Article Text

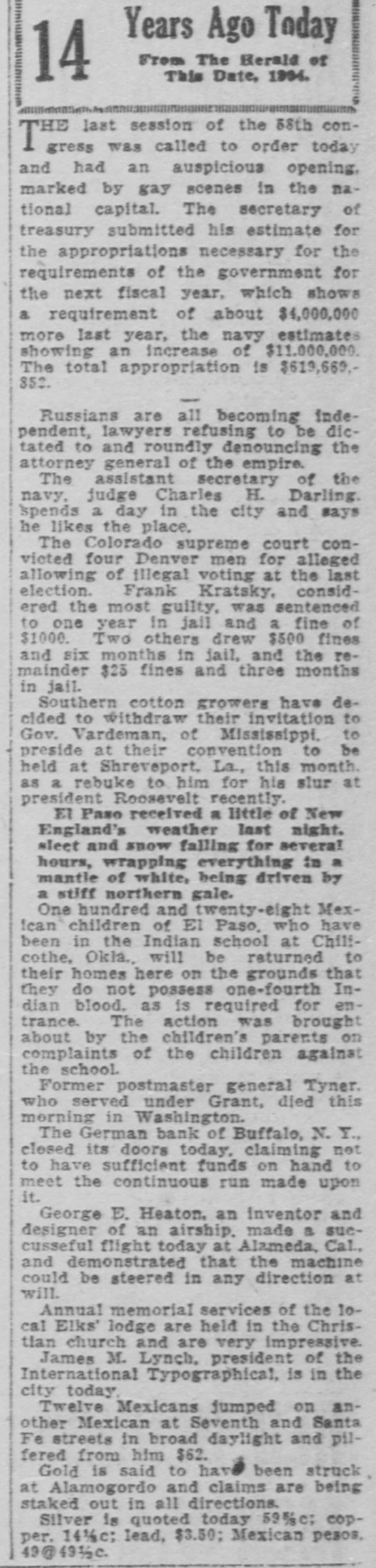

Years Ago Today From The Herald of 14 This Date, 1994. THE last session of the 58th congress was called to order today and had an auspicious opening, marked by gay scenes in the national capital. The secretary of treasury submitted his estimate for the appropriations necessary for the requirements of the government for the next fiscal year, which shows a requirement of about $4,000,000 more last year, the navy estimates showing an increase of $11,000,000. The total appropriation is $619,669.852. Russians are all becoming independent, lawyers refusing to be dictated to and roundly denouncing the attorney general of the empire. The assistant secretary of the navy, judge Charles H. Darling. spends a day in the city and says he likes the place. The Colorado supreme court convicted four Denver men for alleged allowing of illegal voting at the last election. Frank Kratsky, considered the most guilty, was sentenced to one year in jail and a fine of $1000. Two others drew $500 fines and six months in jail, and the remainder $25 fines and three months in jail. Southern cotton growers have decided to withdraw their invitation to Gov. Vardeman, of Mississippi. to preside at their convention to be held at Shreveport. La., this month. as a rebuke to him for his slur at president Roosevelt recently. El Paso received a little of New England's weather last night. sleet and snow falling for several hours, wrapping everything in a mantle of white, being driven by a stiff northern gale. One hundred and twenty-eight MexIcan children of El Paso. who have been in the Indian school at Chilicothe, Okla., will be returned to their homes here on the grounds that they do not possess one-fourth Indian blood. as is required for entrance. The action was brought about by the children's parents on complaints of the children against the school. Former postmaster general Tyner. who served under Grant, died this morning in Washington. The German bank of Buffale, N. Y., closed its doors today. claiming not to have sufficient funds on hand to meet the continuous run made upon it. George E. Heaton. an inventor and designer of an airship. made a suecusseful flight today at Alameda, Cal., and demonstrated that the machine could be steered in any direction at will. Annual memorial services of the 10cal Elks' lodge are held in the Christian church and are very impressive. James M. Lynch, president of the International Typographical, is in the city today. Twelve Mexicans jumped on another Mexican at Seventh and Santa Fe streets in broad daylight and pilfered from him $62. Gold is said to have been struck at Alamogordo and claims are being staked out in all directions. Silver is quoted today 59%c; copper, 14½c; lead, $3.50; Mexican pesos, 49½c.