Article Text

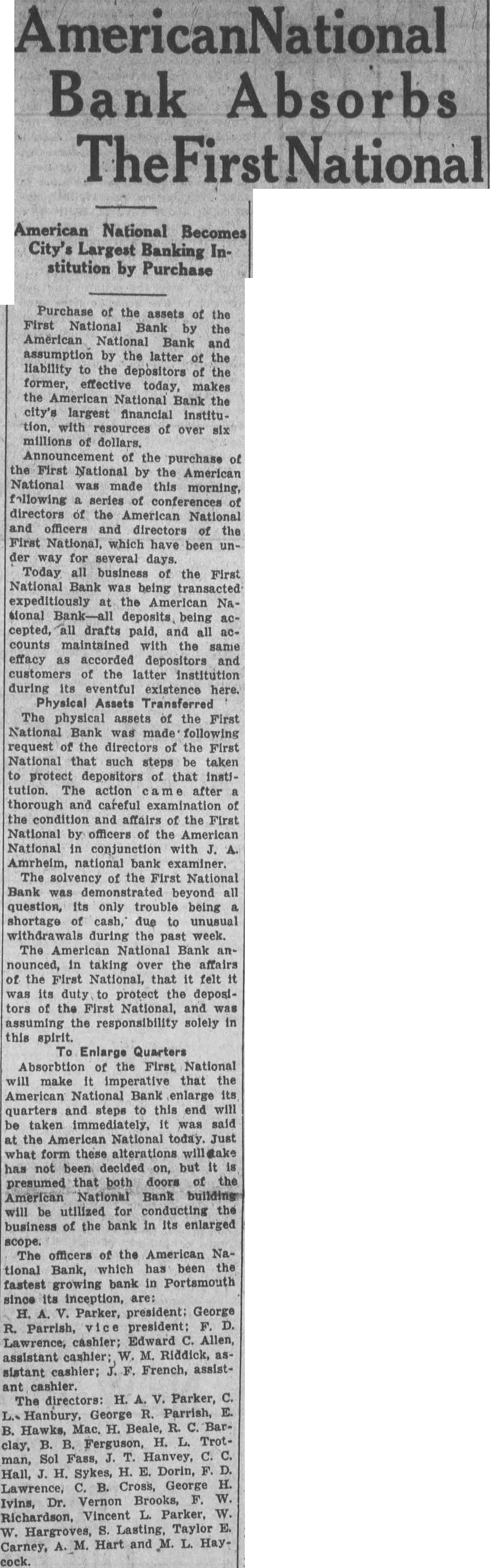

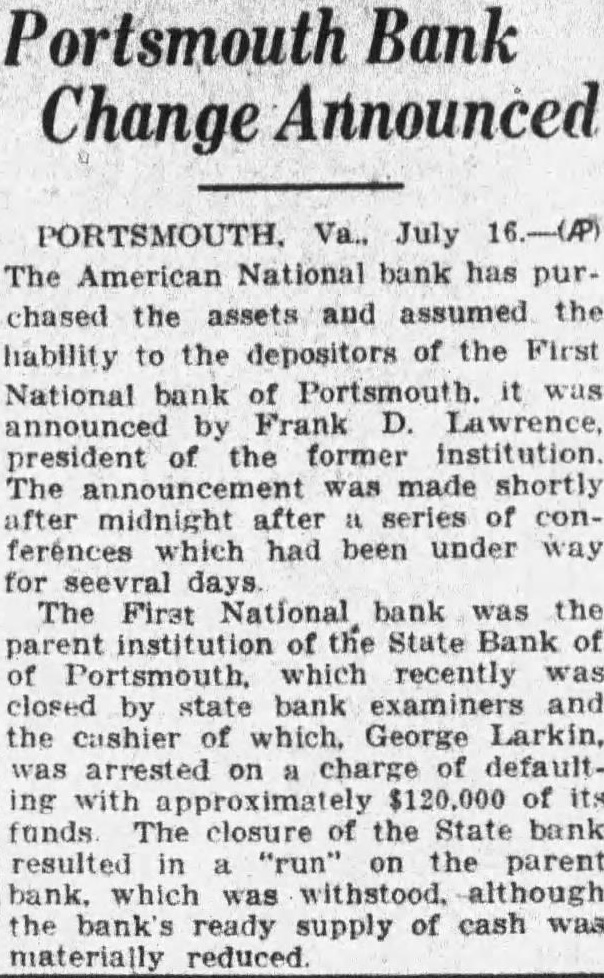

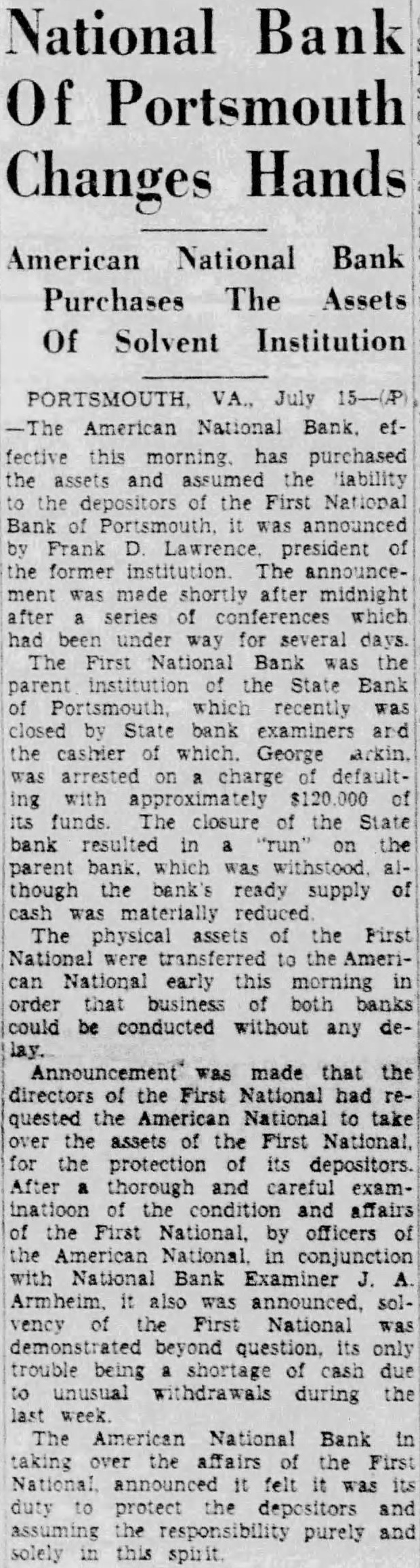

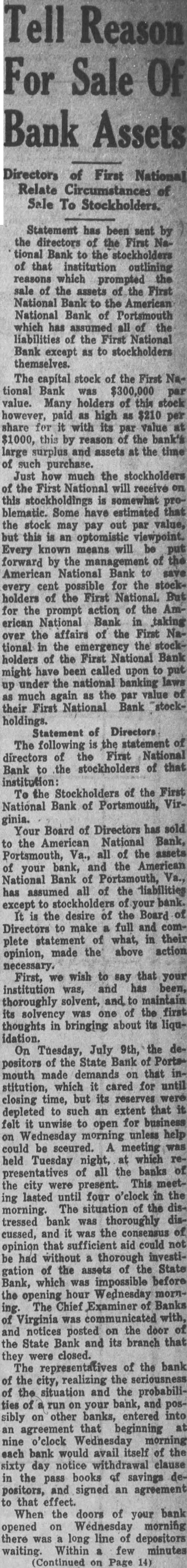

Bank Absorbs American National Becomes City's Largest Banking Institution by Purchase Purchase of the assets of the First National Bank the American National Bank and assumption by the latter the liability the depositors the former, effective today, makes the American National Bank largest financial instituresources of over six millions dollars. Announcement the purchase the First National by American National made this morning, following series conferences directors of the American National officers directors the First National, which have been der several Today all business of the First National Bank was being transacted expeditiously the Na. sional deposits being cepted, all drafts paid, and counts maintained the same effacy customers the latter institution during its eventful existence Physical Assets The physical assets the First National following request the directors the First National steps taken to protect depositors institution. The action after thorough and careful the and affairs the First National officers the National conjunction examiner. The solvency the First National Bank question, its only trouble being shortage cash, due unusual during week. The Bank antaking over the affairs of the First National, that felt its protect the deposithe First National, and assuming responsibility solely this spirit. Enlarge Quarters Absorbtion the First National will that the American Bank and steps this end will be taken the National today. Just what has decided but presumed doors the American National Bank building be utilized conducting the business of the bank in its enlarged scope. The officers of the American National Bank, has been the fastest growing bank Portsmouth its H. Parker, president: George Parrish, Edward Allen, assistant cashier; Riddick, asFrench, assistsistant cashier; cashier. The directors: H. Parker, Parrish, B. Hawks, R. BarTrotclay, Sol Fass, Hanvey, Hall, Sykes, Dorin, Cross, George Ivins, Dr. Vernon Parker, W. Hargroves, Taylor Hart and HayCarney, cock.