Click image to open full size in new tab

Article Text

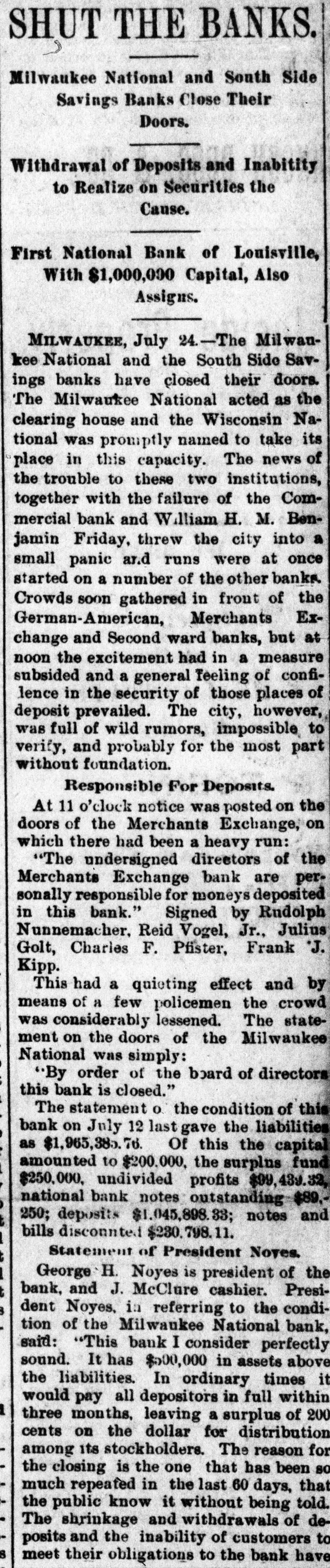

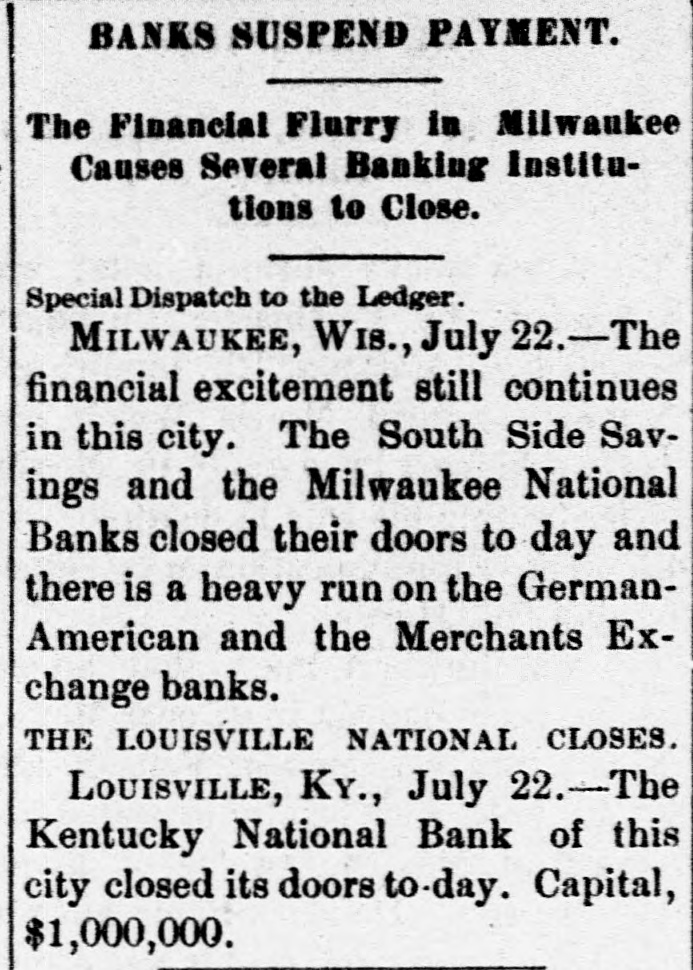

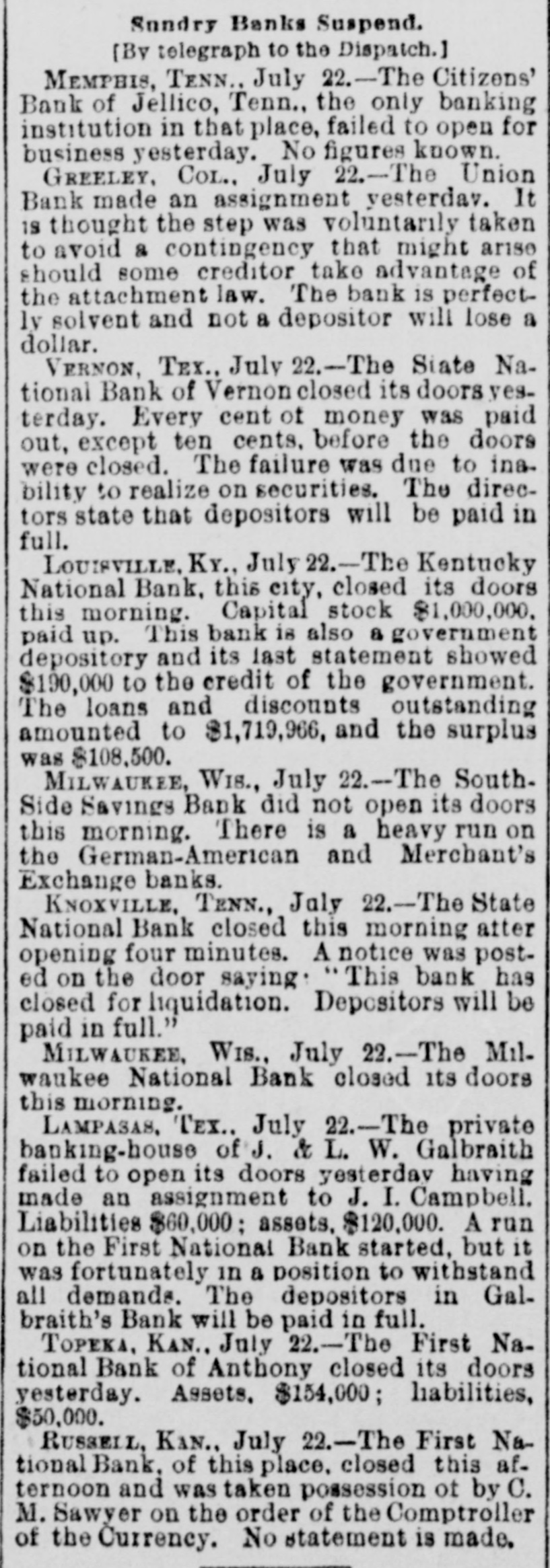

Sundry Banks Suspend. [By telegraph to the Dispatch.] MEMPHIS, TENN., July 22.-The Citizens' Bank of Jellico, Tenn., the only banking institution in that place, failed to open for business yesterday. No figures known. GREELEY, CoL., July 22.-The Union Bank made an assignment yesterdav. It 18 thought the step was voluntarily taken to avoid a contingency that might arise should some creditor take advantage of the attachment law. The bank is perfectly solvent and not a depositor will lose a dollar. VERNON, TEX., July 22.-The State National Bank of Vernon closed its doors yesterday. Every cent of money was paid out, except ten cents, before the doors were closed. The failure was due to inability to realize on securities. The directors state that depositors will be paid in full. LOUISVILLE, Kr., July 22.-The Kentucky National Bank, this city, closed its doors this morning. Capital stock $1,000,000. paid up. This bank is also a government depository and its last statement showed $190,000 to the credit of the government. The loans and discounts outstanding amounted to $1,719,966, and the surplus was $108,500. MILWAUKEE, WIS., July 22.-The SouthSide Savings Bank did not open its doors this morning. There is a heavy run on the German-American and Merchant's Exchange banks. KNOXVILLE, TENN., July 22.-The State National Bank closed this morning atter opening four minutes. A notice was posted on the door saying: This bank has closed for liquidation. Depositors will be paid in full." MILWAUKEE, WIS., July 22.-The Milwaukee National Bank closed its doors this morning. LAMPASAS, TEX.. July 22.-The private banking-house of J. & L. W. Galbraith failed to open its doors yesterday having made an assignment to J. I. Campbell. Liabilities $60,000; assets. $120,000. A run on the First National Bank started, but it was fortunately in a position to withstand all demands. The depositors in Galbraith's Bank will be paid in full. TOPEKA, KAN., July 22.-The First National Bank of Anthony closed its doors yesterday. Assets, $154,000; liabilities, $50,000. RUSSELL, KAN., July 22.-The First National Bank, of this place, closed this afternoon and was taken possession ot by C. M. Sawyer on the order of the Comptroller of the Currency. No statement is made.