Article Text

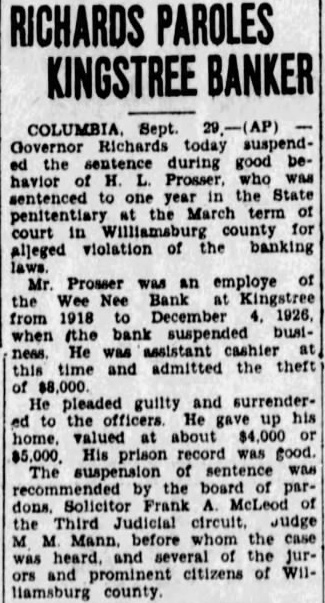

RICHARDS PAROLES KINGSTREE BANKER Sept. Richards today the during good behavior Prosser, was to the State sentenced penitentiary term county for court violation of the banking alleged Prosser was an employe of Mr. Wee Nee Bank Kingstree from 1918 December bank suspended busiwhen He was assistant cashier time and admitted the theft He pleaded guilty and surrenderofficers gave up his home. about His prison record was good. The sentence the board dons. Solicitor of the Third Judicial Judge before whom the case heard. several the ors and prominent citizens liamsburg county.