Click image to open full size in new tab

Article Text

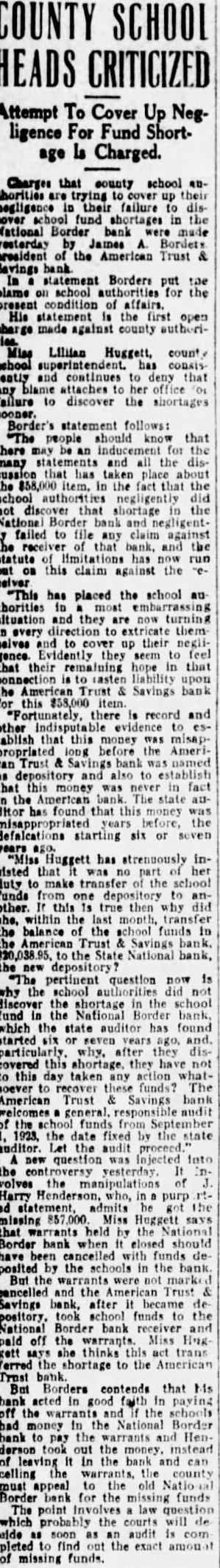

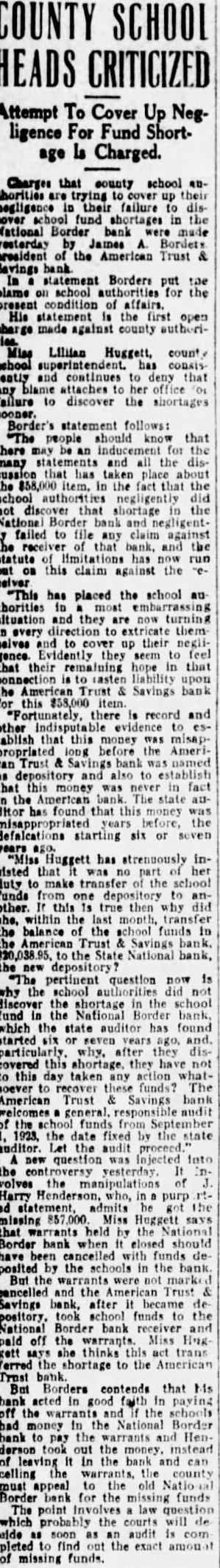

COUNTY SCHOOL HEADS CRITICIZED

Attempt To Cover Up Negligence For Fund Shortage is Charged.

Charges that county school authorities are trying cover up their negligence in their failure to discover fund shortages in the National Border bank mude yesterday by James A. Bordets president of the American Trust & Savings In statement Borders put the blame on school authorities for the present condition of affairs. His statement is the first open made against county authorischool superintendent. has consistently and continues to deny that any blame attaches her office failure to discover the shortages sooner. Border's statement follows: "The people should know that there may be an inducement for the many statements and all the dissussion that has taken place about the $58,000 item, in the fact that the school authorities negligently discover that shortage in the National Border bank and negligentfailed to file any claim against the receiver of that bank, and the statute has now run out on this claim against the "This has placed the school au thorities most embarrassing situation and they are now turning in every direction to extricate themselves and to cover up their negligence. Evidently they seem to feel that their remaining hope in that connection is to lasten liability upon the American Trust & Savings bank this $58,000 "Fortunately, there is record and other indisputable evidence to tablish that this money misaplong before the American Trust & Savings bank was named as depository and also to establish that this money was never in fact in the American bank. The state attditor has found that this money misappropriated years before, the defalcations starting six or seven years "Miss ago. Huggett has strenuously insisted that was no part her duty to make transfer of the school funds from one depository to other If this is true then why did she, within the last month, transfer the balance of the school funds in the American Trust & Savings bank. $20,038.95. to the State National bank, the new depository The pertinent question now is why the school authorities did not discover the shortage in the school fund in the National Border bank. which the state auditor has found started six seven years ago, and. particularly. why, after they discovered this shortage, they have not to this day taken any action whatsoever to recover these funds? The American Trust & Savings bank of the school funds from September 1923, the date fixed by the state auditor. Let the audit proceed. new question was Injected into the controversy yesterday. It in. volves the manipulations of Harry Henderson, who, purp rted statement, admits he got the missing 857,000. Miss Huggett says that warrants held by the National Border bank when It closed should have been cancelled with funds de posited by the schools in the bank But the warrants were not marked cancelled and the American Trust & Savings bank, after it became de pository. took school funds to the National Border bank receiver and paid off the Miss gett says she thinks this act trans ferred the shortage to the American Trust But Borders contends that Ms bank acted in good faith in paying off the warrants and if the had money in the National Border bank to pay the warrants and Henderson took out the money, instead of leaving the bank and can celling the the county must appeal to the old Border bank for the missing funds The point Involves a law which probably the courts will de eide as soon as an audit is com pleted to find out the exact amount of missing funds.