Click image to open full size in new tab

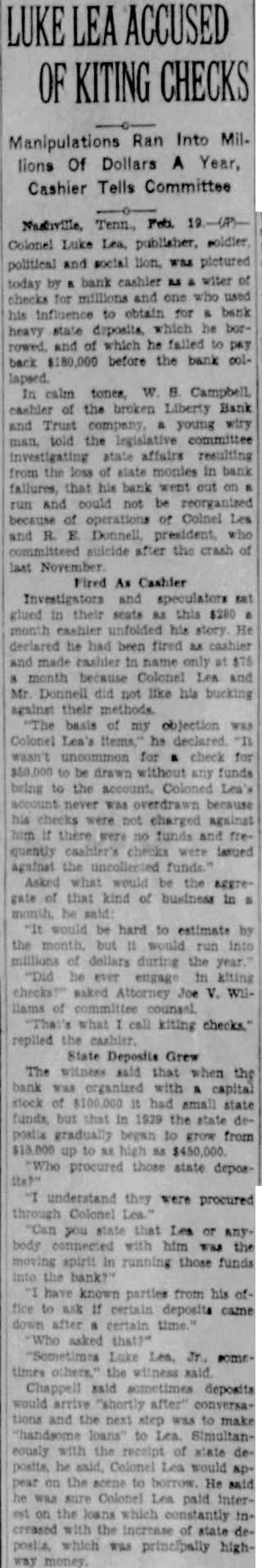

Article Text

SUPPORTS JUDGE LEA

Atkinson Thwarted in Efforts Army Fliers Attempted to to Evade Indictment. Avoid Civilian Ship.

PICK PROSECUTOR TODAY TENNESSEAN IS VICTIM

Gilbert, on Criminal Bench, Suntained by Justice Cook, Appoint District Attorney General Pro Tem for Case. and Observer of Second Plane Able to on Hospital Grounds Hurt by Falling Ship. saying diligent investigations had failed to produce evidence substantiate such charge that was his duty both when when not

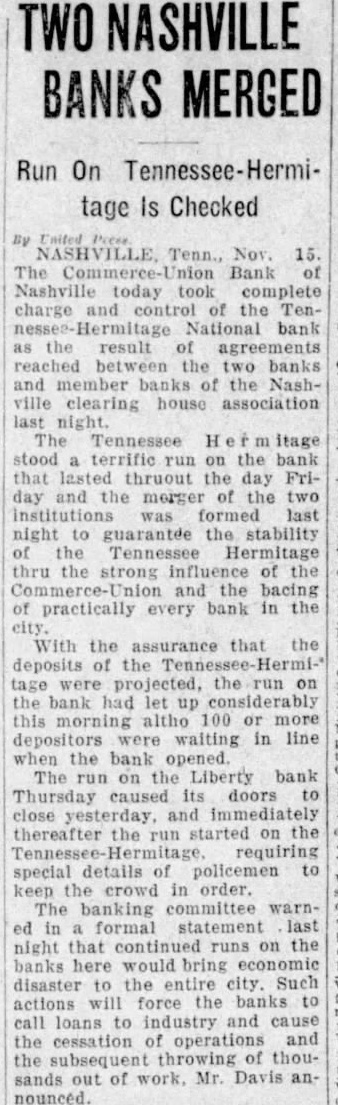

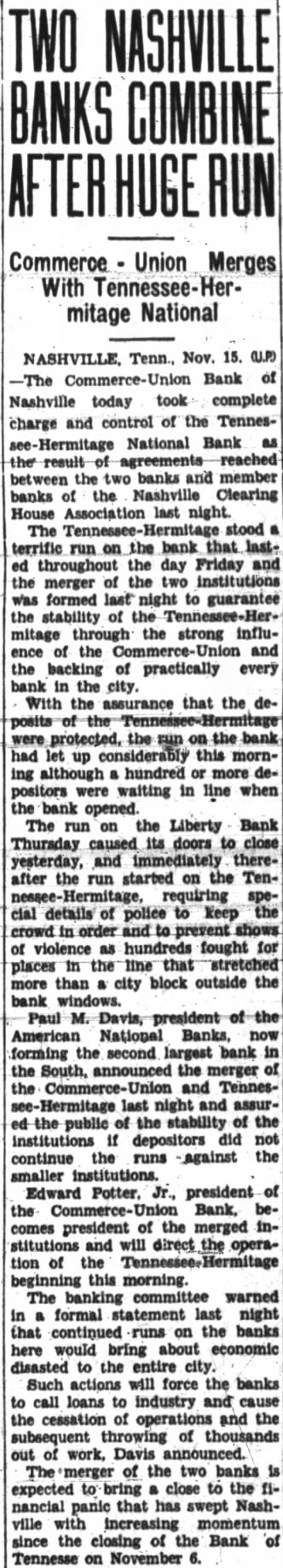

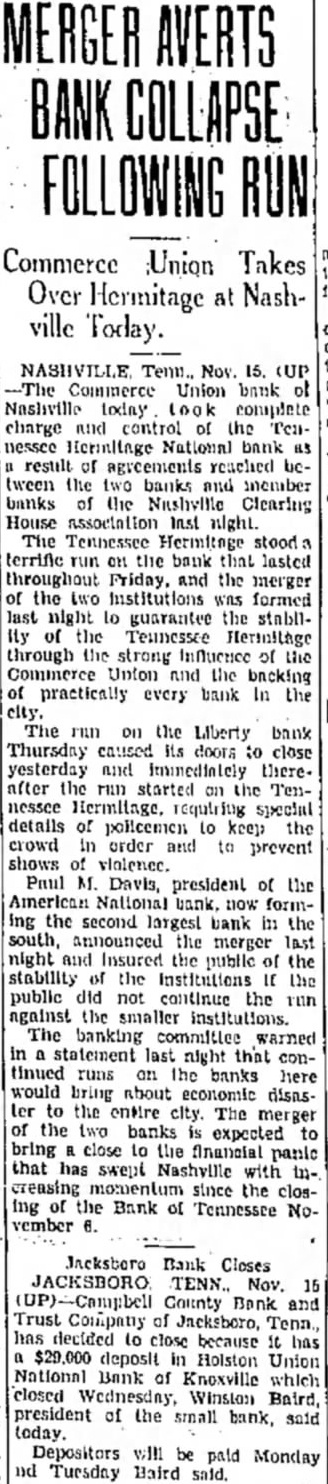

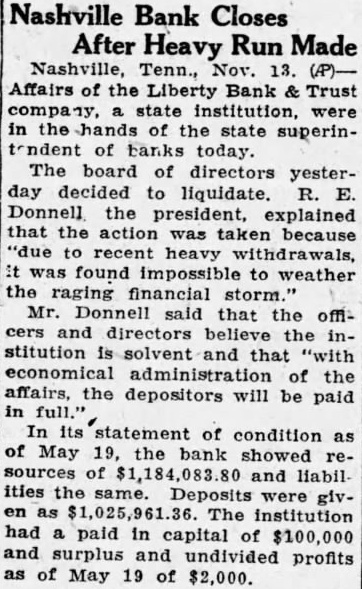

By The Associated Press. By The Associated Press. NASHVILLE, July NEWINGTON, Conn., July Court Judge Charles Gilbert United States army planes Cooling hit the tonight that he expected to appoint crashed over Newington today and district attorney general pro tem carried two men to their deaths their own and rising tomorrow draw conspiracy flight formation of six weather prevails the dictment against Col. Luke Lea planes maneuvered to avoid an Plains Luke Lea, Jr., in with civilian and Pacific states oncoming plane. the closed Liberty Bank & Trust Two other army fliers leaped to the middle Mississippi Ohio Company. safety with their parachutes. This action will follow the failure and Second Lieut. Benjamin Lowery reports of Attorney General Richard M. Hempstead, Y., formerly of Atkinson to comply with an order Ocoee, directing him to draw an indictCorp. Harold Strosnyder of WichWEATHER BUREAU. ment in his official capacity, since Temperature Kas., his observer, were burned Rainfall no private citizen had agreed to act death their ship. plunging too as prosecutor. Today was the final cloudy rapidly for them to jump, struck allowed for compliance, corner of the laundry of the CedarChallenged Authority. crest Tuberculosis Sanitarium. Atkinson challenged the crashed to earth and burst into court's authority to direct him flames. file an indictment for the grand Plane Fell Slowly. Lieut. also reserve of plane, Christi, David Spicer, escaped their fluttered earth out of control, they file indictments. able to safety Following the court's refusal their parachutes. While many revoke Atkinson sought patients the sanitarium in the supreme court descended. Lieut. today obtain writ removing the Kelley landing tree, Sergt. record to that tribunal and another Spicer becoming in telesuperseding the criminal wires. The army planes were en route Justice William L. Cook, in denyEast Hartford from Mitchel the writs, the authorField, Judge Gilbert authorize Angeles, One civilian casualty developed Atkinson prosecute ex-officio. from when Lieutenant did not determine the judge's plunging plane crashed authority control the discretion striking Petriuof the attorney general. celli, 21, of Meriden, the latter sufAnticipate No Violation. fered fractured cuts On this point the opinion said bruises. Petrucelli gone to the general suffered hospital apply for work. injury the court' ac- centered upon far the identity of civilian Parkersburg ticipated the trial judge fliers violate the action dashed straight toward their formay be taken him." mation, throwing them of their Neither Atkinson his attor- line flight and forcing them clear Felts, would comment an attempt to avoid opinion. Jack Lenox, deputy state aviation cannot be assumed that the witnessed crash. judge, before He said that flying and the him, intended by either of the collisorders direct and but could other civ. the official plane the near cloudy exercise of discretion of petitioner Said Ship Was Gray. district attorney.' Justice Cook Winnipeg. Lenox flying blue and silvHis opinion quoted auGround and that his was disthe tance the others, while level sumed that he in mind Charles Morris, state aviation limitations imposed exercise power in direct- late today said of district attor- gray neither of the of the army forfor Maximum any upon temperature degrees: Surviving army fliers early tioner, they mean or official that plane which property plunged toward them was painted humidity: a.m., 89; and silver, and no other Suffers No Injury. Maj. William "Since the petitioner has suffered rises Ryan, officer and sets his official capacity etions officer of Mitchell Field, cannot be anticipated the the trial judge will violate the law the crash, said that he had an Midnight any future action that may of the civilian pilot, but by him, the withprepared make charges. and the writs must Statements witnesses, he was During the recent legislative inplane the in THIS DATE LAST YEAR. cinity just before the temperature 93; minimum (Continued on Page Two) Jan. ficers of the flight, Major Deficiency BANS MEXICAN DIVORCE. that the army in flat when the civilian machine towards The dived, he said, The civilian plane dived. avoid Kelly's shot upward as though carried by of struck Lieutenant plane.