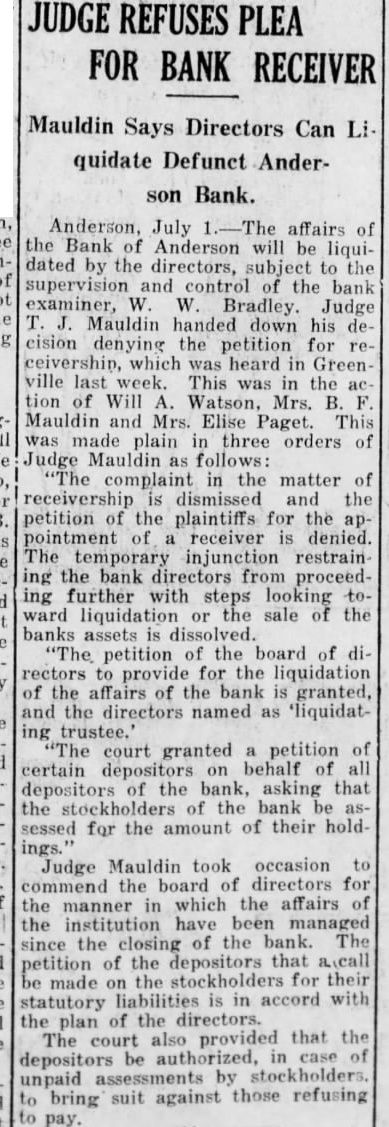

Article Text

JUDGE REFUSES PLEA FOR BANK RECEIVER Mauldin Says Directors Can Liquidate Defunct Anderson Bank. Anderson, July affairs of the Bank of Anderson will be liquidated by the directors, subject to the supervision and control of the bank examiner, W. W. Bradley. Judge Mauldin handed down his cision denying the petition for ceivership, which was heard Greenville last week. This was in the tion of Will Watson, Mrs. Mauldin and Mrs. Elise Paget. This was made plain in three orders of Judge Mauldin as follows: "The complaint in the matter of receivership dismissed and the petition of the plaintiffs for the pointment of receiver denied. The temporary injunction restrain ing the bank directors from proceeding further with steps looking ward liquidation or the sale of the banks assets dissolved. petition of the board of rectors provide for the liquidation of the affairs of the bank is granted, and the directors named as 'liquidating trustee. court granted petition of certain depositors on behalf of depositors of the bank, asking that the of the bank sessed for the amount of their hold ings. Judge Mauldin took occasion commend the board of directors for the manner in which the affairs of the institution have been managed since the closing of the bank. The petition of the depositors that a.call made the for their statutory liabilities is in accord with the plan of the directors. The court provided that the depositors be in case unpaid by bring suit against those refusing pay.