Article Text

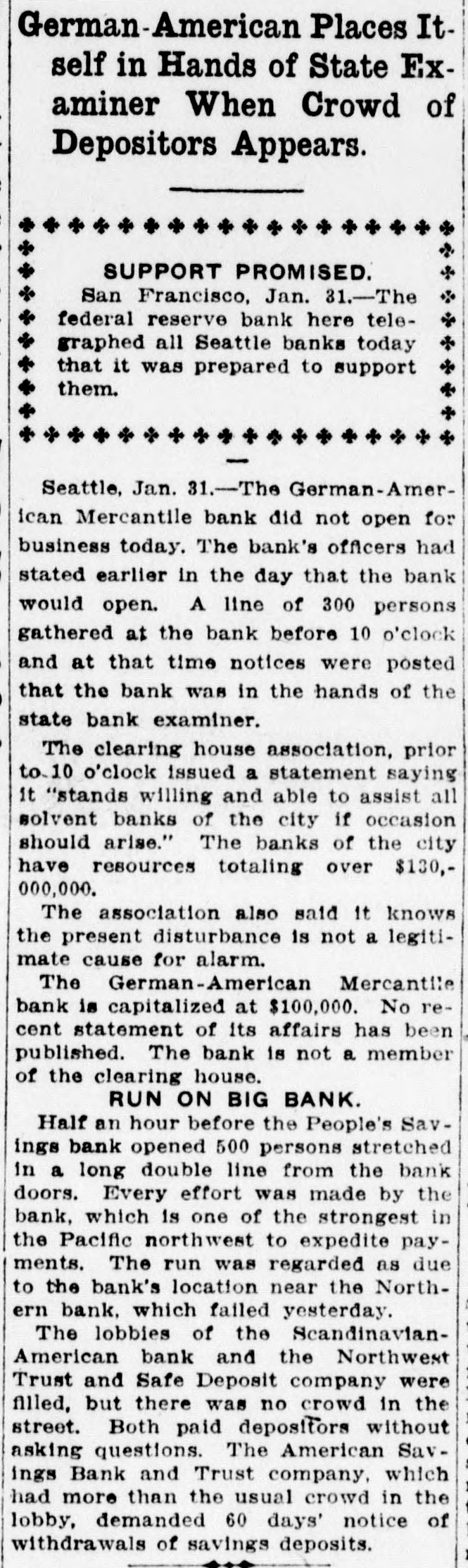

German-American Places Itself in Hands of State Examiner When Crowd of Depositors Appears. SUPPORT PROMISED. San Francisco, Jan. 31.-The federal reserve bank here telegraphed all Seattle banks today that it was prepared to support them. Seattle, Jan. 31.-The German-American Mercantile bank did not open for business today. The bank's officers had stated earlier in the day that the bank would open. A line of 300 persons gathered at the bank before 10 o'clock and at that time notices were posted that the bank was in the hands of the state bank examiner. The clearing house association, prior to. 10 o'clock issued a statement saying it "stands willing and able to assist all solvent banks of the city if occasion should arise." The banks of the city have resources totaling over $130,000,000. The association also said it knows the present disturbance is not a legitimate cause for alarm. The German-American Mercantile bank is capitalized at $100,000. No recent statement of its affairs has been published. The bank is not a member of the clearing house. RUN ON BIG BANK. Half an hour before the People's Savings bank opened 500 persons stretched in a long double line from the bank doors. Every effort was made by the bank, which is one of the strongest in the Pacific northwest to expedite payments. The run was regarded as due to the bank's location near the Northern bank. which failed yesterday. The lobbies of the ScandinavianAmerican bank and the Northwest Trust and Safe Deposit company were filled, but there was no crowd in the street. Both paid depositors without asking questions. The American Savings Bank and Trust company, which had more than the usual crowd in the lobby, demanded 60 days' notice of withdrawals of savings deposits.