Article Text

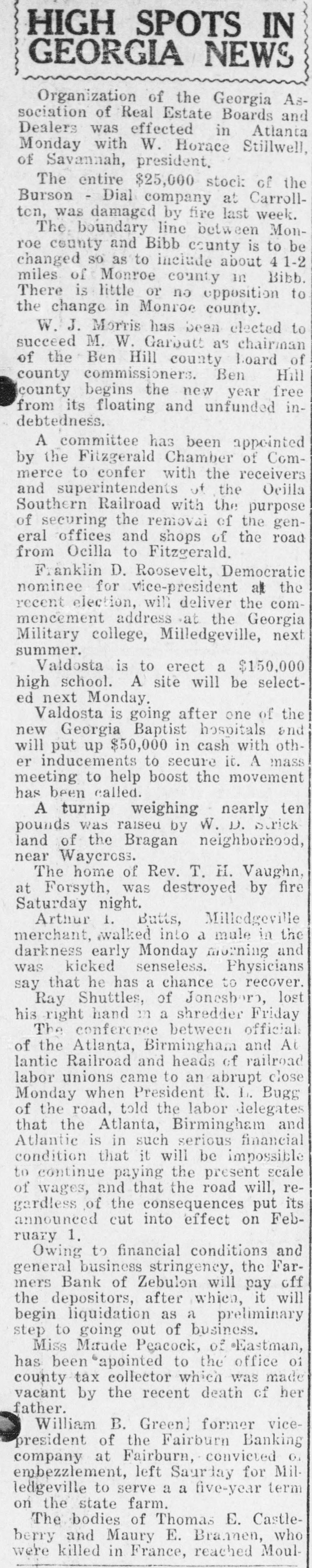

HIGH SPOTS IN GEORGIA NEWS Organization of the Georgia Association of Real Estate Boards and Dealers was effected in Atlanta Monday with W. Horace Stillwell, of Savannah, president. The entire $25,000 stock of the Burson - Dial company at Carrollten, was damaged by fire last week. The boundary line between Monroe county and Bibb county is to be changed SO as to include about 41-2 miles of Monroe county in Bibb. There is little or no opposition to the change in Monroe county. W. J. Morris has been elected to succeed M. W. Garbatt as chairman of the Ben Hill county Board of county commissioners. Ben Hill county begins the new year free from its floating and unfunded indebtedness. A committee has been appointed by the Fitzgerald Chamber of Commerce to confer with the receivers and superintendents ut the Oeilla Southern Railroad with the purpose of securing the removal of the general offices and shops of the road from Ocilla to Fitzgerald. Franklin D. Roosevelt, Democratic nominee for vice-president all the recent election, will deliver the commencement address at the Georgia Military college, Milledgeville, next summer. Valdosta is to erect a $150,000 high school. A site will be selected next Monday. Valdosta is going after one of the new Georgia Baptist hospitals and will put up $50,000 in cash with other inducements to secure it. A mass meeting to help boost the movement has been called. A turnip weighing nearly ten pounds was raiseu by W. 1). Strick land of the Bragan neighborhood, near Waycross. The home of Rev. T. H. Vaughn, at Forsyth, was destroyed by fire Saturday night. Arthur 1. Butts, Milledgeville merchant, walked into a mule in the darkness early Monday morning and was kicked senseless. Physicians say that he has a chance to recover. Ray Shuttles, of Jonesboro, lost his right hand in a shredder Friday The conference between official of the Atlanta, Birmingham and At lantic Railroad and heads of railroad labor unions came to an abrupt close Monday when President R. I. Bugg of the road, told the labor delegates that the Atlanta, Birmingham and Atlantic is in such serious financial condition that it will be impossible to continue paying the present scale of wages, and that the road will, regardless of the consequences put its announced cut into effect on February 1. Owing to financial conditions and general business stringency, the Farmers Bank of Zebulon will pay off the depositors, after which, it will begin liquidation as a preliminary step to going out of business. Miss Maude Peacock, of Eastman, has been apointed to the office 01 county tax collector which was made vacant by the recent death of her father. William B. Green) former vicepresident of the Fairburn Banking company at Fairburn, convicted O. embezzlement, left Saurday for Milledgeville to serve a a five-year term on the state farm. The bodies of Thomas E. Castleberry and Maury E. Brannen, who we're killed in France, reached Moul-