Click image to open full size in new tab

Article Text

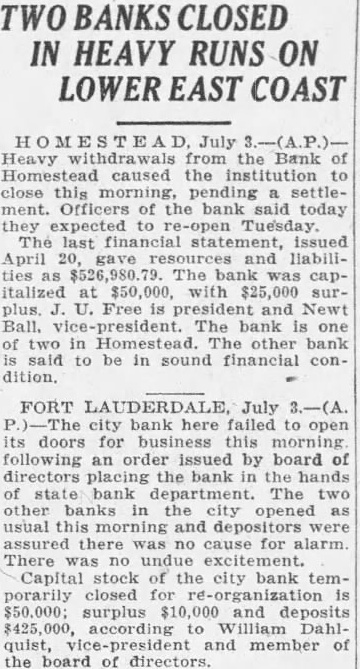

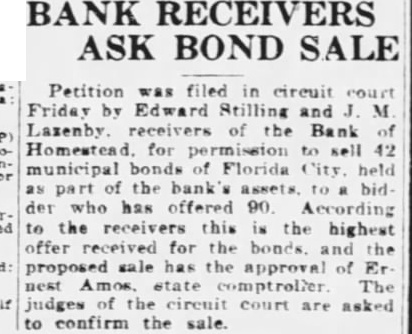

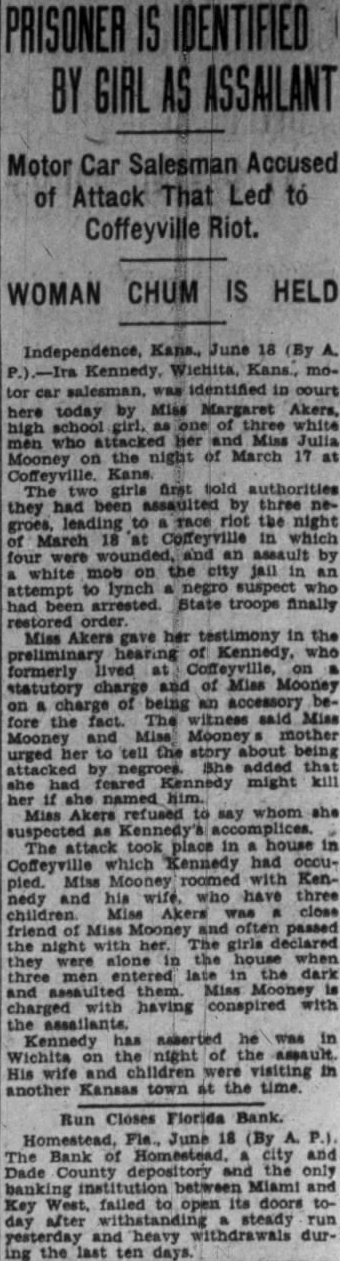

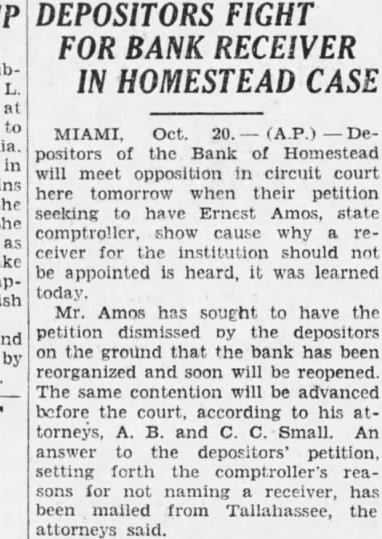

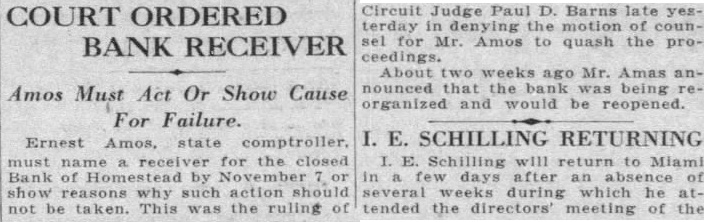

BANKS CLOSINGS

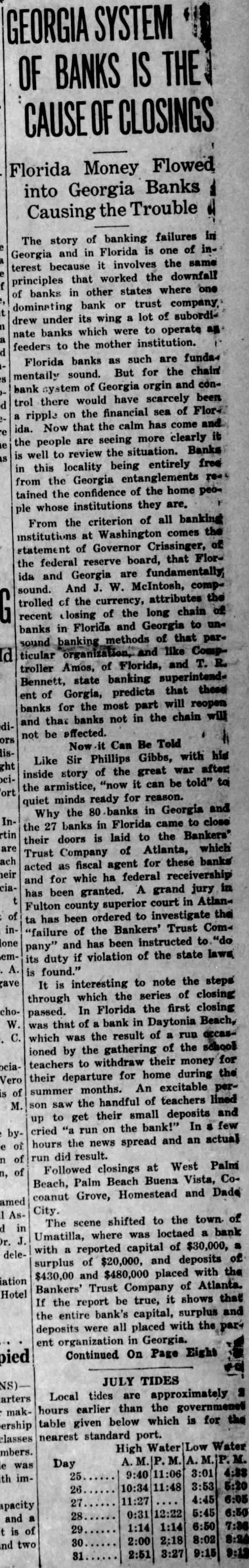

Flowed Florida Money Banks into Georgia Causing the Trouble

The story of banking failures is of and in Florida one Georgia it involves the same terest because the downfall that worked principles where one in other states of banks bank trust dominating or lot of subordiunder its wing drew which to operate nate banks were feeders to the mother institution. banks as such are Florida But for the sound. and conof Georgia orgin bank system trol there would have scarcely been ripple on the financial sea of Florhas and that the calm come ida. Now more clearly the are seeing people Banks review the situation. well to entirely free locality being in this Georgia entanglements from the tained the confidence of the home ple whose institutions they are. of all banking the criterion From the Washington comes institutions at of Governor Crissinger, statement that Florreserve board, the federal fundamentally, and Georgia are ida W. McIntosh, sound. And attributes the trolled of the currency, the long chain of recent losing and Georgia to banks in Florida methods of that banking like ticular Florida, and troller Amos, state banking Bennett, that these Gorgia, predicts ent of will for the most part banks in the chain that banks not and be affected. not Can Be Told with his Sir Phillips Gibbs, Like after of the great war inside story be told" to "now it can the armistice, ready for reason. quiet minds Why the banks in Georgia and to close banks in Florida came the 27 the Bankers' is laid to their doors which of Atlanta, Trust Company for these banks acted fiscal agent as federal receivership and for whic ha jury in granted. A grand has been court in AtlanFulton county superior the of ordered to investigate ta has been Trust Com< of the Bankers' "failure instructed to and has been pany" its duty if violation of the state laws, is found." note the steps interesting to It is through which the series of closing Florida the first closing In passed. bank in Daytonia Beach, that of was the result of run which was of the ioned by the gathering their for to withdraw money teachers home during the for their departure An excitable months. summer of teachers lined the handful saw up to get their small deposits few and the bank!" In cried run on and an actual hours the news spread did result. of run West Palmi Followed closings at Beach, Palm Beach Buena Vista, Cocoanut Grove, Homestead and Dade City. The scene shifted to the town of loctaed bank where was Umatilla, capital of $30,000, with reported delesurplus of $20,000, and deposits of $430.00 and $480,000 placed with the Bankers' Trust Company of Atlanta. Hotel it shows that If the report be true, the entire bank's capital, surplus all placed with the deposits were ent organization in Georgia. On Page Eight Continued

JULY TIDES Local tides are approximately earlier than the hours below which is for the table given nearest standard port. Water Water High Day 3:01 25 26 10:34 11:27 4:45 27 5:45 6:50 0:31 1:14 6:50 1:14 2:00 2:18 8:02 30