Article Text

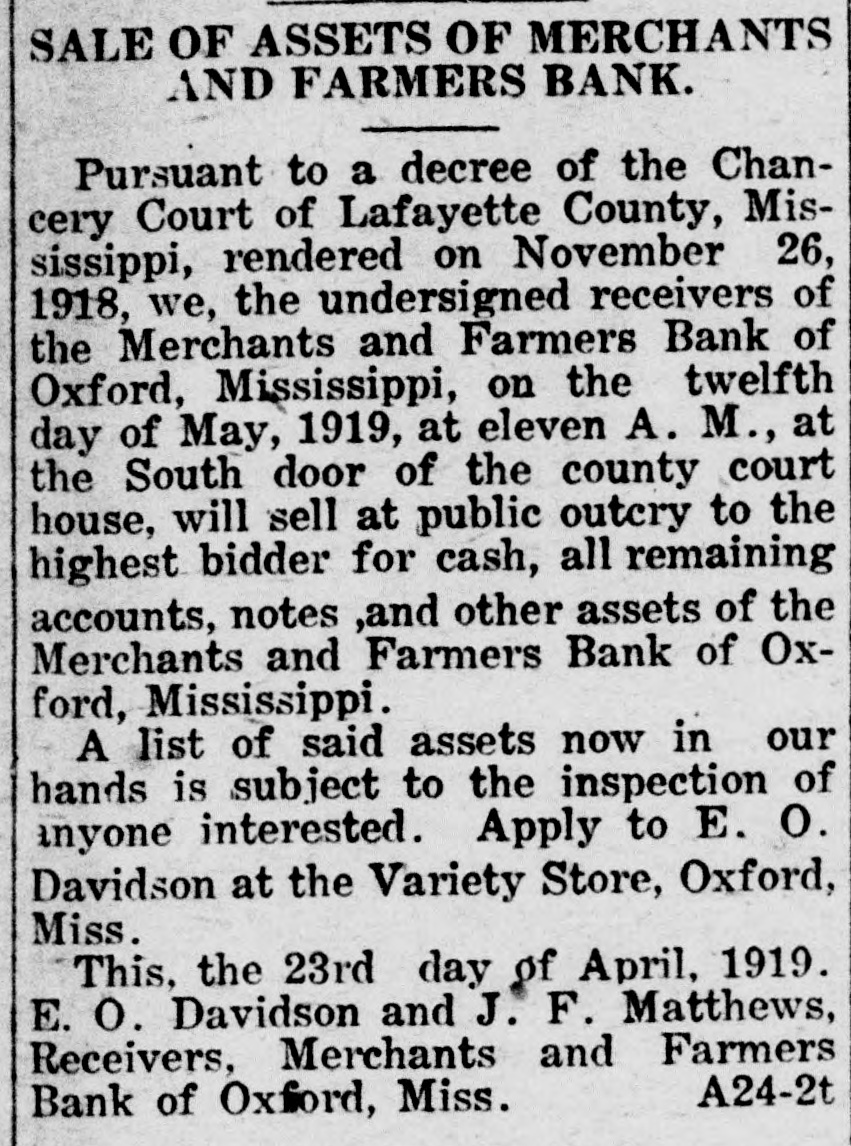

SALE OF ASSETS OF MERCHANTS AND FARMERS BANK. Pursuant to a decree of the Chancery Court of Lafayette County, Mississippi, rendered on November 26, 1918, we, the undersigned receivers of the Merchants and Farmers Bank of Oxford, Mississippi, on the twelfth day of May, 1919, at eleven A. M., at the South door of the county court house, will sell at public outcry to the highest bidder for cash, all remaining accounts, notes ,and other assets of the Merchants and Farmers Bank of Oxford, Mississippi. A list of said assets now in our hands is subject to the inspection of anyone interested. Apply to E. O. Davidson at the Variety Store, Oxford, Miss. This, the 23rd day of April, 1919. E. O. Davidson and J. F. Matthews, Receivers, Merchants and Farmers A24-2t Bank of Oxford, Miss.