Article Text

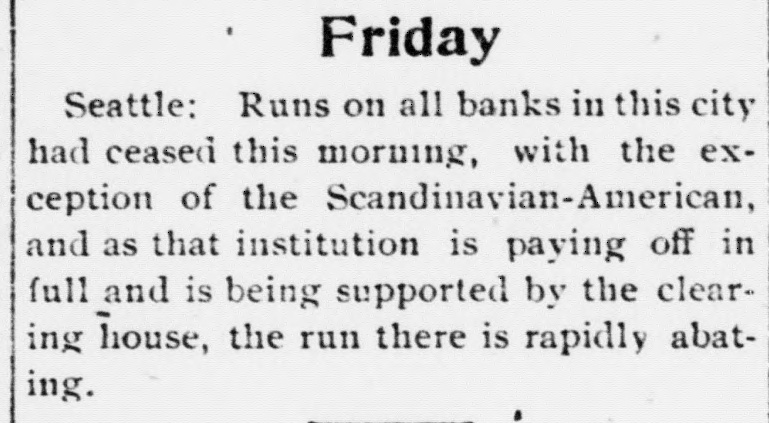

SEATTLE IS IN GRIP OF FREAK PANIC, FEDERAL RESERVE TO AID BANKS SEATTLE, Wednesday.-Following the run of yesterday, the German-American bank did not open for business today and the Fremont State bank, a small suburban institution closed its doors at noon. The former bank is among the small institutions of the city and was not in a position to meet instant demands for SO much cash, although able to pay out fully. Up to 1:30 o'clock this afternoon offers of cash assistance had been tendered to the Seattle banks by outside institutions in case of need which totaled several hundred millions. San Francisco bankers offered to put $50,000,000 in cash on a special train. Strong support was forthcoming early today for all local banks which have been in any way affected by the closing of the Northern Bank and Trust company yesterday morning. The Seattle clearing house gave notice this morning that all solvent banks, whether members of the clearing house or not, will be given support. This announcement strengthened the situation among the bankers considerably, and it is believed that all but the weakest institutions will be able to get by without outside assistance. The freakishness of the situation is seen in the fact that there is a slight run on the Dexter Horton National bank, the strongest instituation in the Northwest, which carries the largest cash reserve west of Chicago, and north of San Francisco. It is estimated that this bank can pay out cash as fast as the teller can count it for weeks. There is also a slight run on the aNtional Bank of Comnerce, which is almost as strong. The run started yesterday on the People's Savings continues and there is quite a run at the ScandinavianAmerican bank. The officials have examined both of these banks recently and report them perfectly sound. All of the banks with the exception of three are experiencing a heavy rush of business today but for some reason for which there is no apparent cause there is not the slightest excitement around the Seattle National, Union Savings & Trust Company or Bank of Califronia.