Click image to open full size in new tab

Article Text

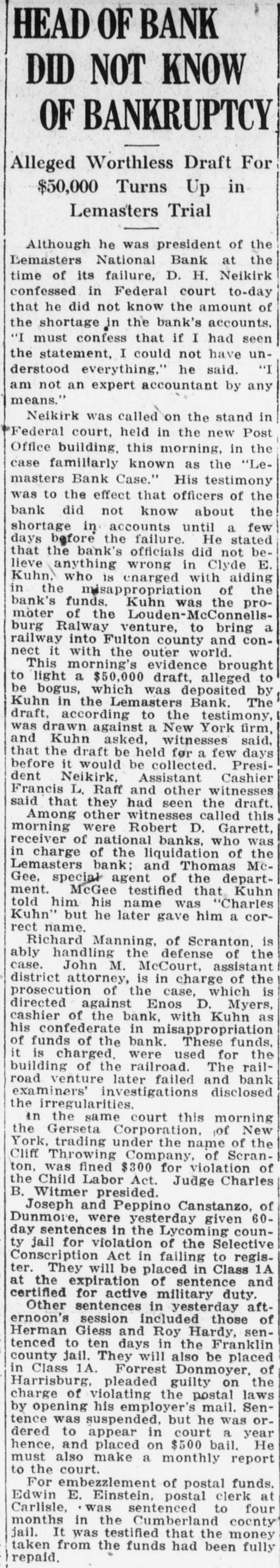

# HEAD OF BANK

# DID NOT KNOW

# OF BANKRUPTCY

# Alleged Worthless Draft For

# $50,000 Turns Up in

# Lemasters Trial

Although he was president of the Lemasters National Bank at the time of its failure, D. H. Neikirk confessed in Federal court to-day that he did not know the amount of the shortage in the bank's accounts. "I must confess that if I had seen the statement, I could not have understood everything," he said. "I am not an expert accountant by any means."

Neikirk was called on the stand in Federal court, held in the new Post Office building, this morning, in the case famillarly known as the "Lemasters Bank Case." His testimony was to the effect that officers of the bank did not know about the shortage in accounts until a few days before the failure. He stated that the bank's officials did not believe anything wrong in Clyde E. Kuhn, who is enarged with aiding in the misappropriation of the bank's funds. Kuhn was the promoter of the Louden-McConnellsburg Ralway venture, to bring a railway into Fulton county and connect it with the outer world.

This morning's evidence brought to light a $50,000 draft, alleged to be bogus, which was deposited by Kuhn in the Lemasters Bank. The draft, according to the testimony, was drawn against a New York firm, and Kuhn asked, witnesses said, that the draft be held for a few days before it would be collected. President Neikirk, Assistant Cashier Francis L. Raff and other witnesses said that they had seen the draft. Among other witnesses called this morning were Robert D. Garrett, receiver of national banks, who was in charge of the liquidation of the Lemasters bank; and Thomas McGee, special agent of the department. McGee testified that Kuhn told him his name was "Charles Kuhn" but he later gave him a correct name.

Richard Manning, of Scranton, is ably handling the defense of the case. John M. McCourt, assistant district attorney, is in charge of the prosecution of the case, which is directed against Enos D. Myers, cashier of the bank, with Kuhn as his confederate in misappropriation of funds of the bank. These funds, it is charged, were used for the building of the railroad. The railroad venture later failed and bank examiners' investigations disclosed the irregularities.

In the same court this morning the Gerseta Corporation, of New York, trading under the name of the Cliff Throwing Company, of Scranton, was fined $300 for violation of the Child Labor Act. Judge Charles B. Witmer presided.

Joseph and Peppino Canstanzo, of Dunmore, were yesterday given 60-day sentences in the Lycoming county jail for violation of the Selective Conscription Act in failing to register. They will be placed in Class 1A at the expiration of sentence and certified for active military duty.

Other sentences in yesterday afternoon's session included those of Herman Giess and Roy Hardy, sentenced to ten days in the Franklin county jail. They will also be placed in Class 1A. Forrest Donmoyer, of Harrisburg, pleaded guilty on the charge of violating the postal laws by opening his employer's mail. Sentence was suspended, but he was ordered to appear in court a year hence, and placed on $500 bail. He must also make a monthly report to the court.

For embezzlement of postal funds. Edwin E. Einstein, postal clerk at Carlisle, was sentenced to four months in the Cumberland county jail. It was testified that the money taken from the funds had been fully repaid.