Article Text

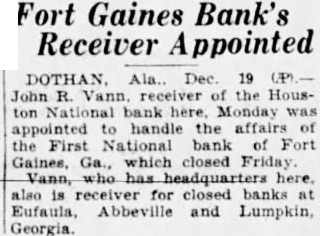

Fort Gaines Bank's Receiver Appointed John R. Vann. receiver of the Houston National bank here, Monday was appointed to handle the affairs of the First National bank Fort Gaines, Ga., which closed Friday Vann, who has headquarters here also is receiver for closed banks at Eufaula, Abbeville and Lumpkin, Georgia.