Article Text

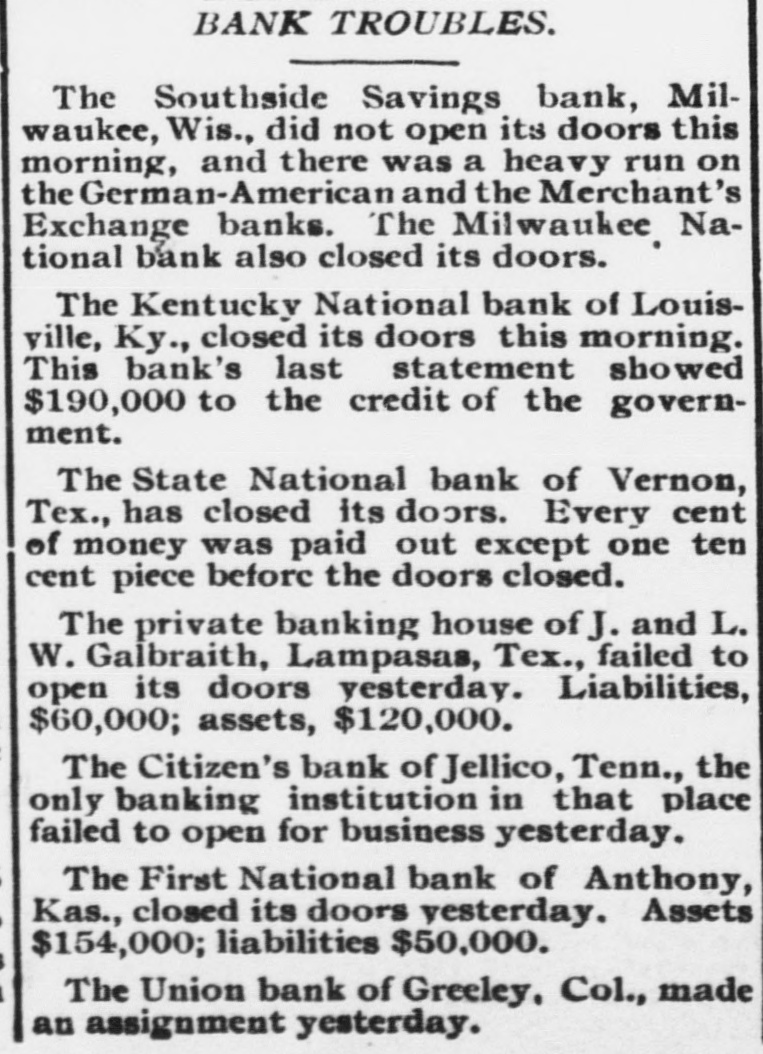

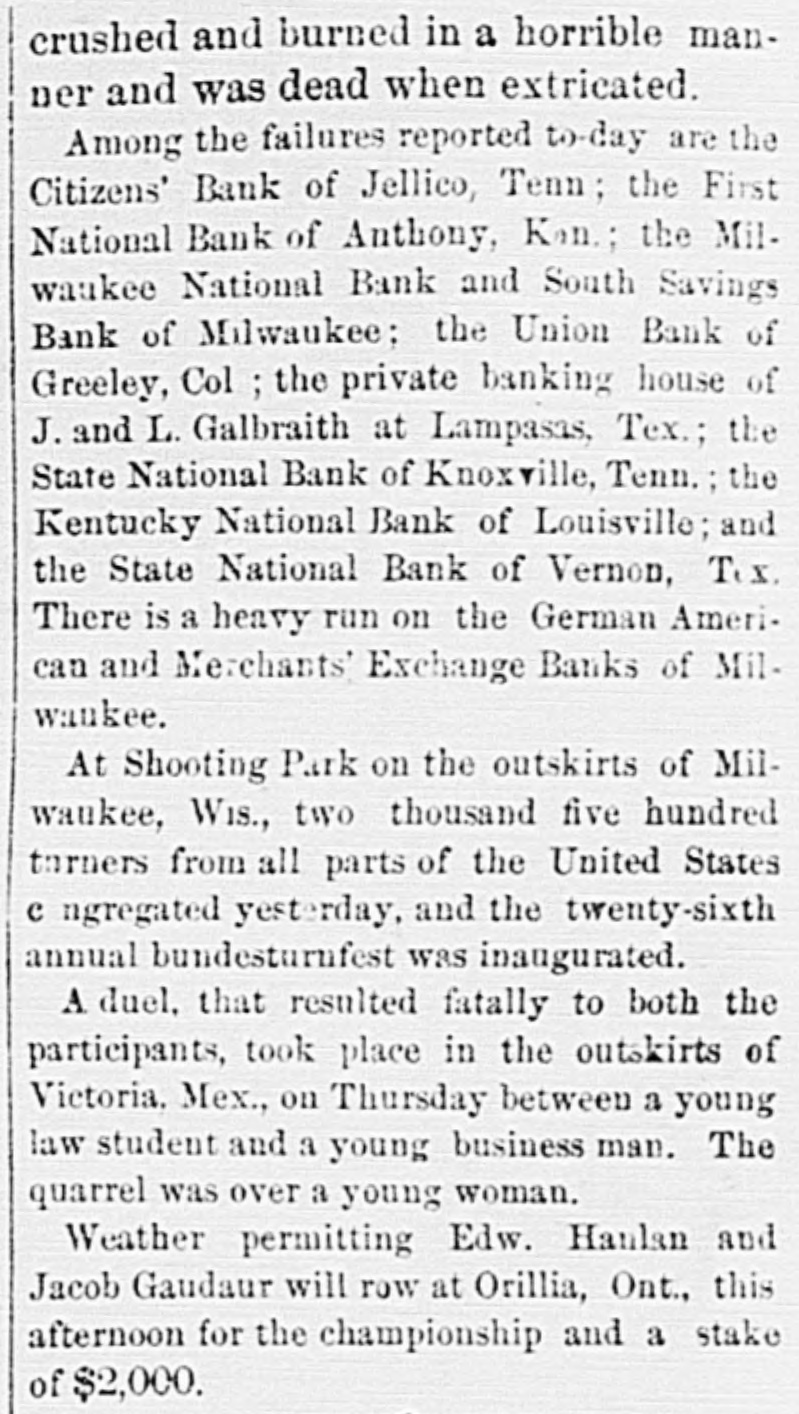

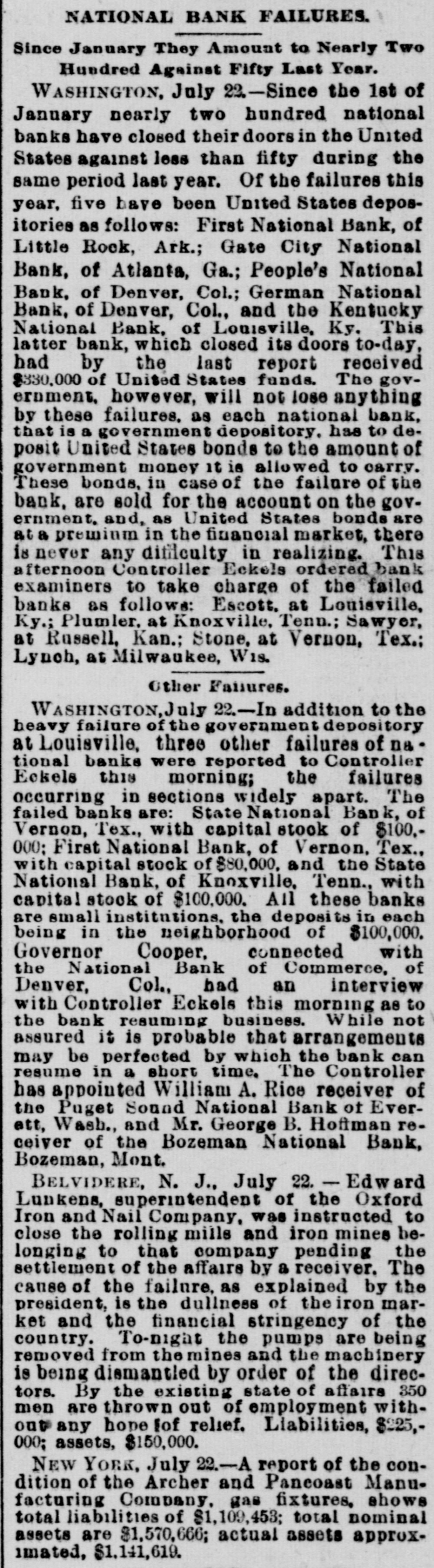

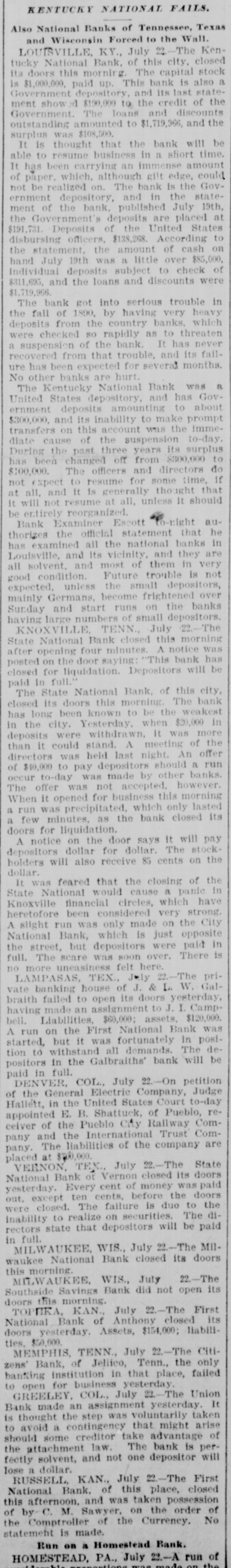

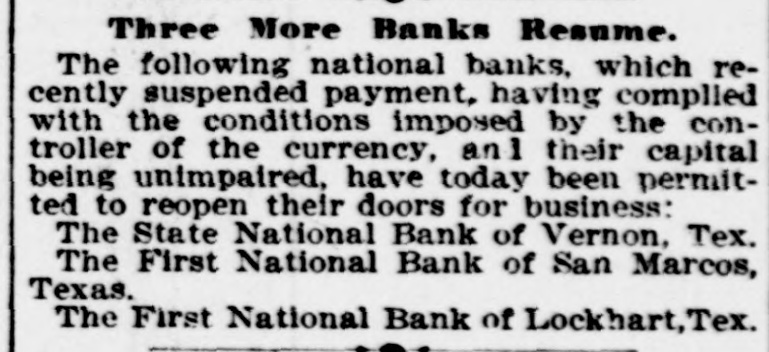

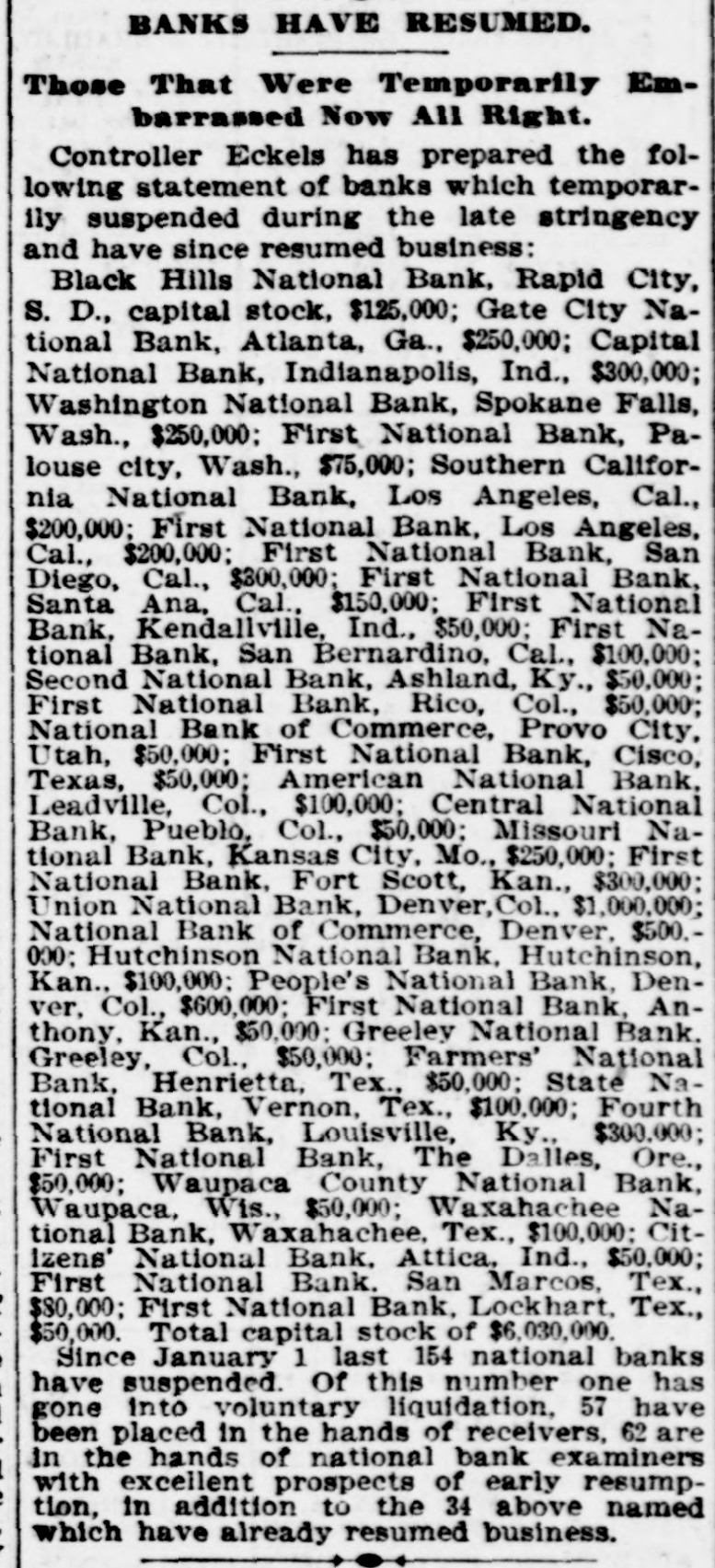

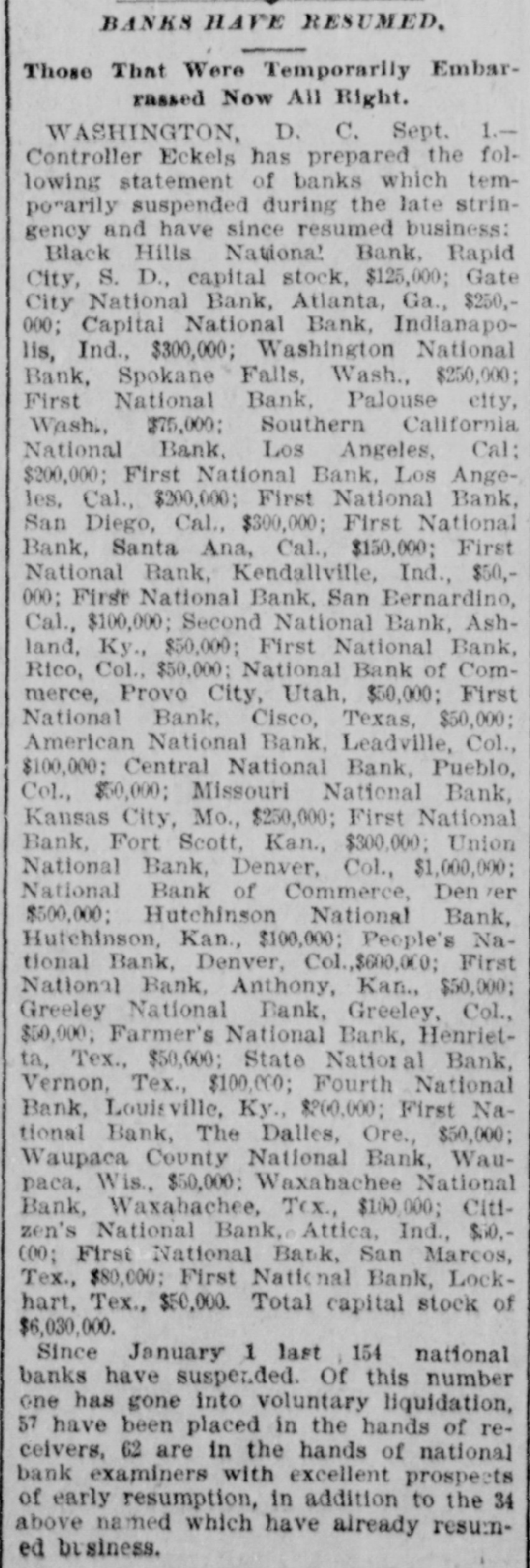

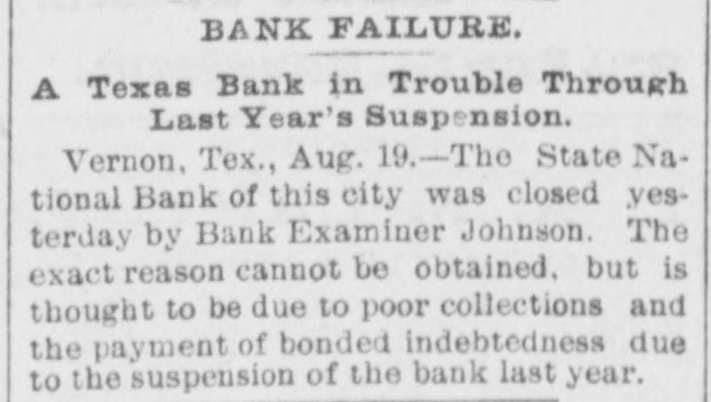

BANKS HAVE RESUMED. Those That Were Temporarily Embarrassed Now All Right. WASHINGTON, D. C. Sept. 1.Controller Eckels has prepared the following statement of banks which temporarily suspended during the late stringency and have since resumed business: Black Hills National Bank, Rapid City, S. D., capital stock, $125,000; Gate City National Bank, Atlanta, Ga., $250,000; Capital National Bank, Indianapolis, Ind., $300,000; Washington National Bank, Spokane Falls, Wash., $250,000; First National Bank, Palouse city, Wash., $75,000: Southern California National Bank, Los Angeles, Cal: $200,000; First National Bank, Los Angeles, Cal., $200,000; First National Bank, San Diego, Cal., $300,000; First National Bank, Santa Ana, Cal., $150,000; First National Bank, Kendallville, Ind., $50,000; First National Bank, San Bernardino, Cal., $100,000; Second National Bank, Ashland, Ky., $50,000; First National Bank, Rico, Col., $50,000; National Bank of Commerce, Provo City, Utah, $50,000; First National Bank, Cisco, Texas, $50,000; American National Bank, Leadville, Col., $100,000; Central National Bank, Pueblo, Col., $50,000; Missouri National Bank, Kansas City, Mo., $250,000; First National Bank, Fort Scott, Kan., $300,000; Union National Bank, Denver, Col., $1,000,000; National Bank of Commerce, Den ver $500,000; Hutchinson National Bank, Hutchinson, Kan., $100,000; People's National Bank, Denver, Col.,$600,000; First National Bank, Anthony, Kan., $50,000; Greeley National Bank, Greeley, Col., $50,000; Farmer's National Bank, Henrietta, Tex., $50,000; State National Bank, Vernon, Tex., $100,000; Fourth National Bank, Louisville, Ky., $200,000; First National Bank, The Dalles, Ore., $50,000; Waupaca County National Bank, Waupaca, Wis., $50,000: Waxabachee National Bank, Waxabachee, Tex., $100,000; Citizen's National Bank, Attica, Ind., $50,000; First National Bank, San Marcos, Tex., $80,000; First National Bank, Lockhart, Tex., $50,000. Total capital stock of $6,030,000. Since January 1 last 154 national banks have suspended. Of this number one has gone into voluntary liquidation, 57 have been placed in the hands of receivers, 62 are in the hands of national bank examiners with excellent prospects of early resumption, in addition to the 34 above named which have already resumed business.