Article Text

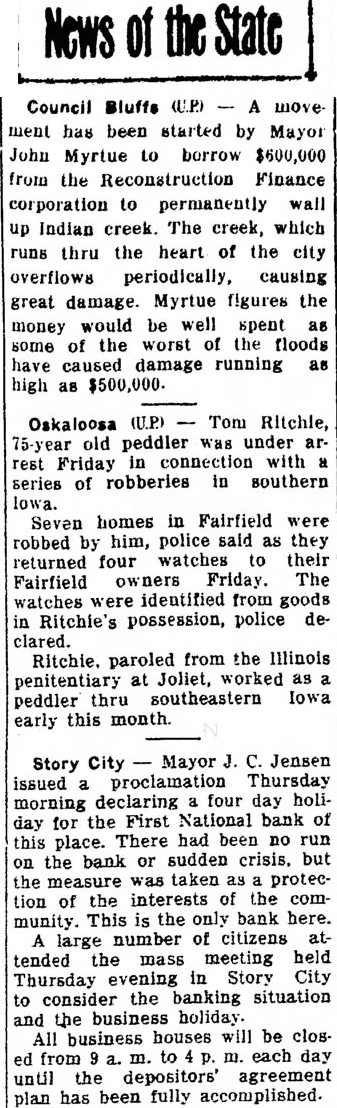

News of the State Council Bluffs (U.P.) A move ment has been started by Mayor John Myrtue to borrow $600,000 from the Reconstruction Finance corporation to permanently wall up Indian creek. The creek, which runs thru the heart of the city overflows periodically, causing great damage. Myrtue figures the money would be well spent some of the worst of the floods have caused damage running as high as $500,000. Oskaloosa (U.P.) Tom Ritchle, 75-year old peddler was under arrest Friday in connection with a series of robberies in southern lowa. Seven homes in Fairfield were robbed by him, police said as they returned four watches to their Fairfield owners Friday. The watches were identified from goods in Ritchie's possession, police declared. Ritchie. paroled from the Illinois penitentiary at Joliet, worked as peddler thru southeastern Iowa early this month. Story City Mayor J. C. Jensen issued a proclamation Thursday morning declaring four day holiday for the First National bank of this place. There had been no run on the bank or sudden crisis. but the measure was taken as protection of the interests of the community. This is the only bank here. large number of citizens attended the mass meeting held Thursday evening in Story City to consider the banking situation and the business holiday. All business houses will be closed from a. m. to m. each day until the depositors' agreement plan has been fully accomplished.