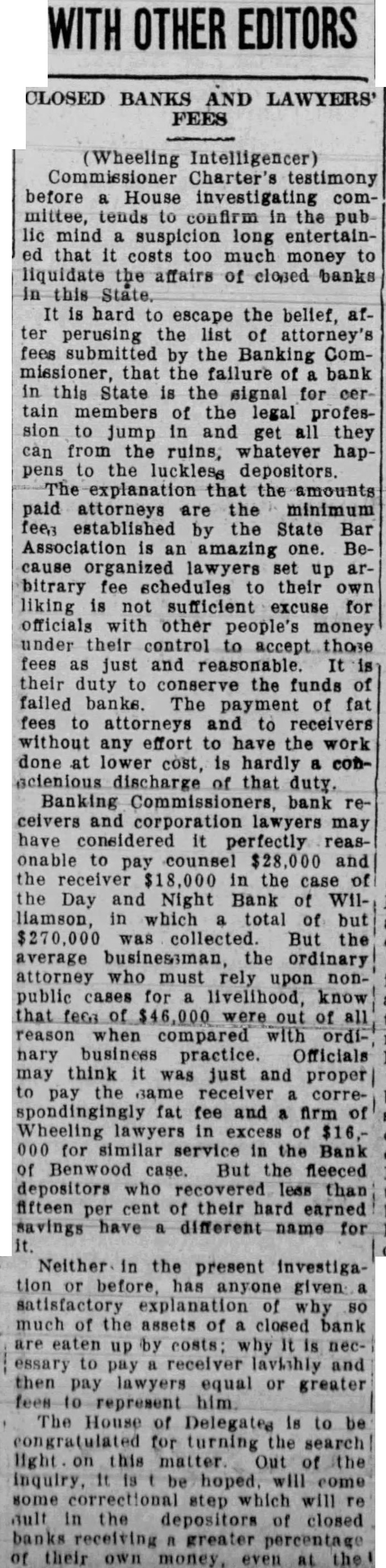

Article Text

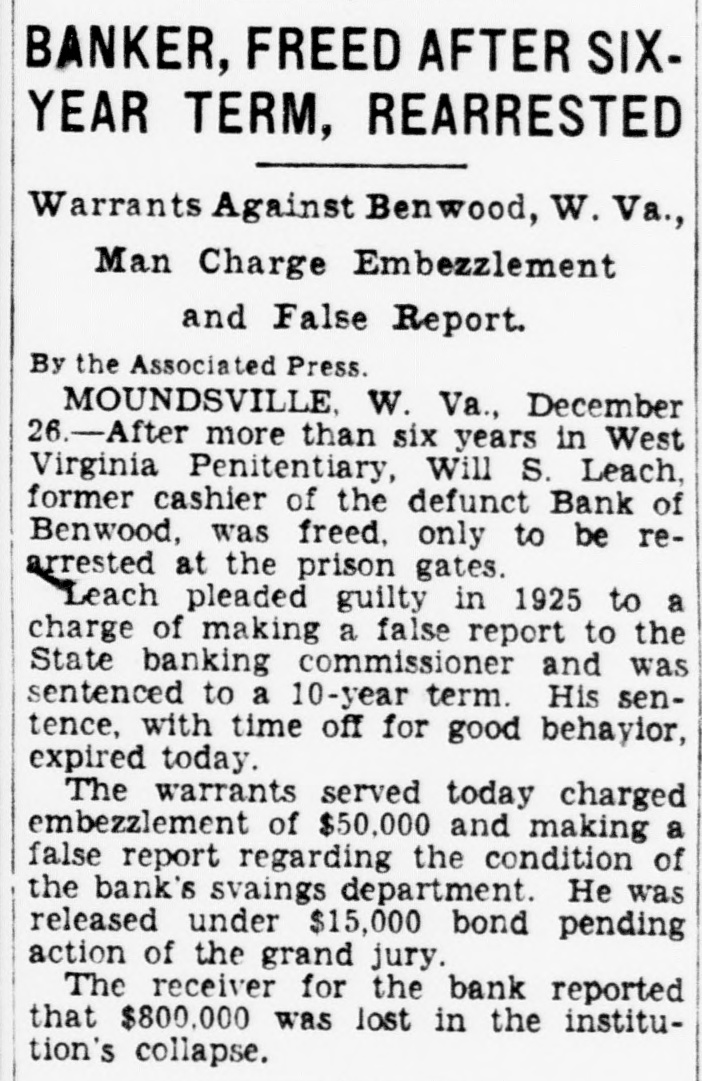

BANKER, FREED AFTER SIXYEAR TERM, REARRESTED Warrants Against Benwood, W. Va., Man Charge Embezzlement and False Report. By the Associated Press. MOUNDSVILLE, W. Va., December 6.-After more than six years in West Virginia Penitentiary, Will S. Leach, former cashier of the defunct Bank of Benwood, was freed, only to be rearrested at the prison gates. Leach pleaded guilty in 1925 to a charge of making a false report to the State banking commissioner and was sentenced to a 10-year term. His sentence, with time off for good behavior, expired today. The warrants served today charged embezzlement of $50,000 and making a false report regarding the condition of the bank's svaings department. He was released under $15,000 bond pending action of the grand jury. The receiver for the bank reported that $800.000 was lost in the institution's collapse.