1.

July 15, 1932

Times Herald

Washington, DC

Click image to open full size in new tab

Article Text

The Departmental 1726 Pennsylvania Ave., has suspended operations, bringing the total to four local institutions which have closed their doors in two days. Notice of the Departmental Bank's given by the board of directors in a statement, which said: "This action was wholly voluntary on the part bank, and was taken purely precautionary measure, in view of the recent closing of several local banking W. M. Taylor, bank examiner, is in charge the institution. The North Capitol Savings Bank, the International Exchange Bank closed yesterday, and the Bank of Brightwood. Wednesday.

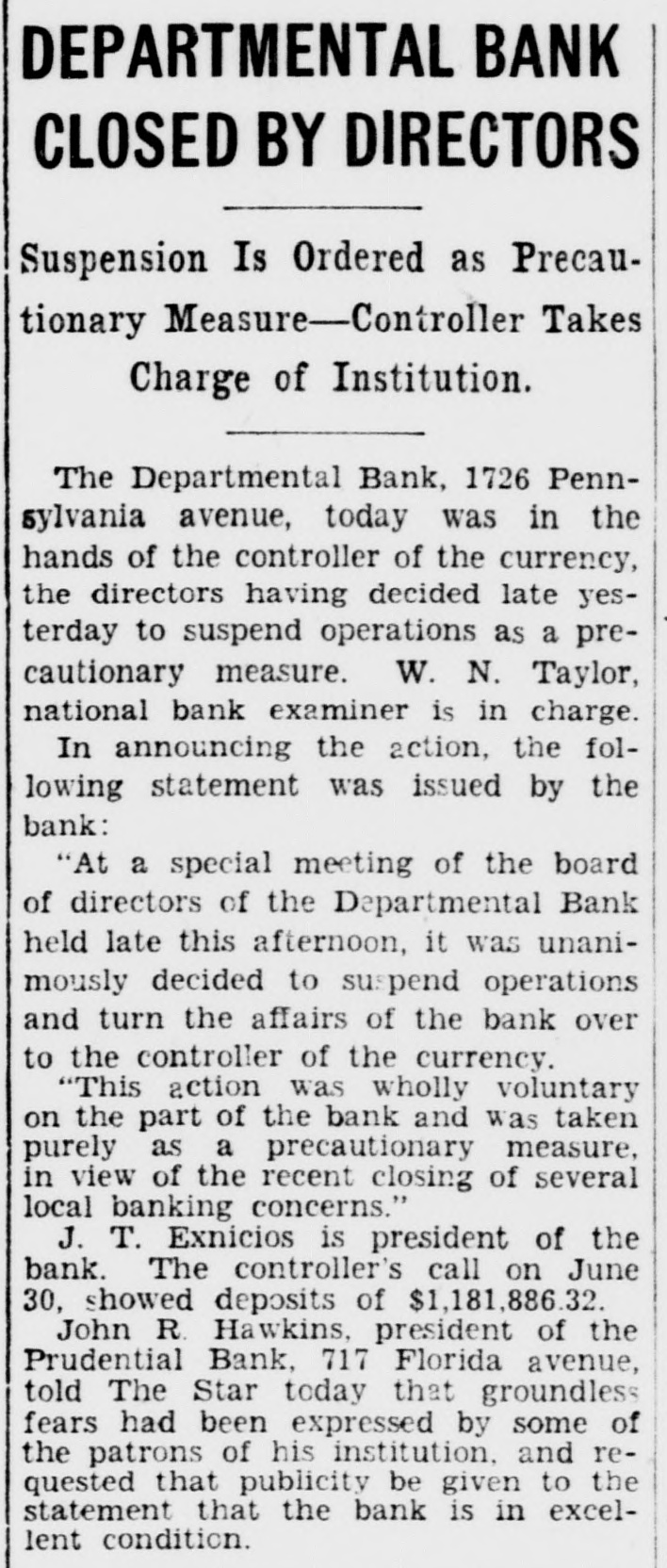

2.

July 15, 1932

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

DEPARTMENTAL BANK CLOSED BY DIRECTORS Suspension Is Ordered as Precautionary Measure-Controller Takes Charge of Institution. The Departmental Bank, 1726 Pennsylvania avenue, today was in the hands of the controller of the currency, the directors having decided late yesterday to suspend operations as a precautionary measure. W. N. Taylor, national bank examiner is in charge. In announcing the action, the following statement was issued by the bank: "At a special meeting of the board of directors of the Departmental Bank held late this afternoon, it was unanimously decided to suspend operations and turn the affairs of the bank over to the controller of the currency. "This action was wholly voluntary on the part of the bank and was taken purely as a precautionary measure, in view of the recent closing of several local banking concerns." J. T. Exnicios is president of the bank. The controller's call on June 30, showed deposits of $1,181,886.32. John R. Hawkins, president of the Prudential Bank, 717 Florida avenue, told The Star today that groundless fears had been expressed by some of the patrons of his institution, and requested that publicity be given to the statement that the bank is in excellent condition.

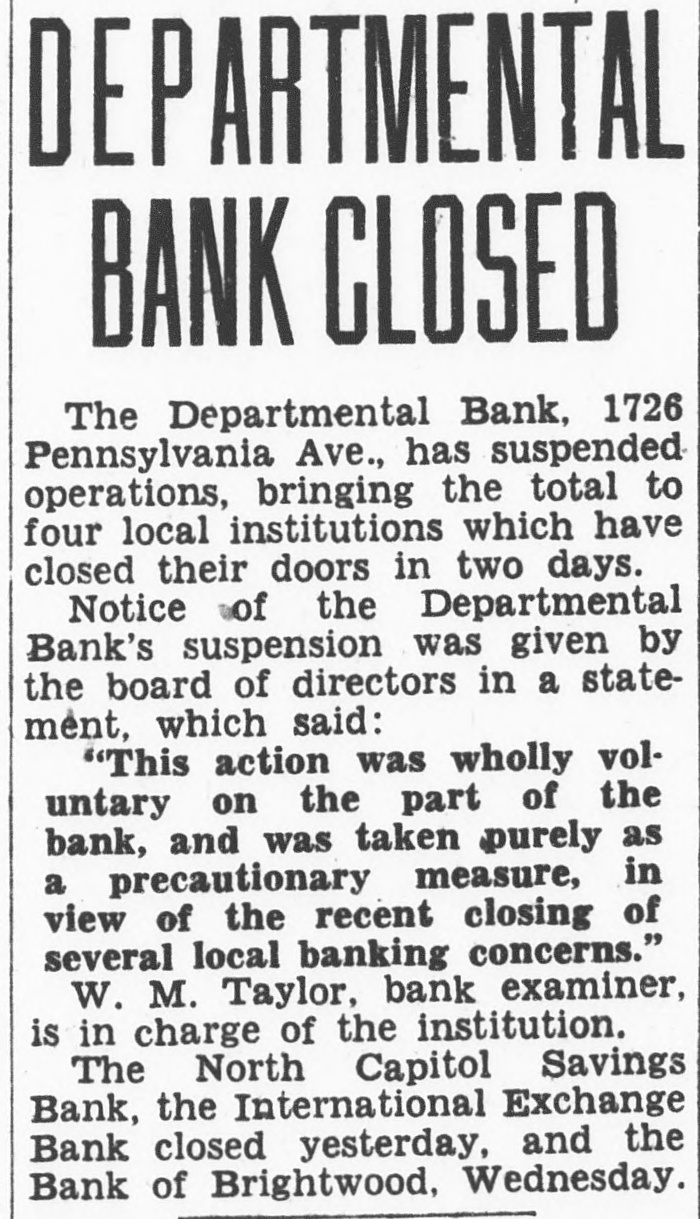

3.

July 15, 1932

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

DEPARTMENTAL BANK CLOSED The Departmental Bank, 1726 Pennsylvania Ave., has suspended operations, bringing the total to four local institutions which have closed their doors in two days. Notice of the Departmental Bank's suspension was given by the board of directors in a statement, which said: "This action was wholly voluntary on the part of the bank, and was taken purely as a precautionary measure, in view of the recent closing of several local banking concerns." W. M. Taylor, bank examiner, is in charge of the institution. The North Capitol Savings Bank, the International Exchange Bank closed yesterday, and the Bank of Brightwood, Wednesday.

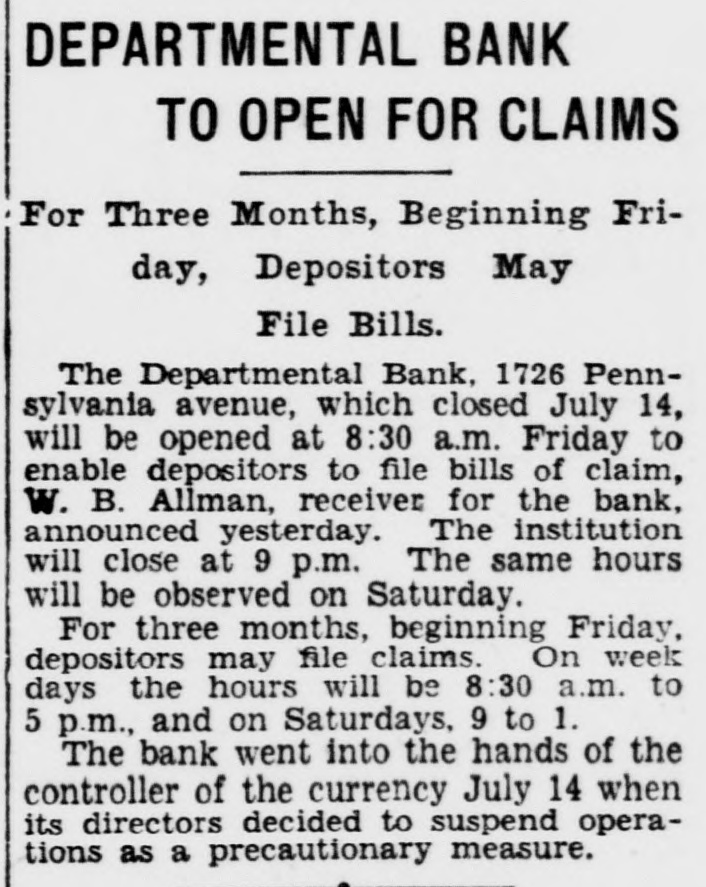

4.

September 21, 1932

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

DEPARTMENTAL BANK TO OPEN FOR CLAIMS For Three Months, Beginning Friday, Depositors May File Bills. The Departmental Bank, 1726 Pennsylvania avenue, which closed July 14, will be opened at 8:30 a.m. Friday to enable depositors to file bills of claim, W. B. Allman, receiver for the bank, announced yesterday. The institution will close at 9 p.m. The same hours will be observed on Saturday. For three months, beginning Friday. depositors may file claims. On week days the hours will be 8:30 a.m. to 5 p.m., and on Saturdays, 9 to 1. The bank went into the hands of the controller of the currency July 14 when its directors decided to suspend operations as a precautionary measure.

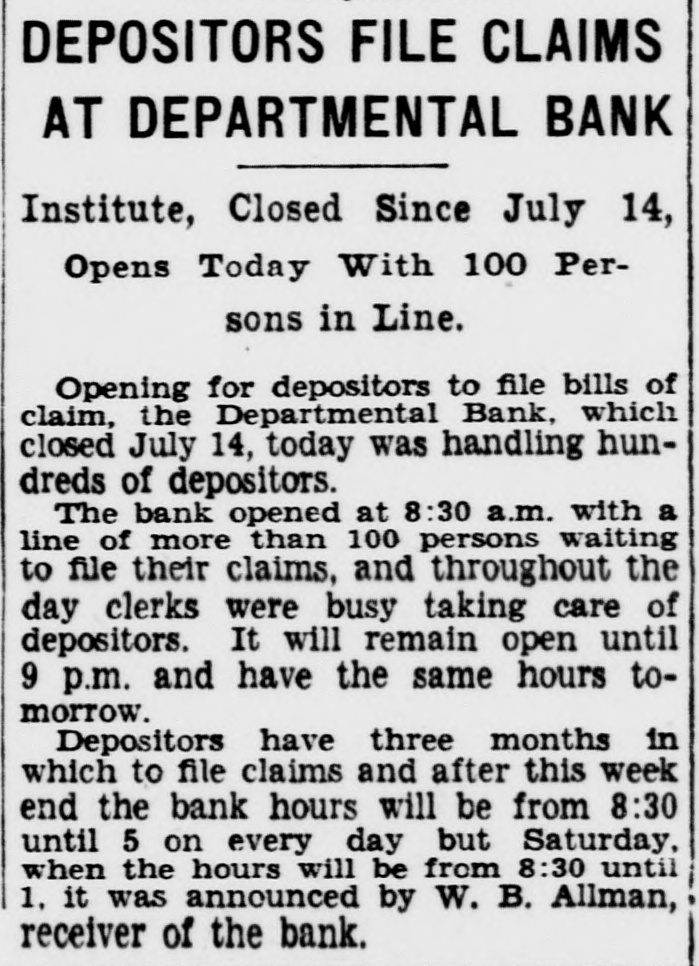

5.

September 23, 1932

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

DEPOSITORS FILE CLAIMS AT DEPARTMENTAL BANK Institute, Closed Since July 14, Opens Today With 100 Persons in Line. Opening for depositors to file bills of claim, the Departmental Bank, which closed July 14, today was handling hundreds of depositors. The bank opened at 8:30 a.m. with a line of more than 100 persons waiting to file their claims, and throughout the day clerks were busy taking care of depositors. It will remain open until 9 p.m. and have the same hours tomorrow. Depositors have three months in which to file claims and after this week end the bank hours will be from 8:30 until 5 on every day but Saturday, when the hours will be from 8:30 until 1. it was announced by W. B. Allman, receiver of the bank.

6.

November 17, 1932

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

BANK INVESTORS GET DEFICIT BILL Shareholders Ordered to Meet Assessments for Departmental November 25. W. B. Allman, receiver for the Departmental Bank, 1726 Pennsylvania avenue, which suspended. operations July 15 last, issued a call to shareholders of the institution today to arrange for payment of 100 per cent assessments on or before November 25. The assessment on the shareholders was levied October 18 under authority of the controller of currency of the Federal Government, and was made for the protection of the depositors of the bank. Assessments Total $106,060. There are approximately 3,000 shareholders affected by the order, and their assessments aggregate approximately $106,060. The full payment of the assessments is due November 25. For the convenience of shareholders employed during the regular hours of the day, the bank will remain open until 10 p.m. November 25. While full payment of the assessment is due next week, shareholders, by signing an agreement before November 25, are given the right to make the payments in four monthly installments, ending February 25, Mr. Allman said. The Departmental Bank operated under a charter granted by the State of Arizona, but was subject to the rules of the National Banking Association and under the control of the Federal controller of the currency. Depositors File Claims. The shareholders of the institution were subject to double liability in case of failure of the bank. A statement of the condition of the bank for the quarter year ended September 30 showed the total of all assets coming into the hands of the receiver up to that date amounted to $1,118,867.65. The total assets uncollected up to that date were $949,606.82 and the total of all liabilities was $906,937.20, while cash on hand at that time totaled $121,041.51. Depositors are being given an opportunity to file claims for payment by the institution.

7.

February 9, 1933

Evening star

Washington, DC

Click image to open full size in new tab

Article Text

7,500 DEPOSITORS WILL GET $375,000

Departmental and Brightwood Banks to Make First Payment.

Nearly 7,500 depositors in two suspended banks will re$375,000 as the first payment on claims the was at the office the Controller of the Currency, Treasury Department. The Departmental Bank, 1726 Pennsylvania avenue, will distribute checks totaling $220,000 to 3,444 depositors, while the Bank of Georgia pay $155,000 to approximately 4,000 depositors, according the receivers of the two banks, of the Departmental and Claude H. Woodward of the Brightwood

30 and 20 Per Cent. The released by acting Controller F. G. Awalt, said the pay30 cent of total ments per claims thus far approved against the Bank, 20 per cent of Departmental total approved claims against the Bank of Brighwood. Other depositors' claims be approved the future, it was may pointed out, in case they will be entitled to the first payment today. "The checks will be available for delivery the offices the respective receivers Awalt's claims against these banks time of delivery of the dividend To assist employes in checks the DeBank, nounced the institution would remain day tomorrow Saturday Beginning Monday, said, the regular banking hours of will be served No "Open" No to keeping the Brightwood open after regular closing time was made by ReBrightwood, Georgia closed last 13, and up until December (Continued on Page Column 5.)

8.

February 10, 1933

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

HERE

Brightwood Will Distribute 20 Per Cent to Depositors; Departmental 30 Per Cent

By RICHARD HATTON

Depositors in two of the four Washington banks closed July order the Comptroller of the Currency able to their "dividend" checks today, according information given out by the Comptroller's of fice. The which have been in charge of receivers are the Bank of and the Departmental Bank About 7,500 depositors in the two banks will benefit the disbursement which will about PAYMENT AT BANKS According to office of the Comptroller the "dividend" be paid by the Departmental Bank will amount to 30 cent. while the disbursement by the Bank of Brightwood will be 20 per cent. Holders of claims against these banks must present their ceivers at the time payment made. that depositors will have to call the banks for their checks. Claude Woodward, the Bank of Brightwood. stated that institution would open at 8:30 today, tomorrow and Monday and remain open until days for convenience of those will receive their the Departmental Bank. Receiver B Allman stated that the bank would open at to day, and Saturday and remain open until and that next week the bank would be open for payments from 8:30 until Neither of the institutions had received loans from the Reconstruction Finance Corporation as had the other closed Washington banks. the International Exchange and the North Capitol of condition of the Bank of issued few days Receiver Woodward gave total assets accounted for as with total liabilities accounted for of Total collections from assets were reported as this figure added from stock assessment This stock assessment was made necesary, reported. because the deficiency was determined to be excess of the capital the bank. The receiver has collected cash Cash in the hands of the receiver and Comp troller amounts Secured and preferred liabilities paid amount Advances for protection assets. amount to and penses of receivership ported as Receiver Allman of the Departmental. and Claude H. Woodward. of the Brightwood in stitution. additional payments will be made soon assets are liquidated and claims proven.

9.

February 10, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

TWO MORE BANKS TO PAY DEPOSITORS Departmental and Brightwood Institutions Paying Out $375,000. While depositors crowded into two suspended Washington banks today to collect the first payment on their claims. Acting Controller of the Currency F. G. Awalt announced two other defunct local banks would issue payments as soon as money in hand permits. The Departmental Bank, 1726 Pennsylvania avenue, and the Bank of Brightwood, Georgia and Colorado avenues, are paying approximately 7,500 depositors a total of $375,000. Two Other Institutions. The International Exchange Bank, Fifth and H streets, and the North Capitol Savings Bank, at H and North Capitol streets, are the two institutions which Awalt said would make an initial payment on approved claims as soon as enough money is collected. All four banks closed last July. The doors of both the Departmental and Brightwood banks were opened this morning at 8:30 o'clock to distribute checks to depositors. Approximately $220,000 is being paid to 3,444 depositors in the Departmental Bank, while the Brightwood institution is distributing checks totaling $155,000 to about 4,000. To Be Open at Night. To expedite distribution of the money, the Departmental Bank will remain open tonight and tomorrow night until 9 o'clock, resuming the regular hours of from 8:30 to 5 beginning Monday. The Bank of Brightwood will be open until 5 o'clock tonight and all day tomorrow until 5. A steady line of men and women filed into both banks throughout this morning, able to draw money for the first time since the institutions closed last July. At the Departmental depositors were being paid 30 per cent of their claims, while at Brightwood 20 per cent was being paid. Additional payments will be made by both banks as liquidation progresses and cash in hand permits, it was said by officials.

10.

February 10, 1933

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

RECEIVERS PAY BANK TOLLS Claude H. Woodward and W. B. Allman, receivers, respectively, for the Bank of Brightwood and the Departmental Bank, closed last July by the Comptroller of the Currency, today began paying the first dividend of about $375,000 to the 7,500 depositors. Bank of Brightwood depositors will receive 20 per cent and Departmental Bank depositors will receive 30 per cent of their approved claims in this installment. Depositors must have their receiver certificates in person at the time of payment. The Bank of Brightwood will be open today until 5 p. m. and tomorrow and Monday from 8:30 a. m. until 5 p. m. The Departmental Bank will be open until 9 p. m. today and tomorrow and from 8:30 to 5 p. m. next week. Further payments will be made from time to time, as the receivers realize on assets.

11.

March 31, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

REGULATION HOLDS DEPOSITS IN BANKS Special Order From Controller Required to Permit Withdrawals. In answer to a continued flood of inquiries to closed local banks concerning the possibility of withdrawals under the much discussed regulation 30 issued recently by the Secretary of the Treasury, conservators of these banks today further explained their refusal to allow withdrawals by pointing to official word received today from the Federal Reserve Bank at Richmond. The official copy of this regulation was received by all local banks, members of the Federal Reserve System, in the hands of conservators. Up to Controller. It was pointed out by conservators that this regulation provides for such "limited banking functions as may be authorized in acordance with law by the controller of the currency in the case of national banks, or by the appropriate State officials in the case of State member banks." In the District, it was explained, the controller of the currency by special legislation has authority over all banks and banking institutions. Thirteen local banks which did not reopen are still in the hands of conservators, and have not yet been granted specific authority by the controller. Such specific permission would have to be granted before the conservators could act, even under regulation 30, they point out, to receive or pay out deposits other than special trust fund deposits. These explanations were made by representative conservators today in view of the fact that inquiries and telephone calls continued to flood the banks to know why accounts are not yet open to withdrawals. Bank Pays 30 Per Cent. In the meantime the Departmental Bank, which is in the hands of a receiver, this morning began paying out dividend checks to about 200 persons who did not get their dividends in the original payment. As explained by W. B. Allman, receiver of the bank, this "supplementary dividend" does not mean that persons receiving one payment now will get another. The Departmental Bank will be open until 10 o'clock tonight for the convenience of persons who found it impossible to get to the bank during regular office hours during the day. The dividend checks are based on payments of 30 per cent of deposits.

12.

April 29, 1933

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

FREES PLAN $285,000 TO LOCAL PATRONS Departmental and North Capitol Ready to Release "Frozen" Accounts Dividends amounting to $285,000 will be paid out Monday by the Departmental Bank and the North Capitol Savings Bank, both closed institutions. The Departmental Bank will pay its second dividend. This time the amount will be $160,000 or about 20 per cent, W. B. Allman, receiver stated. The North Capitol Savings Bank will pay its first dividend of $125,000. To Stay Open Late The Departmental Bank. Allman said,will be open for the convenience of Government workers from 8:30 a. m. to 9 p. m., Monday, Tuesday and Wednesday. Persons unable to call at the bank these days will be able to collect their checks during the regular business hours. About 4.000 checks will be paid out, Allman said. The second dividend payment brings the total paid back to depositors to about $400,000. When the bank suspended the book value of assets was $1,100,000. Payment of the first dividends to of the depositors closed North Capitol Savings Bank, amounting to $125,000, or 12 1/2 per cent, are to be made beginning Monday at 9 a. m.. John S. Ryan, receiver, announced today. 6,000 Checks Ready Six thousand checks are ready for distribution to depostiors of the bank, which closed its dcors last July 14. Regular banking hours are to be observed and only those persons living out of the city will be able to get their dividend checks by mail. All others will be required to call at the bank and sign receipts for the money, Ryan said. As added funds are accumulated from liquidation of the bank's assets further dividends will be declared when the sums have reached sufficient size, he said.

13.

April 30, 1933

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

3 BANKS READY PAY PART OF

Departmental, North Capitol Savings, and Brightwood to Reimburse Up to $500,000

Depositors in three of the Washington banks now being liquidated by receivers will in the near future be paid dividends aggregating nearly half a milion dollars, according to plans of officers in charge. The first to participate will be depositors of the Departmental Pank, who will be paid a dividend of 20 per cent tomorrow. This is the second disbursement by Receiver W. B. Allman and will amount to approximately $160,000. REACHES 50 PER CENT The first payment by the Departmental, made on February 10, was for 30 per cent and amounted to $225,000. The depositors in this bank, when the current dividend is paid, will have received approximately $385,000, or 50 per cent of the amount due them. Receiver Allman stated yesterday that the bank would be open from 8:30 a. m. to 9 p. m. tomorrow, Tuesday and Wednesday for payment of the dividend checks. Those not collecting their check on these days will be able to get them during regular business hours thereafter. About 4,000 checks will be turned over to depositors. AT NORTH CAPITOL Another dividend disbursement to be made tomorrow will be the first payment to depositors of the North Capitol Savings Bank when Receiver John S. Ryan turns over approximately $125,000 to some 6,000 depositors. This is a dividend of 12½ per cent and is the first payment by the North Capitol since being placed in the hands of a receiver. It was learned yesterday, also, that the Bank of Brightwood, now being liquidated under the direction of Receiver Claude H. Woodward. expects shortly. possibly within week or two, to raz a dividend of approximately 25 per cent amounting to something near $110,000. This disburser ent will bring the total repaid to depositors since the bank was placed in the hands of a receiver up to 45 per cent as disbursement of 20 per cent was made February. SAVINGS OBSCURE Every effort is being made by Receiver J. T. Dinger of the International Exchange looking toward the payment of another vidend to depositors but nothing definite can be announced as yet although it is possible a paymay be available by July. Receiver Dinger paid a dividend c: 162-3 per cent, amounting to approximately $83,000 to depositors on March 27. The situation at the Park Savings Bank remains obscure with apparently little hope of liquidation in the near future.

14.

May 1, 1933

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

PAYMENT SOON

Departmental and North Capitol Savings Savings to Distribute Part of Liquid Assets

Two Washington banks, closed before the Roosevelt bank holiday, will begin paying depositors part of their savings today. They are the Departmental Bank and the North Capitol Sevings Bank, the receivers of which, through process of liquidation, gradually have been liquidating the assets. 20 PER CENT DIVIDEND The Departmental Bank, which has been the hands Receiver W. Allman, will pay 20 per cent dividend on deposits. This will amount to about $160,000. will be the second dividend paid on deposits by the Departmental, 30 per cent distribution been made last February. That released Thus with the dividend now about to paid, the Departmental will have turned back to depositors per cent of their deposits, About 4,000 depositors will receive dividend checks. These will be distributed from 8:30 to o'clock morning, and in the same period tomorrow day mornings. Those failing them at that time may call during regular business hours thereafter. The North Capitol Savings Bank, which being liquidated Receiver John S. Ryan, today will begin paying out $125,000, which on first since the bank closed. About 6,000 depositors will share. NEW DIVIDEND DUE The Bank of Brightwood now being by Receiver Claude H. Woodward. expected pay within two weeks dividend 25 per cent on deposits, which will mean the releasing of about This will bring the total of dividend to 45 per cent, 20 per cent dividend having been paid in February. Meanwhile, the thousands of positors whose money became tied when 13 banks failed open after Roosevelt holiday, are anxiously awaiting some word the Treasury Department. In the banking world. all signs point to huge merger

15.

May 1, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

DEPOSITORS LINE UP AT CLOSED BANKS North Capitol Savings and Departmental Pay Out $285,000. Depositors in two closed banks-the North Capitol Savings and the Departmental-lined up today in front of the institutions to receive payments totaling $285,000. At 6 a.m. the line started forming in front of the North Capitol street bank and before the doors opened at 9 o'clock 500 depositors were on hand. Today's payment marked the first release of funds since the bank closed last July. pay out to $125,000 Altogether. the approximately institution 6,000 will depositors. or about 1212 cents on the dollar. There was not quite so great a rush at the Departmental Bank, however, that institution having made an earlier payment of 30 per cent in February. The fact the bank will remain open until 9 p.m. tonight, tomorrow night and Wednesday night also prevented a rush, according to Receiver W. B. Allman. This second payment by the Departmental will aggregate $160,000, or 20 per cent of approved claims, and will be distributed to approximately 4,000 depositors. Receiver John S. Bryan of the North Capitol Street Savings Bank estimated his staff of paying tellers would hand out checks to more than 1,000 depositors today. The bank will close its doors at the usual hour of 3 p.m., but all those who are lucky enough to get inside the bank by that time will be paid off. One other insolvent Washington institution, the Bank of Brightwood, at Georgia and Colorado avenues, is expected to release its second payment within the next 30 days. Depositors will be notified through the newspapers as to the exact date, it was said at the Treasury Department. Further Progress Reported. Further progress was reported today by officials of the Northeast Savings Bank, at Eighth and H streets, in their efforts to sell 10.000 shares of common stock at $10 par value and raise sufficient new capital to reopen the institution. It was announced that 7,300 shares have now been subscribed as a result of the three-week intensive campaign which has been carried on among the officers, stockholders and depositors in the bank. While there has been a slowing up in the number of stock subscriptions, the officials are still very hopeful of getting the savings bank back on its feet. The bank's 15 directors have already put up $230,000 in cash to meet the emergency and have obligated themselves to contribute $110,000 more in connection with the reorganization plan. Much of this money was put up before the bank closed, in an effort to strengthen the bond account.

16.

May 6, 1933

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

PROGRESS SEEN INREOPENING OF DISTRICT BANKS

Stockholders and Depositors Are Backing Reorganization Plans Being Offered Them

By RICHARD HATTON While little information has been available regarding the closed banks of Washington and while the Treasury Department has not as yet made any public statement regarding the local situation there has not been lack. ing determined effort upon the part of officials of closed institutions to evolve plans for reopening and progress has been made charge of number of the institutions being liquidated. More activity has been in the affairs of receivership banks than in those of conservator banks but both classc of institutions are probably suffering from the lack of exhortation anterooms of the Treasury. Stockholders of the Franklin National Bank yesterday appeared to be enthusiastic over the reorganization plan just announced by that institution and there every for believing that, if the Treasury approves, the plan will ultimately be carried though successfully. MANY DEPOSITORS AGREE Yesterday the services of several directors of the Franklin as well as those of the officers were required to handle the long line of de ositors appearing to sign agreements which it is believed will permit the reopening of the bank. Many of these depositors were enthusiastic in their support of the outlined in letters previously sent out by the bank. Stockholders appeared to be perfectly willing to agree to waive 33 1-3 per cent of their deposits on March 14 leaving the balance available for regular transactions, according to the plan. For this 33 1-3 per cent waived all assets not accepted by the reorganized bank will trusteed and participating certificates for the amounts waived be issued to be paid off out of realization upon assets as fast as they become available. Stockholders are also purchasing stock in bank equal to 6 per cent of their deposits on March 14. WAIT TREASURY WORD

With stock stopped after 75 per cent of the required amount had been subscribed and with every assurance that total amount can easily be obtained, the Potomac Savings Bank is only awaiting some word from the Treasury to carry out its plan of reorganization. Meanwhile Receiver J. S. Bryan of the North Capitol Bank has paid out about $90,000 to depositors; the Northeast Savings Bank in charge of President George F Hoover has sold 7,600 of the 10,000 shares required for reorganization; pay ments have been made to depositors of the Bank of Bright wood by Claude H the Departmental Bank by Receiver W. B. Allman and the International Exchange Bank by Receiver T. Dinger and all of these institutions are working toward another percent age payment. The one big mystery among the receivership banks the Park Savings. As institution there no information available and even sensational rumor seems to have dried up.

17.

June 15, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

DEPARTMENTAL BANK TO PAY THIRD TIME 15 Per Cent Dividend Will Make 65 Per Cent Total Paid Depositors Since Closing. The Departmental Savings Bank, 1726 Pennsylvania avenue, which closed 11 months ago yesterday, will pay a third dividend of 15 per cent on Saturday, W. B. Allman, receiver for the institution, announced yesterday. Previously the bank paid two other dividends totaling 50 per cent of deposits. The bank will be open from 8:30 a.m. to 9 p.m. on Saturday. For the benefit of Government workers these hours will be repeated on Monday and Tuesday. After that the regular banking hours will be observed. Depositors must bring their receiver's certificates to obtain the dividend.

18.

July 14, 1933

Evening Star

Washington, DC

Click image to open full size in new tab

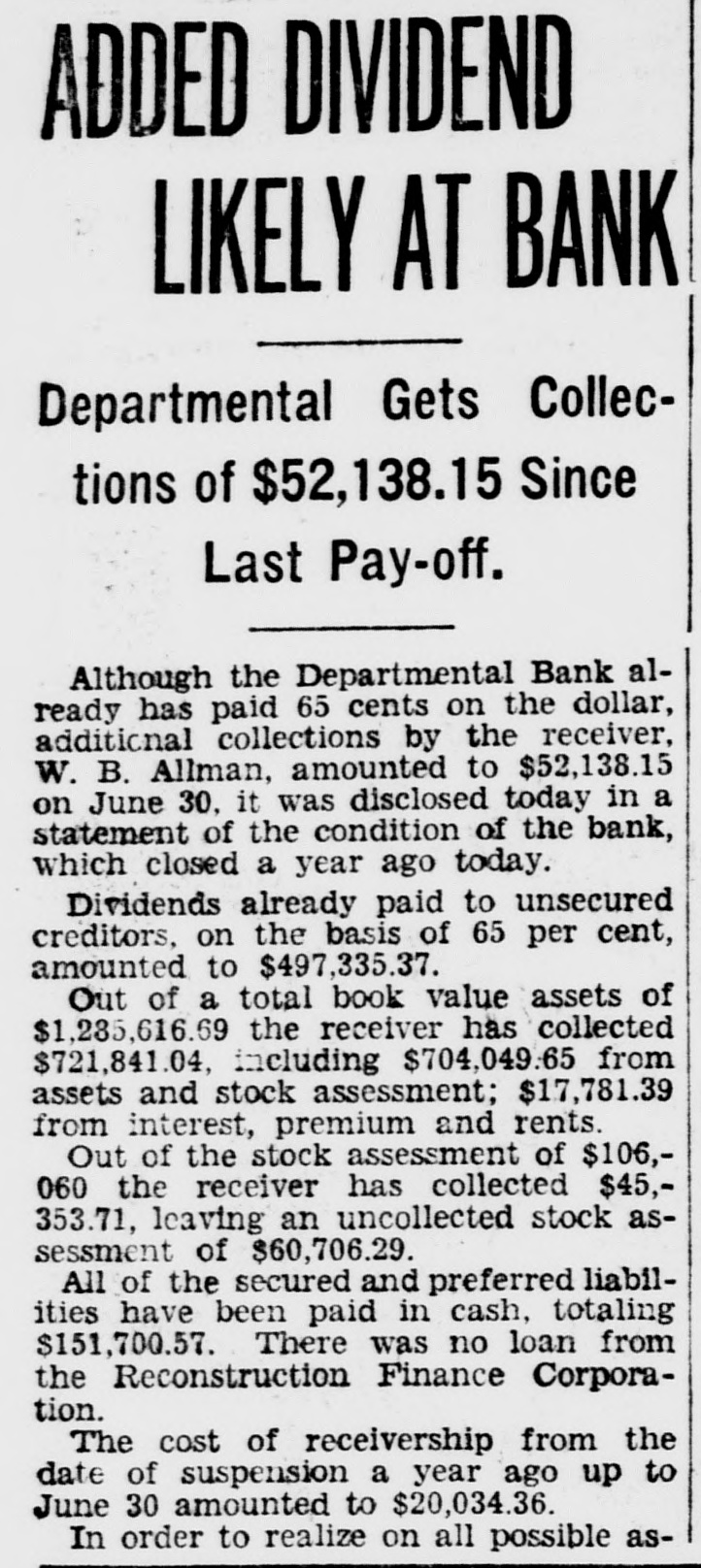

Article Text

ADDED DIVIDEND LIKELY AT BANK Departmental Gets Collections of $52,138.15 Since Last Pay-off. Although the Departmental Bank already has paid 65 cents on the dollar, additional collections by the receiver, W. B. Allman, amounted to $52,138.15 on June 30, it was disclosed today in a statement of the condition of the bank, which closed a year ago today. Dividends already paid to unsecured creditors, on the basis of 65 per cent, amounted to $497,335.37. Out of a total book value assets of $1,285,616.69 the receiver has collected $721,841.04, including $704,049.65 from assets and stock assessment; $17,781.39 from interest, premium and rents. Out of the stock assessment of $106,060 the receiver has collected $45,353.71, leaving an uncollected stock assessment of $60,706.29. All of the secured and preferred liabilities have been paid in cash, totaling $151,700.57. There was no loan from the Reconstruction Finance Corporation. The cost of receivership from the date of suspension a year ago up to June 30 amounted to $20,034.36. In order to realize on all possible as-

19.

January 24, 1934

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

Departmental Bank Pays Fourth Dividend As the Departmental Bank began paying out its fourth dividend this morning, W. B. Allman, receiver, warned depositors that they must present receiver's certificates at the teller's windows before they can receive their comptroller's checks. All windows of the bank will be open today until 5:30 p. m. and will continue so through Saturday for convenience of Government employes.

20.

March 1, 1934

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

BILL WOULD AID DEPOSITORS (Continued from Page 1) witnesses from Detroit to testify in its behalf. Potomac Bank Moves Another development in the closed bank field today was the physical transfer of the Potomac Savings Bank to the District National Bank Building. Quarters of the Potomac Institution were taken over as a branch of the Hamilton National Bank. Since then it has been occupying offices formerly used by the closed Departmental Bank. The move brings into the District National Bank Building three of the five closed banks of which Norman Hamilton is receiver. Mr. Hamilton stated that the others would move in as soon as possible. Almost 30 million dollars belonging to the people of the District of Columbia still is tied up in closed banks, it was learned today from the office of the Comptroller of the Currency. Nineteen banks are closed, so far as the official record goes, although seven listed are included in the group which made up the Hamilton National Bank merger. Many Depositors Involved How many depositors are involved the comptroller's office is unable to estimate. Opinion in local financia circles was that provisions of the bill of Representative Clarence J. McLeod (R.) of Michigan will affect District the

21.

March 6, 1934

The Washington Daily News

Washington, DC

Click image to open full size in new tab

Article Text

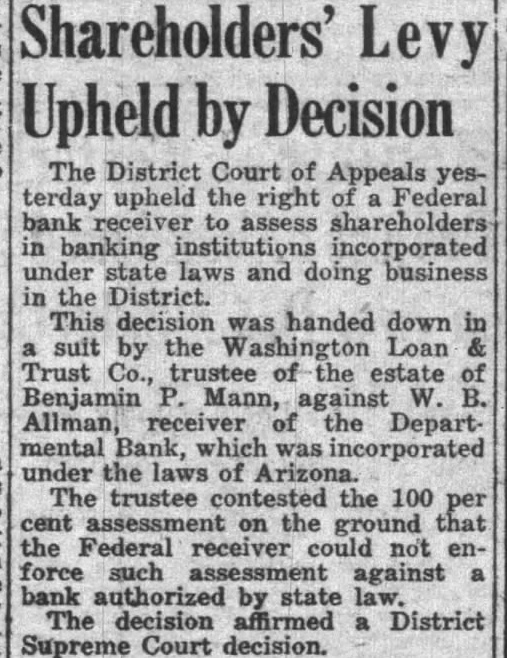

Shareholders' Levy Upheld by Decision

The District Court of Appeals yesterday upheld the right of a Federal bank receiver to assess shareholders in banking institutions incorporated under state laws and doing business in the District. This decision was handed down in a suit by the Washington Loan & Trust Co., trustee of the estate of Benjamin P. Mann, against W. B. Allman, receiver of the Departmental Bank, which was incorporated under the laws of Arizona. The trustee contested the 100 per cent assessment on the ground that the Federal receiver could not enforce such assessment against a bank authorized by state law. The decision affirmed a District Supreme Court decision.

22.

July 16, 1935

The Washington Times

Washington, DC

Click image to open full size in new tab

Article Text

# PARK SAVINGS ASSETS PUT AT $2,953,402.29

With the book value of assets at the date of suspension, March 6, 1933, placed at $2,556,383.68, additional assets acquired since then by Park Savings have raised the total to $2,953,402.29, according to a report by John F. Moran, receiver. Total cash collections on assets of the bank amount to $1,299,787.94.

The Continental Trust Company, which on February 28, with assets valued at $2,298,530.88, has since acquired $52,772.88 in additional assets. Cash collected on the total amounts to $183,046.48.

Since its suspension date, July 14, 1932, North Capitol Savings has added $112,697.47 to its assets, which were valued at $1,231,227.58 in the receiver's first report. Cash collections from assets and stock assessment total $366,231.61.

The Departmental Bank had assets of $1,118,867.65 on the date of suspension, July 14, 1932, to which it has since added $57,964.14. Stock assessment of 100 per cent amounts to $106,060.00. Cash collections total $822,784.55.

23.

July 28, 1936

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

BANK ASSETS HELD WORTH $400,000 But Park Savings' Remaining Holding Carry Book Value of $1,114,393. The Park Savings Bank, closed since March 6, 1933, has remaining assets with a book value of $1,114,393.61, but an estimated value of about $400,000, according to the latest quarterly report of the receiver, John F. Moran. Depositors have received dividends of 20 per cent, amounting to $564,197.62 out of the total of $3,399,516.39 unsecured liabilities at the date of suspension. Cash collected from interest, premium, rents, etc., by the receiver from assets amounted to $65,314.76 toward defraying expenses of liquidation, which, to date, had amounted to $166,815.35. Cash in hands of the receiver on June 30, amounted to $13,307.01. Moran also reported the Departmental Bank, which has paid out a total of 80 per cent amounting to $617,144.97 to its depositors since it was closed July 14, 1932, still has remaining assets with a book value of $331,379.91, but an estimated value of only $54,000. The North Capital Bank, which also closed July 14, 1932, was reported by Moran to have paid out 25 per cent dividends to depositors amounting to $235,122.84, and had remaining assets of book value of $910,492.92, with an estimated value of $309,150.