Click image to open full size in new tab

Article Text

WEATHER REPORT. Such the caption of half page advertisement which the Robbins Myers company, Springhad of its electric and tors in the Saturday Evening Post last week. And that advertisement carried interesting information about something else than the company's the way of statement high temperatures various cities of the United States. From quote: Akron 91, Boise 88, Boston Buffalo Canton 91, Chicago 90, Cleveland 92, Cincinnati 91. Denver 87. Des Moines 90, Detroit Dodge 88, Duluth 89, E1 Paso Eureka 91, Flag staff 88, Fresno 100, Galveston 95, Grand 92, Kansas City 94, New York 92, New chelle 91 Oakland Oklahoma 95, Omaha 98, Philadelphia 90. Phoenix 100, Peoria 92, Pittsburgh Portland, Ore., Portland. 85, Red Bluff 98. Richmond Louis 95, St. Paul 92, Sacramento 100, Salt Lake City 98. San Francisco 89, Jose Santa Fe 100, Seattle 90, Spokane 91, Tucson Tampa 90. We don't know where that record was obtained, nor what day for. But we do know that splended showing for Tam25 cities, scattered throughout the United States, weather from one to 10 degrees than that here. In this well recall that Bennett, local weather observer, made the statement Tampa shows fewdays record temperahigh than other United States. weren't expecting from source, but the Robbins Myers has as fully verified claim summer weathTampa everybody knows winter weather Tampa would have been possible for them to have done they been called to the stand witnesses in the matter. the that they did quite another purpose together. That, of course, makes the testimony they have brought forth all the more impressive.

SUNLIGHT AND TEETH. Country dwellers have better chance flash gleaming white smile their city brethren. Why? Because lack of proper sunshine noticeable effect on dental decay, according to noted physician. Cities where great factories belch forth black smoke obscure sun with fine haze don't give the normal chance. Another reason. then. for doing something about the smoke cities where exists.

ACT, AND NOW. heard for doing will doing about September other weight Uncle should most Tampans which the these will United statement condiwhat doing indicates above should incorrect this subject that Its place Florida, winter. that concerned should Tampa the fault properly showing silence stand vouched States attention bring that done yours. promptly.

TEAMWORK. summary of the report of the British labor commission and the discussion industrial co-operaguarantee for future national prosperity, which sented by Lewis Pierson, chairman board Irving Trust company, in recent address before the England Bankers' of particular interest to the American people.

After pointing out banker's duty keep with the economic situation. to exert his business, and to direct attention healthy and progressive forces which make national Mr. Pierson cited the fact that for half century have been perfecting industrial machine which today produces more manufactured products than any other in world.

To secure this high production quickly learned that two factors were necessary. The first was power machinery and the second development business units large enough command the capital and set elaborate manufacturing plant. production, high wages and high sumption cardinal princimodern American industry. We look abroad and we find low production, low wage and low consumption nations with their factories large proportion of their people unemployed. Mr. Pierson gives quotations from the statements the of the British labor commission which recently visited this country to study our dustrial system with the idea of bettering position of their its people. In conclusion said that these visitors placed their fingers factors their judgment, have largely responfor favored position.

First, high production with its tendant corollaries of high wages and high standards of living; second, co-operative spirit which exists management and labor within American dustry. We behold government devoting its resources authority to the solution of industry's difficulties. From the workman at bench to the utive his desk, the spirit of co-operation team play vigorates whole industrial movement. can keep clearin our minds the tremendous distance which have traversed short years and the sucwhich whole has crowned efforts, there will be little the demagogue the tan can do to disturb the steady progress the American nation That is an excellent statement of the matter. Briefed skeleton, is that teamwork has brought where we are and teamwork only can be counted upcarry further forward.

FIRE WITH FIRE.

Apparently large portion the population of Europe and Asia has whence came one convert the people the United States any pet faith, belief, creed, custom practice emissaries of the outside world fit for personal other reasons introduce to the North American continent. It doesn't speak of the mentality of people when great accept without question the quackeries of every mountebank charlatan chancing to practice their midst, it not little disturbing reasonand discerning Americans that foreigners are ever coming to America the whole country to their way of thinking doing. Whatever one may think of jazz, he will in the Scotch fiddler who is coming the United States jazz' rank incurable egoist, or his threat upon the good sense musical taste of the people. people of this country listened to diers from New England and Scotch highlands, well those of strictly local production, for then turned jazz for welcome relief. These immigrant messiahs are nuisance but insult the intelligence of American people. They should be discouraged much possible, and the Scotch fiddler suggests promising plan. Why not send Scotland shipload of jazz orchestras, to make hounds out of the highland laddies lassies while the kiltie fiddler vainly striving drive the saxophones, percussions and "canned" brasses out the United States? That jazz would emerge the victor on both sides we can prove by many Americans. At any there come times when there nothing with which fight fire but fire.

POSSIBLY GOOD. News dispatches foreign capitals do not paint the situation in Europe in the rosiest hues. fact would difficult picture darker conditions than those existing. The franc has reached new low level and there danger financial collapse in several other countries. Geneva has completely upset the Locarno. From hero of Locarno" Sir Austen Chamberlain has become villian of Geneva." London and Paris are indignant over Ambassador Houghton's pessimistic report international conditions in Europe. Ramsay MacDonald believes death blow has been dealt the league nations. Recall of Berlin's bid for seat in the league demanded by Gernationalists. Manufacture importation of arms in quantities are ported the Balkan states, Rus sia, Poland, Lithuania, Finland, Turkey Greece. All roads seem be leading war, but isn't there dead end to them all? Wars require money, and that something Europe and Asia without. The heads" beyond the have the will but lack means, while over here the will not but the means are unlimited. Perhaps good thing for the world that the United States moment has the bulk of world's wealth.

BOOMS, AND the official linked Canadian failures the extent the outside and So ran the of the Wall Street in issue Monday, July upon the Georgia bank failures of last week. And the caption of this article is the headline which Journal used the one above quoted from Evidently the Wall Street Journal overlooked the fact that the fairly tidy which caused the immediate collapse of the Trust company, of Atlanta, carried many banks its wake owed by that concern Florida bank which could not That ought forever settle the question of whose indebtedness was that caused the

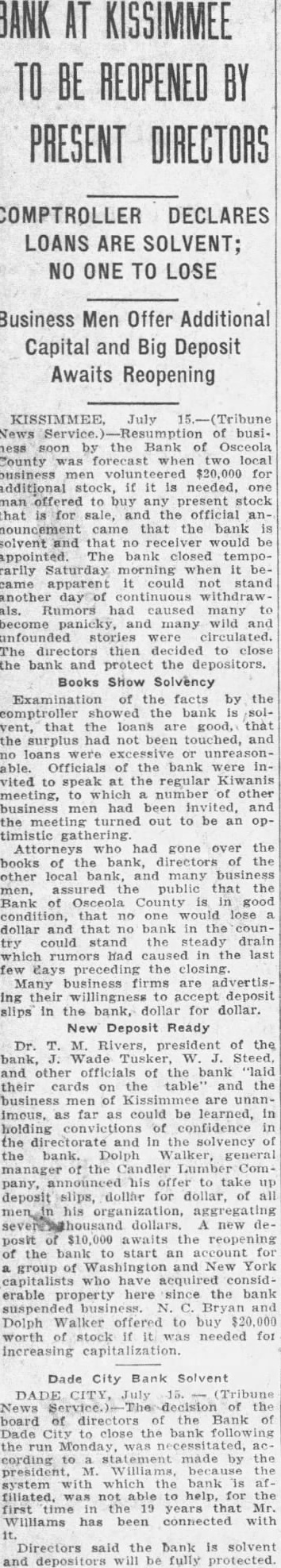

With this exception the Wall Street Journal has, usual when speaks upon such which it undoubted authority set facts accurately and clarity. This, must appear neophyte in banking and financial affairs, is cially true regarding what says to banking most important thing to be considered connection with this whole affair is almost without exception banks which have closed the "chain." number of them banks. But of them had more nominal capital. Some of them. no doubt, ought never to have been brought exist. ence. case of these "petering was merely ter time.

Despite last week's record there no of reason for least fear that the southern banking unsettlement will

As whole Florida banks are soundest of condition. There many reasons for believing that most of them are in better shape this than are banks in other states of which thought breaking entertained. Most bankers have watched the and have carefully against mishap. The trouble with those that have gone decided majority of cases, that they could the funds they right to expect the Bankers Trust company. Official advices from Tallahaswere the effect that the Bank of Osceola county, Kissimmee, and the Bank of Dade Dade City, of the Florida which caught the "jam," will be opened days and that officials optimistic cerning the several other closed banks reopen There no need for excitement. What needed is for ple to keep their feet on the ground and their heads clear. Almost any could be put out of business "run" on the most unprofitable thing in the world "run" bank. Florida all right. Florida banks are right. There nothing to creating disturbance about. only need to give our faith Florida to operate to its capacity.

If the grand jury which failed do anything about Aimee Semple McPherson's story had right slant on things the Semple in the evangelist's name should pronounced simple.

Perhaps ought keep such personal affairs, still help wondering what part Florida had in causing the daughter of the head of the chain bank system which caused SO much trouble to contract that sudden marriage which she sets up being quite foolish one.

Have just finished reading interesting convincing article on the difference in the earning capacity of college those who are not, but to can't reme aber what college was that Charlie Chaplin uated from. does just bit funny John Commoncitizen that no great raised over the police department after leaked some one of the commissioners had gotten into trouble.

This the demand French deputies for dictatormeet the country's financial crisis looks like plea guilty to the charge that the chamber of deputies not capable of meeting it.

Another child ran in front of truck; little, newly made grave; time in St. burg. Parents can't be too persistent about warning their children regard to playing in and crossing streets.

Florida fortunate in that Governor Martin has found that he attend governors' conference Cheyenne, Wyoming. governor not fail to tell them the truth about Florida.

Associated Press reports name Florida as the coolest spot in the country yesterday. That true day except in winterwhen nobody looking place that's so all-fired cool.

Flo Ziegfeld said to be get. ting ready to push stage blondes to the back And the portant question arises, what will that do to the bald head row?

We havn't any idea that the Fulton county, Georgia, grand jury indict Florida because the recent bank failures in our neighbor state.

Statistics inform us that half of the people entertain foolish beeverybody but the statisticians knows that more than half them do.

Latest reports from Europe are that people over there have decided Mr. Mellon will melon for them.

Read about the deaths from heat various of the country and thank the Lord that you live in Florida.

France will find that real triotism doesn't contemplate government's getting along on plate basis.

Iowa republicans are reported having buried hatchet. Suppose of them still have axes up their sleeves?

At any rate Cants might better way for increasing the morale of the police force.

News from Fort Meade is that the phosphate sink dam gave of that sort of good fishing.

Annuling the marriage of that girl fall far short of remedying the evil that has been done.

Wouldn't the Optimist club have membership if the Tampans who are optimists belonged to it?

The people who have pay the bills can't the of creating more useless officials.

Once more want to say that is her sunshine that Florida proud moonshine.

It takes course of study to learn pull teeth. Leg pullers seem be born that way.

Degenerate youth of today The youth of other played "post office."

With all its activity the rolling never gets anywhere worth going. the stop signs not mean stop would be better abolish them.

Herriot neglected to vide legs for his cabinet to stand upon.

The more you do for of people the more you have to

Love blindest when blind to its own interests.

Come Florida and