Click image to open full size in new tab

Article Text

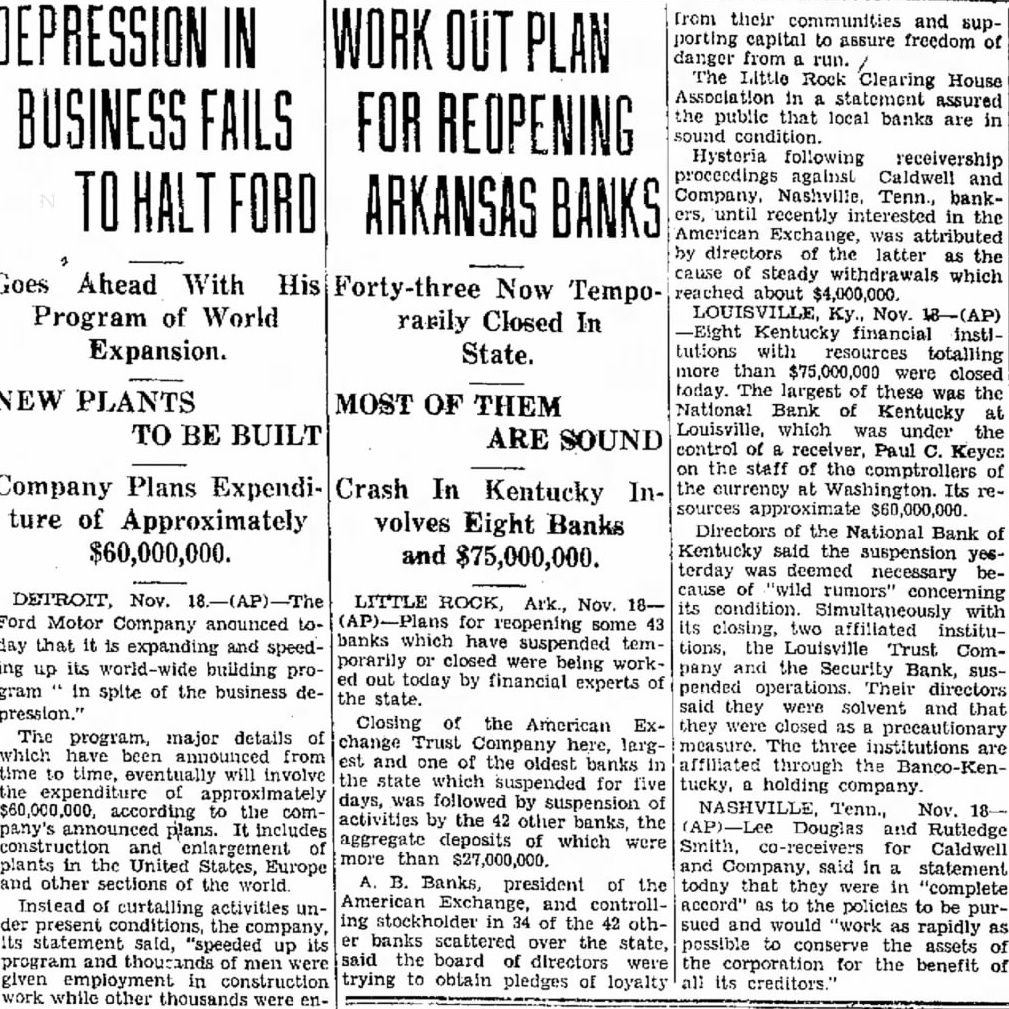

WORK OUT PLAN FOR REOPENING ARKANSAS BANKS

Forty-three Now Temporarily Closed In State.

MOST OF THEM ARE SOUND

Crash In Kentucky Involves Eight Banks and $75,000,000.

LITTLE ROCK, Ark., Nov. 18its condition. Simultaneously with (AP)-Plans for reopening some 43 its closing, two affiliated institubanks which have suspended temtions, the Louisville Trust Comporarily or closed were being workpany and the Security Bank, sused out today by financial experts of pended operations. Their directors the state. said they were solvent and that

Closing of the American Exthey were closed as a precautionary change Trust Company here, larg- measure. The three institutions are est and one of the oldest banks in affiliated through the Banco-Kenthe state which suspended for five tucky, a holding company days, was followed by suspension of NASHVILLE, Tenn., Nov. 18 activities by the 42 other banks, the (AP)-Lee Douglas and Rutledge aggregate deposits of which were Smith, co-receivers for Caldwell more than $27,000,000. and Company, said in a statement A. B. Banks, president of the today that they were in "complete American Exchange, and controllaccord" as to the policies to be puring stockholder in 34 of the 42 othsued and would "work as rapidly as er banks scattered over the state, possible to conserve the assets of said the board of directors were the corporation for the benefit of trying to obtain pledges of loyalty all its creditors." from their communities and supporting capital to assure freedom of danger from a run. The Little Rock Clearing House Association in a statement assured the public that local banks are in sound condition. Hysteria following receivership proceedings against Caldwell and Company, Nashville, Tenn., bankcrs, until recently interested in the American Exchange, was attributed by directors of the latter as the cause of steady withdrawals which reached about $4,000,000. LOUISVILLE, Ky., Nov. 18-(AP) -Eight Kentucky financial instltutions with resources totalling more than $75,000,000 were closed today. The largest of these was the National Bank of Kentucky at Louisville, which was under the control of a receiver, Paul C. Keyes on the staff of the comptrollers of the currency at Washington. Its resources approximate $60,000,000. Directors of the National Bank of Kentucky said the suspension yesterday was deemed necessary because of "wild rumors" concerning