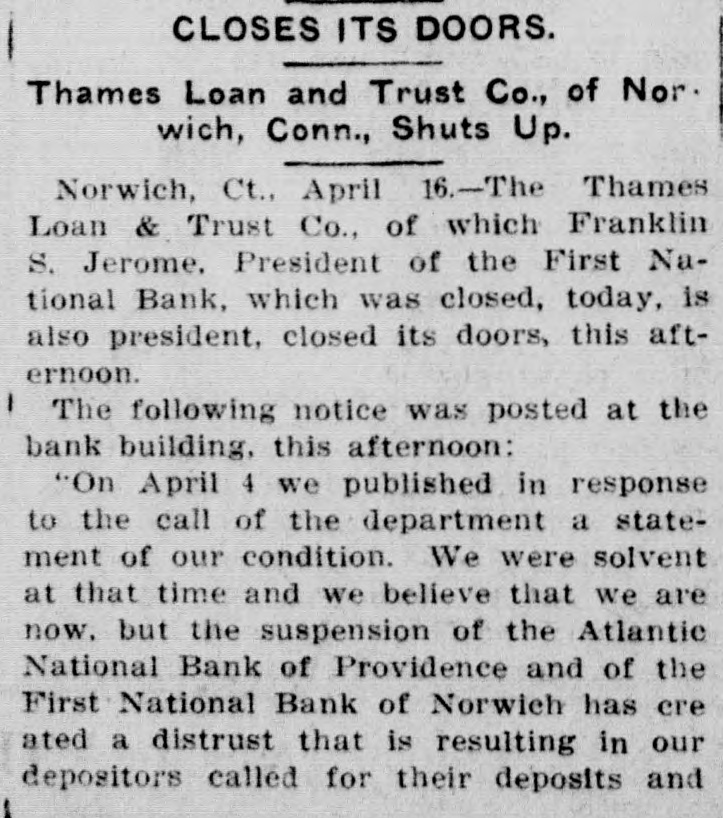

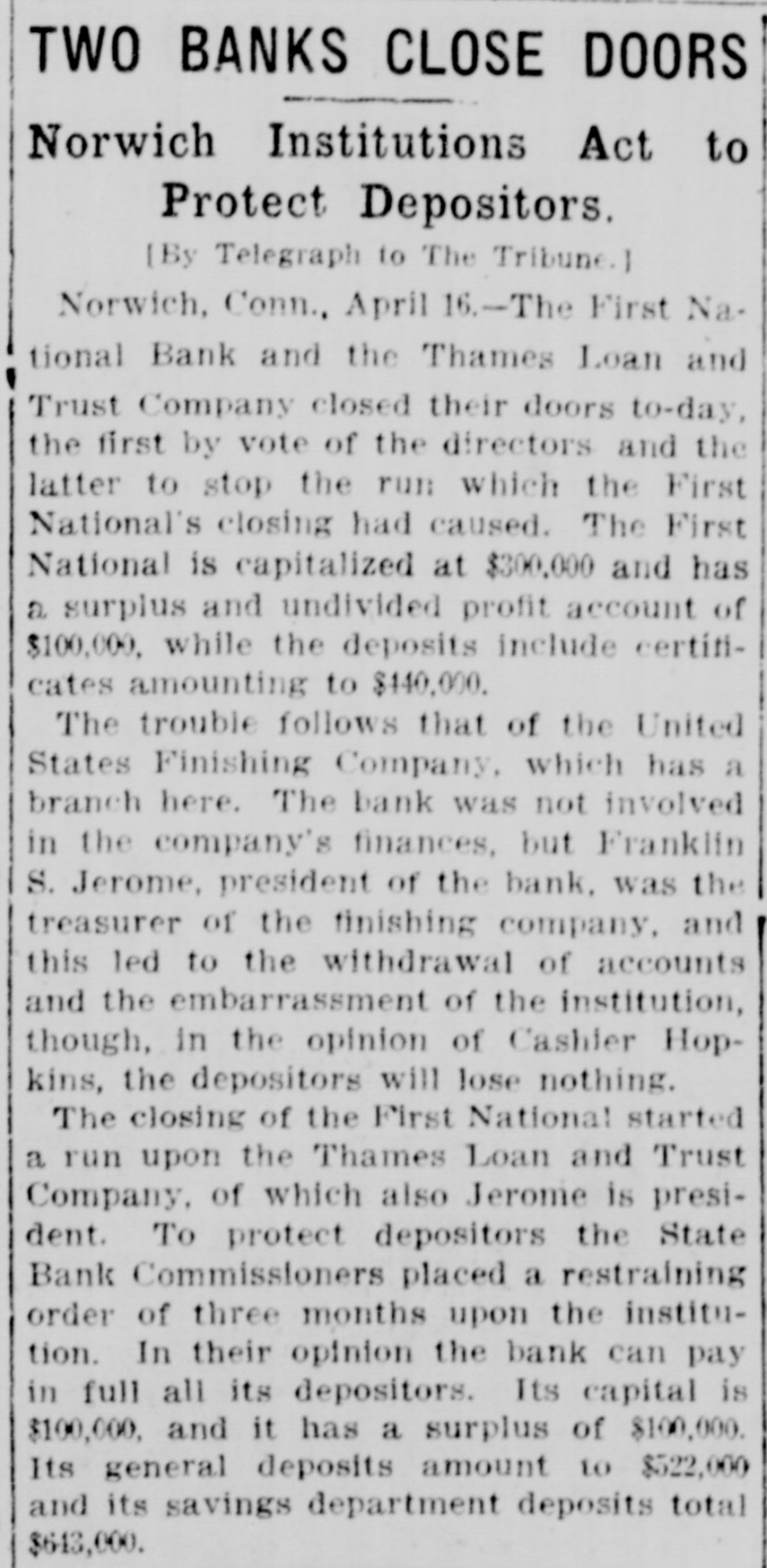

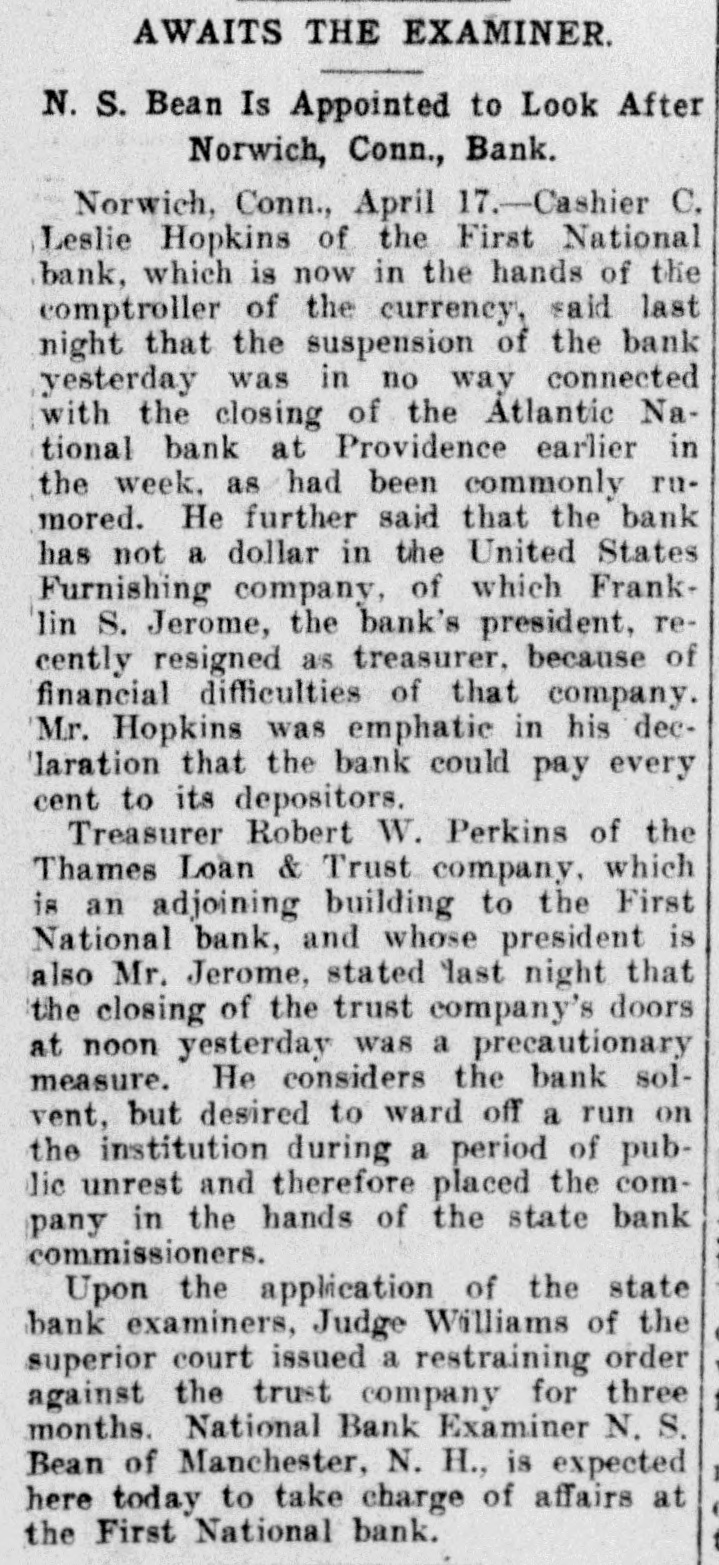

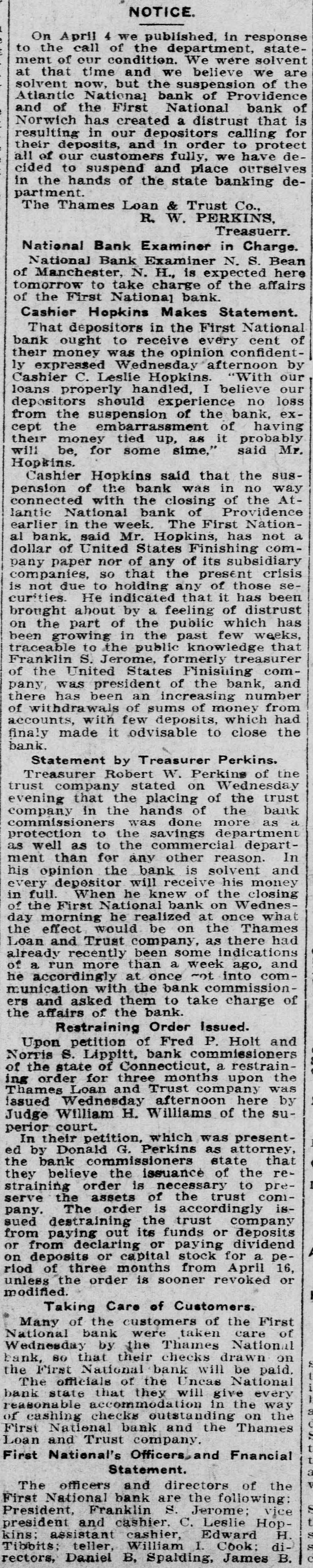

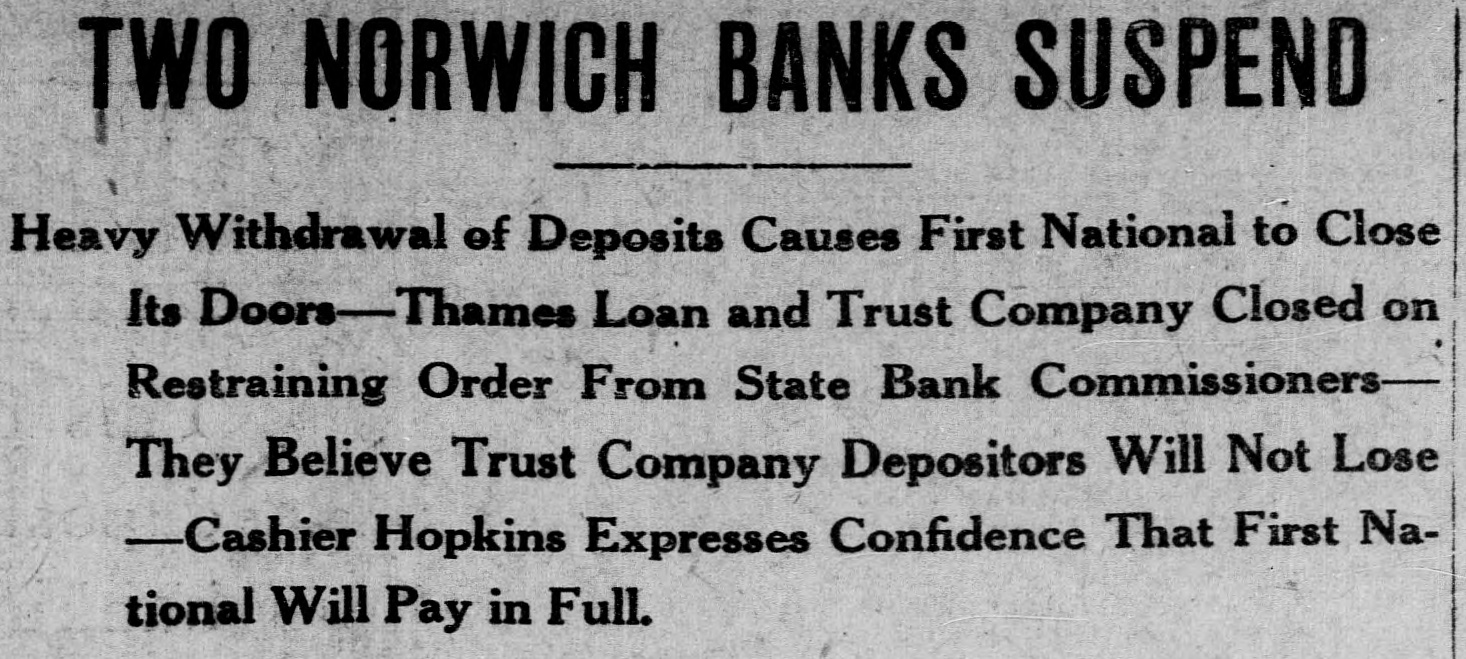

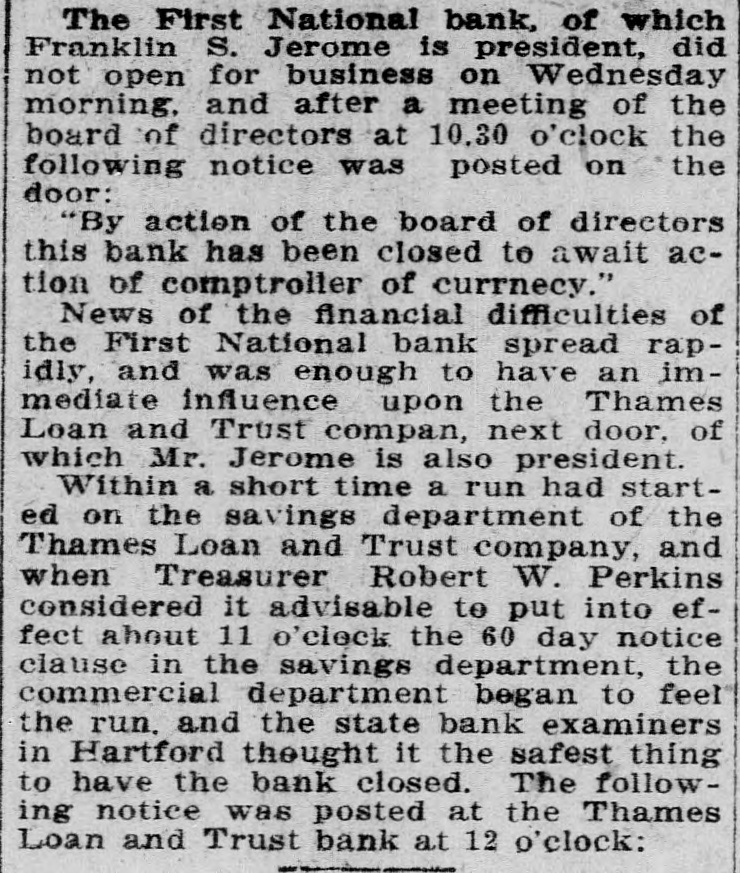

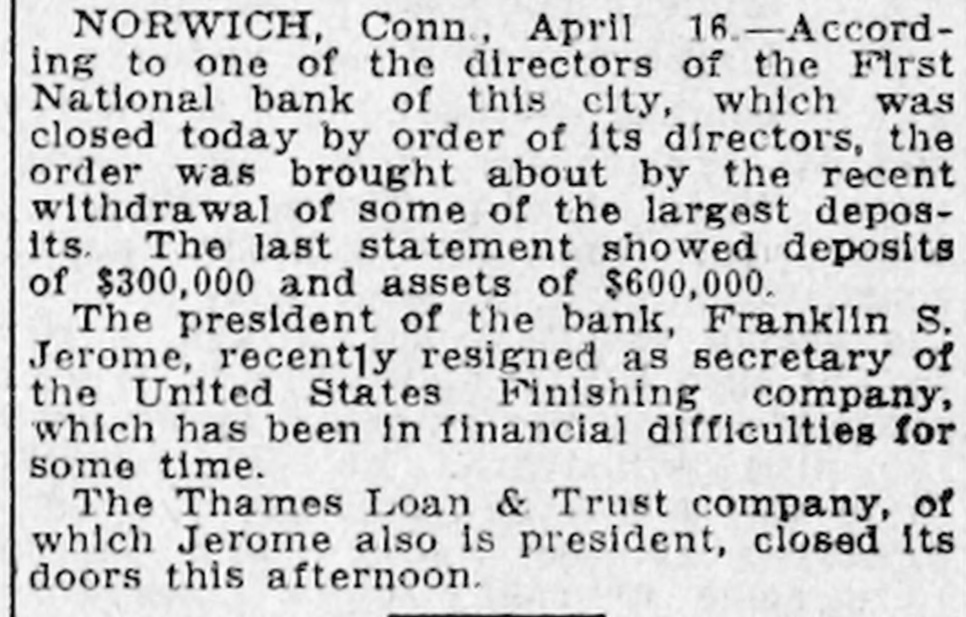

TWO NORWICH BANKS CLOSE THEIR DOORS Bankers Reported Involved in Other Difficulties Close of First National Bank Followed Quickly by That of Trust Company Norwich, April 16-The First National Bank of Norwich was closed today by order of its directors and National Bank Examiner N. S. Dean has been placed in charge. Advices to the comptroller of the currency say the bank was closed because of the relations of its president with a failed commercial concern. The Thames Loan & Trust Company, of which Franklin S. Jerome, president of the First National Bank which was closed today, was president, also closed its doors this afternoon. The following notice was posted at the bank building this afternoon: "On April 4, we published in response to the call of the department a statement of our condition. We were solvent at that time and we believe that we are now, but the suspension of the Atlantic National Bank of Providence and of the First National Bank of Norwich has created a distrust that is resulting in our depositors calling for our deposits, and in order to protect our customers fully we have decided to suspend and place ourselves in the hands of the State Banking Department. (Signed) The Thames Loan & Trust Company, R. W. Perkins, treasurer." The last printed report of the condition of the bank shows that the company is capitalized at $100,000. The surplus and undivided profits amount to $58,822.83. The resources and liabilities of the First National Bank, on April 1, aggregated $1,272,680 including capital stock of $300,00, surplus $108,745, deposits $538,654, loans $737,198. According to one of the directors of the First National Bank of this city, which was closed today by order of its directors, the order was brought about by the recent demanding of their money by some of the largest depositors. The bank has a capital of $300,000 and the last statement showed deposits of $300,000 with assets of $600,000. The president of the bank, Franklin S. Jerome, recently resigned as treasurer of the United States Finishing Company, which has been in financial difficulties for some time.