Click image to open full size in new tab

Article Text

Jupposed, coupled with the admission by

Albert F. Davis, president of the corpor-

stion, that he does not know whether the

proceeds of the sale of these securities

were turned into the treasury. The other

was an Incipient run upon the Central

Frust company, of which Col. Goff was

until recently president, resulting in en-

forcement of the rule which requires a

notice of 90 days before withdrawal of

leposits.

On Monday more than $11,000 was drawn

put by depositors of the Central Trust

company.

It also was discovered that in its last

statement the Central Trust company had

Included among its assets 2575 shares of

the capital stock of the Commercial Cor-

poration, which is scheduled at $25,750, the

main security of which is said to be

$48,000 worth of the bonds of the Home

Realty company.

### DEVELOPMENTS SUMMARIZED.

Developments of the past few days may

be summarized to date as follows:

That the assertion made by counsel for

the corporation that no incumbrances had

been placed on any of its properties since

the early spring is incorrect. Two tracts

of land have been mortgaged to pay debts

of the company, nearly $10,000 having thus

been realized.

That $32,000, which had been placed in

the hands of Col. Isaac L. Goff for in-

vestment by Harriet P. Gladding, now

deceased, and which was originally placed

on first mortgages, has been converted

Into shares of the Home Realty company,

which are believed to have no value.

The $5000 of insurance realized through

the death of Arthur Marchant, which oc-

curred on April 1. the policy having been

written in the office of Isaac L. Goff &

Co., has been converted into bonds of the

Home Realty company through the ef-

forts of A. A. Normandin from the office

of Isaac L. Goff & Co., and Everett A.

Dunham, who is said to be the president

of the Commercial Corporation, one of

the companies in which Col. Goff is inter-

ested. The bonds are not secured.

That Col. Isaac L. Goff and Everett A.

Dunham induced a French Catholic priest

to purchase $5000 worth of the same

bonds, representing, as the priest asserts,

that the properties of the Home Realty

company were free from incumbrances,

and that funds were needed for immedi-

ate building operations, which would en-

hance the property and bring quick and

large profits to the investor.

That a widow who deposited $500

with the Home Realty company, to be

applied to the payment of her con-

tract for a home, was induced to do

so by Col. Isaac L. Goff and that the

same has not, to her knowledge, been

applied to the reduction of the mort-

gage upon her home, but is, she fears,

to figure in the claim against the

Home Realty company.

### THAT BOND ISSUE.

That instead of $50,000 worth of the

bonds of the Home Realty company

having been issued, there has been

another and a supplemental "special"

issue of $50,000, and the president of

the Home Realty company does not

know that the money realized from the

sale of these bonds went into the

treasury of the Home Realty com-

pany.

That nearly $50,000 worth of these

bonds were or are in the possession of

the Commercial corporation, of which

Everett A. Dunham is said to be the

president.

That Everett A. Dunham has so-

licited purchasers of Home Realty

bonds to convert the same into shares

of stock in the Commercial corpora-

tion, the value of said shares being

speculative.

That various members of the Cath-

olic clergy have been solicited to pur-

chase Home Realty bonds, Col. Isaac L.

Goff personally interviewing the pros-

pective clients.

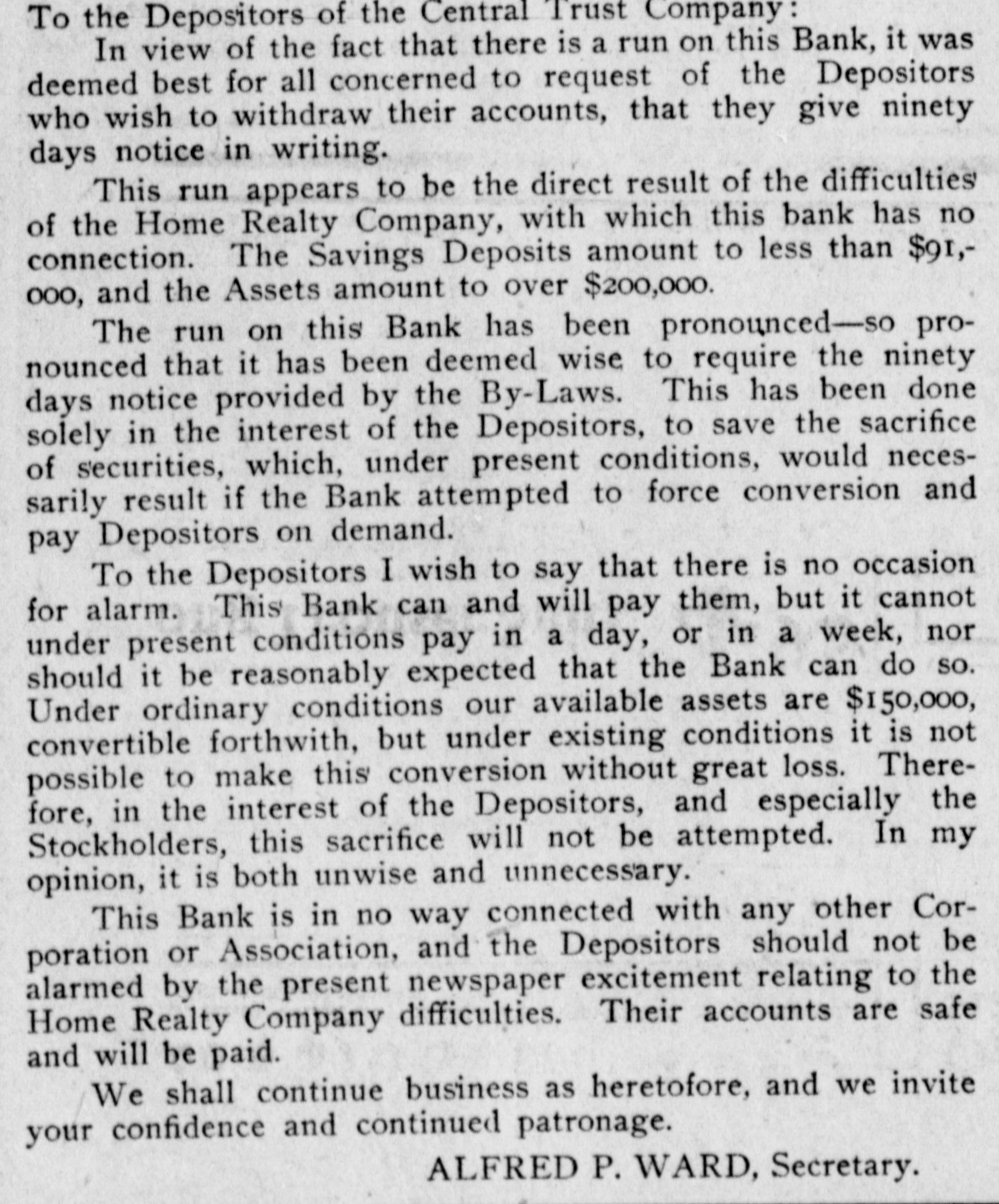

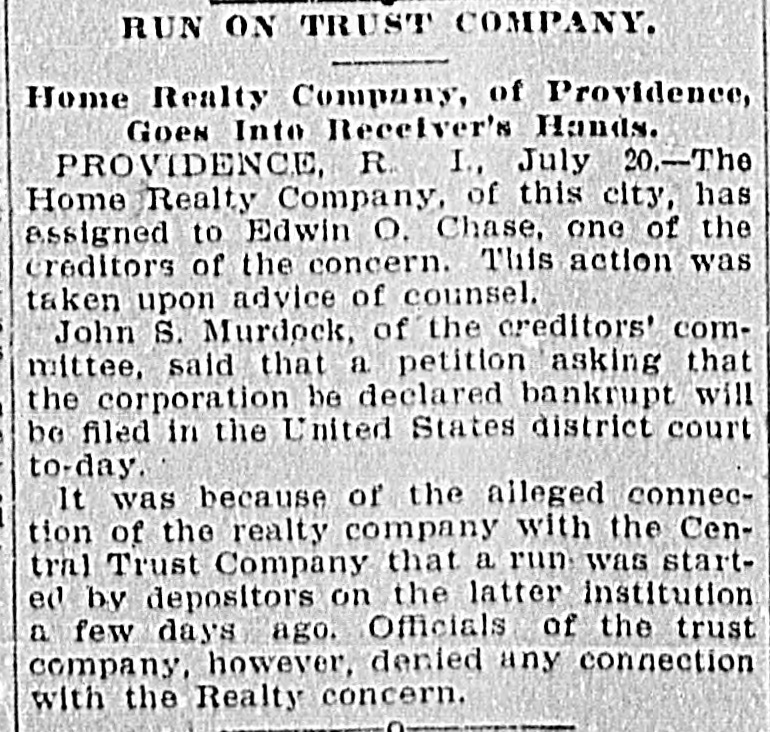

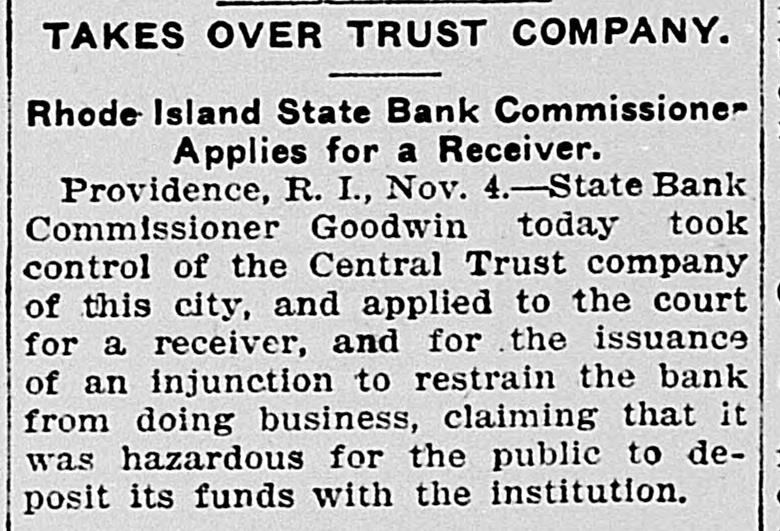

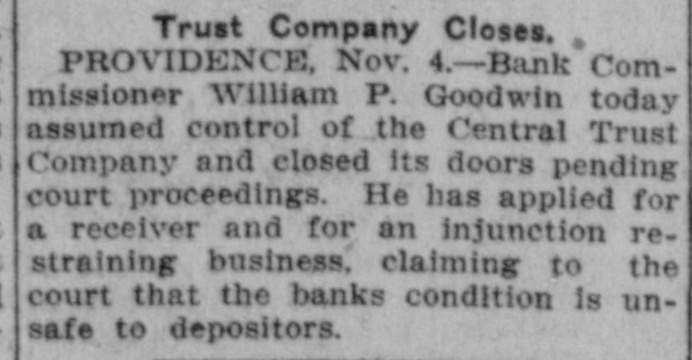

That because of the unrest осса-

sioned among the depositors in the

Central Trust company, of which Col.

Isaac L. Goff was until recently the

president, and because of the business

relations that corporation had with

the Home Realty company, a run was

begun which caused the Central Trust

company to suspend payments yester-

day and to require a 90-day notice

from those desiring to withdraw ac-

counts.

That among the assets of the Central

Trust company is an item of "loans

and discounts," $21,158.16," which is

made up in part, so President Ward

says, "of the notes which priests have

given, and are therefore good."

That, while President Ward assert-

ed that the depositors of the Central

Trust company should feel no uneasi-

ness about their money, as the only

obligation which the company has of

the Home Realty company was $190,

the balance of a note, which is amply

secured, by its last statement to the

bank examiner of this state is held

2575 shares of the stock of the Com-

mercial company, valued at $25,750,

the latter-named company having at

least $48,000 worth of the "unsecured"

bonds of the Home Realty company,

according to the representation which

Everett A. Dunham made before the

creditors' meeting last Thursday.

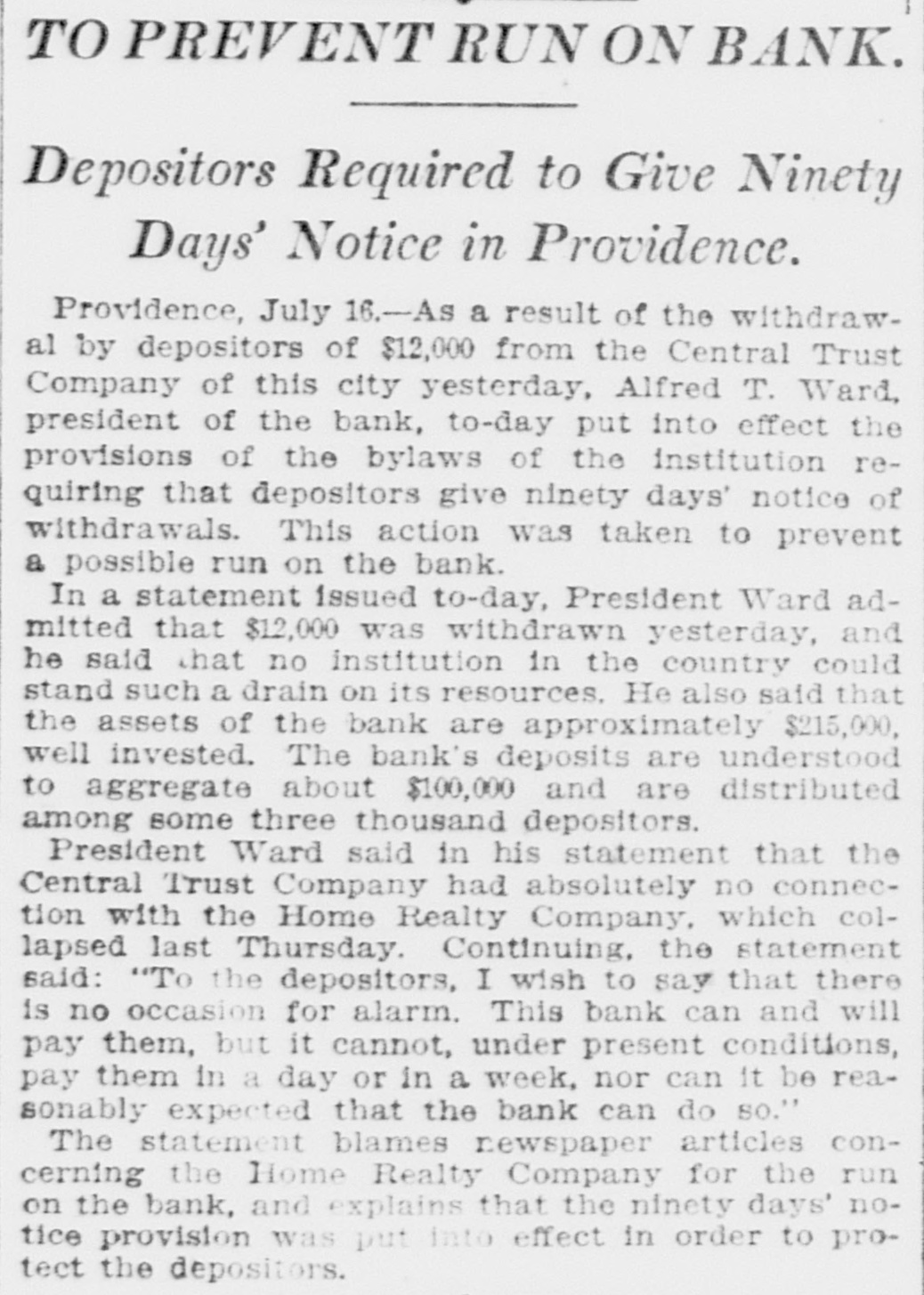

### CENTRAL TRUST COMPANY.

Alfred P. Ward, president and treasurer

of the Central Trust company, declared

that the suspension of payment was sole-

ly in the interest of depositors. He was

emphatic in his declaration that the bank

was perfectly solvent and stated that the

assets were almost double the liabilities.

He said:

"We have required the 90 days notice

from our depositors because they were

withdrawing their money too fast. There

Is no question as to the solvency of the

company, for all our assets are of the

best character. But the fact that $12,000

was taken out yesterday indicated that

we would be compelled to take advantage

of the reservation which we have made,

and today we have demanded notice be-

fore settling up accounts.

"By the figures made out Monday after

the close of business we hal in cash $8000.

Our deposits in savings aggregate about

$90,000. We have mortgages of first-class

variety to the amount of $123,000 and loans

and accounts of $21,000. These loans are

all of the best class, and the majority of

them are for small amounts. The largest

one, for $2000, is a secured claim. We

hold collateral worth $35,000 and stock

worth $25,750.

"Our assets are, therefore, worth about

$215,000 and our liabilities are not much

more than half that amount. Still we

could not, as no bank could, pay all our

depositors if they all demanded payment

at the same time, and if we tried to real-

ize on our assets immediately there would

naturally be some shrinkage. We, there-

fore concluded that the best thing to do