Click image to open full size in new tab

Article Text

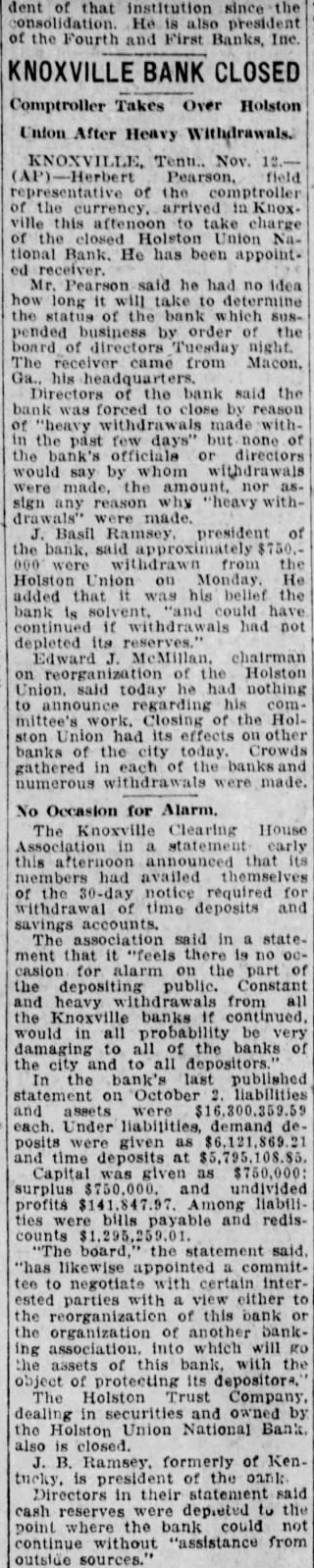

Shrine Guest.

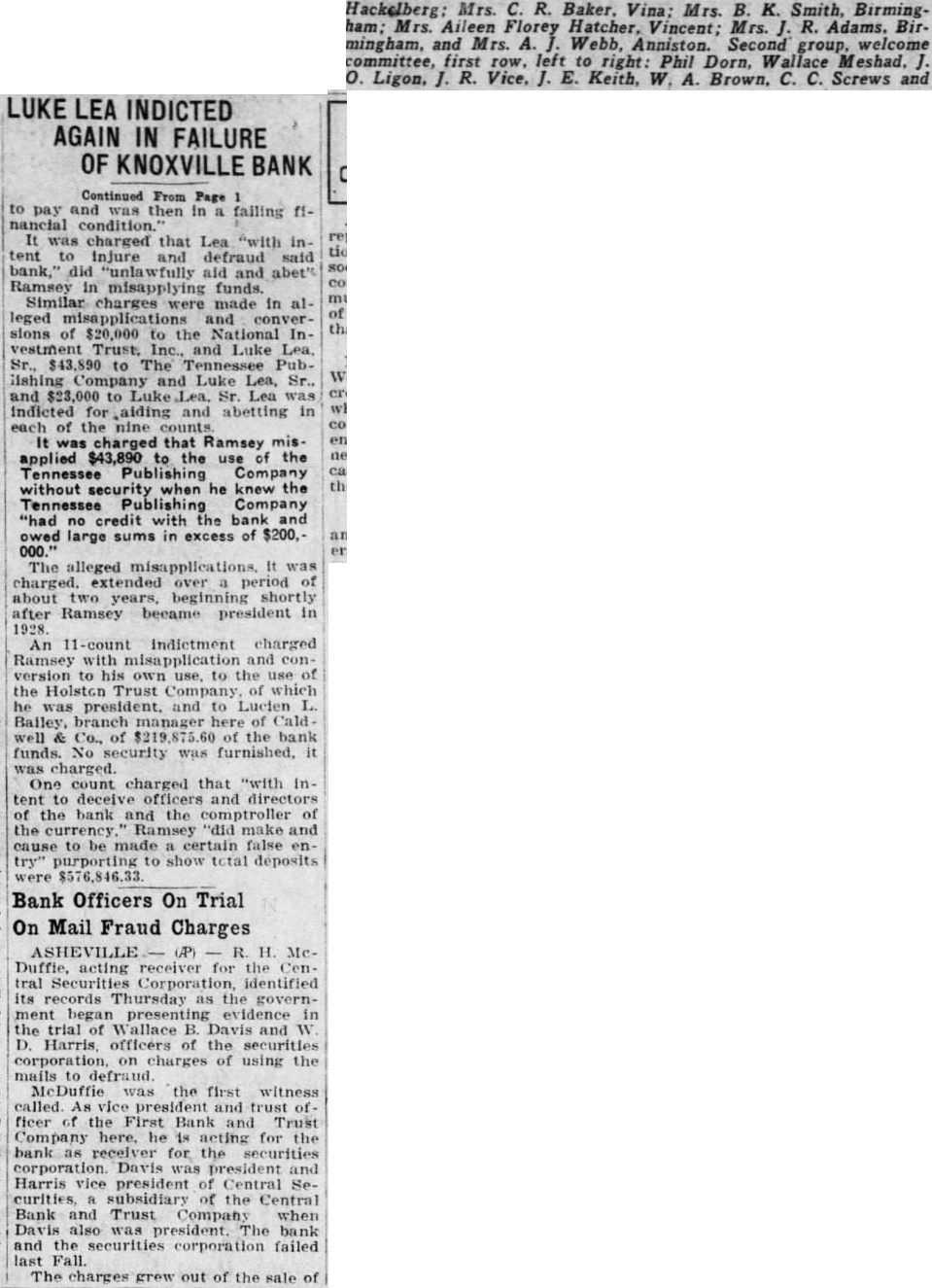

Three days later another note Conley and Maxine and Bobby. was paid. also amounting to $50.000. month later the $75,000 was told. are regarded now as pracItem to the Central Com- tically pany. for obligations of the Central Q.-At whose direction was this Bank & Trust Company of Ashe- $75,000 of Tennessee money used ville, N. C., went through. The to purchase the securities in North curities purchased. the committee Carolina at the bank in which Lea and Caldwell had a finger? porters worried him so much, he By direction of Mr. Ramsey. "That wasn't all that worried loan and the Ramsey checks next him," said Senator Craig came in for committee scrutiny "Mr. Ramsey brought the note STENOGRAPHER RESIGNS. said the "and the $25,000 check was made payable to the The next morning was liscovered that this check had been placed to his personal account take care of two checks for $12,000 each that Henry Waldauer of Memphis, the issued. of these checks court senographer, who contracted had been held for around 10 days.' to record the entire proceeding of "Did the officers of the trust company this the hearing of the state legislative protest main?" asked the committee attor. investigating committee. announced ney here today that had "quit the "What do you mean by legards. committee main, Mr. "It wasn't any one thing that Speaker Haynes, "Don't you mean made me quit,' Mr. Waldauer said. "It was just that didn't like their

"Call It Stealing."

"Call It straight stealing." said the The witness continued the thread of his "The trust company efficers did he Mr. called me up to his desk. and said that as matter fact, was not his but that he was handling for Luke Lea. and that did It because Colonel name was criticised whenever it appeared in Knoxville Q.-Did he mean that the na. tional bank examiners had criticlased the handling Colonel Lea's that. The $25,000 Knoxville Journal note which the was obtained from state deposit re. mained in the trust company until substitute note was sent back The aubstitute was Tennessee Publishing Company note for like amount, signed by Luke vice president, and E. P. Charlet, secretary it come through the United States mails? am not sure. Mr. Ramsey sent It back by secretary with instruction that It was to take the place of the Knoxville Journal was the Knexville Journal taken was about two weeks before the closure became of the Tennes. are Publishing Company note? A. -It is still here.

Yesterday, the witness said, payment $2,500 was made on this note to the receivers. making a total of $7,500 that been paid on it by the Tennessee Publishing Company Q.-Has Col. Lea, or his son. or Mr. Charlet been in here recently A.-Not that know of. Back came the United States mail angle of the story. on which the committee attorneys are putall these payments received in the U. N. mail? The trust company invested $30. 000 of the highway money bonds of the Knoxville Sentinel Company, the witness said. The the loan on the newspaper notes, the $75,000 for North Care. lina securities and the 000 pay its own notes for $230,000 of the $250,000 highway deposit. Q.What became of the re. maining $20,0007 A.-It is still here. "You mean it was there," snorted Chairman Faulkner. The came in exactly 10 days after Mr. Ramsey had walk ed into directors' meeting and suggested that the previous resolution to accept no deposits be scinded. The state banking partment never acted upon this move to receive deposits, but the state money taken anyway At one the trust had $5,000 note on its hands signed by Colonel Lea. but this was paid off. the witness said Who arranged that loan? A Ramsey. The colonel also, through Mr Ramsey. had the trust company take trade of the Belle Meade Land Company one of his Nashville corporations. For handling of this paper, $500 fee was paid. although the check for It was not brought out of Mr Ramsey's private desk until trust officials questioned the handling of the item. It was this item that led to the of the trust company officials, Made Him Resign.

"Mr. Ramsey was no dissatisfied with the of anyone attempting to thwart his plans that he make it NO embarrassing for Mr. Slaughter. he left,'t said Mr. Blaughter's former If Mr. Slaughter decides to swer the committee's long distance subpoena to his home in Mobile, he will be here tomorrow as voluntary witness against Mr. Ramsey The details of the transactions with Caldwell & Company, credited with putting the trust out of business, were revealed in question begun by Speaker Haynea had many deals with Caldwell & Company after Caldwell and Lea bought into the Holston banks? A.-We bought quite few stocks through Caldwell & Company Q-Name some of them. A.Tennessee Products, Southern Surety, Memphis Commercial Appeal bonds, Memphis Natural Gas, Alli- and gator Raincoat Corporation Kentucky Rock Asphalt. Q-The truth that your concorn and Caldwell Company were Interwoven? -Practically all our capital was tied up by stocks and bonds purchased through Caldwell. unloaded on you? A -That is your dealings with Cald. well & Company really broke your trust company? A.-There is no question about it in my mind. Q.-1s It your opinion that the $250,000 deposit was largely the result of the close association of the Holston banks with Caldwell Company A.-My manipulated opinion is that by the deposit was Caldwell Company for the purpose of getting additional money to be used in making the Holston Trust Company buy additional stocks. Caldwell Q-In other words. state read money was diverted to buy Caldwell stocks? we had no for the deposit. need "It was in the atmosphere Cald at that the Knexville well relation to the Holston banks was a poisonous influence, wasn't it, Mr Allen?" asked Senator Craig so. Midnight think rides by Basil Ramsey between Knoxville and Nashville but the questioning. witness came up had litle information about them. Q-Did you know that Ramsey took midnight ride to Nashville just before bank came to Knoxville, got some securities, and then after the examiners left. shuttied them back to Nashville so they of for the Bank ready would Tennessee be know he went to made night trips, but don't know anything about the shifting of se. curities before the coming ch.bank examiners. said the in Florida now, "the newspaper way doing Mr. Waldauer and his assistants withdrew at the close of the sension yesterday, it was learned, and the sommittee left for Knoxville appar ently without having arranged for the keeping of its record.