Article Text

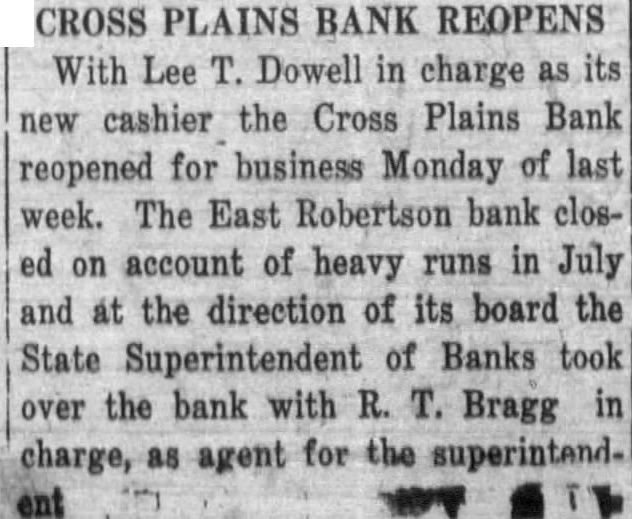

CROSS PLAINS BANK REOPENS With Lee Dowell in charge its new cashier the Cross Plains Bank reopened for business Monday of last week. The East Robertson bank closon account of heavy runs in July and at the direction of its board the State Superintendent of Banks took over the bank with Bragg as for the superintendcharge, agent